Journal of Financial Planning: July 2018

William Reichenstein, Ph.D., CFA, is the Pat and Thomas R. Powers Professor of Investments at Baylor University. He is also head of research at the software firms Social Security Solutions Inc. and Retiree Inc.

William Meyer is CEO of Social Security Solutions Inc. and Retiree Inc. in Overland Park, Kansas. Social Security Solutions Inc. developed SSAnalyzer, a software that helps users decide when to begin Social Security benefits. Retiree Inc. developed Income Solver, software that provides advice on how taxpayers can maximize the longevity of their financial portfolio.

Executive Summary

- The “tax torpedo” refers to the sharp rise and then sharp fall in marginal tax rates caused by the taxation of Social Security benefits. For many middle-income households, this tax torpedo causes their marginal tax rate within a wide range of income to be 150 percent or 185 percent of their tax bracket.

- Many middle-income retirees can have a federal-alone marginal tax rate of 40.7 percent in 2018. If we return to the 2017 tax brackets in 2026, as called for in the Tax Cuts and Jobs Act, then many middle-income retirees will face a federal marginal tax rate of 46.25 percent.

- This paper provides income ranges in 2018 within which the tax torpedo likely will apply for singles, qualifying widow(er)s, married couples filing separately that lived apart for the entire year, and married couples filing jointly.

- Examples illustrate how singles and couples younger than age 70 may be able to reduce the adverse effects of the tax torpedo and thus extend the longevity of their financial portfolio by delaying Social Security benefits until 70.

- This paper also explains how singles and couples already subject to required minimum distributions may be able to reduce the adverse effects of the tax torpedo and extend the longevity of their financial portfolio using Roth conversions.

According to the u.s. Social Security Administration, 62 percent of aged beneficiaries received at least half of their income from Social Security in 2015.1 However, if a person’s objective is to maximize their projected pretax lifetime benefits, it is difficult to determine when a single individual or each partner of a married couple should claim Social Security benefits. If their objective is to maximize projected after-tax lifetime benefits, it is even harder.

This paper explains the “tax torpedo,” which refers to the sharp rise and then sharp fall in marginal tax rates caused by the taxation of Social Security benefits. For many middle-income households, this tax torpedo causes their marginal tax rate within a wide range of income to be 150 percent or 185 percent of their tax bracket. This paper also provides 2018 income ranges within which the tax torpedo likely will apply for both singles and married couples filing jointly.

Examples shared in this paper illustrate how middle-income retirees in their 60s can reduce the adverse effects of the tax torpedo, and thus extend the longevity of their financial portfolio, by delaying Social Security benefits until 70. The key insight is that provisional income—the measure of income used to calculate the taxable portion of Social Security benefits—includes all withdrawals from tax-deferred accounts (TDAs) like a 401(k), but it includes only half of Social Security benefits. Therefore, by delaying Social Security benefits, a household may be able to increase Social Security benefits by, for example, $20,000 and decrease withdrawals from TDAs by an equal amount. This substitution would cause provisional income to decrease by $10,000, which could substantially decrease the taxable portion of Social Security and thus taxes.

The final section explains how households that are already taking required minimum distributions (RMDs) may be able to use Roth conversions to reduce the long-term adverse consequences of the tax torpedo, and thus lengthen the longevity of their portfolio. The key insight is that households with incomes that are beyond the end of the tax torpedo can use Roth conversions to convert pretax dollars in TDAs to after-tax dollars at the sharply lower marginal tax rates that exist after the end of the tax torpedo. Such Roth conversions for one or more years can reduce or possibly eliminate future RMDs that would be taxed at federal marginal tax rates exceeding 40 percent.

Background and Previous Research

Prior research has helped single individuals decide when to claim Social Security retirement benefits (Meyer and Reichenstein 2010, 2012b; and Reichenstein and Meyer 2013a) and helped married couples decide when each partner should claim their retirement benefits and, when applicable, spousal benefits (Reichenstein and Meyer 2013b). Previous research has also helped widow(er)s decide when to begin benefits (Reichenstein and Meyer 2016a); how the existence of a pension from a job not covered by Social Security should affect the claiming decision (Meyer and Reichenstein 2014); how the earnings test can affect claiming decisions (Reichenstein and Meyer 2015); and discussed strategies available when Social Security recipients wish to redo a prior claiming decision (Reichenstein and Meyer 2016b).2 Unlike some prior studies, this paper reflects the significant changes to Social Security rules made in November 2015.

The Social Security claiming decision can also affect the longevity of the financial portfolio (Meyer and Reichenstein 2010, 2012a, 2013b)—a topic explored in this current study. The longevity of the financial portfolio is affected by two decisions: (1) the Social Security claiming decision; and (2) the strategy for portfolio withdrawal during retirement. For example, suppose a household has funds in a traditional IRA, Roth IRA, and taxable account. Meyer and Reichenstein (2013a), Reichenstein and Meyer (2016c), and Cook, Meyer, and Reichenstein (2015) showed that a tax-efficient withdrawal strategy may extend the longevity of this household’s financial portfolio by more than six years.

Rules Affecting Taxation of Social Security Benefits

The taxation of Social Security benefits depends on the level of provisional income (also known as combined income). In equation form, provisional income = modified adjusted gross income (MAGI) + tax-exempt interest + 50 percent of Social Security benefits. For most retirees and those near retirement, MAGI includes everything in adjusted gross income (AGI) except the taxable portion of Social Security benefits. It adds all items on page 1 of Form 1040 for 2017 included in “total income” except the taxable amount of Social Security benefits. It then subtracts everything in the bottom portion of that page except student loan interest deduction, tuition and fees deduction, and domestic production activities deduction. For most retirees, MAGI is AGI less the taxable portion of Social Security benefits.

The taxable portion of Social Security is the minimum of three equations: (1) 85 percent of Social Security benefits; (2) 50 percent of provisional income between the two income threshold levels plus 85 percent of provisional income beyond the second income threshold level; and (3) 50 percent of benefits plus 85 percent of provisional income beyond the second income threshold level.

The first or second formula provides the minimum amount for all households except some singles, qualifying widow(er)s, and married couples filing separately who lived apart for the entire year with less than $4,500 in annual Social Security benefits, and some married couples filing jointly with less than $6,000 in annual Social Security benefits. The first and second income threshold levels are $25,000 and $34,000 for singles, qualifying widow(er)s, and married couples filing separately. The income threshold levels for couples filing jointly are $32,000 and $44,000. These income threshold levels are not indexed for inflation.

What Is the Tax Torpedo?

The tax torpedo is the sharp rise and then sharp fall in middle-income households’ marginal tax rates as their income rises. The tax torpedo is caused by the taxation of Social Security benefits.

A marginal tax rate is the additional taxes paid on each additional dollar of income. The United States has a progressive tax rate structure. The idea behind a progressive tax rate structure is that a taxpayer’s marginal tax rate should be low—possibly zero—at low income levels, but rise as income increases. In general, the income of higher-income households will be too high to avoid paying taxes on less than 85 percent of Social Security benefits.

Consider two single individuals who receive, respectively, relatively low and relatively high levels of Social Security benefits. The examples below show that in both cases, the tax torpedo applies to middle-income households.

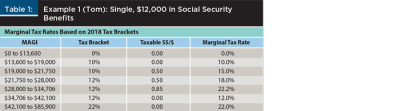

Example 1: Consider Tom, a single retiree who is at least age 65 at year-end 2018. He will receive a relatively low $12,000 a year in Social Security benefits in 2018. (Because middle-income households should not hold tax-exempt bonds, assume Tom does not hold any tax-exempt bonds.) Tom’s provisional income (PI) consists of MAGI plus half of Social Security benefits. Table 1 presents his 2018 marginal tax rate for various levels of MAGI (rounded to the nearest dollar).

The first $13,600 of MAGI is tax free. At MAGI of $13,600, Tom’s PI is $19,600, [$13,600 + 0.5($12,000)]. So, none of his Social Security benefits are included in his AGI. Thus, his AGI is $13,600, which matches his standard deduction of $13,600 (which includes $1,600 for being over age 65). So, Tom’s marginal tax rate is $0 for the first $13,600 of MAGI. For MAGI between $13,600 and $19,000, Tom’s tax bracket and marginal tax rate are both 10 percent.

At MAGI of $19,000, Tom’s PI is $25,000, the first income threshold. For MAGI between $19,000 and $28,000, each dollar of MAGI causes another $0.50 of Social Security benefits to be taxed. Each dollar of income between $19,000 and $21,750 causes taxable income to rise by $1.50. He is in the 10 percent tax bracket, and 10 percent of $1.50 is $0.15. Thus, his federal income marginal tax rate is 15 percent. At MAGI of $21,750, his 2018 tax bracket rises to 12 percent. So, each dollar of MAGI between $21,750 and $28,000 causes an extra $0.50 of taxable Social Security benefits, and his marginal tax rate is 18 percent, [12 percent x 1.50].

At MAGI of $28,000, Tom’s PI hits $34,000, the second income threshold. For MAGI between $28,000 and $34,706, each dollar of income causes another $0.85 of Social Security benefits to be taxed. Since Tom is in the 12 percent tax bracket, his marginal tax rate is 22.2 percent, [12 percent x 1.85].

At MAGI of $34,706, 85 percent of Tom’s Social Security benefits are taxable, which is the maximum. As income rises beyond $34,706, the marginal tax rate and tax brackets are the same.3Thus, Tom’s marginal tax rate drops sharply from 22.2 percent to 12 percent on MAGI between $34,706 and $42,100, where $42,100 represents the top of the 12 percent income tax bracket.

In summary, for each dollar of MAGI between $19,000 and $34,706, Tom’s marginal tax rate is either 150 percent or 185 percent of his tax bracket. Because MAGIs between these levels represents spending between $30,460 and $43,140, Tom is a middle-income household, [e.g., $30,460 = $19,000 + $12,000 in Social Security benefits – $540 in taxes].

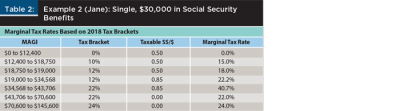

Example 2: Consider Jane, a single retiree who is at least age 65 at year-end 2018. She will receive a relatively high $30,000 a year in Social Security benefits in 2018. Again, assume she does not hold any tax-exempt bonds. Her PI consists of MAGI plus half of Social Security benefits. Table 2 presents her 2018 marginal tax rate for various levels of MAGI (rounded to the nearest dollar).

The first $12,400 of MAGI is tax free. At MAGI of $12,400, Jane’s PI is $27,400, [$12,400 + 0.5($30,000)]. So, $1,200 of her Social Security benefits are included in her AGI, [0.5*($27,400 – $25,000]. Thus, her AGI is $13,600, [$12,400 + $1,200]. Her standard deduction of $13,600, which includes $1,600 for being over 65, will offset this income.

Each dollar of MAGI between $12,400 and $18,750 causes another $0.50 of Social Security benefits to be taxed, causing each dollar of income in this range to increase taxable income by $1.50. Because her tax bracket is 10 percent, her marginal tax rate is 15 percent, [10 percent x 1.50]. At MAGI of $18,750, her 2018 tax bracket rises to 12 percent. So, each dollar of MAGI between $18,750 and $19,000 causes an extra $0.50 of taxable Social Security benefits, and her marginal tax rate is 18 percent, [12 percent x 1.50].

At MAGI of $19,000, Jane’s PI is $34,000. Each dollar of MAGI between $19,000 and $43,706 causes another $0.85 of Social Security benefits to be taxed. Therefore, her marginal tax rate for each dollar of income between $19,000 and $34,568 is 22.2 percent, [12 percent x 1.85]. At MAGI of $34,568, her tax bracket increases to 22 percent. So, her marginal tax rate for each dollar of income between $34,568 and $43,706 is 40.7 percent, [22 percent x 1.85].

At MAGI of $43,706, 85 percent of Jane’s Social Security benefits are taxable. For additional income beyond this level, the tax bracket and marginal tax rates are the same. Therefore, Jane’s marginal tax rate drops to 22 percent on MAGI between $43,706 and $70,600, where $70,600 represents the top of the 22 percent income tax bracket. Her marginal tax rate is a still relatively low 24 percent for MAGI between $70,600 and $145,600, where the latter amount represents the top of the 24 percent tax bracket.

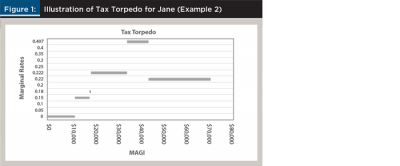

In summary, for each dollar of MAGI between $12,400 and $43,706, Jane’s marginal tax rate is either 150 percent or 185 percent of her tax bracket. MAGIs at these income levels would support spending of $42,400 and $65,533, making Jane a middle-income individual. Her marginal tax rate reaches a maximum of 40.7 percent, before falling sharply to 22 percent at MAGI of $43,706. Figure 1 illustrates this tax torpedo for Jane.

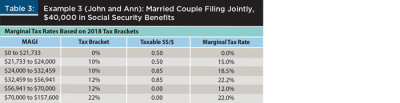

Example 3: Next, consider the tax torpedo in 2018 for a married couple filing jointly with both partners over age 65 at year-end. This couple, John and Ann, receives $40,000 in Social Security benefits in 2018. The income threshold levels for a married couple are $32,000 and $44,000. Assume that John and Ann have no tax-exempt interest. Table 3 presents their situation.

At MAGI of $21,733, their PI is $41,733, [$21,733 + 0.5($40,000)]. So, $4,867 of their Social Security benefits are taxable, [(0.5($41,733 – $32,000)]. Thus, their AGI is $26,600, [$21,733 + $4,867], which is offset by their $26,600 standard deduction (including additional standard deductions of $1,300 each for being over 65.) Although their PI is above the first income threshold level of $32,000 and therefore some of their Social Security benefits go into AGI, they still have taxable income of $0; they pay no income taxes. This paper considers the tax torpedo to begin where taxable income first exceeds $0 and the marginal tax rate therefore exceeds zero.

Each dollar of MAGI between $21,733 and $24,000 causes an additional $0.50 of Social Security benefits to be taxed. Because they are in the 10 percent tax bracket, their marginal tax rate is 15 percent, [10 percent x 1.50].

At $24,000 of MAGI, their PI hits the second income threshold level of $44,000. Every dollar of income between $24,000 and $56,941 causes another $0.85 of Social Security benefits to be taxable. For income between $24,000 and $32,459, their marginal tax rate is 18.5 percent, [10 percent x 1.85]. For income between $32,459 and $56,941, their marginal tax rate is 22.2 percent, [12 percent x 1.85].

At MAGI of $56,941, 85 percent of Social Security benefits are taxed. As income rises beyond this level, their marginal tax rate is equal to the tax bracket. For example, for MAGI between $56,941 and $70,000, their marginal tax rate is only 12 percent.

In summary, each dollar of MAGI between $21,733 and $56,941 has a marginal tax rate that is either 150 percent or 185 percent of their tax bracket. Their maximum marginal tax rate is 22.2 percent, before falling sharply to 12 percent at MAGI of $56,941, illustrating the tax torpedo for this couple.

For this married couple with $40,000 of Social Security benefits, the highest marginal tax rate is 22.2 percent, which is lower than the 40.7 percent marginal tax bracket for the single taxpayer in Table 2 who is receiving $30,000 in Social Security benefits. For a married couple filing jointly, it takes almost $50,000 of annual Social Security benefits before the top marginal tax rate rises to 40.7 percent, [22 percent tax bracket x 1.85].

Based on the Tax Cuts and Jobs Act’s (TCJA) lower tax brackets scheduled for 2018 through 2025, more single taxpayers than married couples should be especially interested in withdrawal strategies that will help them minimize the amount of income that is subject to a federal marginal tax rate exceeding 40 percent.

It is important to note that according to the TCJA, tax brackets and income ranges for each tax bracket are scheduled to revert in 2026 to 2017 levels after COLA adjustments. If that happens, the tax torpedo will become even more damaging, because many singles and married couples would have a wide range of income that is taxed at a federal marginal tax rate of 46.25 percent. For a wide range of incomes, each dollar of additional income would cause another $0.85 of Social Security benefits to be taxable, and their tax bracket would be 25 percent, [25 percent x 1.85 = 46.25 percent].4

Income Ranges Affected by the Tax Torpedo

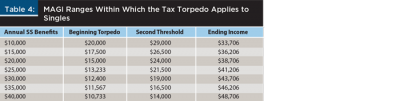

Table 4 presents 2018 MAGI income levels within which the tax torpedo applies to single individuals. The “Beginning Torpedo” column denotes the larger of the level of MAGI where PI reaches $25,000 or the level of MAGI where taxable income equals $0. The “Second Threshold” column denotes the level of MAGI where PI reaches $34,000. And the “Ending Income” column represents the level of PI, where 85 percent of Social Security benefits are taxed.

For example, consider a single individual with $20,000 of annual Social Security benefits. The “Beginning Torpedo” level occurs at MAGI of $15,000, which produces PI of $25,000, [$15,000 + 0.5($20,000)]. The “Second Threshold” occurs at MAGI of $24,000, which produces a PI of $34,000. The “Ending Income” level is $38,706.

When annual Social Security benefits are $25,000 or higher, “Beginning Torpedo” denotes the level of MAGI where taxable income reaches $0. For example, if annual Social Security benefits are $30,000, then a MAGI of $12,400 would produce a PI of $27,400. The portion of Social Security benefits included in AGI would be $1,200, [0.5($27,400 – $25,000)]. So, AGI would be $13,600, which would be offset by the $13,600 standard deduction for a retiree over age 65.

Because the tax torpedo refers to the hump in marginal tax rates as income rises, the rise in MAGI from $10,000 (the level of MAGI where PI hits $25,000) to $12,400 for this single individual receiving $30,000 in Social Security benefits is not considered part of the tax torpedo, even though each dollar of income between $10,000 and $12,400 would cause an extra $0.50 of Social Security to be included in AGI.

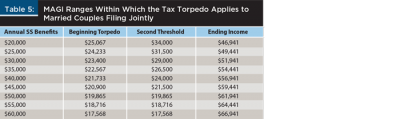

Table 5 presents 2018 MAGI income levels within which the tax torpedo applies to married couples filing jointly. For couples with annual Social Security benefits of slightly less than $11,000 or higher, “Beginning Torpedo” always denotes the level of MAGI where taxable income equals $0. “Second Threshold” denotes the larger of the level of MAGI where PI reaches $44,000 or the level of MAGI where taxable income equals $0. And “Ending Income” denotes the level of MAGI where 85 percent of Social Security benefits are taxed.

For a married couple with $40,000 in annual Social Security benefits, there are no taxes on their first $21,733 of MAGI. Income between $21,733 and $24,000 has a marginal tax rate that is 150 percent of their tax bracket. For income between $24,000 and $56,941, their marginal tax rate is 185 percent of their tax bracket.

For a married couple with $50,000 in annual Social Security benefits, there are no taxes on their first $19,865 of MAGI. By this point, their PI already exceeds $44,000, the second income threshold level. Therefore, for MAGI between $19,865 and $61,941 their marginal tax rate is 185 percent of their tax bracket.

Delaying Social Security May Reduce Taxation of Social Security Benefits

It may be possible to reduce the taxable portion of Social Security benefits by delaying the start of those benefits. Work based on the tax code before the TCJA was done by Meyer and Reichenstein (2013a). To simplify the analysis and keep it tractable, this study assumed MAGI consists of withdrawals from TDAs like a 401(k). As a result, there are no qualified dividends or long-term capital gains that are taxed at preferential rates.

The key insight is that PI includes all withdrawals from TDAs, but only half of Social Security benefits. Therefore, by delaying Social Security benefits, a household may be able to increase Social Security benefits by a given amount and decrease withdrawals from tax-deferred accounts by an equal amount. This substitution would cause PI to decrease, which could substantially decrease the taxable portion of Social Security and thus taxes.

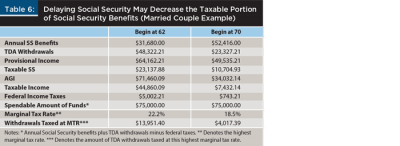

Table 6 presents the situation facing a same-age, middle-income, married couple at least 71 years old in 2018. The sole-earning spouse (assumed male for clarity) has a primary insurance amount (PIA) of $2,400, and his wife has a PIA of zero. Their full retirement age is 66. Their retirement lifestyle requires $75,000 of spending in 2018. Table 6 compares two strategies for attaining their spending goal.

In the Begin-at-62 strategy, the husband began his retirement benefits and his wife began her spousal benefits several years ago at age 62. In 2018, his retirement benefits will be $1,800 per month, while his wife’s spousal benefits will be $840 per month for total annual Social Security benefits of $31,680, [75 percent ($2,400)12 months + 70 percent ($1,200)(12 months)]. To attain their spending goal, they would withdraw $48,322.21 from their TDAs. This would cause $23,137.88 of Social Security benefits to be taxed. They would pay total taxes of $5,002.21. Furthermore, the last $13,951.40 of TDA withdrawals would be taxed at a 22.2 percent marginal tax rate, [12 percent x 1.85].

In the Begin-at-70 strategy where the husband and wife delayed their Social Security benefits until age 70, their combined annual benefit in 2018 would be $52,416, [132 percent($2,400)12 months + $1,200(12 months)]. To attain their spending goal, they would only need to withdraw $23,327.21 from their TDAs. This would cause $10,704.93 of Social Security benefits to be taxed, and would reduce their total taxes to $743.21. In this strategy, they avoid the 22.2 percent marginal tax rate and only have $4,017.37 of TDA withdrawals taxed at a marginal tax rate of 18.5 percent, [10 percent x 1.85]. In short, delaying Social Security benefits allows them to minimize the adverse effects of the tax torpedo.

By delaying Social Security until 70, this couple increased their joint Social Security benefits by about $20,700 a year and decreased TDA withdrawals (and thus MAGI) by about $25,000. This substitution decreased annual taxes by about $4,300 (the difference between the $20,700 increase in Social Security benefits and the $25,000 decrease in TDA withdrawals). Delaying benefits until 70 allowed them to reduce provisional income by about $14,600, which decreased the taxable portion of Social Security benefits by about $12,400.

The Begin-at-70 strategy in Table 6 assumed their RMDs will be $23,327.21 or less in 2018. Suppose all TDA balances are in the sole-earners’ rollover IRA, and he will be age 71 at the end of 2018. His RMD for 2018 would be $23,327.21 or less if this IRA’s 2017 end-of-year balance was $618,171 or less, [$23,321.21 x 26.5]. One advantage of delaying Social Security until age 70 is this couple will be able to withdraw more funds from their TDAs to finance spending in their early retirement years, reducing their TDA balances once RMDs begin. Because they will not be receiving Social Security benefits in their early retirement years, TDA withdrawals in those early retirement years will not be subject to the sharply higher marginal tax rates caused by the tax torpedo.

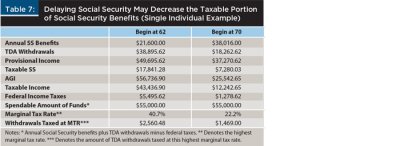

Table 7 presents the situation facing a single individual at least 71 years old in 2018. She has a PIA of $2,400 and full retirement age of 66. Her middle-income retirement lifestyle requires $55,000 of spending in 2018. Table 7 compares two strategies for attaining her spending goal.

In the Begin-at-62 strategy, she began her retirement benefits several years ago at age 62. In 2018, her annual retirement benefit will be $21,600, [75 percent($2,400)12 months]. To attain her spending goal, she would withdraw $38,895.62 from her TDAs and she would pay $5,495.62 in taxes. Furthermore, the last $2,560.48 of TDA withdrawals would be taxed at a 40.7 percent marginal tax rate, [22 percent x 1.85], and the prior $13,135.14 of TDA withdrawals would be taxed at 22.2 percent marginal tax rate, [12 percent x 1.85].

In the Begin-at-70 strategy, her annual benefits would be $38,016, [132 percent($2,400)12 months] in 2018. To attain her spending goal, she would only need to withdraw $18,262.62 from her TDAs. She would pay $1,278.62 in taxes. In this strategy, she avoided the 40.7 percent marginal tax rate and would only have $1,469 of TDA withdrawals taxed at a marginal tax rate of 18.5 percent, [10 percent x 1.85]. Like the previous example, delaying Social Security benefits allows her to minimize the adverse effects of the tax torpedo.

In the Begin-at-70 strategies shown in Table 6 and Table 7, the households delayed the beginning of their Social Security benefits until 70. In their early retirement years, they would have to withdraw more funds from their TDAs to finance their retirement needs. Therefore, by delaying the start of Social Security benefits, their TDA balances at age 701/2 will be lower than if they began their Social Security benefits earlier. And if they delay their Social Security benefits, their RMDs will be lower, which Tables 6 and 7 demonstrate can cause a sharp decrease in the taxable portion of Social Security benefits and, therefore, taxes.

Expanding Income Beyond the End of the Tax Torpedo

Here is a strategy for decreasing the adverse impact of the tax torpedo for households already subject to RMDs:

Consider a single individual subject to RMDs in 2018 who will have $30,000 in annual Social Security benefits this year. She plans to limit withdrawals from her TDAs in 2018 and subsequent years to her RMD. For 2018, her RMD would cause her MAGI to be $43,800, which from Table 2, slightly exceeds the income level associated with the end of the tax torpedo. Furthermore, if she continues to limit withdrawals from her TDAs to her RMD each year, her income will likely remain near or slightly beyond the end of the tax torpedo in subsequent years, and she will pay a 40.7 percent marginal tax rate on about $9,300 of these withdrawals each year.

Instead, from Table 2, in 2018 she could convert $26,800, [$70,600 – $43,800], from TDAs to a Roth IRA to take her income to the top of the 22 percent tax bracket. This $26,800 would be taxed at a 22 percent marginal tax rate. Each year she makes such a Roth conversion would likely reduce the amount of her TDA withdrawals that would be taxed at a 40.7 percent marginal tax rate by about $1,000.

Alternatively, she might more aggressively convert funds from TDAs to a Roth IRA for fewer years. For example, in 2018 she could convert $101,800 to a Roth IRA and have $26,800 taxed at 22 percent, and $75,000 taxed at 24 percent marginal tax rates. Each year she makes such a Roth conversion would likely reduce the amount of her TDA withdrawals that would be taxed at a 40.7 percent marginal tax rate by about $4,000. As a result, it may be better for her to convert funds to a Roth account now and have them taxed at 22 percent or 24 percent, then to have them remain in her TDA and be taxed at a 40.7 percent marginal tax rate in future years.

Caution: Although unusual, there is an important qualification. If she converts too much (e.g., more than $100,000) to a Roth IRA in 2018, it might cause her to pay larger Medicare premiums in 2020. Increases in 2018 Medicare premiums occur at income—defined as AGI plus tax-exempt interest—thresholds of $85,000, $107,000, $133,500, and $160,000 for singles and twice these levels for married couples filing jointly.

Increases in Medicare premiums are effectively tax increases. So, if she will be on Medicare in 2020, then her Roth conversion decision in 2018 should consider: (1) the additional taxes on this conversion amount in 2018; (2) the impact, if any, of this 2018 conversion on her 2020 Medicare premiums; and (3) the impact, if any, of this 2018 conversion on Medicare premiums in 2021 and later years.

The larger her 2018 Roth conversion, the larger her 2020 Medicare premiums might be (since 2018 income determines 2020 premiums), but the lower would be her 2021 and later RMDs and thus potentially her 2021 and later Medicare premiums. In practice, she may want to convert less than $101,800 to a Roth IRA in 2018 to limit its effect on the size of her 2020 Medicare premiums.

Conclusion

Middle-income households, and the financial planners who serve them, should be primarily concerned about how decisions on Social Security claiming, withdrawal, and conversions from these households’ financial portfolios will affect the taxable portion of their Social Security benefits, because their incomes will likely be too low to affect the size of their future Medicare premiums.

In contrast, high-income households should be primarily concerned about how their withdrawal and conversion decisions from their portfolios will affect the size of their future Medicare premiums, because their incomes will likely already be so high that 85 percent of their Social Security benefits will be taxable.

The tax torpedo can cause households’ retirement-age marginal tax rates to substantially exceed their tax brackets. Together, the tax torpedo and the Medicare-premium issue add complexity to the issue of how to properly coordinate a household’s Social Security claiming decision and financial portfolio withdrawal decision.

Endnotes

- See the “Fast Facts & Figures about Social Security, 2017” (SSA Publication No. 13-11785), downloadable at ssa.gov/policy/docs/chartbooks/fast_facts.

- All of these topics are covered in Social Security Strategies, third edition, by Reichenstein and Meyer (2017., Retiree Inc.).

- Technically, at AGI levels exceeding $200,000 for singles or $250,000 for married couples filing jointly, the Net Investment Income Tax applies, which causes marginal tax rates to exceed tax brackets. However, these income levels far exceed the income levels where households will already pay taxes on 85 percent of Social Security benefits.

- Geisler (2017) showed that the federal-alone marginal tax rate based on the 2017 tax structure (which is scheduled to come back after adjustments for COLAs in 2026) can be as high as 55.5 percent. And in personal correspondence with the authors, Geisler noted that based on the 2018 tax structure, the federal-alone marginal tax rate can be as high as 49.95 percent. In this study, the 46.25 percent and 40.7 percent marginal tax rates are emphasized, because they would be more common. However, the authors acknowledge the potentially higher marginal tax rate of 55.5 percent and 49.95 percent that have been explained by Geisler.

References

Cook, Kirsten, William Meyer, and William Reichenstein. 2015. “Tax-Efficient Withdrawal Strategies.” Financial Analysts Journal 71 (2): 16–29.

Geisler, Greg. 2017. “Taxable Social Security Benefits and High Marginal Tax Rates.” Journal of Financial Service Professionals 71 (5): 56–67.

Meyer, William, and William Reichenstein. 2010. “Social Security: When to Start Benefits and How to Minimize Longevity Risk.” Journal of Financial Planning 23 (3): 49–59.

Meyer, William, and William Reichenstein. 2012a. “How the Social Security Claiming Decision Affects Portfolio Longevity.” Journal of Financial Planning 25 (4): 53–60.

Meyer, William, and William Reichenstein. 2012b. “Social Security Claiming Strategies for Singles.” Retirement Management Journal 2 (3): 61–66.

Meyer, William, and William Reichenstein. 2013a. “The Tax Torpedo: Coordinating Social Security with a Withdrawal Strategy to Minimize Taxes.” Retirement Management Journal 3 (1): 25–32.

Meyer, William, and William Reichenstein. 2013b. “Adding Longevity through Tax-Efficient Withdrawal Strategies.” Journal of Wealth Management 16 (1): 57–64.

Meyer, William, and William Reichenstein. 2014. “Social Security Benefits for Employees in Jobs Not Covered by Social Security.” Journal of Retirement 2 (1): 23–34.

Reichenstein, William, and William Meyer. 2013a. “Social Security Strategies for Singles.” AAII Journal 35 (11): 30–33.

Reichenstein, William, and William Meyer. 2013b. “Social Security Strategies for Couples.” AAII Journal 35 (12): 29–34.

Reichenstein, William, and William Meyer. 2015. “Social Security’s Earnings Tests: A Primer for Financial Planners.” Journal of Financial Planning 28 (1): 53–60.

Reichenstein, William, and William Meyer. 2016a. “Social Security Claiming Strategies for Widows and Widowers.” Journal of Retirement 3 (4): 77–86.

Reichenstein, William, and William Meyer. 2016b. “Redo Strategies: When Can You Redo a Prior Social Security Claiming Decision?” Journal of Financial Planning 29 (6): 48–53.

Reichenstein, William, and William Meyer. 2016c. “Retirement Income Planning: Why the Conventional Wisdom Is Never the Optimal Withdrawal Strategy.” Journal of Investment Consulting September/October: 9–11, 22.

Citation

Reichenstein, William, and William Meyer. 2018. “Understanding the Tax Torpedo and Its Implications for Various Retirees.” Journal of Financial Planning 31 (7): 38–45.