Journal of Financial Planning: June 2020

Adam Hetts is vice president, head of portfolio construction and strategy at Janus Henderson Investors. In this role, he leads the Portfolio Construction and Strategy Team (janushenderson.com/pcs) focused on delivering actionable investment strategy and thought leadership to help clients in all aspects of the investment management process.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

Janus henderson partnered with the Journal of Financial Planning and FPA on their annual Trends in Investing Survey for the first time this year. Considering the extreme market volatility and economic uncertainty that dominated the first few months of 2020, it turned out to be a rather opportune period in which to be involved in this type of research.

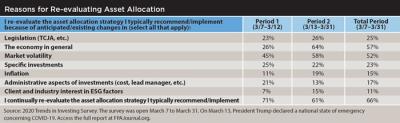

The survey’s findings on asset allocation are especially telling: Overall, more than half (56.6 percent) of respondents said they typically re-evaluate their asset allocation strategy based on the economy in general, while 51.7 percent do so based on market volatility. However, when we look at the responses to this question for the period of March 13 through March 31, those percentages jumped considerably, with nearly 64 percent re-evaluating asset allocation due to the economy, and just over 58 percent doing so in response to market volatility.

The dramatic price swings that occurred across asset classes during those particularly volatile weeks clearly had an impact on advisers’ asset allocation strategies. And not surprisingly, those dramatic moves led to an unusually large volume of rebalancing inquiries on the Portfolio Construction and Strategy (PCS) Team here at Janus Henderson. Here, I share a couple of different concepts that resonated with clients during these consultations regarding how to best approach portfolio analysis during a time of chaos.

A Sell-off Doesn’t Change Everything

In our view, rebalancing, diversifying, and/or reallocating during a downturn should follow the same process as during less volatile markets: gauge performance against various benchmarks, assess drawdown potential versus investor suitability, identify intended and unintended concentrations and gaps, remedy as needed, rinse and repeat. In other words, the short-term environment should not allow market-timing impulses to be the driving force behind reallocation.

View Sunk Costs from a Blank-Slate Perspective

Extreme losses might lead to a, “Well, I can’t sell now” perspective. Going back to the general reallocation process just mentioned, advisers should examine these exposures by asking, “If I were building a portfolio from a blank slate, would I buy this exposure at this price level at these levels of uncertainty?”

This blank-slate approach can offer much-needed perspective and a reprieve from the regret that investors may be feeling in the wake of this sell-off. Barring special circumstances related to taxes (more common) and illiquidity (less common), incumbent losses are nothing more than sunk costs that should be ignored.

Start at the Beginning

Amid extreme market turmoil, another helpful way to cut through the noise is to start at the beginning. The original target allocation set for an investor is what was determined to be that individual’s optimal, long-term asset allocation. A portfolio drifted by market movement is, by definition, suboptimal, being underweight recent losers and overweight recent winners and adding, essentially, a “momentum” trade to the portfolio. Is this momentum trade part of the original plan? If not, is it worth the cost to rebalance? These dilemmas are not specific to rebalancing—they are what any investor faces when making asset allocation decisions.

Are Portfolio Losses Unacceptable, or Merely Unusual?

During the extreme market turmoil of the 2007–2008 global financial crisis (GFC), many asset classes experienced losses inherent to their risk/reward profile (e.g., U.S. equities) and therefore, such losses may be expected to repeat during another market shock. The gravity of such losses is, then, merely unusual and arguably suitable within certain portfolio risk profiles.

On the other hand, some portfolio losses during the GFC were unacceptable for certain investors. These losses landed well outside the normal boundaries of expected returns—most often because of an inappropriately high level of risk within an investor’s fixed income allocation, normally meant to be the risk-managing piece of a diversified portfolio. This resulted in unexpectedly large total portfolio drawdowns, forced selling of long-term investments at market lows, delayed retirement, and other unwelcome outcomes. Even worse, following the GFC, these fixed income miscalibrations only grew more common thanks to record-low rates and a decade-long historic bull market, leading to potentially disastrous and unacceptable outcomes, yet again.

In just a month’s time, the losses in High Yield compared to the U.S. Agg are already showing a double-digit difference, while the Industry Portrait is showing average adviser fixed income losses slightly worse than the U.S. Agg. The Industry Portrait is only an average, and actual fixed income portfolio losses in our database cover the entire range of performance—some of which, unfortunately, will prove unacceptable for investors.

This year’s crisis has shown, in just a matter of weeks, double-digit return dispersions between traditional government fixed income and non-investment-grade fixed income—dispersions the likes of which we have not seen since the GFC. Given the large degree of fixed income allocation diversification since the GFC, many fixed income portfolio losses, unfortunately, will prove unacceptable from a risk-management perspective.

A Consistent Framework for Portfolio Analysis

Going back to our survey results, 66 percent of respondents stated that they continually re-evaluate their asset allocation strategy. When faced with the unprecedented volatility and uncertainty we are currently experiencing, this process takes on heightened importance and may cause some advisers to question their traditional approach. But in our view, the framework used to analyze portfolio moves—large or small—is always the same.

When reassessing clients’ asset allocation in a time of crisis, we recommend advisers start by identifying and diagnosing which portions of the portfolio are experiencing losses, which are merely unusual, and which are unacceptable. Then, when it is time to rebalance, we believe it is prudent to use the same reallocation principles as you would follow in less volatile markets, with an eye toward both current portfolio positions and baseline asset allocation.

Rebalancing is not a generic question with a universal answer; it depends on specific asset allocations and portfolio goals.

Fixed income securities are subject to interest rate, inflation, credit, and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings. The opinions and views expressed are as of the date published and are subject to change without notice. Investing involves risk, including the possible loss of principal and fluctuation of value.