Journal of Financial Planning: September 2021

Tim Jager, principal at Meradia, has 30 years of investment management technology experience and a proven history of delivering strategic, transformative projects on time and within budget. This includes enterprise architecture and data management, data transformation and system design, master and reference data management, global security master management, global account master management, global trade flow management, client reporting transformation, post-acquisition integrations, global system conversions, custom design and development, and third-party integrations. Founded in 1997, Meradia provides strategic advisory and implementation services to the investment management industry.

NOTE: Click on images below for PDF versions.

Financial planners who rely on their customer relationship management (CRM) system solely as a contact repository could be missing out on business growth opportunities.

A CRM is often used to store logistical information, including client and prospect names, email addresses, and phone numbers, and then tracks your team’s outreach to those contacts. It involves a lot of time from you and your colleagues to enter and update forms and data. This information then is used to generate status updates to management on where certain opportunities and prospect communications stand. Ultimately, your team’s performance is measured through metrics taken from the CRM.

Does a CRM with this objective really make your life as a planner better? Not often. If anything, it cannibalizes your efforts to do your job and the CRM serves more of a “Big Brother” role, watching and reporting what you do.

How do you flip the use of your CRM on its head so it grows your business? Stop viewing it as a management tool, but rather an information powerhouse.

Rethink What Data Your CRM Stores

Have you ever stopped to ask yourself the purpose behind your CRM? It often causes discord because it plays multiple roles for various stakeholders at the same time. Some of the most common examples include:

- A repository for all client-related information and part of a data governance solution that captures and refines content for usage. This becomes especially valuable if the CRM is integrated into all client interactions and systems such as telephone, email, reporting, billing, and transactions.

- A tool to monitor and measure activity and provide critical data and metrics for management. This can take on many forms like pipeline management and opportunity forecasting as well as interaction reports and, in some cases, compensation intelligence. Using this model, you may hear questions like “When was the last time you called John Smith?” or “How many prospect calls did you make this month?”

- An interaction and information repository that includes customer details to assist team members with tasks like automated follow-up activity, status reminders, high-priority contact identification, and overall customization of the client experience. This requires the use of data analytics and combinations of disparate data sets such as sales transactions, web interactions, logins, downloads, data aggregation, third-party data, industry data, market data, and client attributes. This model provides insight and intelligence to the relationship and allows the CRM to assist planners in their activities. However, most teams only utilize a few pieces of this information and leave much of the data within the organization untapped.

Ultimately, your CRM should equip you with meaningful insights into a client’s life, not just their contact information. Does your client have children? If so, what are their ages? Are they heading to college or getting married? Has the client recently started a family and needs to shop around for a 529 college savings plan? These core milestones can show you and your planning team where value-add opportunities exist. I once spoke with a planner who onboarded a new client because they connected over their love for marathons. They met at a local race, stayed in touch, and eventually built a relationship. This is the type of information your CRM should hold.

Consider which attributes help you define your target client base. Where are your top clients located geographically? What do they do for a living? Capture and store personal information in an easily searchable format. Most importantly, collect data in a way that is automated and doesn’t require the planner to fill out endless forms with required fields that risk flawed or gamed information, and accidental or intentional omission. It will require some thought as to how to capture this data, but with this model, you will collect meaningful insight that will augment relationships.

Many planners make heavy usage of social media platforms to research prospects and current customers for insights that inform how best to serve them. Today, some CRM systems integrate with major social media platforms, so you can glean key personal information while staying compliant with data aggregation guidelines. While this capability is still in its early stages, it could yield significant business-building opportunities down the line. This can also assist in managing connections outside of the direct network.

Use Your CRM as a Business Intelligence Tool

Beyond deepening client relationships, your CRM can tell you a lot about your business.

I once asked a firm what their most impactful sales interaction was, to which they answered, “breaking bread.” It made sense. It was an engagement outside of business hours where someone was allocating their personal time to the relationship. Fully expecting to see an uplift in sales, we started tracking client dinners in the CRM. Through a back-end system, we looked at activity tied to expense reports, tied to restaurants, tied to the dinner attendees as well as the cost of the meal. We looked for any impact within a 30-day window and compared this information against contacts who did not attend dinners. When we crunched the numbers, the results from a statistical perspective were meaningless. There was virtually no correlated uplift in sales activity directly tied to dinner events.

Upon further research, we ran this scenario on a reverse basis and analyzed how dinners impacted redemptions. It turned out they had a huge impact. The likelihood of redemptions dropped dramatically when we had dinner with people. Suddenly, dinners stopped being a sales activity and became a retention activity. Until looking at the data, we never thought taking someone to dinner for sales would help retain their assets.

We realized that in highlighting the latest capabilities and developing the personal connection, the client was more likely to remain with the firm in the future. This challenged the existing compensation model that was mainly based on sales and led to changes that embraced retention-based activities. We started rewarding team members for keeping clients and decreased the compensation reliance on sales.

This powerful example illustrates how CRM data, when appropriately housed, can show clear trends that make you question how you approach your business. The insight on retention rate was powerful, but what was even more impactful was seeing how ineffective it was to correlate client dinners purely to sales.

Track Clients and Prospect Journeys

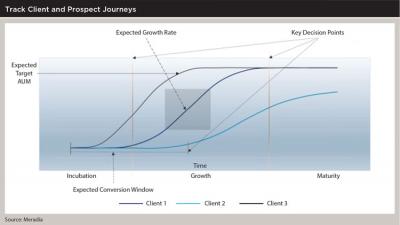

As the adage goes, it takes seven touchpoints to make a sale. While this is a loose guideline, the saying holds true. There is often a long incubation period before a prospect becomes a client. However, a conversion should happen at some point. A prospect should not be a prospect forever.

Your CRM should be keeping a record of information to advance business-development efforts. If someone has been a prospect for several years, it might be time to have a frank conversation with them. Is there truly a chance they will do business with you? Or are you wasting their time as well as yours? While you should not cut off the interaction, you might consider taking a step back and deploying a more targeted focus on other prospects with a higher chance of a conversion.

On the other hand, you should track the progress of current customers. As they reach certain maturity milestones, there should be checkpoints for deciding with the client how the relationship should move forward. These milestones can exist both in terms of the client’s life events and relational events with the firm regarding account maturity. This model allows for the provision of the right service at the right time and does not require the client to initiate the conversation.

Planners can benefit from understanding their client base and focusing on activities both individually with a client and strategically as a team. Suppose a firm determines that a majority of its clients are at a high level of account maturity. They should then look to align more strategies and resources toward account development or vice versa. The underlying data contained in the CRM can provide significant insight into where planners should focus their efforts and how to build both tactical and strategic models for moving forward.

The prospecting process can be long and complex, but you have the data in-house to map out a thoughtful and profitable plan through your CRM. Leverage key pieces of information, such as the number of prospect meetings in a specific timeframe, to identify when conversion points should occur. Then you can more accurately prioritize relationship efforts with prospects who have the highest likelihood of coming on board.

Enhance Your Firm’s Strategy

A CRM is a powerful but frequently underutilized and mistrusted tool. It should serve as a central data component that helps you define client engagement, business models, and growth opportunities. It is not going to grow your business when used solely for tracking sales. Rethink what your CRM stores, and it will work for you, not derail your efforts.

Firms are often so focused on cost reduction and increased efficiency that they miss the unlimited potential upside available if they leverage the business intelligence housed in the CRM data to increase market share.