Journal of Financial Planning: March 2019

Tao Guo, Ph.D., CFP®, is an assistant professor in the Department of Economics, Finance, and Global Business at William Paterson University. His research interests include retirement income strategies, household portfolio management, and financial decision-making quality.

Yuanshan Cheng, Ph.D., CFP®, is an assistant professor of finance in the Department of Accounting, Finance, and Economics at Winthrop University. His research interests are risk management strategies in retirement planning, retirement income strategies, and the value of financial advisers.

Philip Gibson, Ph.D., CFP®, is an assistant professor of finance in the Department of Accounting, Finance, and Economics at Winthrop University. His research interests include household finance and retirement income strategies.

Louis J. Pantuosco, Ph.D., is a professor of economics in the Department of Accounting, Finance, and Economics at Winthrop University. His research interests include labor, public policy, wage determination models, and monetary policy.

Executive Summary

- This study examined self-reported happiness, as derived from daily activities in retirement, by investigating the activities that lead to increased happiness and the optimal allocation of time for such activities.

- Findings indicate that retirees prefer active activities such as socializing, walking, or exercising, as well as those that require human capital, such as working or volunteering, compared to passive activities, such as staying at home and watching television.

- The need to engage in active activities increased with age, while the desire for passive activities decreased with age. However, most retirees spent more time on passive activities, which contributed to a decrease in overall happiness.

- There appeared to be a gap between how retirees would like to spend their time and what they actually do in retirement. This gap indicates an area that could lead to a reduction in happiness during retirement.

- Although time allocation largely affected retirees’ happiness, household wealth was not related to how retirees allocated their time.

- Financial planners can not only ensure the appropriate use of retirement assets for their clients, but also provide guidance on how clients might plan their daily activities.

When entering retirement, one experiences many changes. For example, instead of focusing on the accumulation of assets, retirees concentrate on the decumulation of assets and the adjustment of their disposable income (Banks, Blundell, and Tanner 1998). Retirees also experience a change in their social networks (Holt-Lunstad, Smith, Baker, Harris, and Stephenson 2015) and daily routines.

Financial planners historically have focused on recommending and managing financial assets. As the financial planning profession continues to evolve, however, it is essential for planners to help their clients improve their mental state.

Lawson and Klontz (2017) argued that financial planners can be more comprehensive by integrating elements of financial psychology and financial therapy theory into the six-step financial planning process. In this regard, they also can assist clients in other aspects of retirement, such as time allocation and choice of daily activities, which will be to their clients’ benefit.

Using a national dataset on retirees, this study explored retirees’ time allocations for, and self-reported happiness from, daily activities. The results revealed that retirees preferred active activities such as socializing, walking, or exercising, as well as those activities that require human capital, such as working or volunteering, compared to passive activities, such as staying at home and watching television.

Although optimal time allocations were identified in this study, there appeared to be a gap in how retirees would like to spend their time and what they were actually doing in retirement. This gap indicates an area that could lead to a reduction in happiness during retirement. The study also found that household wealth did not change how individuals allocated their time in retirement.

The findings have implications for financial planning practice, as ample financial resources and a well-developed time allocation are equally important to retirees. Specifically, it is recommended here that financial planners provide guidance and related resources on how their clients might plan their daily activities, and that planners encourage clients to perform such activities.

Literature Review

Retirement well-being has been widely studied in the literature. Prior studies have explored the effects of financial resources on retirement well-being, with income and wealth as two main measurements of financial resources. Andrews (1993) and Radner (1998) summarized the impact of retirement income on retirement well-being and found them significant in explaining well-being levels. Levine, Mitchell, and Moore (1996) studied the relationship between retirement wealth and well-being among males and females and found significant differences in well-being between the genders. Lusardi and Mitchell (2011) showed that financial literacy and planning helped to improve retirement well-being.

How clients plan their daily activities in retirement also affects their overall happiness. Becker (1965) was among the first researchers to propose a utility theory that considered time allocation. His theory suggested that individuals derive happiness when performing activities that consume both goods and time. As such, the choice and quality of daily activities affect individuals’ well-being.

Feather (1990) suggested that the lower subjective well-being of unemployed individuals was explained by the loss of self-esteem due to the lack of meaningful daily activity, rather than a reduced income level. Butrica and Schaner (2005) found that retirees who worked or volunteered had higher levels of subjective well-being. Similarly, Bender (2012) found that productive activities at older ages enhanced physical and mental health.

Beier, Torres, and Gilberto (2016) categorized activities into groups, such as productive, physical, social, and leisure, and showed that the variety of daily activities performed during retirement had a positive impact on mental and physical well-being. Also, Sunder, Chatterjee, Palmer, and Goetz (2016) found that time spent on activities related to financial services was positively associated with retirement well-being.

Inappropriate allocation of time and choice of daily activities could result in social isolation and chronic loneliness, negatively affecting a retiree’s health and well-being. Hawton et al. (2011) found that social isolation was consistently associated with poor health and low well-being in older individuals. Consistently, studies also have found that social isolation increases the risks of premature mortality (Holt-Lunstad, Smith, and Layton 2010), and results in poorer cognitive functioning (Cacioppo and Cacioppo 2014), as well as high blood pressure and immune disfunction (Uchino 2006). The impact of social isolation on health is so pronounced that Holt-Lunstad (2018) argued that the health risk of social isolation in many cases exceeded that of smoking and obesity, pointing to the existence of a “loneliness epidemic.”

Retirees’ time allocation also has significant implications for financial spending. Hurd and Rohwedder (2003) explored time spent on activities in retirement to explain why consumption declined through retirement, which is considered a “retirement consumption puzzle.” Blanchett (2014) documented that although overall retiree spending declined in real terms, the spending of younger retirees declined much slower. He suggested that this was due to the health of younger retirees, because they were able to spend more on traveling and other activities. Kalenkoski and Oumtrakool (2014) studied how retirees spent their time on 20 separate activities during retirement and proposed that time-spending behaviors inform how much income retirees need in retirement.

Although several studies have looked at time expenditures during retirement and their impact on overall well-being or retirement spending, this study examined self-reported happiness from a comprehensive list of daily activities performed during retirement. This study identified which activities yielded more happiness, as well as the optimal time needed for each activity. This study also explored how household wealth affected retirees’ time-allocation decisions.

The results of this study provide insight for financial planners for their work with retirees and highlight the importance of assessing clients’ activities. In practice, it is vital that financial planners have conversations with their clients who are approaching retirement or in retirement about appropriate time-use and activities to enhance well-being throughout retirement.

Data and Methodology

This study used data obtained from the Health and Retirement Study (HRS), a longitudinal survey administered by the University of Michigan’s Institute for Social Research and sponsored by the National Institute on Aging and the Social Security Administration. The purpose of the HRS is to investigate the health and economic circumstances of Americans aged 51 and older. It contains detailed information on household demographics, health conditions, employment history, financial status, retirement preference, and behaviors.

The time use and happiness data in this study came from the psychosocial and lifestyle questionnaire in the HRS. The survey module contains items about respondents’ life circumstances, subjective well-being, daily activities, and personality traits. Responses collected in 2014 were investigated in this study. Because this survey module was distributed to a subsample of respondents, a weight was applied to reflect the distribution of the full population.

This study focused on responses to the following two groups of questions that were related to the activities listed in the survey: (1) “How much time did you spend … yesterday?” and (2) “Rate each experience on a scale from 0 (did not experience at all) to 6 (the feeling was extremely strong). You felt happy when you were … yesterday.” 1

The activities included in the survey were:

- Watching television

- Working or volunteering

- Walking or exercising

- Health-related activities other than walking or exercising (e.g., visiting a doctor, taking medications, doing treatments)

- Traveling or commuting (e.g., by car, train, bus)

- Socializing with friends, neighbors, or family

- Staying at home alone

- Running errands

Smith et al. (2014) argued that the above activities were most frequently performed by older adults and were closely related to their health and subjective well-being. Responses to these two groups of questions make it possible to study current retirees’ time use and their happiness from performing each of these activities.

As mentioned earlier, Becker (1965) proposed a theory of the allocation of time, whereby individuals consume a combination of time and goods when performing activities that directly contribute to their utility or happiness. For example, a home-prepared meal is a result of the ingredients and the time spent cooking. Individuals with time constraints might be limited to certain activities, which has the potential to reduce happiness.

For the analysis, an ordinary least squares regression model was used. Within the model, happiness from each activity was a function of time spent. The analysis also assumed a typical Cobb-Douglas Utility function, with diminishing marginal utility. As individuals spend more time on one activity, the marginal utility of that activity decreases. Individuals also could experience reductions in the happiness derived from engagement in that particular activity. For example, watching television for a few hours could be relaxing and enjoyable. Conversely, watching television for 10 hours straight might be tedious and exhausting.

In the regression model, happiness from each activity was regressed against time spent, the second power of the time spent, and key demographic characteristics. Health condition was controlled because it affected whether retires could engage in certain activities and how many hours they spent with the activity; and it was measured as the number of the respondent’s medical conditions. Education attainment was controlled because education level is an indicator of human capital and could be related to engagement in activities. The natural logarithm of household income and household wealth were controlled as some activities could be constrained by financial resources. Gender, race or ethnicity, and marital status were also controlled in the model.

Actual Time Use by Current Retirees

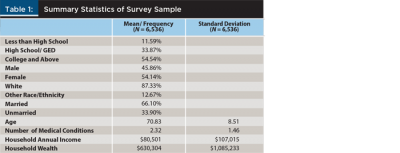

Table 1 presents the summary statistics for the survey sample. On average, retirees were 71 years old and had two medical conditions, an annual household income of $80,501, and household wealth of $630,304. Table 2 presents the average time spent, and happiness ratings for, each activity by respondents aged 60 years and older.

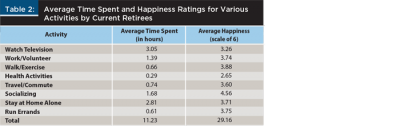

The survey captured approximately 11 hours of respondents’ daily time use. This is the time spent outside of sleeping and essential daily activities, such as meal preparation, eating, housekeeping, maintaining personal hygiene, dressing, and toileting. Respondents spent, on average, 3.05 hours watching television and 2.81 hours staying at home alone. Their happiness from these activities, however, was among the lowest. These retirees spent, on average, 0.29 hours on health-related events, which also were associated with a low level of happiness. Further, retirees spent, on average, 1.68 hours socializing, and reported the highest happiness among all activities. The average time spent walking or exercising was 0.66 hours, and the level of happiness associated with these activities was second to the level of happiness derived from socializing. Overall, the results indicate that, on average, there is a clear distinction between the levels of happiness that result by engagement in the different daily activities.

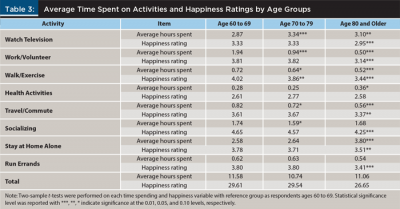

Table 3 presents the average time use and happiness ratings by respondents in different age groups. The total hours spent on the eight activities that were studied decreased with age. For example, respondents aged 60 to 69 spent a total of 11.58 hours on these eight activities, while retirees aged 80 and older spent 11.06 hours on these activities. A reduction in mobility could be a contributing factor, as older adults are spending a considerable amount of time on essential daily living activities such as meal preparation, eating, housekeeping, hygiene, and dressing. There is a clear difference in the time spent on each activity between all age groups.

Total time spent on the eight activities decreased with age, but the time spent on watching television, staying at home, and running errands increased with age. Two-sample t-tests were performed on each time spent and the happiness variable, with the reference group being respondents aged 60 to 69. There was a statistically significant difference for respondents aged 80 and above in time spent watching television and staying at home. A statistically significant difference also was observed for respondents aged 70 to 79 in time spent watching television. Meanwhile, the time spent working or volunteering, walking or exercising, traveling or commuting, and socializing, declined with age. The difference with the reference group was statistically significant for all other age groups.

Similar to the findings presented in Table 2, it is clear that retirees experienced different levels of happiness from performing each activity. Even though retirees in all age groups spent only less than two hours socializing, their happiness score was the highest, at about 4.25 to 4.65. A similar pattern was observed for working or volunteering and walking or exercising. In contrast, respondents in all age groups spent about 3 hours watching television, but their average happiness score was only about 2.95 to 3.33. Respondents spent about 0.30 hours on health-related activities, and their average happiness score was below 3 (recall that the happiness score is on a scale of 1 to 6). Happiness from performing each of these eight activities all decreased with age, even though the time spent on these activities either increased or decreased with age. The reduced happiness was statistically significant for respondents aged 80 and above.

Time spent watching television and staying at home increased with age, while happiness decreased. It could be argued that these two activities are typical passive leisure activities, while other activities in this study demand more self-motivation, better health, and/or financial resources. In other words, retirees in the survey might spend more time on these activities because other activities became difficult or impossible to perform. It also was possible that their social networks shrank in size as they got older.

A set of ordinary least squares regression tests2 were conducted on each age group. Estimated regression beta coefficients are reported in the appendix. Projected happiness3 on each activity was calculated based on these coefficients.

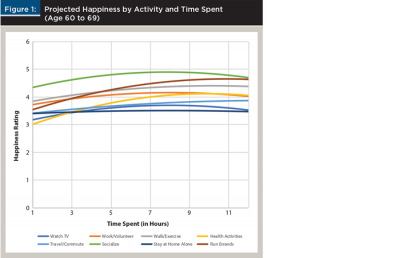

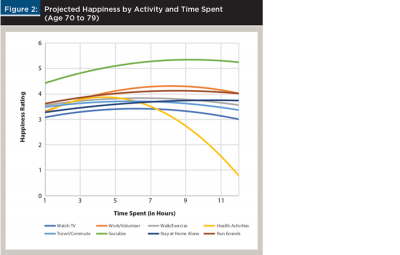

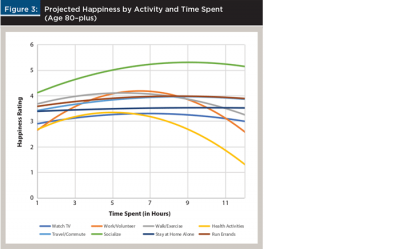

Figures 1, 2, and 3 show the predicted happiness by time spent on each of the eight activities for retirees aged 60 to 69, 70 to 79, and 80 and older, respectively. Although derived from actual time spent and happiness responses, these figures present projected happiness, assuming that a certain amount of time could be spent on each activity. Although spending 12 hours per day on any of these activities seems unrealistic, these figures address: (1) which activities provided a higher level of happiness; and (2) at what point retirees started to experience a decline in happiness from engaging in these activities.

Consistent with the findings reported earlier, retirees preferred socializing, walking or exercising, and working or volunteering. These three activities consistently provided the highest level of happiness among all age groups, whereas staying at home, watching television, and health-related activities provided the lowest happiness.

Variations were found among the three age groups in regard to how happiness changed with time spent on each activity. When retirees aged 60 to 69 spent about eight hours socializing, their happiness was the highest. Peak happiness from socializing increased to about nine hours for those aged 70 to 79 and those above age 80. For retirees aged 60 to 69, the highest level of happiness was achieved when they spent approximately seven hours working or volunteering. For retirees aged 70 to 79, the time was slightly longer than eight hours.

These findings suggest that desire for active leisure activities increases with age. A possible explanation is that retirees might begin retirement with the goal of spending more time at home or watching television, which they have missed during their working years. Later, they realize that engaging in social activities provides more happiness. Similarly, many workers might dream of leaving the workforce right after they retire, but they may then recognize that working part-time improves their self-esteem and happiness while increasing the longevity of their portfolio.

Optimal Time Use by Retirees

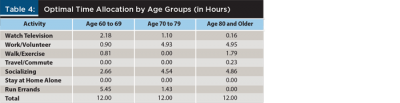

With the help of the model used in this study, it was possible to identify a time allocation that provides the most happiness for retirees in different age groups. Take retirees aged 60 to 69 (shown in Figure 1) as an example. Using the happiness from each activity and the time spent, an optimization method4 was applied to identify how much time could be spent in each activity to achieve the most happiness. Based on the survey questions and previous summary statistics, it appears that health activities were performed according to current health status. Hence, individuals involuntarily spent time on health-related activities as opposed to choosing to do so. For this reason, only the other seven activities were included in this optimization procedure.

Table 4 shows the optimal time allocation for retirees in different age groups. A total of 12 hours was assumed to be spent on these seven activities. These results are consistent with the previously mentioned findings. The demand for socializing and working or volunteering increased with age. The optimal time allocation on these activities increased from 2.66 to 4.86 hours for socializing, and 0.90 to 4.95 hours for working or volunteering. The time allocation for traveling or commuting increased from zero to 0.23 hours for retirees aged 80 and above. These results are consistent with the notion that retirees enjoy being away from home. The optimal time allocation for watching television fell from 2.18 to 0.16 hours, and the optimal time allocation for staying at home alone was zero for all retirees.

Compared to actual time allocations shown in Tables 2 and 3, current retirees seemed not to be spending their time consistent with their optimal time allocation. Although active leisure activities were desired, retirees spent much more time at home performing passive leisure activities. The gap between actual time spent and optimal time spent could lead to reduced happiness, loneliness, or even depression. This finding is consistent with the previous observation that, while current retirees spent more time on these two passive leisure activities as they aged, their happiness declined.

Time Use and Household Wealth

The financial planning profession has traditionally focused on the financial aspects of retirement and aimed to provide clients with sufficient financial resources to achieve their spending objectives in retirement. Assuming that a financial planner is able to help his or her clients to attain wealth during retirement, then those clients would be expected to engage in dynamic leisure activities. The results presented by this anlysis thus far have indicated that dynamic leisure activities provide more happiness. Unfortunately, these activities were more likely to be limited due to financial constraints. This section explores whether ample financial resources would be sufficient for clients to perform desired dynamic leisure activities. This study also investigated how household wealth affected retirees’ time allocation decisions.

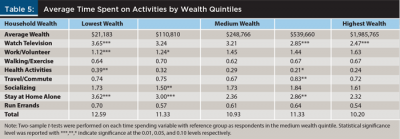

The respondent sample was divided into quintiles by household wealth. The average time spent on the eight activities for retirees with different levels of wealth are shown in Table 5. Average household wealth (including home equity) ranged from $21,183 to $1,985,765, and variations in the time spent among retirees with different levels of wealth were identified. Two-sample t-tests were performed on each time-spending variable, with the reference group as respondents in the medium-wealth quintile.

Time spent on passive leisure activities such as watching television and staying at home decreased with wealth, and a statistically significant difference was observed for most wealth quintiles. There was, however, only about a one-hour difference in time spent between respondents with the lowest wealth and those with the highest wealth. Time spent on health-related activities also decreased with wealth, with a statistically significant difference observed in only two wealth quintiles. This is consistent with previous findings that passive leisure activities were not desirable, in general.

Time spent working or volunteering increased with wealth, with a statistically significant difference observed in two low-wealth quintiles only. There was no significant difference in time spent walking or exercising and socializing among all wealth quintiles. In summary, there was some evidence that time spent on passive leisure activities decreased with wealth, but little evidence that time spent on active leisure activities increased with wealth. As such, financial resources had only a marginal impact on how individuals plan their daily activities

The total time spent on all eight activities dropped from 12.59 hours for retirees at the bottom-wealth quintile to 10.20 hours for retirees at the top wealth quintile. It is possible that high-wealth individuals spent more time on other activities that were not captured in this survey.

Overall, although time allocation largely affected retirees’ happiness, financial resources did not appear to change how individuals allocated their time. In addition to ensuring ample retirement assets for their clients, financial planners also may consider providing guidance on how their clients allocate their time.

Conclusion and Implications

This study contributes to the body of knowledge on the retirement experience by examining the time spent by respondents on major activities during retirement and the happiness derived from each activity. Understanding the implications of time allocation and happiness from a national dataset can help financial planners to learn about additional factors that have an impact on retirees’ well-being. This study found that retirees preferred active leisure activities, such as socializing and working or volunteering, compared to passive leisure activities, such as watching television and staying at home. Overall, ample financial resources and a well-developed time allocation were shown to be important to retirees.

The findings have important implications for financial planning practice and can help financial planners start conversations with their retiree clients on how they can spend their time during retirement. Managing financial assets is a critical part of financial planning, but planners can provide additional value by helping clients better allocate their time. The results related to optimal time allocation provide guidelines for how clients can allocate their time.

Planners can be more intentional in introducing and educating clients on the benefits of optimal time allocation in daily activities. Socialization provided the most happiness among the eight activities in this study. Although many financial planners already host frequent gatherings and provide opportunities for clients to socialize with each other, this study reaffirms the value of these social activities. Working or volunteering is another highly desirable activity. Clients who value volunteer activities might benefit from a list of volunteer opportunities provided by their financial planner. Tools that help retirees track their time use and maintain a healthy lifestyle also could be beneficial. Mimicking the group share function in workout apps, financial planners could create a community of sharing and collectively promote an active lifestyle for their clients.

In short, life planning and retirement coaching could be an essential part of the services provided to the retired client. When needed, financial planners also can incorporate a partnership with a counseling service into their practice.

Although social isolation and chronic loneliness in older people calls for a large-scale public health intervention, financial planners can help to identify clients at high risk for social isolation and chronic loneliness and offer additional guidance. For clients who are living alone, divorced, widowed, or spending the majority of their time watching television and staying at home alone, planners can consider engaging in conversations with those clients about senior communities and other ways to rebuild their social network. Relocating retiree clients to popular retirement communities or near social networks of family and friends may not only provide tax benefits, but also improve retiree well-being. Cattan, White, Bond, and Learmouth (2005) found that interventions involving group educational activities were most effective.

Financial planners can consider hosting seminars, specifically for their high-risk clients, to teach them about loneliness and health. Notably, providing resources in regard to where to seek help could save lives. For example, older individuals are able to call a toll-free hotline offered by the Institute of Aging (called the Friendship Line, 800-971-0016) when they feel depressed or suicidal, and the AARP Foundation sponsors a Connect2Affect program (connect2affect.org) for the elderly to connect with nearby communities and volunteer groups.

Endnotes

- The HRS included assessments on happiness, as well as how interested in activities and content the respondents were. The survey also provided guidance on creating an index of activity-related positive affect based on these three assessments. The authors chose to use only the happiness measure in this analysis, because it is straightforward and easy to comprehend. Additional tests were performed and it was found that an identical conclusion could be reached when the positive affect index was used.

- The dependent variable, happiness from performing each activity, was assessed on a 6-point scale. Although the ordinal nature of this variable challenges the assumptions of ordinary least squares regression, our validity checks did not find a significant violation.

- A set of ordinary least squares regression tests was conducted on each age group, whereby happiness from performing each activity was regressed against time spent, the second power of the time spent, and key demographic characteristics, including health condition, education attainment, gender, race or ethnicity, marital status, income, and wealth. Then, projected happiness on each activity was calculated based on estimated beta coefficients. The reference group was white married male retirees who had a moderate health condition, high school education, $40,000 annual income, and $1 million of net worth. The conclusions derived based on this reference group were very similar to those of other demographic groups.

- This approach maximized the total score of happiness from all seven activities on the condition that the total time spent on these seven activities was up to 12 hours. In other words, the optimal time allocation shown in Table 4 provides the highest total happiness if retirees spend 12 hours in total on these seven activities.

References

Andrews, Emily S. 1993. “Gaps in Retirement Income Adequacy,” in The Future of Pensions in the United States, ed. by Richard Schmitt. Philadelphia: Pension Research Council and University of Pennsylvania Press.

Banks, James, Richard Blundell, and Sarah Tanner. 1998. “Is There a Retirement-Savings Puzzle?” The American Economic Review 88 (4): 769–788.

Becker, Gary S. 1965. “A Theory of the Allocation of Time.” The Economic Journal 75 (299): 493–517.

Beier, Margaret E., W. Jackeline Torres, and Jacqueline M. Gilberto. 2016. “Activities Matter: Personality and Resource Determinants of Activities and their Effect on Mental and Physical Well-Being and Retirement Expectations.” Work, Aging and Retirement 4 (1): 67–78.

Bender, Keith A. 2012. “An Analysis of Well-Being in Retirement: The Role of Pensions, Health, and ‘Voluntariness’ of Retirement.” The Journal of Socio-Economics 41 (4): 424–433.

Blanchett, David. 2014. “Exploring the Retirement Consumption Puzzle.” Journal of Financial Planning 27 (5): 34–42.

Butrica, Barbara A., and Simone G. Schaner. 2005. “Satisfaction and Engagement in Retirement.” Perspectives on Productive Aging, a data and policy brief by the Urban Institute’s Retirement Project. Available at urban.org/retirement.

Cacioppo, John T., and Stephanie Cacioppo. 2014. “Older Adults Reporting Social Isolation or Loneliness Show Poorer Cognitive Function Four Years Later.” Evidence-Based Nursing 17 (2): 59–60.

Cattan, Mima, Martin White, John Bond, and Alison Learmouth. 2005. “Preventing Social Isolation and Loneliness Among Older People: A Systematic Review of Health Promotion Interventions.” Ageing & Society 25 (1): 41–67.

Feather, Norman T. 1990. The Psychological Impact of Unemployment. New York, N.Y.: Springer.

Hawton, Annie, Colin Green, Andy P. Dickens, Suzanne H. Richards, Rod S. Taylor, Rachel Edwards, Colin J. Greaves, and John L. Campbell. 2011. “The Impact of Social Isolation on the Health Status and Health-Related Quality of Life of Older People.” Quality of Life Research 20 (1): 57–67.

Holt-Lunstad, Julianne. 2018. “The Potential Public Health Relevance of Social Isolation and Loneliness: Prevalence, Epidemiology, and Risk Factors.” Public Policy & Aging Report 27 (4): 127–130.

Holt-Lunstad, Julianne, Timothy B. Smith, and J. Bradley Layton. 2010. “Social Relationships and Mortality Risk: A Meta-Analytic Review.” PLoS Medicine 7 (7): 1–20.

Holt-Lunstad, Julianne, Timothy B. Smith, Mark Baker, Tyler Harris, and David Stephenson. 2015. “Loneliness and Social Isolation as Risk Factors for Mortality: A Meta-Analytic Review.” Perspectives on Psychological Science

10 (2): 227–237.

Hurd, Michael, and Susann Rohwedder. 2003. “The Retirement-Consumption Puzzle: Anticipated and Actual Declines in Retirement Spending.” National Bureau of Economic Research Working Paper No. w9586. Available at nber.org/papers/w9586.

Kalenkoski, Charlene M., and Eakamon Oumtrakool. 2014. “How Retirees Spend Their Time: Helping Clients Set Realistic Income Goals.”

Journal of Financial Planning 27 (10): 48–53.

Lawson, Derek. R., and Bradley T. Klontz. 2017. “Integrating Behavioral Finance, Financial Psychology, and Financial Therapy into the 6-Step Financial Planning Process.” Journal of Financial Planning 30 (7): 48–55.

Levine, Phillip B., Olivia S. Mitchell, and James F. Moore. 1996. “Women on the Verge of Retirement: Predictors of Retiree Well-Being.” Pension Research Council Working Paper No. 97-2. Available at pensionresearchcouncil.wharton.upenn.edu.

Lusardi, Annamaria, and Olivia S. Mitchell. 2011. “Financial Literacy and Planning: Implications for Retirement Wellbeing.” National Bureau of Economic Research

Working Paper No. w17078. Available at

nber.org/papers/w17078.

Radner, Daniel B. 1998. “The Retirement Prospects of the Baby Boom Generation.” Social Security Bulletin 61 (1): 3–19.

Smith, J. Carson, Kristy A. Nielson, John L. Woodard, Michael Seidenberg, Sally Durgerian, Kathleen E. Hazlett, Christina M. Figueroa, et al. 2014. “Physical Activity Reduces Hippocampal Atrophy in Elders at Genetic Risk for Alzheimer’s Disease.” Frontiers in Aging Neuroscience 6 (61) 1–7.

Sunder, Aman, Swarn Chatterjee, Lance Palmer, and Joseph W. Goetz. 2016. “How Retirees Prioritize Socializing, Leisure and Religiosity—A Research-Based Study for Planners.” Academy of Economics and Finance Journal (7): 99–105.

Uchino, Bert N. 2006. “Social Support and Health: A Review of Physiological Processes Potentially Underlying Links to Disease Outcomes.” Journal of Behavioral Medicine 29 (4): 377–387.

Citation

Guo, Tao, Yuanshan Cheng, Philip Gibson, and Louis J. Pantuosco. 2019. “Time Allocations and Self-Reported Happiness of Retirees: An Exploratory Study.” Journal of Financial Planning 32 (3): 38–47.