Journal of Financial Planning: June 2022

Danielle Andrus is editor of the Journal of Financial Planning. She can be reached HERE.

Bridger Cummings is assistant editor of the Journal of Financial Planning. He can be reached HERE.

Note: Click on the images below for PDF versions.

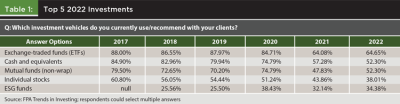

Since we began including questions about environmental, social, and governance (ESG) investments in our annual Trends in Investing survey, we’ve seen planner interest fluctuate. A little over a quarter of respondents said they were using these strategies back in 2018, rising to over 38 percent in 2020. The most recent iteration of the survey, conducted in February and March 2022, found utilization of ESG has fallen to 34 percent of respondents. Even so, ESG funds are among the top five investments respondents are currently using. Twenty-seven percent say they will increase their usage over the next 12 months.

Clients and planners are seeing what’s happening in the world, from extreme weather to the pandemic to social justice movements, and making connections between these issues and the companies they invest in, according to Amy O’Brien, global head of responsible investing at Nuveen.

“We’ve seen this rise of the conscious consumerism movement, and now I think the next mile really is to create that linkage to portfolios,” she said.

Investment professionals are increasingly examining how all the funds in a client’s portfolio incorporate ESG factors regardless of whether they are invested in ESG-branded funds, which typically address very specific social and environmental outcomes, O’Brien said.

“ESG is still a product line, but these are important factors to look at across the portfolio, so it’s no longer just a product line,” she said.

She believes all investors will benefit from the holistic approach that incorporates ESG across an entire portfolio. Survey respondents seem to agree. Nearly 37 percent of respondents in the 2022 survey use an integrated risks and opportunities approach when they consider funds for their clients. Less than 19 percent prefer positive screens and 15 percent use negative screens.

An integrated approach helps avoid a “language problem” that planners who recommend ESG funds have had for many years, she added. Just focusing on excluding or including certain industries can create tension in client conversations. Probing deeper into client values to uncover what’s important to them can “depoliticize” conversations about favoring clean energy or water over fossil fuels or weapons.

“We’re in an environment where there are different forces at work, and if you can really engage with the client, putting aside the jargon, putting aside the politics, and point to how these factors add value to the investment process, everybody wins,” O’Brien said.

ESG investing is gaining credibility in the industry as regulators ramp up their own look into these strategies, O’Brien said. The Securities and Exchange Commission issued a Risk Alert in 2021 that cautions investment professionals to be clear and consistent in how they communicate with investors about ESG.

“I think, perhaps, 10 years ago a lot of advisers and investors thought all funds were the same. That’s clearly not the case. You’ve got this interesting confluence of factors [affecting ESG investment]. But I think it’s really that personal connection that the individual investor has had to some of these issues that is prompting some of the outreach back to the adviser community.”

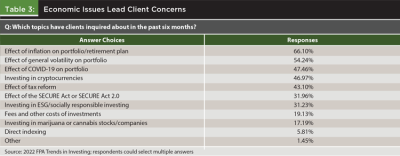

Our survey found that 14 percent of respondents expect to decrease their usage of ESG funds in the next 12 months. Over 31 percent of respondents said their clients had asked about ESG or socially responsible investing in the previous six months, down from a survey high of 39 percent in 2021.

What’s on their mind instead are inflation and volatility. Two-thirds of respondents said their clients were reaching out with concerns about how inflation will affect their portfolio and retirement plans, while 54 percent cited volatility as a common concern. Even though the pandemic is weighing less heavily on clients’ minds than last year, it’s still in their top three concerns.

O’Brien believes ESG presents an opportunity for planners to learn more about their clients and what’s important to them.

“It’s natural that those other topics are going to be top of mind. You can’t watch any news program right now without those kinds of topics dominating,” she said of inflation and volatility. Many of the world’s events are key ESG themes, she added. “This is the time to lean in on these issues and, frankly, strengthen relationships with your clients who want to know how the world events are impacting their portfolio.”

Other Findings

The survey revealed some changes in thinking around some investments and planning strategies.

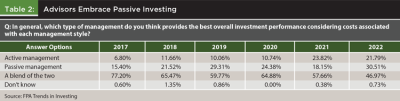

Although planners reported a dramatic drop in ETF usage over the past two years (85 percent in 2020 to 65 percent in 2022), their interest in passive investing has increased. The share of planners who feel passive-only investing provides the best overall performance for the cost jumped from 18 percent last year to over 30 percent in 2022. Meanwhile, active-only investing slipped from 24 percent to 22 percent. Planners who feel a blend of active and passive provides the best value fell from 58 percent to 47 percent.

Cryptocurrency is still of interest to planners, but they’re more critical about its potential. Only 20 percent of respondents in 2022 called it a viable investment option, down from nearly 28 percent last year. Meanwhile, those who see cryptocurrency as either a gamble (31 percent) or interesting but not investment-worthy (33 percent) increased from 28 percent and 30 percent, respectively.

Economic Outlook

In general, investors don’t lean too heavily either way with their general market outlook, but there is slight optimism that it will get modestly more bullish in the upcoming years.

Yusuf Abugideiri, CFP®, partner and senior financial planner at Yeske Buie, said that optimism came from their general belief that humans are resilient. “Our firm’s worldview is that over time, the markets are going to perform well because human beings are ingenious, creative, and resilient.”

Sterling Raskie, Ph.D., CFP®, EA, senior lecturer of finance at the University of Illinois-Urbana-Champaign and vice president of client engagement at Blankenship Financial Planning, had a similar sentiment. Investors and planners might be concerned about the short term, but you must always be thinking with longer time horizons than what is in the news today. “If an investor’s outlook or goals are long term, anything in the short term is just noise . . . there’s always going to be little bits of fluctuation here and there . . . I think overall, I tend to be optimistic.”

Advisers are always getting questions from their clients, and that can be reflective of concerns about current events. Two-thirds of advisers reported that clients had inquired about the effects of inflation, which is at a four-decade high. There was also concern regarding general volatility (54 percent of clients), the pandemic (47 percent), and inquiring about cryptocurrency (also 47 percent).

Regarding inflation, Abugideiri said, “Our refrain has been that we’re not concerned. We’re seeing dramatic increases in prices coming out of one of the most dramatic and rapid declines in activity in the spring of 2020, but the snapback was just as rapid—a jolt one way and a jolt in the opposite direction is going to create some dramatic reverberations.”

Raskie stated that he felt the effects were being overblown. Volatility is a two-way street, and investors are overjoyed when it is volatile in their favor, and unsurprisingly unhappy when it jumps back down. But that’s just the nature of the market. Raskie thinks that a lot of investors are getting questions about the pandemic and inflation, but most fellow advisers are likely just curious as well and not overly concerned. There will always be shocks to the system—9/11, the housing bubble crisis, the pandemic, the war in Ukraine, etc. At the end of the day, it’s the adviser’s job to reassure clients that everything is going to be OK and to reassure them that their portfolio is diversified enough that it can weather the storm, even if there are day-to-day fluctuations.

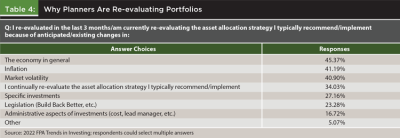

We also asked about how confident investors were in the traditional 60/40 portfolio and whether they have reconsidered their plans in the last few months. Fifty-eight percent of respondents expressed some level of confidence in the traditional 60/40 portfolio. Over 71 percent said they had recently re-evaluated their clients’ portfolio allocations. Responses were varied as to why, but it depends on how you interpret that question. In Abugideiri’s firm, he said they review their distributions annually, so the default answer was that they are always reconsidering their clients’ portfolios based on their goals and risk tolerance.

Raskie wondered if the people who said that they were reevaluating their portfolios were potentially younger or inexperienced advisers who were chasing returns. If you are constantly trying to beat the market, you are going to be switching things up, and usually unsuccessfully. Their firm sticks to their guns, and their clients know what to expect.

Both Abugideiri and Raskie stressed that they get questions, but they try to be the guiding light of reason, assuring their clients that even if we are living in unprecedented times, there will always be shocks to the system, and their clients need to think long term and not just watching the daily blips of the market.

Click HERE for this report as well as other FPA Research.