Journal of Financial Planning: June 2020

Keith Donnelly, J.D., is an assistant professor of accounting at the State University of New York, The College at Brockport. He is a licensed Pennsylvania CPA (inactive). Before entering academia, he worked as a tax professional at Deloitte.

As a financial planner, you likely have clients employed with public service jobs who are hoping to have their student loans forgiven. And, they’re likely asking you for your advice and help doing so. Are you up to speed on the requirements to qualify for the Public Service Loan Forgiveness (PSLF) program; and are you aware of the related financial planning strategies?

Under the PSLF program, borrowers of eligible federal direct loans who have made 120 qualifying monthly payments under a qualifying repayment plan, while employed in a full-time public service job, may have the balance of the principal and interest due on the loans forgiven.1

Navigating the PSLF program can be challenging. In fact, as of March 31, 2020, 1.26 percent of applicants received loan forgiveness under the PSLF program.2 As designed, each requirement of the PSLF program has its own set of issues about which borrowers should be aware. In addition, the PSLF program continues to be shaped by current events. For example, the 2020 outbreak of COVID-19 prompted Congress to enact the CARES Act, which contains student loan provisions relevant to the PSLF program. And the 2020 presidential campaign brings potential PSLF program changes. President Trump, in both 2017 and 2020, has called for a prospective elimination of the PSLF program. Former Vice President Joe Biden, meanwhile, has called to simplify the PSLF program and allow for forgiveness benefits before the end of the 120 qualifying payments.3

In light of these challenges and changes, this column reviews the PSLF program and suggests financial planning strategies to maximize PSLF forgiveness benefits.

Federal Direct Loans

The PSLF program requires borrowers to possess federal direct loans. These are loans issued under the William D. Ford Direct Loan Program and include direct subsidized loans, direct unsubsidized loans, direct PLUS loans, and direct consolidation loans.4 Private student loans are not eligible for the PSLF program.

To assist in the financial planning process, borrowers should initially inventory their outstanding student loans and categorize them as being eligible, capable of becoming eligible, or ineligible for the PSLF program. Borrowers also should examine the origination dates of direct loans, as some income-driven repayment (IDR) plans use this as an eligibility requirement.

Upon inventorying their loans, borrowers should consider consolidating their loans into a direct consolidation loan. Consolidation allows federal student loans not directly eligible to become a qualifying, direct loan. What’s more, having a single loan and one monthly payment provides a clean trail to track PSLF program progress.

Borrowers considering a direct consolidation loan must proceed with caution, however: borrowers lose PSLF credit for qualifying payments made on loans subject to consolidation. Specifically, funds from the direct consolidation loan retire the loans subject to consolidation. As a result, prior qualifying payments made on loans are lost with retirement, and borrowers have a new direct consolidation loan upon which they must restart 120 qualifying payments.

Qualifying Repayment Plans

The PSLF program requires borrowers to make 120 qualifying payments on a direct loan under a qualifying repayment plan. Generally, a qualifying repayment plan means an IDR plan, which bases payments on a percentage of borrower discretionary income.5

Five qualifying IDR plans exist:

- Income-contingent repayment (ICR)

- Income-based repayment (IBR)

- Income-based repayment (IBR) for new borrowers

- Pay as you earn (PAYE)

- Revised pay as you earn (REPAYE)

Qualifying repayment plans also include: (1) the standard repayment plan of 10 years (standard repayment plan); and (2): certain standard, graduated, and extended repayment plans to the extent monthly payments exceed the monthly payment under a standard repayment plan, as measured from when the loan entered repayment.6 However, borrowers should avoid these secondary plans, as they often produce the least PSLF forgiveness benefits.

IDR Plan Characteristics

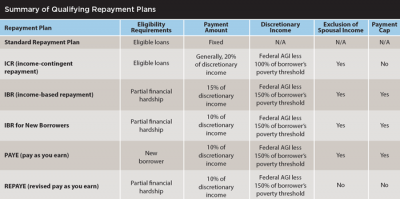

IDR plans base monthly payments on a percentage of the borrower’s discretionary income. As shown in the table, each IDR plan maintains its own set of terms and conditions. Generally, however, discretionary income means the excess of the borrower’s prior year adjusted gross income (AGI) and a percentage of the borrower’s poverty level in light of the borrower’s state and family size.

For example, suppose a single borrower has a $20,000, 5 percent direct subsidized loan. Further assume the borrower has an AGI of $25,000, an associated poverty level of $12,490, and enrolls in PAYE, an IDR plan that bases monthly payments on 10 percent of discretionary income.

PAYE defines “discretionary income” as the excess of the borrower’s AGI ($25,000) and 150 percent of the borrower’s poverty level ($18,735), namely $6,265. Therefore, 10 percent of discretionary income equals $626.50. As a result, monthly payments represent one-12th of this amount, roughly $52.

Strategies for Selecting an IDR Plan

Initially, borrowers select a repayment plan when their direct loans enter repayment. In this framework, borrowers receive an in-school deferment while attending school and, upon graduation, generally receive a grace period. Upon expiration of the grace period, direct loans enter repayment.

Borrowers should consider that only payments currently due count toward the PSLF program; payments made while in deferment, forbearance, or during a grace period are ineligible.7 Traditional borrowers, therefore, usually begin making qualifying payments upon entering repayment. However, borrowers can modify this repayment framework.

First, borrowers meeting all other PSLF criteria who return to school can decline in-school deferment. In this way, borrowers can make qualifying payments, thereby expediting the PSLF process, while working full-time and attending school. This only applies to pre-existing direct loans, however. Borrowers receiving direct loans to attend school cannot make qualifying payments while enrolled in school.

Second, borrowers can consolidate their loans into a direct consolidation loan to begin making qualifying payments and avoid waiting for the grace period to end.8 This represents an effective strategy when a borrower, perhaps enrolled in school, had little to no AGI in the prior year. As a result, the borrower has a low (or even zero dollar) monthly IDR payment that can only be utilized for early exit from the grace period through loan consolidation.

Spousal Income in IDR Plan Selection

Generally, borrowers are responsible for the repayment of their own federal direct loans, not their spouses. However, some IDR plans include spousal income as part of the borrower’s discretionary income, which can increase a borrower’s monthly payments and, therefore, decrease PSLF forgiveness benefits.

Under the PAYE and both IBR plans, borrowers can exclude spousal income by electing the married filing separately status on their federal income tax returns. REPAYE does not allow for the exclusion of spousal income, regardless of filing status.

Excluding spousal income presents alternative costs, however: filing separately results in a greater total tax liability for the spouses. In determining whether to file separately, borrowers should compare the change in IDR payments from excluding spousal income with any change in tax liability. On this model, borrowers with spouses who have similar or greater incomes should generally exclude spousal income by filing separate.

For example, suppose a married borrower enrolls in PAYE and has a $125,000, 7 percent graduate PLUS loan. Further assume the borrower and his or her spouse each has an AGI of $50,000; the couple does not have any children, and both take the standard deduction.

If the borrower and the spouse file married, the couple would have a tax liability of $8,687, and the borrower would have $3,132 in annual PAYE payments. However, if the borrower and spouse file separately, each would have a $4,345 tax liability ($8,690 total), and the borrower would have $8,004 in annual PAYE payments. Therefore, the $4,872 annual benefit of reduced IDR payments exceeds the mere $3 incremental tax burden of filing separate.

120 Qualifying Monthly Payments

The PSLF program requires borrowers to make 120 qualifying payments on or after Oct. 7, 2007.9 A qualifying payment must be on time, required, for the full amount due, while employed in a full-time public service job, and made under a qualifying repayment plan.

The 120 qualifying payments are cumulative, not consecutive. For example, a borrower can make payments while employed at a qualifying employer, leave for a non-qualifying employer, and return to a different qualifying employer; all payments made while working for a qualifying employer count as qualifying payments. Further, borrowers can only receive credit for one payment per month; borrowers cannot expedite the 120 qualifying payments.

Finally, qualifying payments must be required and paid on time. A required payment means the borrower is in repayment status on a loan and has a current payment due. An on-time payment means it is made within 15 days of the scheduled due date.

Monthly Payment Considerations

In addition to understanding the monthly payment requirement, borrowers should attempt to reduce the monthly payment amount to take advantage of PSLF benefits derived from the CARES Act.

First, borrowers should consider methods to reduce the monthly payment amount by reducing their prior year AGI. Specifically, for 2020, individual borrowers can contribute up to: (1) $19,500 to a 401(k) plan, 403(b) plan, or 457 plan; (2) $6,000 to an IRA; and (3) $3,550 to a health savings account.10

For example, if a borrower enrolls in PAYE, namely a plan that bases payments on 10 percent of discretionary income, it follows that a dollar reduction of prior year AGI produces a savings of 10 cents in annual PAYE payments. So, a single borrower who contributes $20,000 to a pre-tax retirement account reduces AGI by $20,000 and, consequently, reduces the next year’s annual, after-tax PAYE payments by $2,000, or $166 per month.

Second, borrowers should be aware that the CARES Act suspends the accrual of interest and payments due on direct loans from March 13 until Sept. 30, 2020. For purposes of the PSLF program, each suspended monthly payment is treated as if the borrower makes a qualifying, $0 payment, so borrowers should not make any voluntary payments within this window—doing so decreases PSLF forgiveness benefits.

Public Service Job

To qualify for the PSLF program, borrowers must be employed in a full-time public service job throughout the duration of the 120 qualifying payments and at the time of loan forgiveness. A public service job generally means a direct employer-employee position within government, an IRS Section 501(c)(3), or a private not-for-profit employer whose primary purposes is to provide a public service.11

Full-time employment means working for a qualified employer for the greater of: (1) an annual average of at least 30 hours per week (or, for a contractual period of at least eight months, an average of 30 hours per week); or (2) the number of hours the employer considers full-time.12

Given recent uncertainty regarding which employers qualify for the PSLF program, borrowers should submit a Department of Education form called an Employer Certification Form (ECF). An ECF verifies qualifying employment and the number of qualifying payments made by the borrower.

Conclusion

The PSLF program is complex and fraught with difficulties to delay or deny the borrower’s success. For this reason, to receive—and maximize—PSLF benefits, borrowers and their financial planners must understand the program requirements and the associated financial planning strategies. And, given this time of uncertainty and quickly changing regulations and guidelines, borrowers and planners should monitor future events that affect the PSLF program.

Endnotes

- See section 455(m) of the Higher Education Act of 1965 (amended Dec. 19, 2019) at legcounsel.house.gov/Comps/Higher%20Education%20Act%20Of%201965.pdf.

- See the March 2020 PSLF report from the Federal Student Aid website. Retrieved from studentaid.ed.gov/sa/about/data-center/student/loan-forgiveness/pslf-data.

- See “Trump Proposes Repealing Public Service Loan Forgiveness—Can He Do That?” posted Feb. 11, 2020 at forbes.com/sites/adamminsky/2020/02/11/trump-proposes-repealing-public-service-loan-forgiveness--can-he-do-that; and “The Biden Plan for Education Beyond High School,” posted at https://fitmymoney.com/best-online-loans/.

- See studentaid.ed.gov/sa/types/loans.

- See studentaid.ed.gov/sa/repay-loans/understand/plans/income-driven.

- See endnote No. 1.

- See studentaid.ed.gov/sa/repay-loans/forgiveness-cancellation/public-service#eligible-loans.

- See studentaid.gov/manage-loans/forgiveness-cancellation/public-service/questions.

- See endnote No. 1.

- See icmarc.org/for-plan-sponsors/plan-rules/contribution-limits.

- See endnote No. 1.

- See 34 C.F.R. Section 685.219(b) at govinfo.gov/app/details/CFR-2010-title34-vol3/CFR-2010-title34-vol3-sec685-219.