Journal of Financial Planning: September 2021

William Reichenstein, Ph.D., CFA, is head of research at the software firms Social Security Solutions Inc. (ssanalyzer.com) and Retiree Inc. (incomesolver.com). He is professor emeritus at Baylor University, and is a frequent contributor to the Journal of Financial Planning and other leading professional journals. His latest book is Income Strategies: How to Create a Tax-Efficient Withdrawal Strategy to Generate Retirement Income.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

By coordinating a Social Security (SS) claiming strategy with a tax-efficient withdrawal strategy, financial planners can add substantial value to many clients’ accounts by helping them reduce their lifetime income taxes. The case below illustrates how a planner can add substantial value to a mass-affluent client with $1 million of savings by helping them minimize the adverse effects of the “tax torpedo.” The tax torpedo refers to the income range wherein each dollar of additional income causes another $0.50 or $0.85 of SS benefits to be taxable. Thus, taxable income increases by $1.50 or $1.85. So, the marginal tax rate (MTR) is 150 percent or 185 percent of the tax bracket, where MTR denotes the additional taxes paid on the next dollar of income. This column explains how financial planners can help many clients avoid, or at least minimize, the adverse effects of this tax torpedo.

The taxable portion of SS benefits depends on the taxpayer’s Provisional Income (PI). PI is the sum of Modified Adjusted Gross Income plus half of SS benefits plus tax-exempt interest. MAGI includes everything in AGI after deducting the taxable portion of SS and adding back the student loan interest deduction. Since few retirees have a student loan interest deduction, in general, MAGI = AGI - taxable SS benefits. There are two PI income threshold levels for single individuals of $25,000 and $34,000, and two for married couples filing jointly of $32,000 and $44,000. Unless annual SS benefits are below $9,000 for a single taxpayer, the taxable portion of SS benefits is the lower of (1) $4,500 + $0.85(PI - $34,000); or (2) 85 percent of SS benefits. Unless annual SS benefits are below $12,000 for a married couple filing jointly, the taxable portion of SS benefits is the lower of (1) $6,000 + $0.85(PI - $44,000); or (2) 85 percent of SS benefits.1

Case

Consider Jim Smith, who is single and lives in an income tax-free state. Although this case assumes the taxpayer is a single individual, the same lessons apply to married couples. Jim retired in December 2020, the month he turned 66. He has a life expectancy of 89 years, and his Primary Insurance Amount is $2,400. He spends $6,600 per month in real terms beginning in January 2021, which is when this case begins. At that time, he had $1 million in financial assets including $700,000 in a tax-deferred account (TDA), like a 401(k), and $300,000 in a taxable account with a cost basis of $270,000. I assume the current tax rules of the Tax Cuts and Jobs Act apply, which calls for higher tax rates to return in 2026. Historically low returns will occur, which reflects today’s interest rate environment. Inflation will be 1 percent per year. His portfolio will maintain a 40 percent stock and 60 percent fixed-income exposure throughout retirement. He began Medicare Part B in January 2021.

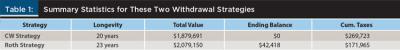

Table 1 summarizes the results from two withdrawal strategies, which were run for this case in www.incomesolver.com. In both strategies, he delayed filing for SS benefits until age 70. In the Conventional Wisdom (CW) Strategy, he withdraws funds to meet his spending needs from his taxable account until exhausted and then from his TDA. In 2021–2023, he is in the 0 percent tax bracket because his withdrawals from his taxable accounts are largely tax-free withdrawals of principal. Jim’s taxable account is exhausted in 2024, and his TDA withdrawals that year put him in the 10 percent bracket. Beginning in 2025, he withdraws all funds to meet his spending needs from his TDA. He is in the 22 percent tax bracket in 2025 and the 25 percent bracket in 2026–2040. Due to the taxation of SS benefits, a lot of his TDA withdrawals in 2025 are taxed at an MTR of 40.7 percent (22 percent bracket x 1.85), and a lot of his TDA withdrawals in 2026–2040 are taxed at an MTR of 46.25 percent (25 percent bracket x 1.85). His portfolio is exhausted in 2041, so it fails to meet his spending needs and he pays no taxes in 2041–2043. The total value of $1,879,691 is the sum of his lifetime spending, which is an after-tax amount.

The second withdrawal strategy is the Roth 22 percent, 2024 Multiple Accounts 15 percent (henceforth, Roth) Strategy. In 2021–2023, he withdraws funds to meet his spending needs following the CW Strategy, and then makes Roth IRA conversions to fill the 22 percent-and-lower tax brackets. In 2024–2025, he withdraws funds from his TDA to fill the 15 percent-and-lower tax brackets, which means he fills the 12 percent-and-lower tax brackets because the 15 percent bracket is not scheduled to return until 2026. He then withdraws additional funds to meet his spending needs from his taxable account. In 2026–2043, he withdraws funds from his TDA to fill the 15 percent tax bracket. In 2026, he withdraws the remaining funds from his taxable account, and then withdraws tax-free funds from his Roth IRA to meet the rest of his spending needs. In 2027–2043, after withdrawing funds from his TDA to fill the 15 percent tax bracket, he withdraws tax-free funds from his Roth IRA to meet the rest of his spending needs. His portfolio lasts his 23-year remaining lifetime, with an ending balance of $42,418 for his heirs. This ending balance is an after-tax amount, which assumes remaining pretax funds in his TDA are reduced by 20 percent to reflect the embedded tax liability. The total value of $2,079,150 is the sum of lifetime spending plus the ending balance.

Three factors can explain the additional $199,459 of after-tax total value from the Roth Strategy. The first factor is the tax-efficient Roth conversions made in 2021–2023 and the tax-efficient use of these funds in later retirement years. In 2021–2023, after withdrawing funds from his taxable account to meet his spending needs, Jim converts funds to a Roth IRA to fill the 0, 10, 12, and 22 percent tax brackets. Since he has not yet begun SS benefits, the MTR on these conversion amounts is generally the same as his tax brackets. In 2026–2043, after withdrawing TDA funds to fill the 15 percent tax bracket, he withdraws tax-free funds from his Roth IRA to meet additional spending needs. If he had to withdraw additional TDA funds in these years, they would have been taxed at MTRs of 46.25 percent, (25 percent bracket x 1.85). In 2035, which is a representable year, Jim is projected to pay $6,310 in taxes with the Roth Strategy compared to paying $17,598 in taxes with the CW Strategy. In contrast, in the CW Strategy, from 2026–2040 Jim pays an MTR of 46.25 percent on a lot of his TDA withdrawals. In short, the tax savings in the Roth Strategy come from generally paying MTRs of 0 percent through 22 percent on 2021–2023 Roth conversions and using these Roth balances in 2026–2043 to avoid additional TDA withdrawals that, due to the taxation of SS benefits, would have been taxed at MTRs of 46.25 percent.

Altogether, Jim is projected to pay $97,759 less in lifetime taxes with the Roth Strategy. However, this amount understates this strategy’s relative advantage. In the CW Strategy, Jim’s portfolio is exhausted in 2041. So, his projected taxes are $0 in 2041–2043. Through 2040, Jim’s lifetime taxes are projected to be $118,053 lower with the Roth Strategy.

The second factor explaining the Roth Strategy’s advantage is the lower portion of taxable SS benefits in this strategy. In the CW Strategy, Jim pays taxes on 85 percent of SS benefits each year until his portfolio is exhausted. In contrast, due to the ability to withdraw tax-free funds from his Roth IRA, in a typical year in the Roth Strategy, Jim pays taxes on about 55 percent of SS benefits.

The third factor is the impact of the withdrawal strategies on lifetime Medicare premiums. In the Roth Strategy, Jim pays more in Medicare premiums in 2023–2025 due to his Roth conversions in 2021–2023. In the CW Strategy, Jim pays one spike in Medicare premiums each year from 2029–2042. With the Roth Strategy, the ability to make tax-free Roth IRA withdrawals allows Jim to avoid paying higher Medicare premiums in these years. With the Roth Strategy, Jim pays $8,244 less in lifetime Medicare premiums.

Despite having to pay higher Medicare premiums in a few early retirement years in the Roth Strategy, it is easy to understand the tax advantages of converting pretax funds in a TDA to after-tax funds in a Roth IRA in the early years before SS benefits begin. In general, the MTRs on these Roth conversions are 0 percent to 22 percent. Yes, these early-year Roth conversions caused spikes in MTRs due to exceeding one or more Medicare income threshold levels. However, despite having to pay these spikes in Medicare premiums, it is better to make Roth conversions that are generally taxed at these relatively low MTRs than to retain these funds in TDAs, where the TDA balances will generally be taxed at MTRs of 46.25 percent during most of his retirement years.

Conclusion

Due to the taxation of SS benefits, millions of Americans pay MTRs of 185 percent of their tax brackets on substantial TDA withdrawals in retirement. The key lesson in this case is to focus on your clients’ marginal tax rate. Too many advisers solely focus on tax brackets and do not consider their clients’ MTRs. In the case study, in the Roth Strategy, Jim makes Roth conversions in his early retirement years before his SS benefits begin, when his MTRs on the converted funds are generally the same as his tax brackets. These Roth balances provide the ammunition that allows him to avoid making additional TDA withdrawals in later retirement years that would be taxed at MTRs of 185 percent of the tax bracket, due to the taxation of SS benefits. In this case, these Roth balances allowed Jim to avoid making TDA withdrawals during most of his retirement years that would have been taxed at MTRs of 46.25 percent. In contrast, based on current tax legislation, many moderately wealthy clients like Jim, who follow the Conventional Wisdom Withdrawal Strategy, will have to pay federal MTRs of 46.25 percent on a wide range of their TDA withdrawals during most of their retirement years. This case illustrates that coordinating a SS claiming strategy with a tax-efficient withdrawal strategy can add substantial value to many clients’ accounts by helping them minimize both their lifetime income taxes and the taxable portion of their SS benefits.

Endnotes

- For additional discussion of how the taxation of SS benefits and income-based spikes in Medicare premiums produce elevated MTRs for retirees, see Reichenstein, William. 2019. Income Strategies: How to Create a Tax-Efficient Withdrawal Strategy to Generate Retirement Income. This book, which uses www.incomesolver.com software, describes strategies that combine a smart Social Security claiming strategy and a tax-efficient withdrawal strategy to add value to clients’ accounts. For articles on tax-efficient withdrawal strategies in retirement, including discussion of the tax torpedo, see the following: (1) Reichenstein, William. 2020. “Savings in Roth Accounts and Making Roth Conversions before Retirement in Today’s Low Tax Rates.” Journal of Financial Planning 33 (7): 40–43; (2) Reichenstein, William and William Meyer. 2018. “Understanding the Tax Torpedo and Its Implications for Various Retirees.” Journal of Financial Planning 31 (7): 38–45; and (3) Reichenstein, William and William Meyer. 2020. “Using Roth Conversions to Add Value to Higher-Income Retirees’ Financial Portfolios.” Journal of Financial Planning 33 (2): 46–55.