Journal of Financial Planning: March 2014

One of the more challenging aspects of advising clients about life insurance is helping them to recognize that life insurance is an asset, rather than an expense. For many people, this view is a bit of a foreign concept in a world where other types of insurance (auto, homeowners, health, and liability, just to name a few) merely reimburse the policyholder for a contemporaneous, out-of-pocket, economic loss that the policyholder hoped would never occur—leaving the policyholder in the same economic position as he or she was in before the loss took place.

Life insurance is unique in the sense that it covers a loss that is certain to eventually occur. It is not a question of whether the policyholder will have a claim, but instead when. As long as the policy is maintained, the stream of premium payments will ultimately result in the policyholder’s receipt of the death benefit—and this allows for a rate-of-return calculation that is inapplicable to other types of insurance coverage.

Cash Value Life Insurance

The investment nature of some life insurance policies is more obvious than others. Policies that are designed to build cash value, such as whole life, variable life, and indexed universal life, allow the policyholder to access a return on their investment without having to wait for any loss to occur. Inside build-up (net of surrender charges) is fully liquid, enabling such policies to be listed on a balance sheet and easily compared to alternate uses for the dollars that were used to pay premiums, such as stocks, bonds, or mutual funds. This analysis is probably a fair measuring stick when determining the value of the policy to the insured, but because it overlooks the present value of the death benefit, it understates the value of the policy to the beneficiaries.

Life Insurance Purchased Exclusively for the Death Benefit

Life insurance policies purchased exclusively for the death benefit also have real economic value. The most common example of this is a policy that is issued with a no lapse guarantee (sometimes referred to as an “NLG policy”). Under this type of policy, the insurance carrier guarantees payment of a specified death benefit so long as the policyholder makes all scheduled premium payments in a timely manner.

Although NLG policies often have little or no cash surrender value, they provide the policyholder with certainty that neither the death benefit nor future premiums will be affected by market performance, changes in interest rates, or changes in policy charges. The only unknown variable remaining is timing—when the death benefit will be received and how many premiums must be paid until then. This makes it possible to calculate, with reasonable certainty (subject to the continued solvency of the insurance carrier) the rate of return that would be earned on the premiums paid if the insured died in any given year.

Moreover, because life insurance proceeds are not subject to income tax (except in cases where an existing policy has been “transferred for value”), the return on premiums is an after-tax return, which should be adjusted to its pre-tax equivalent before comparing the projected return on a life insurance policy to the projected return of other investments.

An Economic Analysis

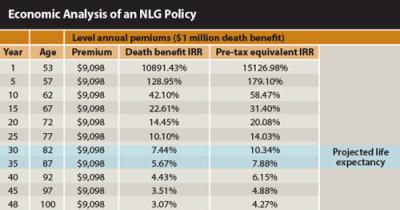

Consider a healthy 52-year-old male who was recently offered a preferred rating on a $1 million NLG life insurance policy. For an annual premium of $9,098, the insurance carrier guaranteed that neither the annual premium amount nor the amount of the death benefit would ever change. If we assume that an alternate investment of the same dollars would generate growth taxed at a blended rate of 28 percent (federal and state), the economics of this policy can be illustrated in the table.

For a pure economic analysis of this policy, set aside all of the traditional reasons one might purchase life insurance (to replace an income, fund a buy-sell agreement, provide liquidity for estate taxes, etc.) and imagine that the client has committed to setting aside $9,098 per year in an irrevocable trust for the benefit of his children, to be distributed following his death. How should the trustee of the trust invest these funds?

Although the performance of the policy as compared to other investments will vary, depending upon how long the insured lives and the rate of return that one expects to earn on those other investments, the policy provides a substantial advantage over alternate investments in the early years, which gradually declines for each additional year of the insured’s life.

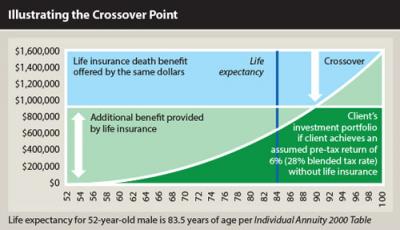

The point at which the growth of alternate investments is projected to exceed the policy’s death benefit is often called the “crossover point.” When the crossover point occurs after the insured’s life expectancy, the policy offers not only a projected rate-of-return advantage over the alternate investments, but it also provides a substantial degree of certainty and “insures” against both mortality risk (the risk that the insured may not live long enough for the trust assets to grow to the amount he desires to leave his children), and market risk (the risk that alternate investments might perform worse than expected).

The graphic compares this hypothetical policy to an alternate investment that is projected to provide a pre-tax return of 6 percent with an after-tax return of 4.32 percent at a 28 percent blended tax rate.

Convertible Term Life Insurance

Few people focus on it, but there is also an investment component to term life insurance—as long as the policy is convertible to a permanent product. When you pay the annual premium on a convertible term life insurance policy, you actually get two things: the right to receive a death benefit if the insured dies during the coming year, and the ability to purchase a permanent life insurance policy at favorable rates that are based on the insured’s current good health. And that could have substantial value in the event that the insured’s health declines significantly over the course of the next year.

This can be a great alternative for individuals who are interested in purchasing an NLG policy but who do not presently have the cash flow to fund the premiums. By purchasing a convertible term policy now, they will lock in the right to purchase (at a later point in time) coverage that is priced on their current good health.

Even policyholders who do not intend to retain coverage beyond the end of the level term should view the conversion feature as an option that could be exercised in the event of an adverse change in health.

Jordan H. Smith, J.D., LLM, is vice president, advanced design at Schechter Wealth in Birmingham, Michigan, where he provides legal perspective to Schechter advisers and their clients in the design and implementation of advanced strategies that involve estate planning, taxation issues, trust design and preservation, and transfer of wealth. He is also the owner and founder of Insurable Interests LLC, an insurance and advisory firm.