Journal of Financial Planning: April 2017

Randy Gardner, J.D., LL.M., CPA, CFP® is the head of financial planning for the Horace Mann Companies.

Leslie Daff, J.D., is a state bar certified specialist in estate planning, trust, and probate law, and the founder of Estate Plan Inc.

Your clients may ask you: what are the most expensive and least expensive ways to pay for college? To help you answer this question, let’s look at an example.

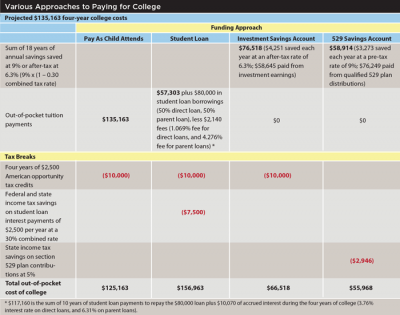

According to the College Board, the average undergraduate cost for in-state, public university tuition and room and board for the 2016–2017 academic year is $20,090, up 2.7 percent from the previous year. For a child born in 2016, the cost of college starting in 18 years at a 2.7 percent inflation rate will be $32,452 for the first year, $33,329 for the second year, $34,229 for the third, and $35,153 for the fourth year for a total of $135,163. Parents might approach this financial obligation by saving for it in advance in an investment account, saving for it in advance in a state’s Section 529 plan, paying for it out of earnings while the child attends college, or borrowing while the child attends college and repaying the student loans later. The table on page 37 illustrates the various approaches to paying for this $135,163 education expense.

As the example in the table illustrates, student loan borrowing is the most expensive way to pay for college. The additional fees and finance charges increase the cost $31,800 (more than 25 percent) beyond the cost of paying for college as you go. The least expensive way is to pay the majority of the costs with investment earnings that have grown tax-free in a Section 529 plan.

In this column, we will review the basics of 529 plans, highlight recent legislative changes to them, and point out some opportunities and traps related to their use.

Review of 529 Plan Basics

Enacted in 1996, Section 529 provides for two types of plans: (1) a prepaid tuition program; and (2) the more popular, state-administered college savings plan.

Section 529 plans allow an account owner to make contributions to an account established for the purpose of paying a beneficiary’s qualified higher education expenses at any eligible post-secondary educational institution. A person can establish a 529 plan account for him or herself, for a family member, or for a friend.

Once a 529 plan account has been established for a designated beneficiary, anyone may donate to the beneficiary’s account with no limitations on who may be a donor and no income limitations restricting the amount of contributions.

Although no federal income tax deduction is allowed for contributions to 529 plan accounts, 529 plans are tax-advantaged because the income and gain within the accounts are not taxable as long as distributions are made for qualified higher education expenses. Accumulated earnings, but not contributions, withdrawn for purposes other than education are taxable and are subject to a 10 percent penalty.

Changes in investment selection, previously limited to one time per year, are now permitted twice a year and when there are beneficiary changes. And similar to an IRA, an account owner can roll amounts from one 529 plan to another, as long as the rollover is accomplished within 60 days.

Recent Legislative Changes

The Protecting Americans from Tax Hikes Act of 2015 (PATH Act) added to the list of qualified education expenses the purchase of computers, printers, software, related equipment, and Internet access. Previously, these technological purchases were allowed only if they were required by the educational institution. The original qualified higher education expense list included: tuition, fees, books, and supplies; expenses for special needs services in the case of a special needs beneficiary; and room and board for students who are enrolled in the eligible educational institution on at least a half-time basis.

The second change pertains to refunds from an educational institution paid by means of a qualified 529 plan distribution. The refund may now be redeposited back into the student’s 529 plan account without the imposition of taxes or penalties as long as the funds are returned within 60 days of the date they were withdrawn. This legislative change is similar to, but does not change, the Tax Court’s 2011 holding in Karlen v. Commissioner. There, the taxpayer withdrew funds and then decided that he did not wish to do so and redeposited the funds into the same 529 plan. The transaction was not a valid rollover because the taxpayer did not indicate the funds would be rolled over at the time of withdrawal, and the funds were placed back into the same qualified plan, not a new qualified plan. The distribution was treated as taxable.

The third PATH Act change removes the requirement that multiple 529 plan accounts with the same owner and beneficiary must be aggregated to determine the earnings portion of an account distribution. Now only the earnings portion of the 529 plan account from which the distribution occurred is used to determine the amount of tax and penalty.

Example: Tina has two 529 accounts. Account A has $20,000 of contributed amounts and no earnings. Account B has $30,000; $20,000 of contributions and $10,000 of earnings. Tina takes $5,000 from Account A and does not use it for qualified higher education expenses. Prior to the PATH change, Tina would aggregate the accounts to determine the tax effect finding that $1,000 ($5,000 x (10,000/50,000)) is taxable. With the PATH Act change, Tina treats none of the distribution as taxable because the funds were distributed from Account A, which has no earnings.

This treatment supports having more than one Section 529 plan account for the same beneficiary. Multiple accounts make it possible to avoid taxable treatment if funds are needed for a non-education purpose. Furthermore, if one of the accounts declines in value, the account owner can close the account and claim the investment loss as a miscellaneous itemized deduction, subject to the 2 percent of AGI floor, on his or her return.

State Income Tax Deductions for Contributions

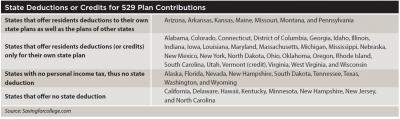

Although no federal tax deductions are allowed for contributions to a 529 plan, many states do allow an income tax deduction for contributions. A list of states allowing deductions for 529 plan contributions appears in the table above.

If a client lives in a state that offers a tax deduction only to its own state plan, consider taking advantage of the deduction. Although the deduction is only available in the client’s state, the funds accumulated can be used to attend colleges in other states.

If the client lives in a state that allows a deduction for any state’s plan, be sure to shop for the plan that provides the benefits most important to the client. Variables include: the contribution amount; the investment selections offered; fees assessed by the 529 plan in that state; and the friendliness of the terms of the state’s plan.

Estate Planning Provisions

Although concerns about estate and gift taxation may be short-lived under the Trump administration, the 529 plan succession rules will still apply. A contribution to a 529 plan account on behalf of a designated beneficiary is treated as a completed, present-interest gift for gift tax and generation-skipping transfer tax purposes. The contribution is not excludable as a transfer to an education institution. Consequently, an individual can contribute up to $14,000 annually to each descendant without having to file a gift tax return. If the contributor is married and splits gifts with his or her spouse, the amount that can be contributed doubles to $28,000.

One of the special rules with regard to 529 plans allows a donor to make five years of annual exclusion gifts to a 529 plan in one year. This provision means that a single person can contribute up to $70,000 (5 x $14,000) free of gift taxes as long as the donor makes an election on a federal gift tax return to treat the gift as made ratably over a five-year period. Married couples who are splitting gifts can double this benefit and contribute up to $140,000 to each descendant’s 529 plan account.

Example: If a married couple established 529 accounts for each of their four children, the couple could reduce the value of their estate by $560,000 (4 x $140,000) and have the assets grow income tax-free in their children’s accounts.

The downside of the five-year rule is: if the donor dies during the five-year period, the donor’s gross estate for estate tax purposes will include the portion of the 529 contributions that are allocable to the tax years following the donor’s date of death.

Example: If the donor makes a $70,000 gift to a 529 plan account in year 1 and dies in year 2, then the contributions for years 3, 4, and 5, or $42,000, will be included in the donor’s estate for estate tax purposes.

With the exception of this gift tax rule, the treatment of 529 plan assets at death is extremely favorable. Even though the account owner retains control of the 529 plan account, can change the beneficiary, and can make withdrawals from the account, the assets of 529 accounts are not included in the account owner’s gross estate; they are treated as assets of the beneficiary.

Furthermore, account owners may designate successor owners of the 529 plan account at any time the account is in existence. When the account owner dies, the account does not terminate. Instead, ownership of the account transfers to the person designated by the deceased account owner. If there is no person designated as a successor owner, ownership succession may be designated by the terms of the state’s plan or through probate.

The account owner should be careful in the selection of their successor owners, because the successor owner may withdraw all of the account funds. The account owner should also check the terms of the state’s 529 plan to see if the trustee of his or her living trust may be named as a successor owner of the account.

To recap: besides being the best way to pay for a descendant’s college expenses, Section 529 plans offer several wealth management advantages. And, 529 savings plans are constantly changing. Two useful websites for obtaining the latest information about 529 plans are the College Savings Plans Network (collegesavings.org) and Savingforcollege.com.