FPA believes financial planning is an essential profession that has an important impact on society. Those who practice this critical vocation, including FPA Members across the nation, are in a position to provide a positive, life-altering influence for their clients and their clients’ loved ones. But not everyone calling themselves a “financial planner” provides, or even offers, financial planning services.

That needs to change.

Over the past few years, the FPA Board of Directors, FPA Public Policy Council, and other industry groups have debated the merits of title protection that would ensure anyone professing to be a “financial planner” meets threshold competency and ethical standards. While others may want to continue debating the issue, the FPA Board of Directors unreservedly believes this is a fight worth pursuing, especially considering a recent FPA advocacy survey revealed that nearly 80% of FPA Members want the title “financial planner” to be protected — and only 4% oppose.

The FPA Board of Directors believes the legal recognition of the term “financial planner” through title protection is an acknowledgment that anyone proclaiming to be a financial planner meets threshold standards that protect consumers and advances the financial planning profession.

The push for title protection is a substantial advocacy issue that may require allocating resources and many years of planning and effort to realize. But FPA is ready to lead this push, which is why we are making the legal recognition of “financial planner” through title protection FPA’s primary advocacy objective now and in the years to come. There are four central reasons for this steadfast commitment to the legal recognition of “financial planner” through title protection.

- Title protection of “financial planner” will distinguish financial planners from other financial service providers. If federal and/or state policymakers continue to leave “financial planner” undefined, some will take liberties with the title – even if they are not providing financial planning services.

- Title protection will establish threshold standards for financial planners without creating an unnecessary regulatory burden for those using the title. Title protection will address the lack of competency and ethical standards by some who represent themselves as financial planners.

- Title protection will enable consumers to identify and engage with a qualified financial planner. Currently, the term “financial planner” can be used freely and without basis for marketing purposes, which leads to consumer confusion. Like physical and mental health, financial health is paramount to everyone’s well-being. Consumers engaging a financial planner for comprehensive financial planning services must be able to trust that their financial health is the focus of the relationship.

- The legal recognition of the title financial planner is a critical step in recognizing financial planning as a distinct, essential profession. Financial planning is a young profession that has yet to achieve the same level of recognition that other honorable professions have achieved, including medicine, law, and accounting. These recognized professions are deemed essential and beneficial to society. Like doctors, lawyers, and accountants, FPA believes financial planners are equally essential.

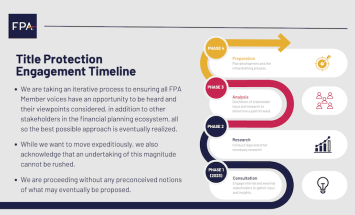

In the weeks and months ahead, FPA leaders will be engaging you and all stakeholders in discussions to explore the many potential strategies we may employ in this pursuit, including what the threshold standards to be called a “financial planner” should encompass. Everything is on the table, so this input will be critical in shaping how we proceed in the years ahead.

Please make no mistake about it. Title protection is a major undertaking that will likely take many years of hard work, perseverance, and, more importantly, unwavering leadership by FPA as the Association that is committed to the legal recognition of financial planners. We recognize that not everyone in financial services will share this same bold vision, and we accept that. But we know this is what’s right for our Members, consumers, and the profession of financial planning.

We look forward to providing frequent updates on our progress and welcoming you to the table as we explore our pursuit of the legal recognition of the term “financial planner.”

And, if you have not yet contributed to the FPA Political Action Committee (FPA PAC), please consider doing so. The pursuit of title protection will require considerable financial resources and the FPA PAC will provide us with some of that additional needed support. We have seen the important impact that FPA and the FPA PAC can have when we leverage our resources to impact the legislative process – like we did recently in Kentucky. Now we can have the same impact on an even bigger stage with your support. Contribute today!

-------------------------------------------------------

FPA Member Gregory A. Furer, CFP®, CRPC® shares his thoughts on the announcement.