Journal of Financial Planning: September 2017

Russell Kroeger, CFP®, EA, founder of Paradigm Wealth Architects, holds a bachelor’s in finance from Virginia Tech and is pursuing a master’s degree in financial planning and taxation at Golden Gate University. He’s a graduate of Yeske Buie’s residency program and the FPA Residency Program, and was a 2016 NexGen co-director for FPA of San Francisco. He now serves as director of advocacy for San Francisco as a representative of FPA of California, as well as the NexGen representative for the OneFPA Advisory Group.

Yusuf Abugideiri, CFP®, is a senior financial planner at Yeske Buie. He holds a bachelor’s in finance from Virginia Tech and a master’s in economics from George Mason University. He served as the director of public relations of FPA of the National Capital Area. He is a graduate of the FPA Residency Program, and in 2016 was named to InvestmentNews’ 40 Under 40 list and WealthManagement’s list of the top CFP® holders under age 36.

In a 2010 Journal article, Neal Van Zutphen wrote, “When clients engage a financial planner, many of their basic needs are already met. They have assets to work with and expectations to meet. They are future-focused, wanting to secure their retirement and meet other financial goals such as college funding and leaving an appropriate legacy. Most of all, they seek fulfillment.”1

This quote describes the nature of the traditional financial planning engagement. It also explains why so many millennials do not believe they can, or should, engage a financial planner: their financial situation is the antithesis of the one described above.

According to the Pew Research Center, millennials are carrying record levels of student debt, and the Kelly Global Workforce index indicates that this generation is more focused on pursuing their passions than higher earnings.2

And yet, the 82 million millennials in America currently comprise its largest generation and stand to inherit a portion of what the Boston College Center on Wealth and Philanthropy estimates will be a $59 trillion wealth transfer over the coming decades.3

Here, we propose a framework based on the six-step financial planning process through which financial planners can engage millennial clients. Use the framework to harness financial planning policies as decision-architecture to overcome the unique challenges millennials face and prepare them to be stewards of the resources they will accumulate and inherit.

The framework is a three-step model:

Step 1: Use a robust discovery process to uncover worldviews and identify goals.

Step 2: Craft policies to overcome scarcity mentality and clear the path to progress.

Step 3: Build confidence in decision-making abilities through collaboration.

This model serves as the mechanism by which the planner can help the millennial client achieve a sense of subjective well-being and have balanced relationships with their money, loved ones, past, and present.

We’ll describe each step and explain how it relates to the needs of millennials. But first, let’s discuss millennials’ generational traits and worldviews that underpin their financial planning needs.

The Millennial Worldview

We need to be seen and heard to feel valued. Studies note that many millennials have spent their lives in a digital environment. A typical millennial finds, consumes, and shares content on social media platforms.4

This form of self-expression is unprecedented in human history and has enabled millennials to share their views, opinions, and insights with the world while receiving immediate and direct feedback to curate their online personas.5 Financial planners must account for this while building relationships with millennial clients.

We need help making decisions to avoid failure. Studies show that millennials value their parents’ opinions and acknowledge parental influence on their own values and attitudes.6

Millennials may delay major decisions and life events—like moving out of the family home or getting married—to avoid having their parents think they’ve made a mistake.7 This need can be addressed by engaging a financial planner to advise the millennial client on the best course of action.

We need to collaborate to be successful.8 Developing a relationship with a millennial client in which they feel they are part of the ongoing development of their financial plan, and view their financial planner as a partner who is helping them realize their goals, speaks directly to this need to collaborate.

Each of these worldviews relates directly to the three steps of the framework.

Step 1: Uncover Worldviews and Identify Goals

The first step of the framework is to use a robust discovery process to uncover worldviews and identify goals.

The first two stages of the six-step financial planning process are: (1) establishing and defining the client-planner relationship; and (2) gathering data and determining goals and expectations. This is most effectively achieved through a systematic discovery process, as clients have reported that such a process leads to higher rates of retention, satisfaction, cooperation, and openness about personal and financial goals.9

Taking millennial clients through a robust discovery process acknowledges the millennial worldview of needing to be seen and heard. The planner can use the discovery process to learn about the millennial’s value system and goals. Establishing the relationship in this way will help the millennial client see his or her goals and values reflected in the planning policies, which will help the client embrace the policies, and provide purpose and direction for the financial planning process10 (more on this later).

The financial planner’s challenge in motivating a millennial client toward positive action is twofold: (1) the planner must begin to cultivate a positive outlook to help the client realize his or her desired future; and (2) in setting goals to pursue that future, the planner must find ways to make the client feel connected to a vision of themselves that may not be realized for decades.

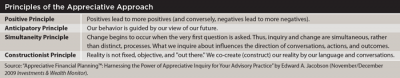

Appreciative inquiry provides the planner with a tool that creates space for optimism to thrive. Using this method, the planner can focus on the unique strengths of the millennial client (age and technological savviness) rather than his or her weaknesses (financial limitations such as high levels of debt or relatively low savings capacity).11 This approach to discovery can empower clients to achieve their goals because they believe they can do so. For a summary of the principles that support this argument, see the table on this page.

Deferring gratification in service of the future is difficult, but planners can address this by framing trade-offs in terms of present and future selves rather than present and future rewards.12 Creating a connection to the millennial’s future self drives the potency of that vision and may increase their willingness to act in service of it. The planner can guide the client through exercises to achieve this, such as writing a letter from the perspective of their future self, thanking their present self for making decisions in service of the future they both want. Once the initial discovery is complete, the client and financial planner can move to the next step of the framework.

Step 2: Craft Financial Planning Policies

The third and fourth stages of the six-step financial planning process are: (3) analyzing and evaluating the client’s financial status; and (4) developing and presenting the financial planning recommendations and/or alternatives. For millennial clients, this can most efficiently be achieved through the construction of financial planning policies, defined as compact decision rules that can serve as a touchstone in the face of changing external circumstances.

Young people are a great fit for the use of policies because they go through several major life changes at the outset of their professional lives. For a millennial at the beginning of their financial planning journey, rebuilding their entire financial plan with each change is not an effective use of time for the planner or the client. Instead, financial planning policies can help the client through multiple life transitions without having to develop a new financial plan with each change in their circumstance.13

Financial planning policies streamline the decision-making process and help millennial clients feel confident they are acting in a manner that aligns with their values, effectively meeting their need for help when making decisions as described in the millennial worldview to that effect. Furthermore, this approach enhances the client’s focus on their resourcefulness rather than their resources.

What makes a policy different from an observation, belief, goal, or action item is that policies are dynamic. When unique inputs—based on changing circumstances—are fed into the policy, it must have the capacity to return unique outputs. A good policy is constructed such that it has enough breadth to address any conceivable development while providing specific instruction as to what to do next.14

Financial planning policies are useful tools as the client progresses through the financial planning process. Here is an example of a dynamic policy that relates to a client’s stated goal and belief:

Belief: meeting current and future needs are equally important objectives.

Goal: begin saving for retirement without compromising ability to meet monthly obligations.

Policy: 5 percent of the client’s monthly surplus (the amount remaining after bills are paid) is directed to their Roth IRA up to the annual maximum; if they reach the limit, these funds are then directed toward funding additional travel and vacations.

Cash flow planning provides a tangible way to illustrate policies in action:

Goal: build a rainy-day fund to avoid using credit cards for unexpected expenses.

Policy: direct 10 percent of monthly take-home pay toward building a cash reserve equal to six months’ of living expenses; once the rainy-day fund is established, redirect 10 percent of monthly take-home pay as extra payments toward student loans.

Cash flow planning is a primary driver in many financial plans and is hypercritical to the millennial client’s initial planning phase for two reasons: (1) establishing good habits now will pay dividends in the future (when millennials will presumably have more discretionary cash at their disposal and can increase their savings amount); and (2) establishing a mechanism by which they can track their progress perceptibly, watching their account balances grow toward accomplishing their goals with each deposit.

The use of financial planning policies also provides an efficient method of developing recommendations to address gaps in the millennial client’s current financial situation, many of which will likely fall under “financial hygiene.” Maintaining good financial hygiene is achieved through regular reviews of the client’s financial plan with a focus on identifying holes (for example, ensuring the client has the proper insurance coverages in place; they’ve drafted a will and established agents to act on their behalf in the event of incapacitation; the beneficiaries of their retirement accounts reflect their current desires; etc.).

Here’s an example:

Goal: secure appropriate levels of property/casualty insurance while maintaining maximum cash flow flexibility.

Policy: use insurance to cover those potential losses that exceed the emergency fund and choose the highest deductibles consistent with the emergency fund.

Establishing a strong financial foundation creates the sense of resilience necessary before building toward the future. Strengthening the millennial client’s financial hygiene by identifying and addressing the gaps in their plan enhances their financial security and furthers the positive momentum that originated from the discovery process. The policies can be used as a benchmark to establish tangible markers for success, transforming the abstract into the attainable.

Millennials place a premium on living a life that aligns with their value system—one that provides meaning and fulfillment. Positive financial planning addresses the millennial client’s desire for a holistic approach to their planning needs by focusing on how money is related to topics like purpose, meaning, achievement, leveraging strengths, happiness, gratitude, optimism, etc.15 According to well-being theory, an individual does best in a life where they experience positive emotion, engagement, relationships, meaning, and accomplishment, or PERMA.16

Planners can work with their millennial clients in step 1 to identify the ways in which elements of PERMA are currently manifested in their clients’ lives. In step 2, planners can create space for clients to work toward long-term goals while ensuring current PERMA needs are met. This enables the client to avoid feeling that deprivation of their current desires is the only mechanism for serving their future self.

When engaging a millennial client, financial planners can use appreciative inquiry to ask what PERMA elements the client wants to place a greater emphasis on as they develop financial planning policies so that their present self and future self are both fulfilled. Focusing on the specific words used by the client and using that verbiage to build the policies will enhance the effectiveness of the policy—the client will then view the policy as their own, rather than as a rule imposed upon them by their planner.17

However, scarcity mentality (the notion that when the mind focuses on one thing, other skills like self-control, attention, and long-term planning suffer) is a major obstacle to achieving an optimistic outlook and positive feelings.

The combination of high levels of debt, low capacity to save, low levels of financial literacy, and an inability to sort through a plethora of constantly changing alternatives can create an overwhelming amount of stress in the millennial client’s mind. Relatively young as the millennial may be, it can feel as though there is not enough time to evaluate every option to make the best decision.

Studies have shown that those struggling to move past the deliberation stage of the decision-making process (a byproduct of a scarcity mentality or lack of trust in decision-making) oftentimes make selections based on suboptimal criteria. Research has also shown that individuals who feel “time-poor” make decisions that belie their ability to take advantage of their resources, but that their decision-making abilities improve simply by alleviating the specific stressor of a time-crunch.18 This has compelling implications when viewed through the lens of a millennial client who joined the workforce around the time of the Great Recession: they are carrying record levels of debt, are having to sift through more information than any generation that preceded them, and have observed how impactful their decisions can be to their long-term financial health.

The role of the financial planner is to serve as a change agent, helping the client craft policies that remove the need for deliberation, building confidence in their decision-making ability, and creating a decision-architecture rooted in their value system.

Step 3: Build Confidence through Collaboration

The fifth and sixth stages of the financial planning process are: (5) implementing; and (6) monitoring the financial planning recommendations. In moving through steps 1 and 2, the financial planner and millennial client develop the base of their long-term engagement. Ongoing meetings will contain elements of discovery, analysis, and the development of new recommendations as the client’s life unfolds.

As the millennial client steps closer to achieving her goals, her vision becomes clearer and crystallizes—this is the process of the millennial client’s transformation from her present self into her future self. This type of engagement aligns with the millennial client’s need to collaborate to feel like she is on the path to success, as outlined in the millennial worldviews mentioned earlier.

Ongoing check-ins are invaluable. Throughout the first two steps, the engagement is focused on priming the millennial client for action by identifying the issues that need to be addressed and formulating mechanisms for doing so. In the third step, the financial planner works to help the millennial client take action and stay the course in the face of changing circumstances. At each check-in meeting, the planner must vigilantly look for signs that progress is sputtering. The millennial client’s engagement with a financial planner facilitates a client’s self-actualization, the apex of Maslow’s hierarchy of needs. Self-actualized clients are more able to be open-minded and flexible as they navigate through life events.19

The financial planner could spend time in each check-in meeting reviewing the millennial client’s experience of trying to live their policies, celebrating victories, and helping them learn from shortfalls, further strengthening the policies and the client’s connection to them. In working as a change agent, the financial planner may play the role of a coach, helping the millennial client learn from their failures as they adjust to their policies. Staying connected to the client throughout the financial planning process positions the financial planner to catch signs of relapse early on and help the client get back on track.

Working with a financial planner enables millennial clients to build confidence in their own decision-making ability while speaking to their worldview that better results are achieved through collaboration. This is imperative within the context of evaluating trade-offs in the present that may not have a near-term benefit. The millennial client must feel confident that their decisions to delay gratification are keeping them on a trajectory in alignment with their long-term vision. The planner can use the check-in meetings as opportunities to remind the client of why the policies exist, how they reflect their values and work in service of their goals, and help the client make adjustments confidently.

Conclusion

The three-step model proposed here addresses the millennial client’s need to work toward both short- and long-term goals and provides a procedure for accomplishing that balance. The development of financial planning policies that reflect the client’s value system—as uncovered during the discovery process—enables the client to conceptualize money as a means rather than an end, speaking directly to the worldviews of the millennial generation.

The millennial client works with the financial planner in a partnership; the collaborative nature of the relationship is the basis for optimism and confidence in the millennial’s financial plan, fueling their progress in transforming their present self into their future self.

In his book Financial Planning 3.0: Evolving our Relationships with Money, Dick Wagner asserted that “… we are engaging in work of the utmost importance to individuals, communities, and the world. It is work worthy of the certainty that we are, indeed, practicing in the most important profession of the 21st century…. Why financial planning? Because financial planners are the only fiduciaries with comprehensive skills working with individuals and families one at a time with respect to the most powerful and pervasive secular forces on the planet.”

If we agree with Wagner, it is incumbent upon financial planners as fiduciary trustees of those forces to determine ways to serve the millennial generation to help prepare them to be the stewards of their resources and the inevitable transfer of wealth from the generations who came before them.

Endnotes

- See “A Visual Aid for Successful Financial Planning: The Happiness Risk/Reward Pyramid” in the January 2010 Journal of Financial Planning.

- See “Most Millennials Resist the ‘Millennial’ Label” at people-press.org/2015/09/03/most-millennials-resist-the-millennial-label, and “Generational Crossovers in the Workforce—Opinions Revealed” at slideshare.net/perryky/kelly-services-generational-crossovers-in-the-workplace-09.

- See “A Golden Age of Philanthropy Still Beckons: National Wealth Transfer and Potential for Philanthropy Technical Report” at bc.edu/research/cwp/publications/by-topic/wealthtransfer.html.

- See “Understanding Generation Y and their Use of Social Media: A Review and Research Agenda” in the Journal of Service Management at doi.org/10.1108/09564231311326987.

- See “Narcissism and Social Networking Sites: The Act of Taking Selfies” in the Elon Journal of Undergraduate Research in Communications (2015, volume 6, issue 1) at inquiriesjournal.com/articles/1138/narcissism-and-social-networking-sites-the-act-of-taking-selfies.

- See “Educating the Millennial Generation for Evidence-Based Information Practice” in Library Hi Tech (2006, volume 24, issue 3) at doi.org/10.1108/07378830610692163.

- See endnote No. 4.

- See “Principles for Teaching the Millennial Generation: Innovative Practices of U-M Faculty,” posted to the University of Michigan’s Center for Research on Learning and Teaching at crlt.umich.edu/op26.

- See “The Efficacy of Life Planning Communication Tasks in Developing Successful Planner-Client Relationships” in the June 2008 Journal of Financial Planning.

- See “Policy-Based Financial Planning as Decision Architecture” in the December 2014 Journal of Financial Planning.

- See “Appreciative Financial Planning™: Harnessing the Power of Appreciative Inquiry for Your Advisory Practice” in the November/December 2009 Investments & Wealth Monitor.

- See “Increasing Saving Behavior Through Age-Progressed Renderings of the Future Self” in the November 2011 Journal of Marketing Research.

- See endnote No. 10.

- See endnote No. 10.

- See “From Functioning to Flourishing: Applying Positive Psychology to Financial Planning” in the November 2015 Journal of Financial Planning.

- See the 2011 Martin E. P. Seligman book, Flourish: A Visionary New Understanding of Happiness and Well-Being.

- See endnote No. 10.

- See “The Psychology of Scarcity,” from the February 2014 Monitor on Psychology.

- See endnote No. 1.