Journal of Financial Planning: October 2020

Executive Summary

- The death of a spouse, particularly if the deceased spouse was the financially empowered partner in a marriage, can be economically devastating for the survivor.

- Due to dependencies in marriage, low levels of financial self-empowerment can create financial risk for those experiencing widowhood. Women have been shown to be less knowledgeable, less interested in, and less confident with money, which leads to feelings of disempowerment.

- Financial empowerment can be shared through externalities in marriage but cease upon marital dissolution.

- In this paper, self-empowerment was framed as the combination of financial literacy, financial attitudes, and financial well-being that provides a sense of confidence and control over one’s overall financial situation.

- Based on the results from a series of ordinal logistic regression models, it was determined that older widowed women were likely to feel more confident in their overall financial situation if they delegated money management tasks to their new spouse or partner, despite experiencing financial risk and vulnerability.

- Results from this study have practical implications for financial planners. Financial planners need to be aware that shared financial empowerment in a post-widowhood marriage exposes widows to future risk because women tend to outlive men. Prior to a post-widowhood marriage, financial planners are in a unique position to explore feelings of financial confidence and encourage a proactive attitude among clients. Financial planners can help widowed clients participate in day-to-day personal finance activities as well as pre-planning activities that can cultivate their clients’ financial self-empowerment and reduce future exposure to financial risk.

Laura Mattia Ph.D., CFP®, is principal/fee-only planner at Atlas Fiduciary Financial LLC, Women’s Money Empowerment Program Director at the Women’s Resource Center in Sarasota, Fla., and an instructor at Texas Tech University. She is passionate about her work to empower women in transition and to contribute to the financial planning profession.

Eun Jin Kwak is a Ph.D. student in the Department of Financial Planning, Housing, and Consumer Economics at the University of Georgia. Her research interests include risk-tolerance assessment and behavioral financial planning.

John E. Grable, Ph.D., CFP®, is a professor of financial planning at the University of Georgia. He is the author of several textbooks and the co-author of over 100 peer-reviewed research papers.

Carrie L. West, Ph.D., is chair and an associate professor of Communication Studies at Schreiner University, and the director of research for Soaring Spirits International. Her research is primarily focused on helping widowed people construct resilience after loss.

Linda Y. Leitz, Ph.D., CFP®, EA, is a financial planning practitioner with the firm she founded, Peace of Mind Financial Planning Inc., in Colorado Springs, Colo. She teaches part time for the University of Colorado, Boulder in the CFP® certificate program.

Kathleen M. Rehl, Ph.D., CFP®, CeFT®, is the author of Moving Forward on Your Own: A Financial Guidebook for Widows. She owned Rehl Financial Advisors for 18 years before retiring to a an encore career empowering widows and their advisers.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

Financial empowerment is a subjective construct incorporating knowledge, skills, motivation, and confidence. It incorporates financial literacy, financial attitudes, and financial well-being in a way that enhances a person’s resiliency to threatening circumstances. Financial empowerment is associated with the framing of responsible decisions and behaviors around money (Ford, Baptist, and Archuleta 2011). Positive feelings around one’s household financial adequacy can be achieved through affiliation with someone else’s empowerment or through self-empowerment.

Financial empowerment is not fungible; however, externalities in marriage can allow partners to share in a household’s financial productivity. The notion of shared financial empowerment ceases, however, in cases of widowhood, divorce, or separation from the financially empowered partner. Self-empowerment or self-help is thought to have a positive impact on individual behavior (Kaur and Kaur 2017).

Although financial empowerment can be shared through a partner’s skills, without self-empowered skills, self-efficacy necessary to sustain appropriate behavior will generally be absent (Pitt, Shahidur, and Cartwright 2006). Feelings of financial security, if derived from skilled self-empowerment, allow someone to hedge against marital economic shock.

Over the past several decades, researchers have shown that financially empowered individuals are better at budgeting and saving (Perry and Morris 2005), investing (Van Rooij, Lusardi, and Alessie 2011), and planning for retirement (Lusardi and Mitchell 2008). Friedberg and Webb (2006) reported that financial empowerment is a critical factor that can be used to describe financial security. Despite this knowledge and the associated outcomes and consequences associated with a lack of empowerment, some individuals—particularly women—lack the financial knowledge, motivational attitude, or personal traits typically associated with financial empowerment (Yoong 2011). Researchers studying female financial empowerment have pointed to an inability among low-empowered females to avert social program dependence resulting from widowhood (Gillen and Kim 2009).

Many women fail to recognize the vulnerability associated with low levels of self-empowerment. Women who have experienced a marital shock due to widowhood often come to realize that they are exposed to risks associated with a lack of empowerment (Harris 2017). Policymaking designed to protect widows from economic shock has generally been ineffective as poverty rates for elderly widows has remained three to four times higher than the rate for elderly married women or single men (McGarry and Schoeni 2005). While widowhood can result in financial distress and poverty for numerous reasons, women who take matters into their own hands, seeking higher levels of financial empowerment by shifting their financial attitude and striving for an improvement in financial wellness, are often better able to plan more effectively for their future (Lusardi and Mitchell 2008).

The purpose of the research reported in this paper was to evaluate the associations among financial literacy, financial attitudes, financial well-being, and self-empowerment among widows. This paper extends the work of Grable et al. (2017), which provided insights into ways financial planners can assist widows to increase their financial confidence. This study was undertaken to identify additional factors that financial planners should consider when working with widowed clients when an outcome of the client-financial planner relationship involves increasing client self-empowerment.

Literature Review

Financial empowerment. Financial empowerment is a frequently used concept; however, the term remains a vague and unformulated notion. Kasturirangan (2008) defined empowerment as a process in which someone gains control or authority over their own life. Empowerment encompasses many domains of life. As a sub-domain of empowerment, Postmus (2010) defined financial empowerment as an amalgamation of financial literacy and financial attitudes. Much of the literature on financial empowerment focuses on financial literacy. It has been shown across a broad range of studies that financially literate individuals are better at budgeting, saving, and controlling spending (e.g., Moore 2003). Financial literacy has also been shown to be associated with planning for retirement (Lusardi and Mitchell 2007; Lusardi and Mitchell 2008) and wealth accumulation (Stango and Zinman 2009).

Financial empowerment can be thought of as a type of evolutionary personal development process that is exemplified by the act of transitioning from a state of powerlessness in financial condition to participating and envisioning a positive future. For some, financial empowerment results from being financially literate; for others, the concept represents the ability to apply and participate in the financial marketplace using financial knowledge. Yet, for others, empowerment is about financial well-being and resilience to threatening circumstances. In this paper, self-empowerment is framed as the combination of financial literacy, financial attitudes, and financial well-being that provides a sense of confidence and control over one’s overall financial situation.

The literature shows that financial empowerment can be derived from financial literacy (Yoong 2011), exhibiting a positive financial attitude (Gillen and Kim 2009), and enjoying a degree of financial well-being (Yoong 2011). In this context, financial literacy is generally defined as the experience and skills that allow individuals to make informed decisions in their best interest. Financial literacy and financial attitudes are linked to financial knowledge, where motivating positive attitudes must precede investments in financial skills. Financial well-being is also related to financial knowledge and includes personal traits associated with resiliency and adaptability (Haque and Zulfiqar 2016).

The financial empowerment process makes it possible for individuals to achieve a positive sense of their household financial situation (Blanchard, Carlos, and Randolph 2001). While household financial empowerment can be shared in marriage, an attitude that fosters financial self-empowerment moves women closer to goal achievement (Ford, Baptist, and Archuleta 2011). Studies have shown that female financial self-empowerment improves feelings of financial adequacy. Women who maintain independence and power over financial matters are thought to be more self-empowered. They also exhibit elevated states of well-being (Bisdee, Daly, and Price 2013). Self-empowerment even impacts decisiveness in other areas of a person’s life (Abbasi, Zafar, Aslam, and Batool 2008).

Differences between men and women. The literature suggests that differences in feelings of financial literacy and financial self-empowerment exist between women and men. Women tend to be less likely to answer basic financial questions, and when they do, they often miss what are considered relatively easy concepts, including questions related to compound interest, inflation, and diversification. Women are also more likely to say they do not know an answer (Lusardi and Mitchell 2011). In one study, 20 percent of middle-aged females, compared to 35 percent of males, were able to answer a compound interest question correctly (Zissimopoulos, Karney, and Rauer 2008). Women score even worse on more advanced financial literacy topics (Van Rooij, Lusardi, and Alessie 2011; Delavande, Rohwedder, and Willis 2008). Although there are many explanations for these discrepancies, a significant factor is that in many countries, women have less access to financial services compared to males, which creates disparities in financial knowledge (Xu and Zia 2012).

Financial attitudes. Financial self-empowerment is also associated with the financial attitudes held by an individual. A person’s financial attitudes are, in turn, influenced by self-efficacy, which is the belief that one is capable of performing financial duties (Bandura 1982). Without this belief, it is unlikely an individual will participate in financial management tasks. Financial self-efficacy—as a measure of one’s ability to influence financial outcomes—is thought to be as critical as financial knowledge in creating feelings of self-empowerment (Farrell, Fry, and Risse 2016). According to Bandura (1982), self-efficacy fosters interest and motivation, which are associated with achieving financial goals. As someone develops self-efficacy in their capacity to sustain their own needs, self-empowerment investment persists (Harley et al. 2018). Financial literacy and self-efficacy, when combined, inspire participation and skill development in financial management tasks, which then lead to self-empowerment (Gowdy and Pearlmutter 1993).

Well-being. Financial empowerment is related to another important concept: well-being. Well-being is a multidimensional concept, which relates to a person’s subjective perception of the adequacy of their financial resources and their sense of empowerment (Van Pragg, Frijters, and Ferrer-i-Carbonell 2003). According to Haque and Zulfiqar (2016), financial well-being is positively associated with financial literacy and holding a positive financial attitude.

When viewed holistically, financial empowerment can be conceptualized to include the following features: (a) an increased sense of control; (b) increased choice and agency; and (c) an increased feeling of power to influence achievement and outcomes (Haque and Zulfiqar 2016). Overall, financial self-empowerment is encapsulated as a sense of feeling confident and secure in one’s current financial condition.

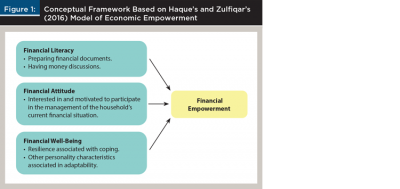

The models used in this study to evaluate the associations among self-empowerment, financial literacy, financial attitudes, and post-widowhood financial well-being were based on an adaptation of the Haque and Zulfiqar (2016) conceptual framework for economic empowerment. In Haque’s and Zulfiqar’s original model, economic empowerment was thought to be significantly and positively related with financial literacy, holding a positive financial attitude, and exhibiting higher levels of financial well-being. In the adapted framework (Figure 1), financial empowerment was hypothesized to be directly associated with an individual’s level of (1) financial literacy, demonstrated by financial preparation; (2) financial attitude, exhibited by a motivation to handle one’s own finances; and (3) financial well-being, evidenced by adaptability and coping abilities.

The remainder of this paper describes the operationalization of the conceptual framework and the modeling techniques used to evaluate the paper’s purpose. This is followed by a presentation of results and a discussion of findings with implications for financial planning practice.

Methodology

Data were collected from a 2016 survey distributed to members of the Modern Widows Club (MWC) and Soaring Spirits International (SSI). Both organizations are 501(c)(3) non-profit organizations. Recruitment for the study was conducted using MWC and SSI list serves and snowball sampling techniques among the widows who participated in the study. Those who participated in the study were eligible for a drawing to receive one of six $50 Amazon or VISA gift cards. Data for this study were delimited to women and those who had remarried or entered into a cohabitation arrangement with a significant other after being widowed. This resulted in a sample size of 452 participants. Nearly all participants in the study were a first-time widow. Age at widowhood occurred between 40 and 79 years, with the mean age of sample participants being 49.72 years (SD = 7.56 years).

Models and Variables

Three models were used to test the conceptual framework. The models were based on an adaptation of the Haque and Zulfiqar (2016) conceptual framework for economic empowerment, as shown in Figure 1. In the models, financial empowerment was the outcome variable, which in this study was defined as confidence in one’s overall financial situation.

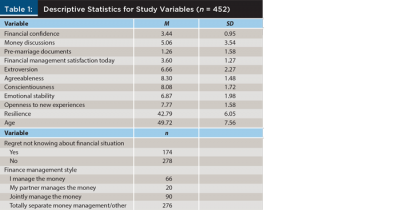

The following question was used to evaluate financial confidence: “How do you feel about your overall financial situation since you married again or entered your long-term romantic relationship?” Five answer choices were provided, ranging from 1 = much less financially confident than before I was widowed, to 5 = much more financially confident than before I was widowed. The mean and standard deviation for the item was 3.44 and 0.95, respectively.

Financial literacy, as an indicator of a widow’s knowledge and skills that allow her to make informed decisions, was measured using two variables. The first variable was an index of pre-commitment document preparation. The index was developed based on responses to the following task assessment: “When you married again or entered your long-term partnership, if you created or updated any of the following documents, please check these below.” Response options included: (a) advanced health care directive; (b) cohabitation agreement; (c) deed to property; (d) financial plans; (e) long-term care plans; (f) prenuptial agreement; (g) trust; (h) will; and (i) other, which was an open-ended response. The summed mean and standard deviation for the index was 1.26 and 1.58, respectively, indicating that those in the study entered remarriage/cohabitation prior to drafting just a few new legal and financial planning documents.

The second financial literacy variable—pre-commitment discussions about money—was measured by asking if a widow and her spouse/partner talked about the following money issues before committing to be together: (a) where to live; (b) how to pay for expenses; (c) credit scores; (d) financial net worth; (e) plans for retirement; (f) outstanding debt; (g) financial support to or for another person; (h) money history; (i) what is important about money; (j) expected inheritance or other source of future money; and (k) other, which was an open-ended response. An index was created based on each participant’s responses. The mean and standard deviation of the index was 5.06 and 3.54 respectively.

A widow’s financial attitude was measured as the motivation to participate in the management of her household’s current joint financial situation. The variable was assessed using the following categories, which were coded dichotomously: (a) I manage the money (n = 66 ); (b) I jointly manage the money (n = 90); (c) My partner manages the money (n = 20 ); and (d) Money is managed separately or managed some other way (n = 276). The separate money management variable was used as the reference category in the regression models.

Financial well-being, which was defined in this study as the ability to adapt and cope, was measured using three variables. The first variable was termed resilience. Resilience was measured using a summated scale comprised of the following 10 items, each of which was measured using a five-point Likert-type scale (i.e., 1 = disagree strongly and 5 = agree strongly): (a) I keep trying even when things are difficult; (b) I like who I am; (c) My house feels like my home; (d) I laugh at least once every day; (e) My life is fulfilling; (f) I can imagine and plan for my future; (g) I can accomplish tasks or projects on my own; (h) I look for creative way to alter difficult situations; (i) Regardless of what happens to me, I believe I can control my reaction to it; and (j) I believe I can grow in positive ways by dealing with difficult situations. Scale items were derived from qualitative and quantitative responses of participants when asked to define resilience after spousal bereavement. The mean and standard deviation score for the scale was 42.79 and 6.05, respectively. Participants exhibited above-average resilience.

Personality was used as another well-being indicator. The choice to assess personality was based, in part, on a report by Moorman, Booth, and Fingerman (2006) showing that trait anxiety is associated with relationship choices among widows. Variables from the “Ten Item Personality Inventory” (TIPI) (see Gosling, Rentfrow, and Swann 2003) were used to assess adaptability on the following five dimensions of personality: (a) extroversion; (b) agreeableness; (c) conscientiousness; (d) emotional stability; and (e) openness. Each measure was scored on a scale of 2 to 10, with the mean and standard deviation of scores being 6.66 (2.27), 8.30 (1.48), 8.08 (1.72), 6.87 (1.98), and 7.77 (1.58), respectively.

A final well-being question asked: “How satisfied are you today with how you’ve handled your finances?” Answer responses were measured using a five-point Likert-type scale (1 = very dissatisfied and 5 = very satisfied). The mean and standard deviation for the item was 3.60 and 1.27, respectively.

Control variables. Two control variables were included in the models. The first was age at widowhood. The choice to include this variable was based on a report by Wu, Schimmele, and Ouellet (2015) that suggested the decision to re-partner after widowhood can be impacted by how old a woman was when she became a widow. The variable was based on asking each participant to indicate the specific age at the time she was widowed. The mean age and standard deviation was 49.72 and 7.56, respectively. Feelings of regret were also included in the models. Regret was assessed using the following question: “At the time you were widowed, did you regret not knowing something about money and finances that you didn’t know?” Answers were coded dichotomously as 1 = no and 2 = yes. Out of the full sample, 174 participants reported they regretted not knowing something about money, whereas 278 participants had no regrets.

Table 1 shows the descriptive statistics for the variables used in this study. The number of participants is shown in the second panel of the table for variables measured dichotomously or nominally.

Data Analysis Methods

Three ordered logistic regression models were developed and tested using financial confidence as the outcome variable. The first model included all of the independent variables. Two additional regression models were then estimated based on lifecycle (age) categories. The results from the three tests were used to provide insights into the association between financial empowerment and factors related to financial literacy, financial attitude, and financial well-being among widows.

Results

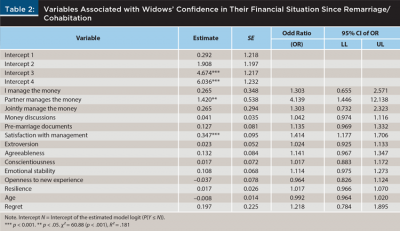

The first model was statistically significant, c2 = 60.88, p < 0.001. The model explained approximately 18 percent of the variation in financial confidence scores. The variable coefficients associated with the first model are shown in Table 2.

Of particular importance in describing financial empowerment was the variable representing a widow’s financial attitude—the question that asked about how money was being managed in the household. Using the category of managing money separately as the reference group, it was determined that financial confidence was highest among those whose partner managed the money. This suggests that some widows in the study found comfort in having their partner handle day-to-day money management decisions. It is possible that widows who fit this profile did not possess the skills or interests to manage money on their own or jointly with their partner. In the model, a widow’s satisfaction with the way she was handling her financial situation was also positively associated with the measure of financial empowerment.

Additional tests were conducted to assess the significance of the independent variables when the model was constrained by the age of the participant. A categorical variable was created to classify participants into the following lifecycle stages:

a. Those under the age of 50, which was used as an indicator of the accumulation and wealth building life stage. Nearly 44 percent of participants were classified into this category.

b. Those over the age of 50, which represented the pre-retirement/retirement life stage. Approximately 56 percent of participants fell into this category.

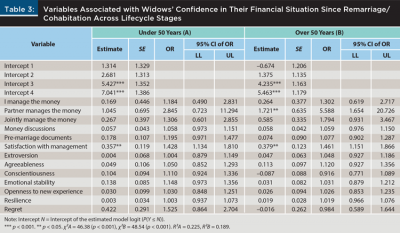

The accumulation lifecycle stage model was statistically significant, c2 = 46.38, p < 0.001.

The model explained approximately 23 percent of the variation in financial confidence. The variable coefficients associated with this model are shown in Table 3, Panel A, Under 50 Years. The variable of most importance to those in this group was reporting satisfaction with the way finances were currently being managed. However, unlike the overall model, who managed the money in the household was not statistically significant in this age constrained model.

The pre-retirement/retirement age lifecycle stage model was also statistically significant, c2 = 48.54, p < 0.001. The model explained approximately 19 percent of the variation in financial confidence. The variable coefficients associated with this model are shown in Table 3, Panel B, Over 50 Years. Among the widows in this group, reporting higher satisfaction in relation to financial management activities was positively related to higher confidence levels. Unlike the accumulation lifecycle stage model, who managed the money in the household was statistically significant. Those who indicated that their partner managed the household financial situation (i.e., a measure of financial attitude) reported being more confident. These results matched the overall model shown in Table 2.

Discussion

The purpose of this study was to evaluate the association between financial empowerment—as indicated by a widow’s financial confidence in her financial situation—and factors related to financial literacy, financial attitudes, and financial well-being. A conceptual framework adapted from Haque and Zulfiqar (2016) was tested using a series of ordinal logistic regression models.

It was determined that in the full model (Table 2), financial empowerment was related to aspects of a widow’s financial attitude and financial well-being. Financial empowerment, as proxied by financial confidence, was highest among those whose partner managed the household financial situation (i.e., an attitudinal measure) and among those who were satisfied with the way their household financial situation was being managed (i.e., a measure of well-being).

In the age-restricted models, confidence tended to be highest among those, regardless of lifecycle category, who reported being satisfied with the way in which the household financial situation was being handled. Among those who were 50 years of age or older, financial confidence was found to be highest among widows whose partner was tasked with daily household management activities. While the shock associated with widowhood may be serious and long-lasting, it is possible that some older widows find comfort in transferring daily financial tasks to their new partner or spouse. It is also possible that although the shock of widowhood is intense, without adequate levels of human capital related to personal and household finance topics, some widows may simply lack the skills and self-assurance necessary to manage household finances independently or jointly.

Other themes emerged from the analyses that are worth noting. First, none of the personality trait variables (i.e., measures of well-being) were found to be related to financial empowerment. Additionally, no statistical significance was found in relation to typical financial planning activities, such as drafting pre-marital documents or engaging in financial planning discussions with one’s new spouse or partner. Findings from this study indicate that feelings of financial empowerment in older widows may be acquired, in part, by task delegation. It may be that older widows prefer to rely on their new partner as a coping mechanism, whereas widows, regardless of age, feel compelled to build empowerment by strengthening their well-being.

Implications for Financial Planning

The results from this study have direct implications for the practice of financial planning. If a goal associated with a client-financial planner engagement involves increasing a widow’s sense of financial self-empowerment, it is important for a financial planner to recognize that widows are not a homogenous subset of the population. As the findings from this study show, feelings of confidence appear to vary based on the age of a widow and the manner in which day-to-day management tasks are dealt with.

It appears that younger widows are particularly interested in building money management systems that increase satisfaction. While this is also true among older widows, older widows may be more prone to delegating financial decisions to their new or future partner. As such, the approach taken when working with an older widow should not necessarily be the same approach used with a younger widow.

Particularly for older widows, financial planners are in a unique position to explore feelings of financial confidence and encourage a proactive attitude prior to the widow entering into a new romantic relationship. Financial planners can help widowed clients participate in day-to-day personal finance activities as well as pre-planning activities that can cultivate financial self-empowerment and reduce future exposure to financial risk. This approach to working with widowed clients appears to provide a direct pathway to helping a widow increase feelings of self-empowerment.

The insight that widows did not achieve financial empowerment through pre-planning activities, such as drafting important pre-marital documents or engaging in money discussions prior to remarriage, may be more related to a lack of preparation than to the benefit of preparation. Financial planners who find themselves tasked with helping a widow after the death of a spouse should, in almost all cases, take steps to help the widowed client develop self-empowerment attributes and skills. This process would include ensuring pre-marital documents have been developed and money discussions occur prior to a post-widowhood marriage.

Working with widowed clients requires the thoughtful application of counseling and communication skills. A financial planner who works with widows must be deliberative when working with widowed clients. The importance of applying a systematic and deliberative counseling and communication strategy cannot be overstated. It appears that some financial planning professionals fall short in this regard. For example, those who participated in this study were asked whether they worked with a financial professional before remarriage or entering into a long-term relationship. Approximately 50 percent of those surveyed answered yes to this question. Alarmingly, only a small percentage of these widows were asked by their financial planner whether they were in a new relationship. This means that only a small fraction of financial planners were aware of their widowed clients’ situation and the need to help their widowed clients build self-empowerment skills. This illustrates how using a deliberate financial transitions process—where a financial planner spends time aligning with a widowed client—can help the client enter into a second marriage with greater self-empowerment, which can then protect the client against current and future risks.

A financial planning best practice is to move beyond a core financial situation analysis in a way that reveals a widowed client’s deeper feelings, aspirations, and goals. Those financial planners who may be uncomfortable moving into emotional-laden discussions should consider developing referral networks with Certified Financial Transitionist® (CeFT®), and Certified Financial Therapist-I™ (CFT-I™), and other mental health professionals. Regardless of the way such discussions unfold, financial planners may find a more deliberate process focused on enabling older widows to be an important driver of both financial wellness and self-empowerment.

Limitations

As with all studies that rely on narrowly defined sample frames, certain methodological limitations associated with this study need to be acknowledged. One limitation of this study is related to the manner in which the actual financial condition of those in the sample was captured. Future studies should include direct measures of net worth, income, and household debt in addition to attitudinal measures. It is possible that confidence levels and feelings of empowerment may differ across groups of widows based on the socioeconomic status of a widow’s household.

The study was also limited by the financial literacy measures used in the survey. Direct questions that test a widow’s financial knowledge and confidence with financial concepts could shed light on explaining why some widows feel more empowered to delegate financial management to a new partner or spouse. Finally, future studies should explore the interactions between and among financial literacy, financial attitudes, and financial well-being on financial empowerment with widows. Such a study may provide insights into the way self-empowerment is shaped by gender.

References

Abbasi, Saif-ur-Rehman Saif, Muhammad Iqbal Zafar, Muhammad Aslam, and Zahira Batool. 2008. “Effect of Female Financial Empowerment on Contraceptive and Fertility Behaviour: Woman Control on Household Expenditure.” Pakistan Journal of Agricultural Sciences Pakistan 45: 112–118.

Bandura, Albert. 1982. “Self-Efficacy Mechanism in Human Agency.” American Psychologist 37 (2): 122–147.

Bisdee, Dinah, Tom Daly, and Debora Price. 2013. “Behind Closed Doors: Older Couples and the Gendered Management of Household Money.” Social Policy and Society 12 (1): 163–174.

Blanchard, Ken, John P. Carlos, and Alan Randolph. 2001. Empowerment Takes More than a Minute 2nd ed. San Francisco, CA: Berrett-Koehler Publishers.

Delavande, Adeline, Susann Rohwedder, and Robert J. Willis. 2008. “Preparation for Retirement, Financial Literacy, and Cognitive Resources.” Michigan Retirement Research Center Research Paper No. 2008-190. Available at papers.ssrn.com/sol3/papers.cfm?abstract_id=1337655.

Farrell, Lisa, Tim R.L. Fry, and Leonora Risse. 2016. “The Significance of Financial Self-efficacy in Explaining Women’s Personal Finance Behaviour.” Journal of Economic Psychology 54: 85–99.

Ford, Megan R., Joyce A. Baptist, and Kristy L. Archuleta. 2011. “A Conceptual Approach to Financial Therapy: The Development of the Ford Financial Empowerment Model.” Journal of Financial Therapy 2 (2): 20–40.

Friedberg, Leora, and Anthony Webb. 2006. “Determinants and Consequences of Bargaining Power in Households.” NBER Working Paper No. 12367. Available at nber.org/papers/w12367.

Gillen, Martie, and Hyungsoo Kim. 2009. “Older Women and Poverty Transition: Consequences of Income Source Changes from Widowhood.” Journal of Applied Gerontology 28 (3): 320–341.

Gowdy, Elizabeth A., and Sue Pearlmutter. 1993. “Economic Self-sufficiency: It’s Not Just Money.” Affilia 8 (4): 368–387.

Gosling, Samuel D., Peter J. Rentfrow, and William B. Swann Jr. 2003. “A Very Brief Measure of the Big-Five Personality Domains.” Journal of Research in Personality 37 (6): 504–528.

Grable, John E., Carrie L. West, Linda Y. Leitz, Kathleen M. Rehl, Carolyn C. Moor, Michele N. Hernandez, and Susan S. Bradley. 2017. “Enhancing Financial Confidence Among Widows: The Role of Financial Professionals.” Journal of Financial Planning 30 (12): 38–44.

Haque, Abdul, and Mehwish Zulfiqar. 2016. “Women’s Economic Empowerment Through Financial Literacy, Financial Attitude and Financial Well-being.” International Journal of Business and Social Science 7 (3): 78–88.

Harley, Dana, Sakina Grome, Suk-Hee Kim, Tara McLendon, Vanessa Hunn, James Canfield, Theda Rose, and Anjanette Wells. 2018. “Perceptions of Success and Self-sustainability Among Women Participating in an Entrepreneurial Skills Development and Empowerment Program Through Photovoice.” Journal of Ethnic & Cultural Diversity in Social Work: January: 1–19.

Harris, Bill. 2017. “Preparing Clients for Widowhood.” Journal of Financial Planning 30 (4): 34–35.

Kasturirangan, Aarati. 2008. “Empowerment and Programs Designed to Address Domestic Violence.” Violence Against Women 14 (12): 1,465–1,475.

Kaur, Nripinder, and Harpreet Kaur. 2017. “Microfinance and Women Empowerment.” Vinimaya 38 (3): 30–49.

Lusardi, Annamaria, and Olivia S. Mitchell. 2007. “Baby Boomer Retirement Security: The Roles of Planning, Financial Literacy, and Housing Wealth.” Journal of Monetary Economics, 54 (1): 205–224.

Lusardi, Annamaria, and Olivia S. Mitchell. 2008. “Planning and Financial Literacy: How Do Women Fare?” American Economic Review 98 (2): 413–417.

Lusardi, Annamaria, and Olivia S. Mitchell. 2011. “Financial Literacy Around the World: An Overview.” NBER Working Paper No. 17107. Available at nber.org/papers/w17107.

McGarry, Kathleen, and Robert F. Schoeni. 2005. “Medicare Gaps and Widow Poverty.” Social Security Bulletin 66: 58. Available at ssa.gov/policy/docs/ssb/v66n1/v66n1p58.html.

Moore, Danna L. 2003. “Survey of Financial Literacy in Washington State: Knowledge, Behavior, Attitudes, and Experiences.” Technical Report No. 03-39. Pullman, WA: Social and Economic Sciences Research Center, Washington State University.

Moorman, Sara M., Alan Booth, and Karen L. Fingerman. 2006. “Women’s Romantic Relationships After Widowhood.” Journal of Family Issues 27 (9): 1,281–1,304.

Perry, Vanessa G., and Marlene D. Morris. 2005. “Who Is in Control? The Role of Self-perception, Knowledge, and Income in Explaining Consumer Financial Behavior.” Journal of Consumer Affairs 39 (2): 299–313.

Pitt, Mark M., Shahidur R. Khandker, and Jennifer Cartwright. 2006. “Empowering Women with Micro Finance: Evidence from Bangladesh.” Economic Development and Cultural Change 54 (4): 791–831.

Postmus, Judy L. 2010. “Economic Empowerment of Domestic Violence Survivors.” VAWnet Applied Research Forum. Available at vawnet.org/material/economic-empowerment-domestic-violence-survivors.

Stango, Victor, and Jonathan Zinman. 2009. “What Do Consumers Really Pay on Their Checking and Credit Card Accounts? Explicit, Implicit, and Avoidable Costs” American Economic Review 99 (2): 424–429.

Van Praag, Bernard MS Van Praag, Paul Frijters, and Ada Ferrer-i-Carbonell. 2003. “The Anatomy of Subjective Well-being.” Journal of Economic Behavior and Organization 51 (1): 29–49.

Van Rooij, Maarten, Annamaria Lusardi, and Rob Alessie. 2011. “Financial Literacy and Stock Market Participation.” Journal of Financial Economics 101 (2): 449–472.

Wu, Zheng, Christoph M. Schimmele, and Nadia Ouellet. 2015. “Repartnering After Widowhood.” The Journals of Gerontology: Series B: Psychological Sciences and Social Sciences 70 (3): 496–507.

Xu, Lisa, and Bilal Zia. 2012. “Financial Literacy Around the World: An Overview of the Evidence with Practical Suggestions for the Way Forward.” World Bank Policy Research Working Paper No. WPS 6017. Available at papers.ssrn.com/sol3/papers.cfm?abstract_id=2094887.

Yoong, Joanne. 2011. “Financial Illiteracy and Stock Market Participation: Evidence from the RAND American Life Panel.” Pension Research Council Working Paper No. 2010-29. Available at papers.ssrn.com/sol3/papers.cfm?abstract_id=1707523.

Zissimopoulos, Julie M., Benjamin Karney, and Amy Rauer. 2008. “Marital Histories and Economic Well-being.” Michigan Retirement Center Research Paper No. WP 2008-180 RAND Working Paper No. WR-645. Available at papers.ssrn.com/sol3/papers.cfm?abstract_id=1287296.

Citation

Mattia, Laura, Eun Jin Kwak, John E. Grable, Carrie L. West, Linda Y. Leitz, and Kathleen M. Rehl. 2020. “Self-Empowerment Among Widows: A Financial Planning Perspective.” Journal of Financial Planning 33 (10): 52–60.