Journal of Financial Planning: September 2021

Greg Geisler, Ph.D., is a clinical professor of accounting at the Kelley School of Business at Indiana University (Bloomington). His work has been published in many journals, including seven other articles in the Journal of Financial Planning. He is the 2017 recipient of the Montgomery-Warschauer award. Greg can be reached HERE.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

NOTE: Click on images below for PDF versions.

Retirees at the upper-middle-income or upper-income levels often pay higher Medicare premiums. There is an opportunity available for many such retirees to either completely avoid or significantly reduce this additional cost at the start of their retirement. This opportunity can save some single retirees on Medicare anywhere from approximately $1,700 to $9,500. This opportunity can save some married retirees, if both are on Medicare and file one joint income tax return, anywhere from approximately $3,400 to $19,000. This article focuses on how to execute this opportunity and the amount of savings as a result.

Background

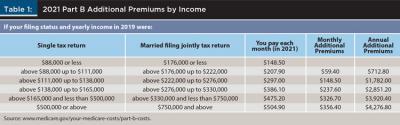

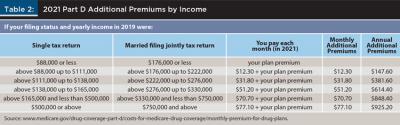

Medicare Part B is commonly called “medical insurance.” For each Medicare participant, premiums are $148.50 per month for 2021, but could be higher. Part D is commonly called “prescription drug coverage.” For each participant, premiums are paid each month; the rate depends on the Part D plan chosen. For some participants, the premiums per month could be higher. The increase in premiums for both Medicare Part B and Part D are named Income-Related Monthly Adjustment Amounts (IRMAA). IRMAA is paid by every participant with relatively high income. IRMAA will also be referred to as “higher Medicare premiums.”

IRMAA is generally based on adjusted gross income (AGI) from Form 1040 plus tax-exempt interest, hereafter referred to as modified AGI (MAGI), for the second-previous year.1 The required addition of tax-exempt interest (on muni, i.e., state and local government, bonds) means that an individual cannot escape higher Medicare premiums by investing in muni bonds instead of bonds that produce taxable interest. Under the federal income tax law, AGI is total income (that is not excluded) minus adjustments to income (i.e., certain deductions). These adjustments are more commonly known as “above-the-line” deductions. For 2021, a very limited amount of cash contributions to charities by individuals ($300 per individual) who do not itemize deductions are above-the-line deductions. Otherwise, above-the-line deductions are not common for retirees.2

Medicare premiums can never be reduced below the base amounts. IRMAA for Medicare Part B is in Table 1 and for Medicare Part D is in Table 2. Note that if MAGI is even $0.01 above a threshold, these additional Medicare premiums increase substantially. In 2021, for someone whose filing status is single, such thresholds occur when MAGI exceeds exactly $88,000, $111,000, $138,000, and $165,000.3 For a married couple filing their tax return jointly, these threshold amounts are all double. These threshold amounts and the additional Medicare premium amounts can increase year to year as they are indexed for inflation. Financial planners can add value for a client moving through retirement by ensuring that MAGI stays below a higher IRMAA threshold each year. IRMAA is effectively an additional tax, since it is based on this income amount from the tax return (i.e., MAGI), and so it will also be referred to as “IRMAA tax.”

Prior Articles

Kitces (2017) points out that IRMAA tax began in 2007 and started hitting a lot more individuals in 2018 as the threshold amounts were lowered. IRMAA tax thus has become an important issue for financial planners with higher-income clients relatively recently. Slott (2018) recommends proactive tax planning to lower future MAGI amounts to reduce or avoid IRMAA tax. For example, he suggests doing conversions of some IRA funds into Roth IRAs (i.e., triggering income) for multiple years starting after retirement and before age 72 when required minimum distributions (RMDs) begin. This will make the RMDs from IRAs lower, which will reduce future MAGI amounts. He also suggests making qualified charitable distributions (after age 70½) from IRAs, since those always reduce MAGI (whereas contributions to charities from a checking account do not reduce MAGI). Thomas (2019) recommends the following additional strategies: distributions from Roth IRAs and qualified withdrawals from health savings accounts, since neither trigger any income; sales or withdrawals of taxable investments, since some of the cash inflow is a nontaxable return of capital (i.e., return of basis); deferring tax-deferred retirement account distributions until required at age 72; and deferring Social Security benefits until age 70. The latter two suggestions can reduce IRMAA tax in the earlier years of being on Medicare, but might increase IRMAA tax after they begin. What has not been well investigated is how much MAGI naturally declines after retiring and how much IRMAA tax can be avoided by such declines, especially if a higher-income individual does not have an entire nest egg invested in tax-deferred retirement accounts (e.g., traditional IRAs).

Filing Form SSA-44 When the Client Retires

Clients might owe no or lower IRMAA tax in the first two years of retirement if there is a “life-changing event” and Form SSA-44 is filed with the Social Security Administration (SSA), and properly shows that MAGI from the current or previous year will be one or more IRMAA thresholds below MAGI from two years prior—when the client was employed. For that reason, when a client retires, the client’s financial planner should always consider whether filing Form SSA-44—because of the life-changing event of stopping work—could reduce IRMAA tax and should ensure such form is properly completed and filed by the client if it does.

The first four scenarios that follow show that holding after-tax cash flow (ATCF) constant, when retiring, MAGI decreases substantially, leads to lower income tax, and can lead to lower IRMAA tax. The fifth scenario shows that even if ATCF increases substantially after retirement, IRMAA tax can decrease if the client has significant taxable investments or investments inside Roth retirement accounts to help fund spending in retirement. For all scenarios below, assume the client will delay starting Social Security benefits (SSB).

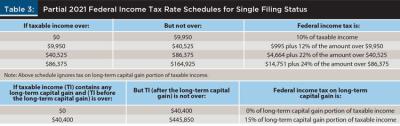

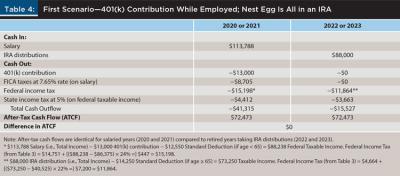

First Scenario: 401(k) Contribution as Employee and 100 Percent Tax-Deferred Retirement Accounts as Retiree

Even if the client has the most tax-disadvantaged investments (i.e., all in tax-deferred retirement accounts (TDRAs) such as traditional 401(k)s and IRAs) to be used for spending in retirement, filing Form SSA-44 can still result in IRMAA tax savings while maintaining the same level of after-tax cash flow.4 In the present scenario, assume the client’s only wealth is in TDRAs. Specifically, assume the client has a $2.2 million nest egg in an IRA at the start of 2022 and withdraws $88,000 in both years.5 Here are the other assumptions used for this first scenario in Table 4: the client is a single individual who retires at the end of 2021, just before turning age 65; has salary income in both 2020 and 2021 of $113,788; puts $13,000 in a 401(k); and has no other income. Note that federal income tax in Tables 4 through 8 is based on the federal tax rate schedules in Table 3. Also note the assumption that state income tax is a flat 5 percent of federal taxable income. Assume the client turns age 65 between January 2, 2022, and February 1, 2022, and begins Medicare on January 1, 2022. IRMAA tax for 2022 is generally based on MAGI for 2020 (i.e., two years prior), which is $100,788 ($113,788 − $13,000) for this client. This individual will pay IRMAA tax of $860.40 ($712.80 + $147.60; see Tables 1 and 2) in both 2022 and 2023, $1,720.80 total, if no Form SSA-44 is filed because MAGI two years prior is above $88,000 but not above $111,000.6

If Form SSA-44 is filed and it demonstrates that MAGI will be $88,000 or less those first two years of retirement, IRMAA tax can be avoided. To summarize, holding after-tax cash flow constant in the two years before and after retirement, even with the most tax-disadvantaged nest egg, some IRMAA tax can be avoided for this unmarried individual just by filing Form SSA-44 with the SSA and demonstrating that income will drop at least one threshold—to $88,000 or less in the first two years this unmarried individual is retired. Table 4 provides the tax return information necessary to compute such Medicare premium savings and shows that after-tax cash flow is identical before and after retirement. Note that IRMAA tax is avoided for 2024 and 2025 also, since those IRMAA tax amounts are based on MAGI in 2022 and 2023, respectively.

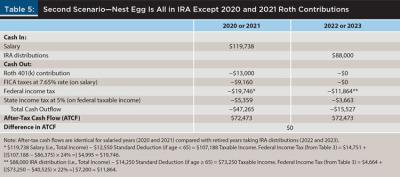

Second Scenario: Roth 401(k) Contribution as Employee and 100 Percent TDRAs Before Such Contribution

Continue to assume the same facts with two changes: salary increases to $119,738; and during the last two years as a salaried employee, the client contributes $13,000 to a Roth 401(k) instead of a traditional 401(k) as in the first scenario. Assume these last two years of being an employee are the first time the client has ever contributed to a Roth retirement account (i.e., tax-exempt account). Without filing Form SSA-44, IRMAA tax in 2022 and 2023 is based on MAGI two years prior, which is $119,738 for this client since contributions to a Roth 401(k) do not reduce AGI. Such individual will pay IRMAA of $2,163.60 ($1,782.00 + $381.60; see Tables 1 and 2) in both 2022 and 2023, $4,327.20 total, if no Form SSA-44 is filed because MAGI is greater than $111,000 but not above $138,000. Filing Form SSA-44 and showing that MAGI will only be $88,000 or less those first two years of retirement will completely avoid this $4,327.20 of IRMAA tax. So, holding after-tax cash flow constant in the two years before and after retirement, even with a very tax-disadvantaged nest egg, more IRMAA tax can be avoided than in the first scenario (where there was a $13,000 traditional 401(k) contribution). Table 5 provides the tax return information necessary to compute such Medicare premium savings and shows that after-tax cash flow is identical before and after retirement.

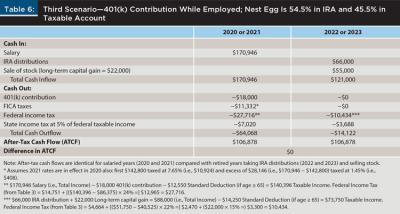

Third Scenario: 401(k) Contribution as Employee, 54.5 Percent in TDRAs and 45.5 Percent in Taxable Account

Next, we will assume the client has a $3.025 million nest egg at the start of 2022—$1.65 million in an IRA and $1.375 million of stock, with a basis of $825,000, that does not pay dividends and is not in a tax-advantaged account—and withdraws $66,000 from the IRA and sells $55,000 of stock for both years. The stock sale results in $22,000 long-term capital gain income and a $33,000 return of basis. In this scenario, assume salary was $170,946 in 2020 and 2021, which, after subtracting an $18,000 401(k) contribution, results in MAGI of $152,946—below the $165,000 and above the $138,000 IRMAA income thresholds (see Tables 1 and 2).

If the client wants the same amount of after-tax cash flow in the two years before and the first two years after retirement, a lot of IRMAA tax can be completely avoided if Form SSA-44 is filed. Such individual will pay IRMAA tax of $3,465.60 ($2,851.20 + $614.40; see Tables 1 and 2) in both 2022 and 2023, $6,931.20 total, if no Form SSA-44 is filed showing that MAGI will only be $88,000 or less those first two years of retirement. Such a large IRMAA tax savings is possible because only 40 percent of the stock sale ($22,000 / $55,000) is income. Table 6 provides the tax return information necessary to compute such Medicare premium savings and shows that after-tax cash flow is identical before and after retirement.

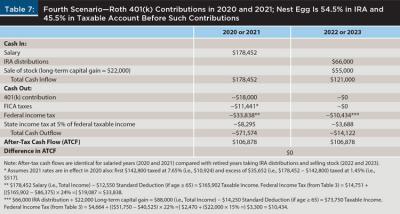

Fourth Scenario: Roth 401(k) Contribution as Employee, 54.5 Percent in TDRAs and 45.5 Percent in Taxable Account Before Such Contribution

Continue to assume the same facts as the last scenario with two changes: salary increases to $178,452; and during the last two years as a salaried employee, the client contributed $18,000 to a Roth 401(k) instead of a traditional 401(k). These last two years are the first time the client has ever contributed to a Roth retirement account. IRMAA tax is based on MAGI, which is $178,452 for this client. Such individual will pay additional IRMAA tax annually of $4,768.80 ($3,920.40 + $848.40) in both 2022 and 2023 if Form SSA-44 is not filed, since MAGI exceeds $165,000 (see Tables 1 and 2).

However, if Form SSA-44 is filed showing that both 2022 and 2023 MAGI will only be $88,000 or less, the additional Medicare premiums (i.e., IRMAA tax) of $4,768.80 will be avoided for both years ($9,537.60 total savings). So, holding after-tax cash flow constant in the two years before and after retirement, IRMAA tax can be completely avoided just by filing Form SSA-44 with the SSA and showing that income will drop to $88,000 or less for this unmarried individual in the first two years this individual is retired. Table 7 provides the tax return information necessary to compute such Medicare premium savings and shows that after-tax cash flow is identical before and after retirement.

Note that if instead of a single individual employee whose income was above $165,000 both years before beginning Medicare, the client is a married couple in which both people are the same age and file a joint tax return, and MAGI was above $330,000 both years before the couple began Medicare and $176,000 or less the first two years of retirement, the total savings would increase to $19,075.20 ($4,768.80 × 2 years × 2 people on Medicare) by filing Form SSA-44 given an analogous fact pattern (i.e., double the income amounts assuming it is a married couple who both work instead of a single individual).

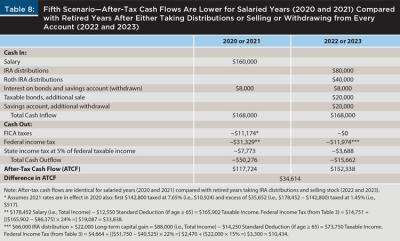

Fifth Scenario: No Retirement Account Contribution When Employed; Wants More Cash to Travel After Retiring; Wants to Pay Less IRMAA

Returning to a single client, assume the client does not want to borrow and wants to spend a lot more the first couple of years in retirement. Vacation travel is a common spending increase for retirees. Can this client still avoid significant IRMAA tax? The more tax-advantaged the client’s nest egg, the easier it is to accomplish this goal. In other words, the greater the portion of the nest egg in Roth retirement accounts and taxable accounts, the greater the client’s ability to take money from the nest egg without producing income. Assume this single client has a nest egg of $4 million and the nest egg is more tax advantaged than in the last scenario. Specifically, assume the client’s nest egg is spread out across the following:

- 50 percent ($2 million) in TDRAs, like IRAs and 401(k)s;

- 25 percent ($1 million) in TEAs, like Roth IRAs and Roth 401(k)s;

- 12.5 percent ($500,000) in taxable U.S. government bonds, the basis and fair market value of which are equal and which pay 1.5 percent interest; and

- 12.5 percent ($500,000) in an FDIC money market account paying 0.1 percent interest.

Also assume the client’s cash inflow before taxes is $168,000: $160,000 salary with no retirement account contributions the two years before retiring, plus $8,000 of interest ([$500,000 × 0.1% =] $500 interest on the money market account + [$500,000 × 1.5% =] $7,500 interest on U.S. government bonds) received is withdrawn and spent; the cash inflow is spread out evenly across all four types of accounts each year during the first two years of retirement, plus the $8,000 of interest earned is withdrawn and spent. For simplicity, we will assume the total investments are $4 million both at the start of 2022 and at the start of 2023, and the total income is the same both years.

Note in Table 8 that the retired client’s after-tax cash flow in 2022 or 2023 is significantly more than it was in 2020 or 2021 (when an employee), while pre-tax cash inflow is $168,000 in both cases, and IRMAA tax is completely avoided. This occurs because only the combination of $80,000 cash inflow from the TDRA along with $8,000 of interest received is income, so filing Form SSA-44 showing this fact can again result in a very large IRMAA tax avoidance.

Such an individual will pay annual additional IRMAA premiums of $4,768.80 ($3,920.40 + $848.40) in both 2022 and 2023 if Form SSA-44 is not filed because MAGI is above $165,000 in each of the prior two years. However, if Form SSA-44 is filed showing that MAGI will be $88,000 or less, the additional Medicare premiums of $4,768.80 will be completely avoided for both years ($9,537.60 total savings).

The following explains why MAGI will only be $88,000 during the first two years of retirement: IRA distributions will be $80,000 ($2 million × 4% = $80,000); Roth (TEA) distributions of $40,000 ($1 million × 4% = $40,000) are not income; sales of taxable bonds of $20,000 ($500,000 × 4% = $20,000) do not trigger any capital gain income, since the fair market value and basis of the bonds is the same; similarly, withdrawing $20,000 ($500,000 × 4% = $20,000) from the savings account does not trigger any income, but those taxable bonds and the savings account produce $8,000 ($500 + $7,500) of taxable interest income that is withdrawn and spent. Since AGI is equal to but not above $88,000 for this single individual, the base amount of Medicare Parts B and D premiums are paid but no IRMAA tax is paid. Meanwhile, after-tax cash flow is $34,614 higher (see Table 8) to support the client’s desire to spend more on increased vacation travel the first two years of retirement. To summarize, such a large reduction in MAGI while increasing ATCF significantly in retirement is possible because of the Roth account and the taxable (i.e., nonqualified) bonds.

Mechanics of Filing Form SSA-44

When an individual first applies for Medicare, and then in subsequent years, during November, they receive a letter from SSA, called an Annual Verification Notice, that determines if they have to pay IRMAA for the upcoming year. After receiving such Notice, Form SSA-44 can be filed if MAGI drops at least one threshold lower due to a life-changing event, which includes a work reduction or a work stoppage, compared with the year SSA is basing IRMAA on. File a separate form for both spouses if married and filing a joint tax return, since IRMAA tax is charged on both spouses on Medicare. If only one spouse worked and then retired, the life-changing event for the other spouse can be the working spouse’s retirement.

On Page 1 of the form is an individual’s name and Social Security number. On Step 1 of Page 2, checkmark one (and only one) life-changing event box and fill in the date of such event. Step 2 on Page 2 asks for MAGI in the year that income was reduced by the life-changing event. This appears to ask for actual MAGI from the individual’s tax return, but the instructions on Page 6 say an estimate for the year can be used if the tax return for that year has not been filed yet. SSA requests that the tax return for the year be sent in after Form SSA-44 is filed so it can compare estimated MAGI with actual MAGI.7 When filing Form SSA-44, try not to underestimate MAGI, since after such comparison, if MAGI is a threshold or more higher than originally estimated, unpaid IRMAA tax plus, presumably, nondeductible interest or late-payment penalties will be owed to SSA.

Step 3 is to estimate MAGI for the year following the year that income was reduced by the life-changing event in Step 2. But Step 3 is filled in only if MAGI will be one or more thresholds below the IRMAA tax threshold in Step 2 (per the first sentence of the instructions for Step 3, which are on Page 7 of Form SSA-44). In the application of this instruction to any of the five scenarios discussed earlier in this article, only Step 2 will be completed because MAGI in the year after the life-changing event (retirement at the end of 2021) is exactly $88,000 in all scenarios (see Tables 4 through 8)—which is below the threshold that triggers having to pay IRMAA tax.

There is another important point to make about Step 2. It “must be more recent than the year of the tax return information [SSA] used.” The instructions to Step 2 for the form say the tax year chosen could be either the “premium year” (2022 in this article’s scenarios) or the “year before the premium year” (2021). The instructions also say to use the “premium year” if MAGI is lower than last year or use “the year before the ‘premium year’” if MAGI is not lower this year than last year. In the five scenarios in this article (in Tables 4 through 8), 2022, the “premium year,” should be chosen because that is the year MAGI drops to $88,000, and no IRMAA tax will have to be paid for 2022 or 2023 if Form SSA-44 is filed and estimated MAGI for 2022 is shown in Step 2.8

Form SSA-44 is submitted to the local Social Security office. One advantage of bringing the form to the local Social Security office is that original documents proving the life-changing event are not mailed into the federal government, so the client doesn’t have to wait to have such documents mailed back. Another advantage is the ability to talk to a Social Security representative and ask the representative if there is any additional information needed to successfully complete the application.

Summary

The Medicare Part B base premium amount in 2021 is $148.50 per month. Most individuals with Medicare Part B pay this base premium amount. However, if modified adjusted gross income (MAGI) as reported on Form 1040 from two years prior is above a certain amount, the individual will pay both the base premium amount and an Income-Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra premium added to the base premium. Table 1 shows the additional Medicare Part B premiums payable when MAGI from two years prior exceeds each threshold. The Medicare Part D base premium amount in 2021 depends on an individual’s choice of prescription drug plan. Table 2 shows the additional Medicare Part D premiums, which are also based on MAGI as reported on Form 1040 from two years prior. As MAGI from two years prior exceeds each threshold, IRMAA increases above the base plan premium.

Financial planners can add value by assisting a client in planning to keep MAGI each year from being in a higher IRMAA threshold, which will reduce the additional Medicare Parts B and D premiums paid two years later. In addition, in the first two years of retirement, MAGI typically decreases compared with MAGI two years prior when the client was employed, as illustrated in this article. If the client is going to have to pay IRMAA the first two years after retiring, a reduction in IRMAA can often be achieved by filing Form SSA-44 with SSA. The attachment to this form can show the details of expected MAGI for the first year of retirement, and this filing can be used to determine any IRMAA tax instead of MAGI from Form 1040 two years prior.

Many clients should file Form SSA-44 because they will avoid paying a significant amount of additional Medicare premiums. Generally, any client who retired and worked full-time after turning age 63 and whose MAGI will cause them to pay IRMAA should consider such a filing. The reason is that after retiring from full-time work, AGI generally decreases—even while holding after-tax cash flow constant—and IRMAA can be based on current MAGI instead of MAGI two years prior if such form is filed.

Conclusion

Assuming a client wants to keep after-tax cash flow the same before and after retiring, the client requires far less income—even if the only source of income at the start of retirement is tax-deferred retirement accounts. This is because after retiring, contributions to retirement accounts from salary and FICA (Medicare and Social Security) taxes end, and these both improve after-tax cash flow. So, holding after-tax cash flow constant before and after retirement requires much less income (and results in lower taxes) in retirement.

For a client who is single and whose MAGI exceeds the first IRMAA threshold (see Tables 1 and 2) in either or both of the two years before retiring, Form SSA-44 should be filed if MAGI is expected to be in a lower IRMAA threshold after retiring. The same is true for a married couple who file a joint tax return and whose MAGI exceeds the first IRMAA threshold.

In such case for someone single, filing Form SSA-44 and showing SSA that MAGI will be in a lower threshold after retiring will typically save many single clients anywhere from $860.40 to $4,768.80 (for one year) or $1,720.80 to $9,537.60 (for two years) due to lower IRMAA. In analogous cases for a married couple filing a joint tax return, all these IRMAA tax savings amounts can be double.

Endnotes

- To be more specific, modified AGI = AGI + tax-exempt interest (on muni bonds) + interest from U.S. savings bonds used to pay higher education tuition and fees + earned income of U.S. citizens living abroad that was excluded from gross income + income from sources within Guam, American Samoa, the Northern Mariana Islands, or Puerto Rico, not otherwise included in AGI. The last three additions to AGI are not common for retirees.

- Above-the-line deductions include items that are common for employed or self-employed individuals, not retirees. Such deductions are contributions to a traditional IRA, which can only be done if the individual or the individual’s spouse is employed or self-employed; health insurance if self-employed; and out-of-pocket educator expenses of an employee teaching K–12 grade level. Note that all of these require having earned income. Other above-the-line deductions include student loan interest paid (not common for retirees) and alimony paid on divorces finalized before 2019. Only the latter might apply to a significant number of retirees. Above-the-line deductions do not include itemized deductions, which are more common for retirees. The latter include contributions to charity, home mortgage interest paid, state and local income tax, and real estate tax. (The total for the latter two taxes are capped at a maximum of $10,000 for 2021, unless the tax law is changed after publication of this article.) Finally, above-the-line deductions include limited cash contributions to charity if the taxpayer does not itemize deductions but instead takes the standard deduction. This cash contribution deduction is common for retirees but is quite limited ($300 maximum if single and $600 maximum if married filing jointly for 2021).

- There is one more threshold not mentioned. It is $500,000 if single and $750,000 if married filing jointly. This threshold will not be a focus of this article for three reasons: first, it is so much higher than the IRMAA threshold below it (i.e., $165,000 if single or $330,000 if married filing jointly); second, it is rare to have retired clients with MAGI this high; and third, it is the smallest increase in IRMAA tax when MAGI exceeds a threshold.

- For simplicity, assume the employee’s health insurance and all parts of the retiree’s Medicare have similar coverages, and that the after-tax cost of the employee’s share of health insurance is the same as the after-tax cost of the retiree’s base Medicare premiums. The after-tax cost of health insurance paid as an employee and Medicare paid as a retiree thus do not cause a difference in after-tax cash flows before and after retirement.

- Not all states subject IRA distributions to income tax. It is conservative (i.e., does not overstate the retiree’s reduction in state income tax) to assume the IRA distributions are subject to state income tax.

- IRMAA for 2022 and 2023 have not been published yet. The article assumes IRMAA for 2021 applies to 2022 and 2023.

- If the taxpayer does not send the tax return in after filing Form SSA-44, SSA will receive such data later from the Internal Revenue Service, in which case if more IRMAA should have been paid, it will be even later than if the taxpayer mailed the tax return in to SSA, and the total cost of repaying what is owed will be even greater.

- This assumes actual 2022 and 2023 MAGI ends up being the same, or lower, than the estimate. In other words, IRMAA tax is completely avoided in both years only if the estimate of MAGI being $88,000 is the same or higher than the actual MAGI after the 2022 and 2023 tax returns are filed. The instructions at the bottom of Page 8 state that SSA “will use your estimate provided in Step 2 to make a decision about the amount of your IRMAA the following year until [SSA receives your tax return information or you provide an updated estimate].” Accordingly, no IRMAA tax should be paid for 2023, given the scenarios in this article. If the annual notice received in November shows IRMAA tax for the upcoming year (e.g., 2023 because SSA used 2021 MAGI), given the scenarios in this article, another Form SSA-44 should be filed to avoid such IRMAA tax.

References

Kitces, Michael. 2017, November 29. “New IRMAA Surcharges on Medicare Part B and Part D Taking Effect in 2018.” Nerd’s Eye View. www.kitces.com/blog/irmaa-medicare-part-b-part-d-premium-surcharges-new-2018-magi-thresholds/.

Slott, Ed. 2018. “Avoid a Medicare Hit.” Financial Planning 48 (9): 38.

Thomas, Francis C. 2019. “Planning for Medicare Taxes, Premiums, and Surcharges.” Journal of Accountancy 228 (5): 44–50.