Journal of Financial Planning: June 2020

Kenn Tacchino, J.D., LL.M., is the Joseph E. Boettner/Davis W. Gregg Chair of Financial Planning and the director of financial planning programs at Widener University. He is the editor of the Journal of Financial Service Professionals. He was a founding creator of the RICP designation offered by The American College.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

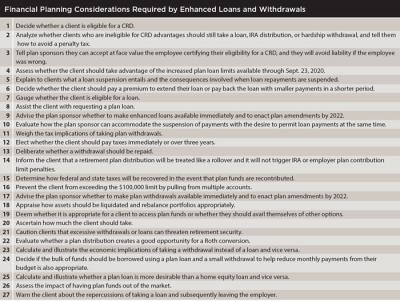

In an effort to provide relief from the economic impact of the pandemic, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law March 27. The new law temporarily lifts strict rules pertaining to withdrawals from either an employer plan or an IRA, thus granting unprecedented access to these funds. The Act also temporarily opens the door to enhanced loans from an employer-provided retirement plan.

Clients are given a window to make elections that may help pay bills that went wanting because of employment interruptions and help them to avoid high interest on credit card debt. Financial planners will be called on to assess the myriad implications that arise from the lenient distribution and loan rules. This article identifies numerous financial planning decisions that must be evaluated based on the temporary relaxation of the law and suggests how planners can add value by steering clients through these issues.

What Is a Coronavirus-Related Distribution?

In order for a client to take advantage of the retirement asset distribution opportunities available under the CARES Act, he or she must meet the criteria established by the new law. There are two categories of coronavirus-related distributions (CRDs): one for clients or their family members who have been diagnosed with COVID-19 by a Centers for Disease Control and Prevention test (or been diagnosed with SARS-CoV-2);1 and another for clients who have suffered adverse financial consequences because of the disease, specifically as a result of: being quarantined, furloughed, or laid off; having work hours reduced; being unable to work because of child care responsibilities; closing the business (business owners and operators); and having reduced hours (business owners and operators).2 Other factors are expected to be determined by the Secretary of Treasury.

How you can help: Clients will be looking for confirmation that they are eligible for the enhanced loan and plan withdrawal options available under the CARES Act. You will need to assess whether clients are eligible by verifying whether the client has met the criteria outlined under the law.

Some clients will consider taking distributions to help loved ones, even though the client does not qualify for relief under the law. If the client is not eligible under the Act as currently defined or as defined by future guidance, you can still advise clients about withdrawals from an IRA or hardship withdrawals from employer plans and/or employer-plan loans that might be available. If a withdrawal for a non-CRD client is required, take special care to plan around the 10 percent penalty by seeing if an exception applies or whether substantially equal periodic payouts could be used to avoid the penalty. You should also warn your clients about the implications of damaging their own retirement security in an effort to help others.

Sponsors of retirement plans will also be seeking assistance concerning CRDs. Let plan administrators know that they may rely on the employee’s certification that he or she satisfies one of the qualifications for a CRD.3 In other words, the plan administrator will not be liable if she believes in good faith that the employee qualifies for a CRD, nor will the plan suffer any adverse consequences as long as employee certification exists.

Plan Loans

One change made by the CARES Act in order to free up cash for current expenses is to provide access to plan funds via the plan’s loan feature. Traditionally, loans from employer plans have been limited to $50,000 or if lower, 50 percent of your client’s vested account balance.4 The CARES Act increases that amount to $100,000 or if lower, 100 percent of your client’s vested account balance if the client qualifies for a CRD.5 The increased limits apply from March 27, 2020 (when the bill was signed) until Sept. 23, 2020.

In addition to increasing the amount that can be borrowed, the CARES Act added the following enhancements:

In an effort to keep money in the paycheck this year, the law allows the CRD-qualifying client to suspend any loan repayments due from March 27, 2020 to Dec. 31, 2020.6 Loan repayments are delayed for a year; however, clients need to be warned that interest continues to accrue, and subsequent loan repayments will be adjusted to reflect the increased interest that is due. Also, clients should be told that they are not required to suspend loan repayments.

If 2020 was one of the five years for the loan repayment, the CARES Act effectively extends the normal repayment period from five years to six years.

How you can help: Clients will need to evaluate whether a plan loan is needed to cope with the altered financial situation brought about by the pandemic. Undertake a cost-benefit analysis to assess whether the client would benefit from the increased plan loan limits that are available through Sept. 23, 2020.

Clients will want to know about the implications involved in suspending their loans. You’ll need to explain to clients what a loan suspension will entail. For example, Peggy has reduced work hours (and pay) due to the coronavirus crisis. She can elect to postpone her 2020 monthly loan repayments that were due April 30 through Dec. 30. Her April 30, 2020 payment will be due April 30, 2021. Her May 30, 2020 payment will be due May 30, 2021, etc. In other words, she has pushed all her future loan repayments back a year and extended the life of the loan by one year. If, for example, she initiated the loan in April of 2020, her last payment will be April of 2026.

Clients will have to decide whether suspending loan repayments and increasing future loan payments is the proper choice for their situation. Planners will need to assess whether the client should pay a premium to extend the repayment of their loan or pay the loan back with less interest in a shorter period of time. For example, your client Julie will take a $75,000 plan loan in August 2020. Assuming a 5 percent interest rate, if she pays the loan back in five years, she will pay $9,920 in interest. If Julie pays the loan back over six years, she will pay $11,966 in interest. While it is true that she is paying the interest back to her own account, it is important to remember that the monthly payments will be larger, and that her retirement assets will be out of the market for the extra year (discussed later).

Clients will wonder whether they are eligible for a plan loan. Let clients know the loan option will not be available to any client who only has an IRA, because by law, IRA accounts do not allow plan loans. In addition, the employer-plan loan option may not be available to every client because not all plans allow plan loans. You’ll also want to let clients know that 401(k) loans are typically not available to former employees. In other words, to get a loan the client must still be working; a client who has been laid off because of the pandemic may not have access to a plan loan. Finally, point out that sometimes a plan may have a limit on the amount of plan loans allowed at one time. If a plan allows only one outstanding loan, and a participant has a $20,000 loan, he can’t get another $80,000 unless the plan is amended.

If a loan is available, clients will need assistance in applying for the loan. Clients must request a plan loan (they are not automatic). The client should be instructed to contact their human resources department to access the paperwork needed for a loan, and they may need to be told how to route the loan to the appropriate checking or savings account to facilitate electronic payment.

Plan sponsors will be evaluating whether enhanced loans should be made available to their employees. For example, ABC Company has a plan that does not allow plan loans. ABC’s planner can suggest, however, that CRD loans should be allowed and implemented immediately. She will be happy to tell the plan sponsor that implementation of CARES Act loan enhancements are allowed without immediate plan amendments. Plan amendments can be postponed until the last day of the first plan year beginning on or after Jan. 1, 2022.7 This same relief applies to plan sponsors that have a loan provision and want to increase the $50,000 limitation to $100,000.

Plan sponsors will be looking to implement loan systems that both suspend payments and accommodate payments at the same time. You may have to spell out the rules for the client’s tech team so they can adapt recordkeeping software to this purpose.

IRA and Employer Plan Withdrawals

Another change made by the CARES Act to free up cash for current expenses is to provide access to otherwise inaccessible funds via a tax-advantaged plan withdrawal. If the client qualifies for a CRD, special standards apply to withdrawals that occur from Jan. 1, 2020 and before Dec. 31, 2020. The special rules are:

- Any potential 10 percent penalty is waived (even if the client is not 59½ years old).8

- Ordinary income tax will be owed on the distribution. However, the client has the ability to spread the tax out ratably over three years (although an election can be made to pay it all at once in 2020).9

- No 20 percent withholding applies to the distribution.10

- The client has the ability to repay 2020 distributed funds tax-free to either an IRA or company plan up to three years from the date of the withdrawal. (It is important to note that the client is not required to recontribute funds).11

How you can help: Clients will be concerned about the tax implications of their withdrawals. Consider a tax strategy to handle plan withdrawals. Clients will need to be told they do not have to worry about a 10 percent penalty, but the distribution is subject to ordinary income tax. A decision must be made whether the client should take the tax liability in a single sum or spread it over three years. Remind clients taking distributions from employer plans that the lack of tax withholding from the distribution might cause a cash flow concern to pay taxes that are owed on the distribution.

In most cases, you’ll likely suggest that taxes be spread over three years based on the universal tax adage to delay paying taxes as long as possible (“accelerate deductions and postpone income” to take advantage of the time value of money). However, if a client’s adjusted gross income was severely reduced by the pandemic, and a return to normalcy is anticipated after 2020, the client may want to pay all taxes due in 2020 based on their lower marginal tax rate. Run the numbers and decide which payment method will result in less tax.

Clients will wonder whether it is sound planning to pay back a withdrawal. For example, your client Ken will have three years from the day after he takes the distribution to pay it back to his IRA or employer plan. You and the client need to deliberate whether it is a good idea to repay the withdrawal from a liquidity perspective. In any case, it is unlikely that Ken will have the wherewithal to pay back distributed funds. However, if he receives an inheritance, an unaccounted-for bonus, or other windfall, you might suggest paying back retirement funds if there are other liquid funds still available.

Clients will be concerned about the ability to repay funds because of IRA and plan contribution limits. If Ken decides he will pay back the employer-plan or IRA withdrawal, let him know that he does not have to worry about recontributed funds triggering excess contribution penalties. The IRS rules that constrain annual contributions are not applicable because his repayment (can be one time) or repayments (can be many payments over the three-year period) will be treated like a rollover, and rollovers were never subject to the rules limiting plan contributions.

Clients will want to know how they will recover taxes if they return funds. If Ken recontributes funds, he will recover the federal and state taxes that apply to the withdrawal. Presumably, Ken will need to file an amended return to recover federal and state taxes. However, you should be on the lookout for the IRS to provide an easier method for accomplishing this objective.

The special exceptions on plan withdrawals apply to distributions up to $100,000 from retirement accounts. Retirement accounts include IRAs, 401(k) plans, 403(b) plans, 457(b) plans, and other qualified plans. The $100,000 limit is per individual, not per plan. In other words, the aggregate limit is $100,000. For plan administrators, the $100,000 calculation is problem-free as long as the administrator caps contributions from all employer plans the employer provides, even those under common control.12

As a practical matter, a plan administrator does not have to worry about IRA distributions tipping the distribution beyond the allotted amount. However, the issue could be problematic for clients with both qualified plans and IRAs, and you need to warn clients not to exceed $100,000 from all sources of retirement accounts.

Prevent a client from exceeding the $100,000 limit by pulling from multiple accounts. For example, your client Patty has both an IRA and a 401(k) plan. She takes out $100,000 from the 401(k), which is approved by the plan administrator. However, if she tries to take out funds from her IRA, warn her that anything taken beyond the $100,000 from the 401(k) will neither be entitled to exemption from the 10 percent penalty nor the other advantages granted by the CARES Act.

The withdrawal option will be available to any client who has an IRA. They can enjoy the CARES Act relief on any amount up to $100,000, if this is the only source of their distribution. However, the employer plan withdrawal option will not be available to every client. Only about half of private sector workers have a retirement account provided by their employer. Many who have a plan have far less than $100,000 in their account (although $100,000 is the maximum and amounts less than $100,000 are fully eligible for the special CARES Act treatment). There is also the question of whether the employer plan allows in-service distributions.

Plan sponsors will need to deliberate whether to make plan withdrawals available to the plan participants. For example, XYZ Company has a plan that does not allow in-service distributions for financial hardships. As XYZ’s planner, you can suggest that CRD withdrawals should be allowed, because implementation of the CARES Act is allowed without immediate plan amendments. Plan amendments can be postponed until the last day of the first plan year beginning on or after Jan. 1, 2022.13

Point out to plan sponsors that there are two major differences between a hardship withdrawal and a CRD withdrawal. A financial hardship is limited to the amount needed to meet the financial need. The CRD is limited to $100,000, even if that amount exceeds the need. And, the hardship withdrawal cannot be repaid, whereas the CRD can be repaid.

Finally, if the client takes a distribution, he will need to be advised on which funds to tap and whether he needs to rebalance his portfolio.

Clients will have questions about how to draw down assets. Given the impact of market declines associated with the pandemic, be prepared to address the issues of clients locking in losses by liquidating stocks that have declined in value through a plan withdrawal.

Appraise how retirement assets should be liquidated. For example, Arthur is about to take a distribution. You advise him to utilize the fixed income portion of his portfolio first. This leaves a greater percentage of stocks intact to participate in any recovery that might occur. You of course remind him that the worst time to withdraw funds is during a market downturn. However, the client has no other choice available. You then help to rebalance the portfolio.

Is a Loan or Withdrawal Warranted?

You and your clients will have to grapple with the issue of whether access to retirement funds is needed to meet their current financial crisis. Given the financial turmoil brought about by the pandemic, the prevailing thinking might be “desperate times call for desperate measures.” However, in most cases it will be the client’s unique circumstances that drive the decision, and assessing the situation may call for looking at several alternative options.

Does the client really need to take a loan or withdrawal? In a perfect world, you could steer clients away from incurring debt or depleting retirement funds. Before future retirement funds are diminished, clients should examine other options, including emergency funds, unemployment insurance, stimulus payments, life insurance cash values, or even selling collectibles.

If a client does need to take a loan or withdrawal, ascertain the amount of the loan or distribution to take. Sitting down with the client and determining what is the appropriate amount to tap should become a common experience in light of what just happened. Plan loans and withdrawals can enable clients to spend more than they otherwise would. Access to loans and withdrawals can increase consumption unnecessarily. When this happens, the client is in danger of establishing a substantial long-term financial hole from which they may not be able to dig out.

Despite the fact that planners will try and steer clients away from a loan or withdrawal, it may be appropriate in limited cases to call for distributions that are not out of necessity but meet a greater financial planning purpose. You are likely to find that the impact of the pandemic is more severe for some clients than for others. For example, a client might have been diagnosed with the disease, but she never lost her stream of income. Ironically, planners will sometimes deem that a withdrawal is warranted despite the fact that the client was relatively unscathed from the economic troubles caused by the crisis.

A client may be curious whether he or she should take advantage of the withdrawal opportunity even if they are not suffering a financial hardship. One good reason for a client who was unaffected or only marginally affected to draw down assets is to facilitate a Roth conversion or to relocate assets to receive Roth treatment. The CARES Act’s provisions do not limit distributions to specific needs, nor require proof of economic loss. In some situations, it may make sense to withdraw plan funds, pay the taxes over three years, and then slowly build a Roth IRA for the client with the disbursed funds.

Is a Loan Preferable to a Withdrawal or Vice Versa?

When funds are needed, a client may wonder whether a withdrawal may be a better way to acquire the money instead of a plan loan. The withdrawal may be viewed as advantageous, because it does not have to be paid back. This will preserve cash flow for this year and the years to come. In some cases, this may be a valid motivation to take a withdrawal instead of a loan, however, withdrawals are taxed; plan loans are not. Also illustrate to the client the impact of a withdrawal versus a plan loan on retirement savings.

For example, Rick (age 35) would like to take out $35,000 to cover lost wages. If he takes out a $35,000 loan, he will repay it with interest to himself. His account at the end of five years (assuming he did not elect the delay) will have grown to $39,629 ($35,000 plus his 5 percent interest rate). When he retires at 65, he will have accrued over $134,197 (5 ROR) by keeping the $35,000 in the plan and repaying his loan.

Conversely, in order to take out enough via the plan withdrawal, Rick would have to take out the $35,000 plus enough to cover the taxes that apply to the withdrawal. If he’s in the 24 percent federal tax bracket, he’ll need to take out $46,052 to cover the taxes he will be responsible for, on top of replacing his wages ($35,000 divided by 1 minus the tax rate of 24 percent).14 If he takes the hardship withdrawal and foregoes a rate of return in his 401(k) portfolio of 5 percent on the $46,052, he will be losing nearly $199,034 at retirement (age 65 in this example). This loss could have been avoided if Rick took the loan instead of the hardship withdrawal. The issue comes down to short-term sacrifice forced by required loan repayments versus draining retirement capital that might derail retirement. For this reason, most planners will suggest the loan option.

In some cases, however, you may suggest taking the bulk of needed funds via a plan loan, and the client should consider taking a smaller withdrawal, which can be used to help with cash flow while the loan is repaid.

Is a Plan Loan More Desirable than a Home Equity Loan?

Of equal importance will be deciding if home equity should be tapped in lieu of a plan loan. You’ll need to do a cost-benefit analysis of taking a plan loan versus taking a home equity loan (or refinancing their house).

The home equity loan (or refinance option) has advantages over the plan loan, including: the ability to take a loan in excess of $100,000 (when applicable and needed); a flexible repayment schedule that can tailor monthly repayments to the client’s budget by extending the life of the loan, and the ability to avoid hastened repayment if the client changes places of employment (more on that below).

Advantages the plan loan has over a home equity loan include: the potential to repay interest to the client’s account (instead of paying interest to a third party, reducing net worth); the potential for a lower rate of interest, and a realization that the shorter payback period may cause more expensive monthly payments but will lower the aggregate interest paid. In other words, it’s a balancing act between monthly payment affordability versus the ultimate amount of interest (and net worth) that is lost.

Plan Loans Are Not a Panacea

The advantage of paying interest back to yourself (instead of someone else) can be a big benefit of a plan loan over a home equity loan or a plan withdrawal. However, plan loans are not a panacea for those who can afford to make the payments. Any type of distribution can hurt a client who fails to have savings invested during a market recovery.

For example, clients who take out a loan and pay themselves back 5 percent interest may lose out on the opportunity to have benefited from 10 percent market gains. The reverse is also true; taking out a loan could save a client from losing money in the stock market, or from their money growing slower than they could pay themselves interest.

Assess the impact of having loaned funds out of the market. Consider illustrating to the client the potential impact of forgone revenue and consider rebalancing the remaining retirement assets to take advantage of Wall Street gains.

Another reason plan loans may not be optimal centers around disruptions with continued employment with the current employer. In many cases, a plan loan becomes due if the employee chooses to leave or is downsized or fired. In the past, an employee typically had between 60 and 90 days to repay the full amount of the loan if they left the job, but under the Tax Cuts and Jobs Act, the rules became more lenient. Now, the employee has until October of the following year to put the money back into their account, or in the 401(k) at their new employer.15 However, if the employee were to default on the loan, any of the benefits payable to the employee are reduced by the outstanding balance that is left, which is treated as a taxable distribution of the amount that was defaulted. This can lead to taxes and penalties being due, because it will be subject to ordinary income tax and any applicable penalties such as when the client is under age 59½.16

Perhaps the worst thing a client can do is take out a loan, only to lose her job the following year when the plan distribution enhancements have expired. In other words, if Kim takes out a loan in August and works until February 2021, when she is fired, she will be on the hook for taxes (no three-year payment option available) and penalties (the 10 percent excise tax may apply) on the former loan, which is now considered a distribution. She would have been better off taking a retirement withdrawal or a home equity loan.

Conclusion

The financial planning decisions described here are made even more difficult for three reasons. First, at the time of this writing, we do not know how long the health and economic crisis will last. Even if the tide turns and life returns to normal, a second recurrence of COVID-19 or a derivative of it is possible. Second, planners are asked to make decisions in a fluid environment. We are uncertain how regulation and new legislation might change the decision-making process. Will new and better opportunities open up? Will opportunities dry up before we are aware that it might have been prudent to seize them? And third, we will have to fight the tendency of some clients to make a dash to squirrel assets into a cash position.

We will need to quell the urge some clients have to take dramatic actions that are not in their best interests. We will have to plea that clients continue contributing to their 401(k) at pre-crisis levels (or better). We will have to prevent clients from prematurely claiming Social Security to meet temporary cash flow needs, sacrificing larger payouts for many years to come. And we will have to make sure they continue to plan appropriately, despite temporary shifts in their environment and way of life.

From a policy perspective, you wonder whether the CARES Act may have created a monster by allowing distributions of such a large amount. The $100,000 seems excessive for the amount that might typically be justifiably needed for most consumers. At least the loan option triggers liquidity without encouraging permanent leakage from retirement plans. But the question needs to be asked: Will easy access contribute to a retirement crisis in the future?

Endnotes

- Act Section 2202(a)(4)(A)(i)(I) and (II) of the CARES Act (P.L.116-136).

- Act Section 2202(a)(4)(A)(i)(III) of the CARES Act (P.L.116-136).

- Act Section 2202(a)(4)(B) of the CARES Act (P.L.116-136).

- See IRS Code Section 72(p). Note that there is a provision for allowing a $10,000 loan even when this is greater than one-half the vested account balance and that loan limits are reduced by loan balances from the plan from the one-year period ending on the day preceding the loan.

- Act Section 2202(b)(1)(A) and (B) of the CARES Act (P.L.116-136).

- Act Section 2202(b)(2) of the CARES Act (P.L.116-136).

- Act Section 2202(c) of the CARES Act (P.L.116-136). Also note it is 2024 for government plans.

- Act Section 2202(a)(1) of the CARES Act (P.L.116-136).

- Act Section 2202(a)(5)(A) of the CARES Act (P.L.116-136).

- Act Section 2202(a)(6)(A) of the CARES Act (P.L.116-136).

- Act Section 2202(a)(3)(A) of the CARES Act (P.L.116-136).

- Act Section 2202(a)(2)(C) of the CARES Act (P.L.116-136).

- Act Section 2202(c) of the CARES Act (P.L.116-136).

- This example does not take into account state taxes for simplicity sake.

- Public Law No: 115-97 Section 13613.

- See IRC Code Section 72(t).