Journal of Financial Planning: December 2022

Bridger Cummings is assistant editor of the Journal of Financial Planning. He can be reached at bcummings@onefpa.org.

Note: Click images below for PDF versions.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

For charitably inclined clients, there are several opportunities to give and even more complications. Some of the more popular options for clients to give to charities that they care about are the following: direct donations, qualified charitable distributions from an IRA, private foundations, and donor-advised funds. The latter is getting more popular, and for many good reasons.

A donor-advised fund (DAF) is a private fund sponsored by a charitable organization. Organizations control the contributions they receive, but donors have advisory privileges over how assets are invested and funds are distributed. This contrasts with private foundations, which are run and administered by the board members of the foundation (Kagan 2022). These are similar but distinct vehicles for donating to charities and receiving tax breaks in the process.

DAFs and Alternative Methods of Donating

Donor-Advised Fund

As mentioned, a DAF is private, but administered by another organization. Donors can open a DAF at an institution that sponsors DAFs. For example, there are over 600 community foundations sponsoring DAFs, according to the National Philanthropic Trust’s “2021 Donor-Advised Fund Report,” which are ideal for donors who wish to be more active in their local community (Kenton 2022). Several charitable arms of financial institutions sponsor DAFs too, like Fidelity Charitable, Vanguard Charitable, and Charles Schwab Charitable, and many donors use funds sponsored by the American Endowment Foundation or the National Philanthropic Trust.

The starting capital to open a DAF is usually minimal—some funds only require $5,000 to start. For contributions, donors can deduct 60 percent of AGI for cash contributions and 30 percent AGI for appreciated securities. The tax benefits to the donor are immediate, but one key point is that the fund does not need to immediately distribute these donations—more on this later. Another benefit is that clients can donate securities and let them mature, meaning their donation can increase over time (although their initial tax break will not). This does mean, though, that when clients donate, they can write off the fair market value at the time of donation and not be liable for capital gains taxes, stepping it up in the DAF. The administrative costs are relatively low, and the fundholder doesn’t need to be very involved in the fund if they don’t wish to be. Funds will generally be given to a charity of choice, but that isn’t guaranteed.

Private Foundation

This is a private entity. It requires more legwork to get going, as there is a lot of paperwork the founder has to file to qualify as a legal foundation, which also takes weeks if not months to arrange. Deductions to foundations are also limited to 30 percent of AGI for cash and 20 percent of AGI for securities (National Philanthropic Trust n.d.). Most institutions only recommend establishing a foundation if the starting capital is significantly higher—usually at least $1 million. However, as this is a private entity with an appointed board, there is potentially complete control over how and where donations are given, which can be important if there isn’t an established charity for the cause the donor wishes to address.

QCDs and Direct Donations

Qualified charitable distributions are made directly from an IRA to the charity, and this is nondeductible but also excluded from taxable income and can be used to satisfy RMD requirements. A QCD cannot be applied to a donor-advised fund. However, both could be used by clients who are particularly inclined to give to charities they care about. If clients have cash they wish to donate, they are always able to do that as well, but many charities are not prepared to accept securities, and the donor must immediately choose where to donate (Gast Fawcett and Jacobs 2019).

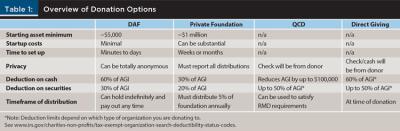

Some of the key points of these various options are compiled in Table 1, but it’s important to remember that there are even more nuances that weren’t addressed for the sake of brevity.

To DAF or Not to DAF?

David E. Hultstrom is the cofounder and chief investment officer of Financial Architects. There are many times when it is advantageous to set up a DAF for those that wish to donate, and he has some specific examples (Hultstrom 2016):

- When there isn’t enough time to select recipient organizations. The donor can make a donation to the DAF, therefore writing it off and saving in taxes for the year, but, crucially, they don’t have to select the recipient yet and can pay out the funds over time. This is helpful if a client gets a big windfall in one year, like from the sale of a business, but isn’t prepared to distribute it yet.

- If the recipients are not prepared to receive securities. It could be that there are smaller charities, religious groups, or other nonprofits that could use some assistance, but they are not prepared or are just overwhelmed with handling securities or large amounts of money at once. By donating to the DAF and selecting the recipient, a check would be written from the fund to the charity, simplifying the process for everyone.

- If the donor wishes to set up a contingent legacy plan. Estate laws are always changing, and if somebody is likely to have an estate over the exemption, they can set up a plan that will pass along the untaxed estate to their heir while donating the rest to a DAF for charitable purposes and avoiding the estate tax on anything over the limit.

- If the donor prefers to remain anonymous. With a private foundation, the paperwork will reveal who owns the foundation and made any donation, but a DAF can be set up in any name, thereby preserving the privacy of the donor if they wish. This could be for reasons as simple as not wanting to be bothered by any organizations soliciting more donations later.

Another reason that one might want to set up a donor-advised fund would be to instill a culture of charitable giving in the family. By creating a DAF and naming the client’s children as the successors, they can be a part of the gifting process for years to come with a DAF that is already funded, so the heirs wouldn’t need to donate any additional funds. Planners might consider having a meeting with their client and their client’s child or other successor to the DAF to explain how the DAF works and what their role would be going forward.

It’s important to remember that a DAF is not a means of wealth transfer. The children will not get the money, but they can be involved in the selection of charities going forward. Any named successor should be on board with participating in the DAF. If they feel that the money should have gone to them, they may be resentful about their perceived fortune being inaccessible to them.

So when would one not want to use a donor-advised fund? If the client wishes to donate over time, the main other option is setting up a private foundation. Hultstrom identified a few cases where a foundation would be more ideal than a DAF:

- If the donor wishes to have greater control. This is particularly important if there isn’t an existing charity for what they want to address. With the direct control of the foundation, they could distribute the money as they wish.

- If the donor wants to “give someone a job.” Someone needs to run the foundation. Since a foundation must have a board of directors, an individual could select some trusted members and potentially a child who would receive an income by being a board member, but they wouldn’t have untold levels of wealth to squander. This could also be a good opportunity to have wise, experienced counsel advising a child who could use some reining in.

Apart from some very niche cases with substantial wealth to back it up, it is almost always better to utilize a donor-advised fund over a private foundation due to the ease of set up and operations and lower overhead costs. In either case, a donor can always write a check for additional gifting and could use a QCD to directly donate to a charity. With so many great features of DAFs, is there anything wrong with them?

The Controversy Surrounding DAFs

A donor-advised fund sounds like a great way to donate to causes donors care about while keeping costs and overhead low, but there are some who don’t view DAFs so highly. Buhayar, Alexander, and Steverman (2022) published a report for Bloomberg that discusses how some wealthy donors are using DAFs to get the benefits of tax breaks now while indefinitely delaying payments.

Bloomberg News analyzed more than 360,000 tax returns filed by private foundations between 2016 and 2022. The analysis showed approximately 1,000 cases where a distribution shortfall was avoided by contributing to a DAF, a gap that would have amounted to $800 million going directly to charities over that six-year period. In short, there are a lot of existing private foundations with a lot of money in them. These foundations are required to distribute at least 5 percent of their funds every year, lest they face a penalty. That money must go to a nonprofit, and the foundation can fill in any donation shortfall by distributing to a DAF. Bloomberg found some foundations that almost exclusively pay out to DAFs. This satisfies the distribution requirements from the foundations, and then the money can sit in the DAF in perpetuity after they already received the tax break. Most of the foundations identified by Bloomberg declined to comment in the report, but some of them make claims that they just haven’t found a cause they want to support yet.

It seems there are a few people and foundations that are keen on distributing to DAFs and holding on to the funds, but they may be a minority. Hultstrom says that almost all of his clients who have set up DAFs have distributed most or all of their funds within a few years, and he thinks that most donors are using DAFs as they are intended.

One group that benefits from funds not being distributed are the organizations administering DAFs. “More than half of Fidelity Charitable’s $50 billion in assets sat in Fidelity products in June 2021, the latest audited financial statements show,” Buhayar, Alexander, and Steverman wrote for Bloomberg. “Those investments would generate about $90 million in management fees annually based on current fund expenses. That’s on top of administrative fees that start at 0.6 percent of assets a year and decline for larger accounts.” Institutions that administer DAFs have an incentive to maintain this behavior, but charities are receiving substantially fewer funds than are earmarked for them, and for which the donors have already received a tax break.

This isn’t to say that by using a DAF, the donor is nefarious or that there are inherent risks in using a DAF. It’s just important to keep in mind that these types of funds are occasionally being used to shift money around without actually contributing to a cause, which can draw ire from policymakers.

Potential Legislation

In fact, the negative attention that DAFs have attracted in recent years has already led to scrutiny from politicians. The bipartisan Accelerating Charitable Efforts Act would make it so that DAFs would have to pay out to a proper charity within 15 or 50 years, depending on the exact type of DAF. Anything left after that time would be subject to taxation (Council on Foundations. n.d.). President Joe Biden has also discussed making it so that distributing to a DAF from a foundation would no longer satisfy the 5 percent requirement unless there was evidence that the money reached the intended charity by the end of the following year after the distribution from the foundation (Buhayar, Alexander, and Steverman 2022).

These proposed changes shouldn’t affect any new donor who plans to use a donor-advised fund as it was intended, as these new bills and ideas are solutions to the (perceived) problem of hoarding. But it’s something to keep in mind. Will DAFs be targeted even more in the future if they continue to be abused? If the loophole gets closed, then it’s quite possible that it would appease lawmakers and charities, as they would get the support they need, even if it takes a while.

The Final Verdict and Next Steps

A donor-advised fund is a great option for clients who are inclined to donate to a charity. The suitability of a DAF only goes up if they are unsure to which charity they would like to donate or if the intended recipient isn’t quite prepared to handle complicated securities or large amounts at once.

Hultstrom shared a story illustrating when a DAF was the perfect solution for a client. His client was an elderly mother of one child. Her son was her sole beneficiary, but she was likely going to be over the estate limit with her savings, pension, and IRA. They set up a DAF with the son as the successor, and they made the son the beneficiary of the IRA with the DAF the contingent beneficiary, so they were able to establish the DAF as recipient of all funds above the estate-tax limit (which was constantly changing at the time and would be finalized upon her passing).

Another client wanted to donate to a few local churches over time (to not overwhelm them with a huge sum at once). These small, local churches were not prepared to receive stocks as contributions, and teaching them how to set up a brokerage account would have been an ordeal. So they set up a DAF where the client could donate stepped-up stocks, and the DAF would periodically write a check to the intended churches, simplifying the process for everyone involved.

Planners with clients who want to make a positive impact in the world should discuss the merits of donor-advised funds and help identify effective charities. Ensure that their potential successors are on the same page, and reach out to an institution that can support DAFs, whether that be a local community foundation or a charitable arm of a financial institution. Let’s make this world a better place.

References

Buhayar, Noah, Sophie Alexander, and Ben Steverman. 2022, October 2. “Wealthy Use Loophole to Reap Tax Breaks — And Delay Giving Away Money.” Bloomberg. www.bloomberg.com/news/features/2022-10-03/rich-use-tax-loophole-to-get-deductions-now-for-donating-later.

Council on Foundations. n.d. “Summary of Accelerating Charitable Efforts Act (“ACE Act”).” https://cof.org/content/summary-accelerating-charitable-efforts-act-ace-act.

Effective Altruism. n.d. “What Is Effective Altruism?” www.effectivealtruism.org/.

Gast Fawcett, Elaine, and Audrey Jacobs. 2019, March 12. “How Do Donor-Advised Funds Compare with Private Foundations and Other Family Giving Vehicles?” National Center for Family Philanthropy. www.ncfp.org/knowledge/how-do-donor-advised-funds-compare-with-private-foundations-and-other-vehicles/.

GiveWell. n.d. “About GiveWell.” www.givewell.org/about.

Hultstrom, David E. 2016, February 19. “Charitable Giving.” Financial Architects, LLC. www.financial

architectsllc.com/blog/299.

Kagan, Julia. 2022, April 24. “Private Foundation.” Investopedia. www.investopedia.com/terms/p/privatefoundation.asp.

Karon, Paul. 2019, December 11. “Does Komen Need a Cure of its Own?” Inside Philanthropy. www.insidephilanthropy.com/home/2019/12/11/does-komen-need-a-cure-of-its-own.

Kenton, Will. 2022, August 10. “Donor-Advised Fund.” Investopedia. www.investopedia.com/terms/d/donoradvisedfund.asp

Myers, Lisa, and Talesha Reynolds. 2013, June 10. “Susan Komen CEO’s Salary Draws Fire as Donations Drop, Races Are Canceled.” NBC News. www.nbcnews.com/news/investigations/susan-komen-ceos-salary-draws-fire-donations-drop-races-are-flna6c10262481.

National Philanthropic Trust. n.d. “Giving Vehicle Comparison.” www.nptrust.org/donor-advised-funds/daf-vs-foundation/.

Sidebar:

Maximizing Impact with Effective Altruism

Unless a donor has a cause in mind that they feel strongly about, it can be difficult to narrow down the myriad of options to one or a few that they wish to receive regular contributions. Effective altruism is a concept that revolves around having the biggest effect with your donations possible; focus on addressing issues that are “important, neglected, and tractable” (Effective Altruism n.d.). One resource to help with this objective is GiveWell, a nonprofit dedicated to researching charities to find “how much good a given program accomplishes (in terms of lives saved, lives improved, etc.) per dollar spent” (GiveWell n.d.).

How far does each dollar you donate go at the charity you give it to? You may have heard of the Susan G. Komen criticisms from a few years ago. The organization touted itself as a nonprofit dedicated to breast cancer research, but it ended up only giving around 16.3 to 19 percent of its budget to research (Karon 2019). Where did the rest go? The organization had a large “education” expense, and its CEO at the time had abnormally large pay in comparison to other charities (Myers and Reynolds 2013). Donating there didn’t have quite the impact that most donors were expecting.

Effective altruism is about ensuring that your donation has the biggest effect. You might have a greater impact on the world by funding medicine to combat malaria ($7 to save one life, according to GiveWell) instead of contributing to a charity that is experiencing diminishing returns in donation effectiveness. Websites like www.effectivealtruism.org and www.givewell.org can help you or your clients find charities that will make a larger impact on the world.