Journal of Financial Planning: March 2011

Geoffrey VanderPal, D.B.A, CFP®, CLU, CFS, RFC®, holds a doctorate of business administration and finance from Nova Southeastern University, is an adjunct faculty at several universities, and is CIO of Skyline Capital Management.

Jack Marrion provides research and consulting services to financial firms in a variety of annuity areas. His sixth book, Index Annuities: A Suitable Approach, co-written with John Olsen, was released this year.

David F. Babbel, Ph.D., is professor of insurance and risk management at The Wharton School, University of Pennsylvania, and senior adviser to Charles River Associates, an economics consulting firm.

Executive Summary

- This paper offers the first empirical exploration of fixed indexed annuity (FIA) returns based on actual contracts that were sold and actual interest that was credited.

- FIAs are designed to have limited downside returns associated with declining markets, and achieve respectable returns in more robust equity markets.

- Studies that have criticized FIAs are usually based on hypothesized crediting rate formulae, constant participation rates and caps, and unrealistic simulations of stock market and interest rate behavior. When actual policy data are used, the conclusions change.

- The returns of real-world index annuities analyzed in this paper outperformed the S&P 500 Index over 67 percent of the time, and outperformed a 50/50 mix of one-year Treasury bills and the S&P 500 79 percent of the time.

- Our study is exploratory, because although it is based on actual contracts and actual crediting rates, our policy data set is neither randomly selected nor comprehensive based upon data provided by 15 FIA carriers.

Financial advisers and financial planners have sought various programs to provide clients protection from systematic risk, also known as market risk. Various asset allocation strategies have been used with limited success when extreme market movements and “black swans” occur (Taleb 2007). It has been known for close to 50 years that equity market returns do not conform to a Gaussian, or Normal (bell-shaped), probability distribution (Mandelbrot 1963; Fama 1963).1 Rather, probability distributions of market returns are typically skewed positively or negatively and leptokurtic (fat-tailed: higher chances of extreme positive or negative returns than suggested by a bell-shaped distribution). When these leptokurtic events occur on the positive side of the distribution, clients are delighted, but the opposite is true when these events occur on the negative end of the two-tailed distribution.

Principal preservation products have evolved to address the needs of many risk-averse consumers by providing them a safety net for their investment/savings capital. The products are structured in a way that reduces correlations with other asset classes. To illustrate better the extremes of market returns, we can examine the Russell 3000 Index that accounts for nearly 98 percent of the publicly traded U.S. equity market. A study by Eric Crittenden and Cole Wilcox (2008) at Blackstar Funds was conducted using Russell 3000 data from 1983 through 2006. The findings were that “about 40 percent of the stocks had negative returns over their lifetime, and about 20 percent of stocks lost nearly all of their value. A little more than 10 percent of stocks recorded huge wins over 500 percent” (Richardson 2009). These data indicate that most of the positive market return over time comes from relatively few performers, which lends support to the use of stock index strategies as part of an overall portfolio.

Furthermore it supports the notion that there is significant risk in the stock market and thus, for moderately to highly risk-averse clients, the need for principal protection programs such as fixed indexed annuities (FIAs). As financial professionals, we are tasked with assisting our more risk-averse clients to protect them from black swans, and many of us have a fiduciary responsibility. One of the significant developments for principal or asset preservation vehicles has been the FIA (VanderPal 2004). Nearly 96 percent of FIAs possess reset (or ratchet) features that allow for locking in positive returns each annual or biannual period. By eliminating the prejudicial effects occasioned by significant stock market declines, and locking in returns annually or biannually, there is less of a need to try and capture large upside market swings to recover from the declines.

During the past few years various articles have been written regarding the value in FIAs, and some people relying on these studies have drawn misleading inferences from them.2 We seek to dispel two basic errors that typify most studies and articles that attempt to describe potential index annuity performance. The first of these is assuming crediting formulae that are rarely used and crediting rates that are seldom observed. While this type of exploratory exercise is fine in and of itself, a problem arises when readers assume the theoretical results are somehow representative of the index annuity world. The second limitation is making assumptions about stock market and interest rate behavior that are not well supported—for example, as discussed in greater detail later, unrealistic assumptions are made about the distribution of future stock returns, interest rates, correlation between stocks and bonds, and constant volatility. This can lead people to make inferences about actual FIA behavior that are unjustified. Our study examines these limitations and shows how actual index annuity returns are at odds with many of the hypothetical conclusions.

We will illustrate these misconceptions by using actual crediting rates on various kinds of FIA policies. With these data we are able to show actual returns on FIAs, rather than make inferences from hypothetical crediting rates derived from assumed (and often constant) rate caps, assumed crediting rate formulae, and hypothetical participation rates—often coupled with theoretical stock market and interest rate moves. This should help inform the public and correct the inaccurate information portrayed by some journalists and industry professionals that FIAs cannot be competitive with other asset classes, by showing instances where the hypothesis is disproven.3

Are Hypothetical Returns Realistic?

Numerous recent studies and popular press articles have explored the performance of FIAs.4 These studies have been based on hypothetical elements in one or more of: annuity contract designs, product parameters, economic environments, stock market behavior, and interest rate behavior. While it is common for economists and others to develop models in order to get a handle on product performance, unfortunately, most of the models to date have created theoretical annuity products whose performance has little relation to FIAs sold in the real world.

The main areas of concern with these models relate to the following dubious assumptions that underlie the model designs. There are many others that we do not discuss here, but they have been discussed at length elsewhere in sources that we identify.

Dubious Assumption #1: Real-World Contract Designs Are Similar to Hypothetical Designs. Collins, Lam, and Stampfli (2009) created a term end point structure (they call it a multi-year, point-to-point) that applied a 75 percent participation rate to any gain over a seven-year period. They then calculated the annual return, deducted a 1 percent spread, and finally compounded the lower of 8 percent or the calculated annual yield to produce the total gain for the period. This is a rather cumbersome structure, and one we cannot find was ever used on any index annuity.

In reviewing specifications on the more than 400 index annuities marketed since the first index annuity sale in February 1995 (Marrion 2003), we failed to find any term end point product that used a crediting method that had a participation rate of less than 100 percent combined with both a cap and a yield spread greater than zero. Indeed, in reviewing all of the product information we have assembled since 1995, the only annuity we found which had a participation rate of less than 100 percent that could change each year—and deducted a yield spread or asset fee and had a cap—was the Americo FlexPlus annuity marketed around the turn of the century. However, it did not use a term end point design; this product used an annual reset or ratchet design, the performance of which differs radically from a term end point structure (Marrion 1996, 1997, 1998, 1999, 2000, 2001, 2002, 2003, 2004, 2005, 2006, 2007).

Often a financial columnist or occasional writer will dismiss the index annuity concept by proposing that a consumer purchase a long-term zero-coupon bond together with an index fund instead of an index annuity (Clements 2005; Pressman 2007; Warner 2005; McCann and Luo 2006). These writers often posit the term end point crediting method as the representative interest crediting structure. However, all term end point designs account for less than 4.5 percent of sales over the last four years, and term end point design using two crediting components represents even less (Marrion 2006, 2007; Moore 2008, 2009). Indeed, Collins, Lam, and Stampfli (2009) base their conclusions on a term end point that uses a cap, but less than 1 percent of the products have ever placed a cap on a term end point crediting method (Marrion 2009). Such a product is certainly not representative of index annuity crediting methods in practice.

The assumed index participation rates also may not be representative. For example, for their chart of seven-year periods starting in December 1988 and with the final seven-year period beginning in December 2000, Collins, Lam, and Stampfli (2009) assume a term end point participation rate of 70 percent to 75 percent, depending upon whether the seventh-year index values are averaged, and place an 8 percent cap on any yearly gain. Because index annuities were not around until the mid-1990s, we cannot decisively state what rates would have been for the early years used. However, one can gather the actual participation rate data from when products did appear. We can state that based on actual FIAs offered, if you had purchased every available index annuity using a term end point annuity with a seven-year term on the first business day of each month from January 1997 through December 2000, your average participation rate would have been 72 percent without a cap (Marrion 1997, 1998, 1999, 2000).5

Looking at “representative” annual reset methods, Collins, Lam, and Stampfli (2009) assume 55 percent index participation with a 7 percent annual cap or 60 percent averaged index participation with a 7.5 percent cap. McCann (2008) compares returns from 1990 through 2007 of the S&P 500 with a hypothetical annual reset point-to-point design that assumes a constant 6.5 percent cap. However, in reviewing actual new money rates for annual reset designs from 1996 to the present, one would have encountered effective participation this low at only a few points in 2003 and 2004, and in 2007 and 2008. Indeed, many averaging products were offering 100 percent first-year participation without a cap in the late 1990s, and many annual point-to-point products have offered 100 percent participation allowing for possible double-digit gains (Marrion 1996, 1997, 1998, 1999, 2000, 2001, 2002, 2003, 2004, 2005, 2006, 2007).

There is nothing wrong with showing how a term end point method might have performed under these assumptions. However, we must keep in mind that the results of the Collins, Lam, and Stampfli (2009) study are not representative of FIAs’ performance, as they depend upon a crediting rate method not used in over 95 percent of sales, and combinations of other contract features not observed in practice.

Dubious Assumption #2: Participation Rates and Caps Never Change. Collins, Lam, and Stampfli (2009) assumed an averaging method had a 60 percent participation rate with a 7.5 percent cap and applied it to the past. McCann (2008) assumed a constant 6.5 percent cap for all of his index annuity performance calculations, which appears to have been a cap on the date his story was completed, when interest rates were heading toward historic lows. On the day he completed his story, the constant maturity rate of a 10-year U.S. Treasury Note was 3.64 percent; by contrast, during the 1990 until 2000 period (within the time frames of both studies) the 10-year Treasury rate was nearly twice as high, averaging 6.66 percent (Federal Reserve Board 2009). Lewis (2005) assumed either a 5 percent or 9 percent cap on an annual reset design and overlooked the interest rate environment that might change these caps, but allowed for the returns to positively affect the T-bill comparison he made. Higher bond yields generate more interest income, thus allowing carriers to buy or synthesize more options to increase index participation, which is why some annual point-to-point products were able to offer 100 percent participation and 14 percent caps in the previous decade (Marrion 1996).

Lewis (2005), McCann (2008), and Collins, Lam, and Stampfli (2009) assume constant index annuity participation rates, while holding caps and spreads steady over long periods. Reichenstein (2009) attempts to remedy this by considering a matrix of renewal cap rates (always constant or descending over time) while not taking into account the actual evolution of cap levels on real contracts. He assumes that a particular annuity whose terms were observed in the late 1990s would have had similar parameters beginning in 1957 and continuing for almost 40 years before the first FIA arrived on the scene. (Indeed, there were not even any index funds available to individual investors until 1977, yet his study assumes that individual investors would have secured better returns over that period by investing in them. His study also assumes that these funds were held together with five-year Treasury bonds that were held for only one month and then liquidated, replacing them with new five-year bonds every month for 52 successive years.)

The flaw in these studies is that they do not take into account the real-world effect of changes in interest rate environments and the market volatility’s effect on the cost of providing the index participation. One cannot assume today’s product parameter levels would have existed in the past because the financial conditions of the past were often quite different. One cannot simply posit a participation rate or cap on crediting rates, hold it constant or have it worsen formulaically over time, and then attempt to make conclusive comparisons with actual stock index returns. Clearly the reach of the conclusions is limited by the unrealistic assumptions underlying the annuity modeled.

Not every study adopts these simplifying assumptions. Gaillardetz and Lin (2006) note that when interest rates increase participation rates also go up, unless offset by increased volatility. One carrier suggested that the uncapped guaranteed participation rates on their seven-year averaging annual reset product from 1980 through 1995 would have ranged from 135 percent to 260 percent, based on bond yields and call option prices in effect (Physicians Life 1996). They understand that index participation is driven by bond yields and option costs and these change over time.

Dubious Assumption #3: Annual Stock Market Returns of 17.6 Percent Are Normal. Collins, Lam, and Stampfli (2009) mention that many attempts to show index annuity comparisons are exercises in data mining, and we quite agree. One way to data mine is to make long-term predictions based on using low participation rates that do not represent the reality of long-term rates. Another is to intentionally select periods that favor one choice over another.

McCann (2008) makes a performance comparison over a 30-year period that happens to start in a year with the lowest end-of-year S&P 500 value over the previous 45 years. Using the correct December 2004 index values, the annualized growth rate of the S&P 500 for McCann’s selected comparison period is 10.05 percent. By contrast, the S&P 500 growth rate from December 1954 to December 1984, another 30-year period, was 5.25 percent, and the average annual growth from December 1964 to December 1994 was 5.79 percent.

In the 30-year period that McCann selected for constructing his comparisons, the S&P 500 ended at 1211.92. If you used a monthly averaged annual reset method to compute where a monthly averaged S&P 500 would have ended, you get an ending value of 591, which is 49 percent of the actual S&P 500 level. By contrast, if your 30-year period ends December 1984, the S&P 500 level is 167.24; however, the monthly averaged S&P 500 computed value is 161.37, almost equal to the actual S&P 500 level. Many performance comparisons pit index annuities against stock market investments over the 1980s and 1990s when stock market returns averaged 17.6 percent and ignore the preceding eight decades with their average return of 8.5 percent (Bogle 2003).

Dubious Assumption #4: Stock Market Returns Conform to a Normal Distribution; Interest Rates and Volatility Are Constant. A more egregious problem in some of the studies that simply simulate hypothetical stock market return scenarios in order to generate hypothetical policy crediting rates is that the simulations are often based on an assumed distribution of stock returns that cannot be supported. For example, McCann and Luo (2006) have conducted studies of hypothetical crediting rate behavior assuming that equity market rates of return conform to a Normal distribution. When Babbel, Herce, and Dutta (2008) re-examined that study but used an empirical distribution that matched the historical record, while keeping intact all of the other assumptions of McCann and Luo, they found that annual crediting rates in the range of 5 percent to 15 percent were about twice as common as what were being credited under the Normal distribution assumption. This implies that FIAs were far more valuable than was being represented under the hypothetical distribution of stock market returns.

In a similar vein, several studies assume that interest rates and volatility are constant throughout an annuity’s life, in order to construct their performance comparisons. Of course, the simplifying assumption has never occurred in the marketplace, and the alternative investments to which FIAs are compared have their returns affected by interest rate movements as well as volatility changes.

Dubious Assumption #5: Managerial Discretion Is Not Involved. Over 95 percent of index annuity sales are in products that may change at least one element of their interest crediting methodology after each reset period. Two primary factors affecting subsequent index participation are bond yields and the price of call options (Gaillardetz and Lin 2006). However, the ultimate determining factor in setting index participation in future years is not the interest rate environment or the cost of options, it is what carrier management decides to do. This human element introduces a random variable that cannot be quantified, thereby making any attempt to project any returns ultimately subjective.

On the other hand, although the insurer does have discretion periodically to change certain contract parameters, such as the cap levels or participation rates, it does not have unfettered discretion to alter them, because the contracts themselves have minimum guaranteed levels for both as well as state minimum nonforfeiture value schedules. More importantly, the insurer faces the discipline of the market. If it tries to credit less than a competitive and fair rate, it will face the dissatisfaction of its consumers, the rancor of its agents, the cost of lapsation and policy surrender, and the hesitancy of agents to ever put future clients in such products. This would essentially be the death knell of its future business. Therefore, consumers have at least three layers of protection: contractual minimums, state minimum nonforfeiture values, and competition enforced by both consumers and, more importantly, agents (because they are more aware of what other companies are offering and have a financial incentive to replace underperforming policies), which should assuage the risk aversion of many.

While such exercises are instructive, they shed little light on how actual FIAs have fared under real-world conditions. In the following section, we will attempt to remedy these deficiencies insofar as available data will permit.

Actual FIA Returns

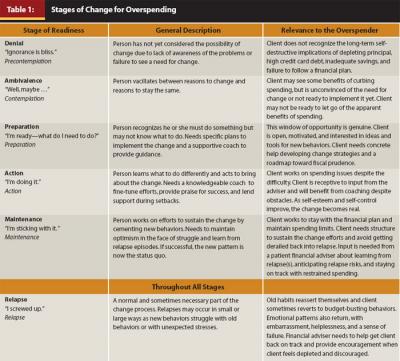

Index annuities have been producing returns since the first one was purchased on February 15, 1995. Unfortunately, most of the articles and studies ignore these data and attempt to portray how index annuities should have performed while ignoring actual results. What we show in Table 1 are actual results. They are not intended to be a prediction of how index annuities will perform in the future, nor are the results intended to be representative of overall industry performance. But we believe this to be the most comprehensive data ever assembled for actual FIA performance data to date.

These results are based on copies of actual customer statements received (with personal information blacked out) for five-year periods requested on an annual basis since 2002. The return data reflect contract periods closest to September 30 with the exception of the 1997–2002 period that uses a January 2 date. The returns reflect the results of products with term end point, high water mark, and annual reset designs with and without crediting rate caps, and with and without averaging. The returns do reflect any fees charged, but not surrender penalties. Annuitization was not required to receive these returns.

There are several limitations with the data in Table 1. The main one is that they are derived from carriers that chose to participate and that chose the products for which they reported returns. This could have imparted some bias in returns, and may differ from what a larger, more random sample would have produced for the periods. Although some of the annuities had contract years ending on the 30th, the contract anniversaries encompassed a three-week range around that end date. The data collected are very few for some periods. And the data reflect results across a very small spectrum of time: only looking at 1997–2010, and then only at one day out of each year. Nonetheless, the 172 contracts for which we have data are real contracts and reflect actual crediting rates that were provided to annuity owners over time under 12 different crediting rate structures used in FIA designs.

This next data set reflects the actual real-world total five-year returns credited to annuity owners for an annual point-to-point with cap structured index annuity, assuming an annuity is purchased on the 21st of every month beginning April 1996, with a final purchase in September 2004.

This annuity was selected because it has been offered every month for 14 years and its performance is publicly available. It is not intended to be representative of anything except itself. Figure 1 compares the FIA returns with the total returns of the S&P 500 over the same period, and a blended return composed of 50 percent of the S&P 500 total return and 50 percent of the compounded return for a series of one-year, U.S. constant maturity T-bills—to render our study more comparable to other studies (cited previously). Also for comparison purposes, we have not rebalanced the portfolios each period. Moreover, we have not deducted from these alternative portfolios any of the annual expenses that typify mutual funds, thereby biasing the comparison to favor mutual funds. (Note that the vertical axis in Figures 1 and 2 shows accumulated returns over five years, which are not expressed in annualized terms.)

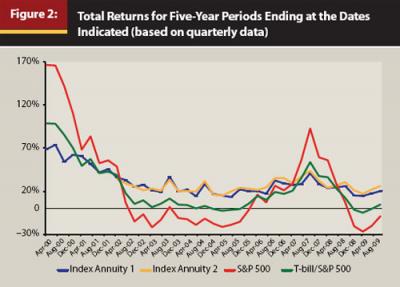

Figure 2 reflects the actual real-world total five-year returns credited to annuity owners for two other index annuities using annual point-to-point with cap structures. (These data are shown separately from the prior chart because the data for these annuities were available only quarterly, whereas the prior chart is based on monthly data.) It shows the actual returns of the annuities if purchased quarterly since inception, one product in April 1995 and the other in April 1998, with a final purchase in October 2004.

These annuities were also selected because they have been steadily available for 15 years in the first example and 12 years in the second (through the end of 2009), and their performance is readily available. Figure 2 compares the FIA returns with the total returns of the S&P 500 over the same period, and a blended return composed of 50 percent of the S&P 500 and 50 percent of the compounded return for a series of one-year, U.S. constant maturity T-bills. Again, we have not deducted from these alternative portfolios any of the annual expenses that typify mutual funds, thereby biasing the comparison to favor mutual funds.

Comparative Results

Collins, Lam, and Stampfli (2009) attempted to predict the future by using the past, creating “a rich set of probable future results [that] is available for inspection.” Based on these “probable” futures, they found the index annuity minimum guarantee to be beneficial at times, but that the index annuity payoff “always lags the investment portfolio’s payoff for returns.” McCann (2008) created his own hypothetical annuity structure, and in the future he created, “99.8 percent of the time the investor would be better off with the Treasury securities and stocks than with the equity-indexed annuity.” However, if your future included all of the 141 five-year periods from April 1995 through 2009, and you had purchased any of these real-world index annuities month after month, these actual index annuity results bested the S&P 500 alone over 67 percent of the time, and bested the 50/50 mix of one-year Treasury bills and the S&P 500 79 percent of the time.6

These returns should not be viewed as representative. As mentioned earlier, the annualized range of returns in Table 1 is from annuity carriers that chose to submit their return data, and although overall a majority of index carriers did provide actual return data (reaching 83 percent of all carriers selling FIAs at one point), self-reporting bias may have resulted, skewing the returns higher than would be seen with a more comprehensive data set. Figures 1 and 2 showing total returns, however, are much more comprehensive. All in all, actual results for 172 five-year periods are shown (it should be noted these three annuities all use an annual point-to-point with cap interest crediting method).

Exercises conducted by McCann, Reichenstein, or Collins, Lam, and Stampfli created hypothetical worlds that either use crediting methods that are, at best, extremely rare (to the best of our knowledge, as we have never encountered them), or dubious assumptions that do not reflect the actual pricing environment—yet these studies have been used by some to condemn index annuities as a failed financial concept. In the interest of fairness, the actual results from 344 five-year returns representing close to 200 different index annuities should be seen for what they are—proving that, contrary to previous research, some index annuities have been competitive with other asset classes.

A Word About Fees and Expenses

According to VaderPal (2008), although FIAs do not provide complete participation in an index, based on various crediting methods and market anomalies, their returns may actually outperform mutual funds or variable annuities over time. Variable annuities with mortality and administration expenses, sub-account management fees, and other charges can account for up to 4.00 percent of annual expenses that erode their market returns. According to Morningstar, the average mortality and expense and management fees are 2.08 percent. So a variable annuity sub-account that earned 10 percent in the market, for example, would net less than 8 percent to the client’s account after internal fees are deducted from earnings.

Unlike mutual funds, an FIA does not deduct sales charges, management fees, or 12b-1 marketing fees. Instead, the insurance company uses a small amount from the underlying portfolio that lowers participation in the market index to cover administrative costs and commissions to brokers (VanderPal 2008). Because the FIA provides policy crediting rate formulae and periodic annuity-owner reports net of any fees and management expenses, it does not separately disclose them. All distribution and management costs are already “baked in” the products’ terms and parameters. No study has been published to date that shows whether these costs exceed those of retail mutual funds (taking into consideration that some of these FIA costs are not comparable, as they are incurred to provide protection against downside returns).

Conclusion

Many of the analyses published on index annuities are based on hypothetical annuities and completely fabricated returns, often calculated over periods that were decades before annuities were even introduced, or over simulated future periods whose characteristics do not conform well to economic conditions that we have ever encountered. Some studies are generated by using selected time periods and crediting criteria to produce the preordained conclusion desired.

The current study, in contrast, has examined some annuities that have actually been sold, and has tracked them over their lives, including all of their periodic changes in contract “levers,” such as evolving interest caps and participation rates and their actual credited interest. While we were relegated to using a relatively short time period, we used the actual period over which FIAs have existed. We cannot say whether our data are representative of all FIAs, although we assembled the largest database of actual returns that has yet been used in a published study.

Our rather modest conclusion is that some index annuities have produced returns that are competitive with other asset classes, such as equities and equity/T-bill combinations. Although FIAs are not designed to be direct competitors of index investing (rather for safety of principal with returns linked to upside market performance), our findings on FIA returns contrast with assertions in other studies—based on no actual return data—that the structure of FIAs necessarily relegates them to being inferior or unsuitable products.

Endnotes

- A recent confirmation of this finding is in Babbel, Herce, and Dutta (2008). In their study, the authors found that there was less than one chance in a million that monthly stock market returns from 1926–2008, and various sub-periods during that time interval, conform to a Normal distribution, whether measured by a Jarque-Bera, an Anderson-Darling, or a Kolmogorov-Smirnov goodness of fit test.

- See, for example, Collins, Lam, and Stampfli (2009), Lewis (2005), McCann and Luo (2006), McCann (2008), Reichenstein (2009), and Warner (2005).

- Refer again to all of the articles indicated in endnote 2 as well as Clements (2005), Pressman (2007), and Gibbs (2011).

- We refer the reader to the articles cited in endnotes 2 and 3.

- To be precise, the average term end point participation rates for seven-year periods were: 1997, 87 percent; 1998, 71 percent; 1999, 61 percent; and 2000, 70 percent.

- A more direct comparison with McCann’s 14-year hypothetical periods is provided by Babbel, Dutta, and Herce (2009).

References

Babbel, David F., Migel A. Herce, and Kabir Dutta. 2008. “Un-Supermodels and the FIA.” Presentation before the Morningstar-Ibbotson Associates/IFID Centre Retirement Income Products Executive Symposium, University of Chicago, November 11. Slide presentation: http://corporate.morningstar.com/ib/documents/UserGuides/UnSupermodelsFIA.pdf; video presentation: http://corporate.morningstar.com/ib/tools/David_Babbel/tape2b.html.

Babbel, David F., and Craig Merrill. 2005. “Real and Illusory Value Creation by Insurance Companies.” Journal of Risk and Insurance 72, 1 (March).

Babbel, David F., and Ravi Reddy. 2009. “Measuring the Tax Benefit of a Tax-Deferred Annuity.” Journal of Financial Planning 22, 10 (October).

Bogle, John C. 2003. “The Policy Portfolio in an Era of Subdued Returns.” Bogle Financial Markets Research Center. Speech before the Investment Analysts Society of Chicago and The EnnisKnupp Client Conference, Chicago, Illinois (June 5): www.vanguard.com/bogle_site/sp20030605.html.

Bogle, John C. 2005. “The Relentless Rules of Humble Arithmetic.” Financial Analysts Journal 61, 6 (November/December).

Clements, Jonathan. 2005. “A Do-It-Yourself Kit for Investors: Build Your Own Equity-Indexed Annuity.” Wall Street Journal (January 26): D1.

Collins, Patrick J., Huy Lam, and Josh Stampfli. 2009. “Equity Indexed Annuities: Downside Protection, But at What Cost?” Journal of Financial Planning 22, 5 (May).

Crittenden, Eric, and Col Wilcox. 2008. “The Capitalism Distribution—The Realities of Common Stock Returns.” BlackStar Funds. http://info@blackstarfunds.com/files/TheCapitalismDistribution.pdf.

Fama, Eugene. 1965. “The Behavior of Stock-Market Prices.” Journal of Business 38, 1 (January).

Federal Reserve Board of Governors. “10-Year Treasury Constant Maturity Rate. H.15. 2009-06-02 9:06 AM CDT Release.”

Gaillardetz, Patrice, and X. Sheldon Lin. 2006. “Valuation of Equity-Linked Insurance and Annuity Products with Binomial Models.” North American Actuarial Journal 10, 4 (October).

Gibbs, Lisa. 2011. “Index Annuities Are a Safety Trap.” Money Magazine: Investors Guide 2011 (January).

Koco, Linda. 2010. “Year End Annuity Results Flow In.” National Underwriter 115, 4 (February).

Lewis, W. Cris. 2005. “A Return-Risk Evaluation of an Indexed Annuity Investment.” The Journal of Wealth Management 7, 4 (Spring).

Mandelbrot, Benoît. 1963. “The Variation of Certain Speculative Prices.” Journal of Business 36, 4 (October).

Marrion, Jack. 1996–2000. Index Annuities Report. Advantage Compendium Ltd.

Marrion, Jack. 1996–2007. Advantage Index Product Sales & Market Report. Advantage Compendium Ltd., vols. 1–39.

Marrion, Jack. 2002. “Interest Crediting Concepts.” Advantage Compendium Ltd., 6, 3.

Marrion, Jack. 2003. Index Annuities: Power & Protection. Advantage Group. St. Louis.

Marrion, Jack. 2008. “Fixed Annuities Are Competitive with Taxable Bond Mutual Funds.” Index Compendium 12, 2.

Marrion, Jack. 2009. “Product Trends.” Index Compendium. Advantage Compendium Ltd., 13, 7.

McCann, Craig J. 2008. “An Economic Analysis of Equity-Indexed Annuities.” Securities Litigation & Consulting Group Inc. (September 10).

McCann, Craig J., and Dengpan Luo. 2006. “An Overview of Equity-Indexed Annuities.” Securities Litigation & Consulting Group Inc. (June).

Moore, Sheryl. 2007–2009. Advantage Index Product Sales & Market Report. AnnuitySpecs.com, vols. 40–46.

Physicians Life Insurance Company. 1996. Vista 500 Market Index Annuity Producers Guide (p. 15).

Pressman, Aaron. 2007. “Retirement Made Complicated: Why Equity-Indexed Annuities Have a Bad Name and What Investors Need to Know.” Business Week (Sept. 24): 98.

Reichenstein, William. 2009. “Financial Analysis of Equity-Indexed Annuities.” Financial Services Review 18, 3 (December).

Richardson, M. T. 2009. The Ivy Portfolio. Hoboken: John Wiley & Sons Inc.

Taleb, N. N. 2007. The Black Swan: The Impact of the Highly Improbable. London: Penguin Books.

VanderPal, Geoffrey. 2004. “The Advantages and Disadvantages of Equity Index Annuities.” Journal of Financial Planning 17, 1 (January).

VanderPal, Geoffrey. 2008. “Equity Index Annuities.” Journal of Personal Finance 7, 2.

Warner, Joan. 2005. “EIAs: Behind the Hype: Equity-Indexed Annuities Are Flying Off the Shelves, But They Carry Risks that Regulators Fear Are Not Fully Disclosed.” Financial Planning (October).