Journal of Financial Planning: June 2015

George Kinder, CFP®, RLP®, is founder of the Kinder Institute of Life Planning and designer of trainings that are recognized worldwide as the standard for client-adviser relationship skills. He recently launched a robo-adviser, LifePlanningforYou.com.

I was asked recently, “If you were a millennial today, and had your understanding of finance and financial planning, what would most concern you about your future?”

“My greatest concern would be that I be able to maximize the amount of freedom I have throughout my life,” I replied. “And I wouldn’t know how to do that. And my fear would be there’s no one out there I can trust."

It is the millennial question. It is also a question for all ages and all people. It is a question as relevant for democracy and economics as it is for personal finance. And it’s one we’ve solved in a very brief 40-year time span of the financial planning profession.

A more detailed follow-up conversation might have gone like this.

Q: Amongst all financial advisers, who can you trust to maximize your freedom throughout your life?

A: A financial life planner.

Q: And amongst all of them who is likely to be the best?

A: The ones with no conflicts of interest, the most appropriate professional designations, and the lowest costs. The ones who put your interests ahead

of their own.

Q: And among all of those?

A: The one who listens best.

The Power of Listening

The greatest value in a financial planning firm and the greatest value to each consumer is the conversation that leads them to freedom—not the brand or the size of the firm, its processes or technology, its AUM or personnel.

How do we deliver freedom in life planning? The process I teach is called EVOKE®, an acronym for the five phases of a client engagement: exploration, vision, obstacles, knowledge, and execution.

The knowledge and execution phases include traditional financial planning and the vision phase includes goal exercises, but by far the most important skill in the whole process is listening. The exploration phase is dedicated to listening.

In the first life planning meeting, the client might talk 80 percent of the time, because it’s the client’s meeting. Our ability to listen well establishes trust—assuming there’s a financial structure that is trustworthy and free of sales and conflicts of interest. Master the art of listening and this is what you will get: authentic emotions, unguarded, neither defensive nor reactive; all the facts on the table, including the most important ones of meaning, purpose, and aspiration; and an authentic relationship imbued with trust and vitality, a partnership.

How does this happen? It’s in supportive, empathetic listening. Making the client your client, not their money. Putting the clients’ interests first, not your own or your firm’s. This is the place where fiduciary happens and trust is established.

Not interrupting, commenting, digressing, clarifying, or solving, or in any way making the meeting the adviser’s until everything’s on the table. The client knows far more than the adviser what will bring them to freedom and what needs to be expressed to get them there. This is a learned kind of listening, involving appropriate use of pauses, knowing how long to hold moments of feeling, how to use the body and gestures, the use of gutturals, other non-verbals, and even occasionally tears. Freedom is not earned lightly, nor should it be taken lightly.

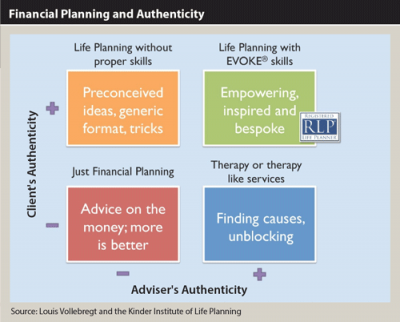

Great listening is infused with natural authenticity rather than with financial knowledge or skills. Inauthentic conversation from either the client or adviser doesn’t deliver freedom. Louis Vollebregt, a lead trainer for the Kinder Institute of Life Planning in Europe, describes the kind of financial advice that results from authenticity/inauthenticity in the adviser or the client in the graphic on page 35.

The Trust Equation

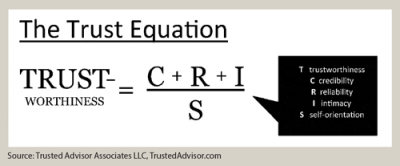

Another way of understanding the value of listening is expressed in Charlie Green’s Trust Equation (Green is the CEO of Trusted Advisor Associates):

Trustworthiness = C+R+I

S

Where C is credibility, R is reliability, I is intimacy and S is self-orientation.

The trust equation helps us to understand the success of robo-advisers. Much has been said about the efficiencies of the new technologies and their ability to reach the underserved. This is as true in life planning as in any other branch of financial advice. No adviser can possibly match a properly designed robo-adviser for low self-orientation and thus for trustworthiness to a consumer. It is safer for a consumer, in the privacy of their computer screen, to reflect on meaningful issues than it is to talk with someone else in the room.

Untethered to products or agendas, a life planning robo-adviser is selfless. Properly designed, it can even deliver unconditional positive regard, along with open-ended questions that go right at the heart to what one values most. The robo-adviser can be designed as a self-reflective process for the consumer, with helpful affirmations and well-placed empathic statements. It can lead to an inspiring statement of personal purpose and then to a self-guided approach to solving obstacles. From there it can move naturally into financial planning and investment. The key to its success is its low self-orientation.

But for many there will be something significant missing —the subtleties of feedback from great listening; key emotional moments supported by empathy, kindness, or affirmation; the vitality and engagement of a supportive human being; and active listening that is so valuable in overcoming obstacles.

A Winning Combination

I believe the best model for life planning firms will combine a free, inspiring, and unconditional robo-adviser that delivers real value to the consumer with the option of working with a human financial planner trained in the listening and life planning skills that reliably deliver freedom to their clients.

So how do we maximize freedom? For consumers, it’s to live your life plan. For advisers, it’s to deliver life planning. Some argue we should change our measure of societal success from GDP to happiness. Life planning adds subtlety to this discussion as it expands our understanding of economic growth to mean the growth of human freedom in all its facets: personal, familial, spiritual, political, and economic.

In the old model of financial advice, with its emphasis on material goals and retirement, clients’ aspirations were ill-defined or all about money. Freedom could seem decades away, if it was even ever articulated. But with the skills of life planning we have learned to articulate dreams of freedom that inspire our clients to meaningful lives and immediate, significant action—action that marries meaning and money. The world of financial advice has changed. Both the fiduciary and the passionate purpose of a financial adviser must be to deliver freedom, and nothing else, to give the client what they truly want.

This column has been excerpted and adapted from Kinder’s forthcoming book, Model Integrity, Deliver Freedom: A Banking Manifesto and the Life Planning Revolution.