Journal of Financial Planning: August 2023

David DeVoe is founder and CEO of DeVoe & Company (www.devoeandcompany.com), a leading consulting firm and investment bank to wealth management firms. He has been a sought-after thought leader on RIA M&A for 19 years.

NOTE: Click on image below for PDF versions

Like the wildly popular award-winning show Succession, planning for succession can be filled with existential angst, division, power dynamics, and drama.

Ideally, your firm’s succession situation follows a different script. With some thoughtful planning and engagement, you can leave all the drama for the screen. In this article, I’ll focus on how to ensure your next generation of leaders is up for the job (and will cover the mechanics of a comprehensive plan). And no cliffhangers here: You’ll soon learn that the lack of talent management may be a bigger problem than the lack of planning.

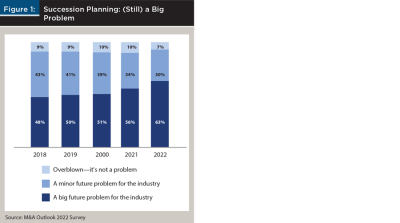

But first, a reality check: Succession planning in the financial planning industry is embarrassingly low—especially because this is an industry of planners. A classic case of the cobbler’s children. And advisers know it. According to our DeVoe & Company research, 63 percent of advisers see the lack of succession planning as a big problem for the future of the industry, a steady increase from about 50 percent a few years ago. Another 30 percent said the lack of succession planning is a minor problem. In total, 93 percent of advisers understand that the industry has a problem.

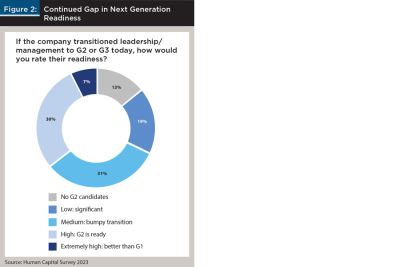

Here comes the plot twist: The issue seemingly can’t be solved by simply putting the elusive succession plan in place. That’s because G2 is not ready to take the reins—or at least that’s what the majority of advisers believe. Nearly two-thirds of surveyed RIA leaders say the second and third generation leaders of their firm are not ready to take over management and leadership roles. So, we have an industry that not only has a planning problem, but one could argue also has a human capital problem.

What’s the founder to do? Well, there’s plenty that can be done. Spoiler Alert: RIAs who develop comprehensive talent management programs focused on next-generation talent will have a better path to succession—and a much stronger firm, to boot.

Preparing for Succession: The Next-Gen Gaps to Fill

Since the next generation leaders in a firm are quite literally “the future of the company,” everyone wins when founders invest time and energy into preparing them for their elevated roles. However, this sort of work is not natural to many or most advisers. It is rare to have an RIA founder who previously worked in human resources or talent management. Most founders have spent their early years becoming experts in investing, planning, relationship management and/or business development—functions quite different from HR. It shouldn’t be a shock that this industry is struggling with many of the fundamentals of managing people.

The best place to start is with your company’s purpose. Any HR expert will tell you that a successful human capital strategy should be rooted in the firm’s mission, vision, and values. Helping next-gen advisers engage with the core purpose of the company and how they fit into the organization’s macro goals is a foundational step in the process. Studies have shown that advisers who are motivated by intrinsic factors—such as believing in the purpose of the company or knowing how they can contribute to the company’s success—will be three times more engaged than those who are focused primarily on money or promotion.1 Few things in life will generate a 3× return, so gaining a better understanding of how to connect your employees to intrinsic motivators is time well spent. DeVoe & Company’s incentive compensation planning work is rooted in this key dynamic.

Elements of a Successful Talent Program

Another valuable lens to look through is the lifecycle of an employee—and consider how to optimize each phase. Successful talent management programs begin in the recruitment phase and extend through the employee’s long-term retention. Elements of a successful program include career pathing and promotions, resource planning, learning and development, performance management, recognition, and intelligently designed compensation structures. Each element contributes to the employee’s engagement and supports a positive culture where employees feel valued and invested in their careers. They also feel committed to a company that has shown them it is an employer of choice.

Not surprisingly, research shows those firms with succession plans exhibit much greater readiness for transitioning to next-generation leadership. So, it’s worth noting what practices those firms are likely to have in place:

- Performance Management. Employees benefit from carefully designed performance goals, which fit in the broader strategy and a firm’s mission and values. Managers also benefit when they commit to delivering regular performance reviews to employees. This allows them to offer ongoing feedback (ideally weekly!) so that employees can improve their skills in real time and grow their capabilities faster. All feedback is useful—the positive and the constructive. Recognition for a job well done is equally important feedback as sharing ideas for improving in specific areas. Unfortunately, nearly 60 percent of RIAs do not deliver performance reviews more than annually.

- Career Pathing. Career paths are important from the onset and throughout one’s growth with a company. As a best practice, a firm should provide detailed career paths and guidance on how to get to the next level. It’s helpful to show employees various career paths within a firm. Even horizontal job changes can benefit and help create well-rounded employees. Our research shows that half of firms believe they are achieving this, which is good news. Employees who can envision career growth opportunities and a future within the company are more likely to stay with a firm.

- Leadership Development. It should be a priority to identify and encourage individuals who represent the next generation. Provide them with opportunities to get additional exposure beyond their role. They and you can assess how they’ll do as they gain exposure, and it’s a surefire way to increase everyone’s confidence.

- Training Programs for Junior Employees. Preparing the next generation of RIA leaders starts with training associates and junior advisers. Unfortunately, more than half of firms (55 percent) surveyed have no structure or only lightly structured training programs in place for associates and junior advisers, and 70 percent do not have formal mentorship programs. RIAs can and should do much better in this area. Start informally if you have to—take an associate to coffee/lunch and talk to them about their role or assign a more senior employee to serve as a mentor to more junior employees—but get started.

- Incentive Compensation. Incentive compensation is arguably the best way to drive results and—done correctly—deepen the company’s relationship with their staff. An ideal compensation plan demonstrates that the company leaders understand the details of each role and have taken the time to prioritize those tasks that are most important to success. As importantly, leadership will calibrate the elements to reward at appropriate increments of performance—a clear path to bigger bonuses and attaining company goals. An elegantly crafted incentive compensation plan also becomes a blueprint for the manager to track key performance indicators and coach advisers to maximum success. DeVoe & Company reminds clients that compensation plans are not a magic wand but instead create a mutual commitment for employee and manager to collaborate on a given stage of the career path.

What’s Next? Building for the Future

The series Succession is a cautionary tale, reminding us of the importance of disciplined migration of leadership. Just as the cobbler’s children need shoes, your clients and staff should sleep well knowing that the future of the firm has been planned. Optimal succession planning goes beyond the transaction and becomes an integrated component of a broader intelligently designed talent management program. Investing in HR—and our people—is the best investment an RIA leader can make.

Office drama can make scintillating storylines and drive high ratings. It can be a guilty pleasure to watch but is painful to live. A thoughtful human capital strategy is your antidote. Leave the drama to the big screen.

Endnote

- See Cho, Y. J., and J. L. Perry. 2012. “Intrinsic Motivation and Employee Attitudes: Role of Managerial Trustworthiness, Goal Directedness, and Extrinsic Reward Expectancy.” Review of Public Personnel Administration 32 (4): 382–406. https://doi.org/10.1177/0734371X11421495.