Journal of Financial Planning: October 2020

James Lange, CPA, J.D., is a nationally recognized IRA, 401(k), and retirement plan distribution expert. He is the author of several books that help IRA and retirement plan owners get the most from their retirement plans using Roth conversions and tax-smart planning as an integral part of the planning strategy (PayTaxesLater.com).

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

With year-end 2020 fast approaching, every financial planner should be discussing smart tactics and planning strategies that can reduce tax burdens for their clients. Properly timed Roth IRA conversions for the right clients serve a dual purpose: (1) they reduce taxes for your client; and (2) they defend your client’s family from the income tax acceleration of the SECURE Act, which subject to exceptions, forces beneficiaries of IRAs to pay income taxes on the inherited IRA within 10 years of the IRA owner’s death.

The question your client will want to know is whether the tax-free advantage of the Roth conversion is great enough to write a big check to Uncle Sam before they have to. Of course, each situation is different. For the purposes of this column, I made certain assumptions and ran the numbers.

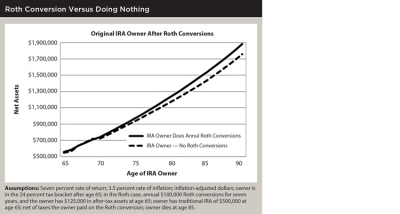

The graph shows that given certain reasonable assumptions, if your client makes seven Roth IRA conversions of $100,000 per year from the ages of 65 to 72, compared to no Roth IRA conversions, the IRA owners themselves (not their kids) are better off by $124,399, if they survive until age 90.

The graph measures the accounts in terms of their relative purchasing power, which is the only way I can compare the value of a traditional IRA to that of a tax-free Roth account. If an individual is in the 24 percent tax bracket, $100 in a traditional IRA might only have purchasing power of $76 ($100 minus the $24 tax on withdrawal). On the other hand, $100 in a Roth IRA will buy $100 of goods and services.

If you have clients who might be candidates for this strategy, they will likely benefit during their own lifetimes by starting the process this year. The CARES Act waived the required minimum distribution requirement for 2020, so if your client does not need their RMD to meet living expenses, they can convert even more money to a Roth IRA and still stay in the same tax bracket.

Best Time to Make a Conversion

In addition, a convergence of factors might make doing a Roth IRA conversion before the end of the 2020 the best time in history to make a Roth IRA conversion.

First, due to the CARES Act, there is no minimum required distribution for 2020. That could lower your client’s income and income tax bracket. This could allow a client to make a larger Roth conversion at a reduced income tax rate.

Also, if you believe tax rates are going up and potentially soon, it is better to make the Roth conversion before the rates go up. With a new administration, taxes could go up next year. Even if the current administration doesn’t change, most IRA owners think the general direction of taxes is going up, not down.

If a Roth IRA conversion is made while the market is down and the market goes back up, the advantage of the Roth IRA conversion will be higher, too.

Right now, if both spouses are alive, they will be subject to the lower married filing jointly income tax rates. After the first death, the survivor will have to file using the single tax rates (starting the year after the death of the first spouse) and Roth conversions will not likely be as beneficial. So, there are many reasons to consider a Roth conversion before year-end. But it is possible, even likely, that a series of Roth IRA conversions over a period of years will work the best. Also, please consider that the SECURE Act raised the age for RMDs to 72, possibly giving more individuals a longer window of opportunity to make Roth IRA conversions.

Here’s the bottom line: Depending on your clients’ individual situations, it is likely that they will benefit during their lifetimes by making a Roth conversion—or more likely, a series of smaller Roth IRA conversions. This issue should be looked at before year-end.

Roth IRA Conversions Are Good for Heirs

Let’s continue with the same example. Assume your clients start making Roth IRA conversions of $100,000/year at age 65 and continue until age 72. The second spouse dies at age 85, leaving the estate to their only child, who is 46 years old. Inheriting the Roth will give the child an additional $400,000 over the course of the child’s lifetime.

After the death of the Roth IRA owner and spouse, the child will own a special asset called an Inherited Roth IRA. Under the SECURE Act, the entire Inherited Roth IRA account will have to be disbursed within 10 years of the IRA owner’s death. If the beneficiary waits for 10 years after the death to distribute the Inherited Roth IRA, the growth during those 10 years is also income-tax free. That is much better than inheriting a traditional IRA where the proceeds and the growth will all be taxed within 10 years of the IRA owner’s death.

Losing the long-term tax-free growth on the Roth IRA over his or her lifetime, like the law provided before the SECURE Act, will be costly to the child. But inheriting a Roth IRA is still far more advantageous than inheriting a traditional IRA.

Recommending Roth Conversions: What You Need to Know

There are many variables to consider if you recommend Roth IRA conversions for retirement and estate planning purposes. One overly simplistic idea would be to convert, each year, only enough money to bring your client to the top of their existing tax bracket. Unfortunately, that is way too simplistic and often results in a strategy that is well below the optimal Roth IRA conversion amount. It also ignores the impact of the additional income on Medicare Part B premiums.

You must run the numbers to determine the best long-term strategy for when and how much to convert to a Roth IRA. Our office uses the Retirement Plan Analyzer and Retirement Distributions Planner by Brentmark, but frankly, it is the skill of the number cruncher that is crucial to arrive at the best conclusion. In addition to knowing your client’s income tax bracket, you would ideally know their children’s likely future income tax bracket. We run our calculations with a reasonable projection for the life expectancies of the children.

At some point, it may become clear that your client is not a suitable candidate for a Roth IRA conversion. One group of people it might not be beneficial for are taxpayers who do not have the money to pay the income tax on the conversion unless they invade their traditional IRA. Then, the math shows the Roth IRA conversion is a breakeven or maybe a little better for the client and maybe better for the heirs, but not enough that it makes sense to write a check from the IRA to pay the taxes on the Roth conversion.

Another example of someone who might not benefit from a Roth IRA conversion is someone who is leaving a substantial percentage of their entire estate to charity. Another group is high-income earners who plan to retire soon. Still, I find that most IRA owners my firm sees will benefit from developing and implementing a long-term Roth IRA conversion strategy.

Here is another huge value-add that hardly any advisers or even attorneys ever bring up, but sometime they should. Our law firm has been strategic in situations where the beneficiaries are in completely different financial positions. We have sometimes left IRA and retirement funds to the child in a low tax bracket and the Roth and after-tax dollars to the child in a high tax bracket. It is a way for all the children to get more purchasing power, assuming we equalize the distributions by giving more total dollars to the child with the lower tax bracket.

Encourage your clients to go into the process of determining how much and when to convert to a Roth IRA with an open mind. For example, one client came to us hoping for a plan that would have converted everything to a Roth; but after running our projections he would still have had a significant traditional IRA at the end of his lifetime. In his case, doing a full conversion would have pushed him into too high an income tax bracket, and both he and his family would have been worse off than if we blindly followed his wishes of gradually converting everything to a Roth before he died.

We also find that, in addition to passing the “math test,” the Roth IRA conversion must pass the stomach test, too. You can show many clients 100 perfect graphs with pages of pages of analysis and footnotes, and they are just not comfortable with writing a big check to Uncle Sam—especially when they don’t have to. I think you have to respect that.

Last but not least, remember that the IRS no longer allows taxpayers to “recharacterize” or undo Roth IRA conversions. If your client makes and pays the tax on a $100,000 conversion and the market goes down, they might suddenly have to pay income tax on an additional $100,000 of income, but the Roth IRA might only be worth $75,000 at the time. Unfortunately, the only solution will be to ride out the market’s fluctuations—and, of course, that may not happen in your client’s lifetime.

Roth IRA conversions are not without risk, but I believe in many cases that the benefits outweigh the risks. And for many taxpayers, before the end of 2020 might be the best time in history to begin to execute a series of Roth IRA conversions.