Journal of Financial Planning: December 2021

Alexa Balmuth is a technical associate at the Massachusetts Institute of Technology AgeLab. She can be reached HERE. Lauren Cerino is a technical associate at the MIT AgeLab. She can be reached HERE. Julie Miller, Ph.D., is a research scientist at the MIT AgeLab. She can be reached at jmiller1@mit.edu. Adam Felts is a technical associate at the MIT AgeLab. He can be reached HERE. Joseph F. Coughlin, Ph.D., is director of the MIT AgeLab. He can be reached HERE.

NOTE: Please click the images below for PDF versions.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

Client-adviser conversations have traditionally focused on concrete information about finances, but expanding that relationship and involving a broader range of topics may address the client’s financial situation more comprehensively.1 A strategy coined “longevity planning” incorporates topics such as eldercare, health, housing, home modification, encore careers, later-life entrepreneurship, and transportation into conversations between clients and advisers, with the understanding that all these topics are intimately connected to the client’s finances and their well-being in retirement.2 Determining where a client is situated within each of these areas can result in more comprehensive financial planning, especially in the context of disruptive events such as the COVID-19 pandemic.3 In addition, expanding conversations can strengthen client-adviser relationships. Establishing clients’ trust and commitment is a multifaceted process that extends beyond leading financial conversations; it also involves making a sincere effort to understand the context of clients’ lives and the unique complexities involved in their financial priorities and decision-making.4 Financial advisers can then leverage these understandings to individualize their approach and cater to each client’s unique circumstances.

However, the expansion of the advisory role may come with some risk. Because of the traditional expectation that advisers will talk solely about finances, clients may be unsettled by the introduction of more personal topics.

To better understand and compare financial advisers’ and clients’ perspectives about these important topics, two distinct online surveys were fielded. In March 2020, the MIT AgeLab and AIG Life & Retirement surveyed 2,038 financial advisory clients between the ages of 30 and 75. These participants responded to questions about their openness to new conversations with financial professionals and how they envision an ideal advisory relationship. Then, to explore the perspectives of financial professionals themselves, PLAN (Preparing for Longevity Advisory Network, a global network of advisers collaborating with the MIT AgeLab) surveyed 149 financial professionals in the months of June 2021 through August 2021. All participants reported working in direct advisory roles with clients. These participants responded to questions that aligned with those asked of clients in the prior year’s study, including their perceptions of what roles an ideal financial professional would take on as well as their willingness to discuss various financial and non-financial topics.

The following discussion provides insights into how the financial advice industry might need to evolve to achieve the types of personalized, humanistic client-adviser relationships that are favored by clients and conducive to successful planning.

Ideal Advisers

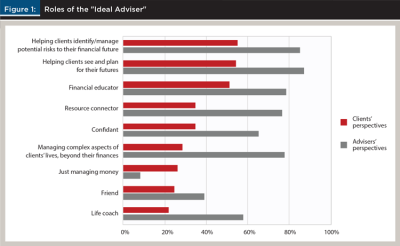

In determining how to best approach the changing client-adviser relationship, we wanted to understand: what roles do clients want their advisers to play in their lives? Clients and advisers were asked to select which roles they associate with an “ideal adviser.” Some of these roles were traditional and centered primarily on finances. Other roles were less conventional, expanding into other aspects of clients’ lives.

When asked to select the roles of an “ideal adviser,” clients and financial professionals demonstrated some alignment in their views. Both groups selected the same top three roles: helping clients identify/manage potential risks to their financial futures, helping clients see and plan for their futures, and financial educator. Although the three most selected roles all related directly to finances, advisers also reported that the ideal financial professional would occupy additional roles; over 50 percent of advisers selected resource connector, confidant, managing complex aspects of clients’ lives beyond their finances, and life coach. “Just managing money” was the least common response for advisers, highlighting the belief among financial professionals that while the ideal adviser should be prepared to manage clients’ finances, their roles should be further-reaching and encompass more aspects of their clients’ lives.

Clients were less likely than financial professionals to name nontraditional roles as aspects of the ideal adviser. Less than 50 percent of client respondents selected roles aside from the top three traditional roles previously mentioned, and they were more likely than advisers to select “just managing money” as the role of the ideal adviser. However, only about a quarter of client respondents said that the ideal adviser’s role would be “just managing money.” Thus, while many clients appear to believe that the ideal adviser should be more involved with a client’s life than simply managing their financial portfolio, they may have greater difficulty envisioning which specific roles or aspects of their lives may be pertinent to discuss with a financial professional.

Another area of agreement between financial professionals and clients pertained to maintaining boundaries in the client-adviser relationship. The role of “friend” was the second least commonly selected adviser role for both groups, suggesting that most advisers and clients wish to maintain a more formal, professional relationship.

Together, these findings suggest that many clients and most advisers agree that the ideal adviser would do more than just manage money. However, compared with the client perspective, advisers appear to more readily envision their profession embodying a wide range of roles, and both parties prefer to maintain a professional relationship rather than a more personal one.

Desire and Willingness to Discuss Topics

In order to translate the idea of a more holistic advisory role into practice, it is important to understand both clients’ and advisers’ levels of comfort in engaging in unfamiliar topics of conversation.

Clients and advisers were asked about their willingness and desire to discuss a variety of topics within the client-adviser relationship.

Clients were initially asked to indicate from a set of topics which ones they had discussed with their financial adviser. Later in the survey, for the topics that respondents indicated they had discussed with their adviser, they were asked to select from the following response options: “I want to discuss this topic again with my financial professional,” “I don’t want to discuss this topic again but would be willing to talk about it with my financial professional if it came up,” and “I don’t want to discuss this topic again with my financial professional.”

For those topics that clients indicated they had not discussed with their adviser, they were asked to select from the following response options: “I want to discuss this topic with my financial professional,” “I don’t want to discuss this topic but would be willing to talk about it with my financial professional if it came up,” and “I don’t want to discuss this topic with my financial professional.”

The above item was mirrored for financial professionals, who were provided the complete set of topics with the following response options: “I want to discuss this topic with my clients,” “I don’t want to discuss this topic but would be willing to talk about it with my clients if it came up,” and “I don’t want to discuss this topic with my clients.”

For all three versions of this question, “willingness” to discuss a topic was operationalized as the selection of either of the first or second response options, while “desire” or “wanting” to discuss a topic—a stronger preference than mere willingness—was operationalized as the selection of just the first response option.

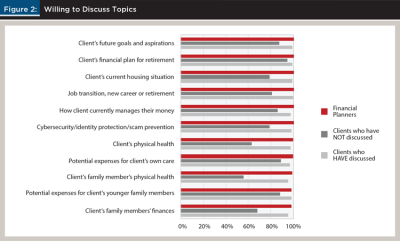

A majority of both clients and financial advisers are at least willing if not wanting to discuss a wide range of topics. Financial professionals were exceptionally willing to discuss topics outside of the financial domain; over 98 percent were at least willing to discuss all the listed topics in the survey with their clients.

In contrast, clients appear more reticent than advisers about delving into unconventional topics. Willingness levels diverged for clients who had already discussed a given topic and those who had not. Specifically, over 95 percent of clients who had already discussed a topic were willing to discuss that the topic again, suggesting that having the conversation did not overstep the boundaries of the client-adviser relationship for them. In comparison, clients who had not already discussed a certain topic were less likely to be willing to discuss said topic with their financial professional.

The upshot of these findings is that clients are generally open to having wider-reaching conversations if they were to come up. However, a client who has never discussed a topic before may be more hesitant. It may be important to use caution when raising some topics for the first time with clients, and a foundation of trust may need to be built first before delving into more personal topics such as clients’ or their family members’ physical health or their family members’ finances—clients who had not yet discussed these topics reported the least willingness to do so.

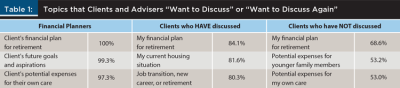

For some topics, clients and financial professionals reported a notably high level of desire for conversations. Both clients and financial professionals most commonly wanted to discuss—or discuss again if they already had—financial plans for retirement, a standard financial advisory topic. Past this number-one topic, however, some differences emerged in the most desirable topics selected by clients and advisers. Clients reported the most desire to talk with a financial professional again about housing and jobs, or to begin talking about potential expenses for younger family members or for their own care. Financial professionals also expressed a desire to discuss clients’ future goals and aspirations, and—like clients who had not yet had the conversation—potential caregiving expenses. Some of these findings are detailed in Table 1.

By assessing clients’ and advisers’ comfort levels in this way, we can identify new “permitted conversations” that will become “welcome conversations,” allowing financial professionals to enlarge the scope of their practice without fear of detracting from their relationships with clients.

Conclusion and Implications for Practice

The adviser of the future will do more than just manage money. As robo-advice and other fintech innovations advance, investing will become increasingly automated. The true value of the advisory relationship lies in the human touch and understanding of the adviser. Clients and advisers alike appear ready to begin talking about less traditional topics that have the potential to benefit clients’ financial well-being and futures overall. Many clients are also looking for their financial professionals to step into a broader set of roles within the realm of finance, such as serving as financial educators, helping visualize and plan for the future, and acting as resource connectors in complex situations.

Despite this openness among clients toward discussing broader and more personal matters, advisers indicated more readiness to jump into these new conversations than clients themselves. In being mindful of this gap, advisers should approach new conversations with the understanding that some clients may not be prepared to engage on non-traditional topics. It may be important to explain to some clients the reasons for bringing up topics of conversation that do not appear directly related to finances, as well as to provide the opportunity for clients to opt out of a conversation if they do not wish to discuss a particular topic. Advisers may need to earn their clients’ trust before these new roles and topics can be comfortably broached. And even in a client-adviser relationship that permits discussions of family, health, and other more personal topics, most clients are likely to prefer to maintain a professional relationship rather than a friendship.

As the field of advice continues to shift and evolve, advisers should feel empowered to dive into these new roles and conversations that will define the future of advice. However, initiating these larger longevity planning discussions will require that firms rethink training and the tools necessary to empower their advisers to initiate and engage in broader conversations. Moreover, both product manufacturers and the financial services industry as a whole may consider a broader public campaign to redefine the role of the adviser in the client’s mind as being about more than retirement financial planning alone, but instead positioning advisers and their teams as trusted expertise to navigate longevity.

Acknowledgements: The Massachusetts Institute of Technology AgeLab wishes to thank AIG and the sponsoring members of PLAN, AgeLab’s Preparing for Longevity Advisory Network (www.agelab.mit.edu/plan), for supporting this research.

Endnotes

- Coughlin, Joseph F., and Lisa A. D’Ambrosio. 2009. “Seven Myths of Financial Planning and Baby Boomer Retirement.” Journal of Financial Services Marketing 14 (1): 83–91.

- Coughlin, Joseph F. 2019. “Planning for 8,000 Days of Retirement: Advisor Value in Today’s Longevity Economy.” Investments & Wealth Monitor March–April 2019: 7–12.

- Brady, Samantha, Julie Miller, and Alexa Balmuth. 2020. “Navigating Client Relationships During COVID-19.” Journal of Financial Planning 33 (8): 44–47.

- Sharpe, Deanna, Carol Anderson, Andrea White, Susan Galvan, and Martin Siesta. 2007. “Specific Elements of Communication That Affect Trust and Commitment in the Financial Planning Process.” Journal of Financial Counseling and Planning 18 (1).