Journal of Financial Planning: October 2016

For many financial advisory firms, effectively serving high net worth (HNW) clients—who are often a small but important segment of their client base—is a top concern. Adviser-applied variable universal life insurance (AAVUL) is a relatively new tool available to advisers to help meet a variety of HNW clients’ wealth planning needs while also creating business benefits for the firm.

Some advisers have had difficult experiences with retail-priced variable universal life (VUL) products. Therefore, this article serves to educate advisers on the advances AAVUL can bring to the planning and execution process for certain clients, as well as situations where AAVUL is not appropriate for others.

Understanding AAVUL

In 1959, the U.S. Supreme Court ruled that variable insurance products—annuities and universal life—were securities. For this reason, these products are required to be SEC registered, and the issuers are subject to both the Securities Act of 1933 and the Investment Company Act of 1940. AAVUL, may then, fit within some advisers’ investment strategies.

AAVUL is institutionally priced and allows the financial adviser to be the builder, manager, and monitor of each policy’s underlying portfolio. There are two types of AAVUL: (1) private placement VUL (PPVUL) for clients with more than $5 million in investable wealth (premium commitments as low as $500,000); and (2) registered VUL for clients with less wealth but in high tax brackets (approximate premium of $25,000 and up).

Like all VUL policies, AAVUL has an underlying customized portfolio that grows free of income and capital gains taxes with no exposure to the alternative minimum tax. The death benefit is tax free to the beneficiary and, while the policy is in force, cash can be accessed tax free prior to the insured’s death via premium withdrawals and low-cost loans (in which the final death benefit is netted against any outstanding balances).

Typical retail-priced VUL products strip away many of these benefits with high sales loads, commission trailers, high insurance costs, and surrender charges. Because of this, advisers have justifiably fled from retail VUL when considering tax management and wealth protection strategies for HNW clients. However, AAVUL removes these obstacles.

Wealth Preservation through Tax Alpha

In U.S. Trust’s 2016 “Insights on Wealth and Worth®” survey, 55 percent of HNW respondents (with at least $3 million in investable assets) stated that it’s more important to minimize the impact of taxes when making investment decisions than it is to pursue the highest possible returns regardless of the tax consequences. And, financial advisers recognize this importance; 75 percent of advisers surveyed said tax-managed investment solutions are important or critical to their business, according to the August 2015 “Financial Professional Outlook” by Russell Investments. Therefore, tax alpha, or the process of adding to return through tax-efficient strategies, can be a consequential planning activity for an adviser’s high-income clients.

Wealth can’t be created unless it’s first preserved. To succeed in wealth preservation, it’s necessary to avoid unnecessary wealth leakage from (1) market declines; (2) unprotected property risks; (3) high fees; and/or (4) taxes. For an adviser serving HNW clients, the logic for having an emphasis on tax management is clear: of these four wealth-leakage categories, none has the year-after-year wealth degradation as the 43.4 percent marginal federal income tax (including the Medicare surtax) and more than 50 percent combined tax for high-tax state filers. Shielding portfolio income and gains from taxes can have a much greater impact compared to cutting investment fees or decreasing portfolio volatility.

Each client has a different tax management profile determined by factors such as age, marital status, federal marginal tax rate, state income tax type and rate, spending budgets, investment holdings, portfolio return structure, cost basis, and planning tasks (such as charitable giving and estate planning).

The tax alpha tactics commonly used by advisers, including tax-loss harvesting, minimizing short-term gains, asset location analyses, and investing in ETFs instead of mutual funds, are often customized according to a client’s specific tax management profile. Because tax-management profiles are unique to each client, the ability to scale operations is limited. Tax management can be a high-cost service to execute that can lead to lower per-client profitability.

Likewise, asset location—the investment analysis that optimally assigns products to different portfolios for the highest after-tax return—can be appealing, but implementation can be challenging due to individual client customization.

AAVUL, however, can ease these implementation challenges. Access to the AAVUL’s portfolio value is tax free, per IRS regulations (and structured as a non-modified endowment contract wherein the premiums are paid in over a fixed number of years), regardless of the investment product held in the portfolio. AAVUL also eliminates other planning hindrances associated with tax-deferred portfolios, such as required distributions (IRA/qualified annuity), inflexible distributions (529 plans), penalties for invalid distributions (IRA/529/qualified annuity), or limited contribution amounts (Roth IRA).

AAVUL Portfolio Design in Action

In a HNW client’s total investable wealth plan, there are a variety of different portfolios. The taxable portfolio (for example, at 60 percent) is the primary driver for wealth planning and execution. Comprehensive portfolio design would still incorporate tax-inefficient investments, because each would provide important portfolio benefits such as lowered volatility, improved risk-adjusted returns, and portfolio income.

However, consider a 20 percent reallocation to AAVUL from the taxable portfolio (so that the taxable portfolio is now 40 percent). Tax-inefficient investments and high-growth equities are shifted to the AAVUL portfolio for tax alpha and asset location results in a single tactical move. This 20 percent carve out creates a long-term, tax-free portfolio companion to the taxable portfolio strategy. Using AAVUL as the tax-efficiency lever that compounds the client’s tax savings over time, links the wealth preservation and wealth creation portfolio objectives.

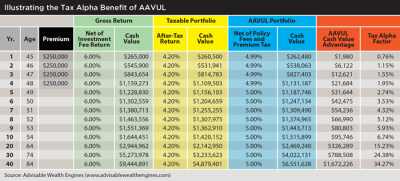

The table compares two identical $1 million portfolios that produce a net-of-product-fees return of 6 percent. The taxable portfolio is exposed to a blended 30 percent tax rate, and the AAVUL portfolio (paid in four installments) includes ongoing insurance charges (1 percent) and premium taxes (8 basis points via a packaged South Dakota trust).

Net of policy expenses, after 10 years, using AAVUL as an asset-location resource (and avoiding wealth leakage due to taxes) creates almost $100,000 in tax alpha compared to a taxable portfolio; therefore, the tax-alpha benefit is 6.74 percent. This tax-alpha benefit compounds, leading to a 15.23 percent impact at 20 years, and 24.38 percent at 30 years.

Protecting Against Investor Control

Advisers interested in using AAVUL should be aware of the investor control doctrine. According to published IRS private letter rulings and U.S. Tax Court litigation (see Jeffrey T. Webber v. Commissioner of Internal Revenue; June 30, 2015), a policyholder will be considered controlling insurance separate account assets if he or she possesses incidents of ownership in the underlying investments, such as the ability to make buy and sell investment decisions. Therefore, should the policyholder be found in control, AAVUL’s tax shield will be lost. Two methods exist to address investor control worries.

Insurance dedicated funds (IDF) and variable insurance trusts (VIT). An investment firm clones an existing strategy and makes it available only to insurance company variable accounts; the IDF commingles multiple policyholders for private placement VUL; a VIT does the same for a registered VUL.

Asset allocator, or managed separate account. Think of a managed separate account as a one-to-one insurance dedicated account that is only available to a specific policyholder’s account and owned by an insurance company. Because the adviser sits between the investor and the portfolio, any publicly available investment can be used (ETFs, mutual funds, individual stocks, REITs, private equity, hedge funds, etc.) as long as the account is properly diversified according to variable account insurance law, known as 817(h).

To date, insurance companies’ worries over an arrangement, plan, contract, or agreement indicating investor control has led to a dominating focus on pure IDF/VIT approaches. However, with the advent of insurance company-specific investing technologies (accessed by the adviser from the company’s web portal), it’s now straightforward to establish clear and auditable investor-control boundaries for the asset-allocator method.

Following an adviser’s approval by the insurance company as an asset allocator over a client/policyholder’s separate account (and appointed by the company through an investment management agreement for full discretionary control), the adviser can designate portfolio objectives, structure performance and risk preferences, and decide on investment products.

At this point, the investing technology’s algorithm would take these inputs, optimize the portfolio, and make the actual product-specific allocations. While the adviser would set rebalancing rules, the algorithm would determine the actual buys and sells to bring the portfolio back to its target.

The insurance company’s technology makes the resulting AAVUL portfolio only available through the policy’s managed separate account itself. The possibility of investor control is eliminated, because the client would not have incidents of ownership even considering the adviser/client relationship.

AAVUL Isn’t Right for Everyone

AAVUL’s three main structural benefits—the tax shield, asset protection, and wealth replacement through the integrated death benefit—may apply to some high net worth clients, but not all.

For example, a family with much of its wealth in equities (public or private) will have income exposed to relatively low dividend and capital gains tax rates. Although the tax shield provided by AAVUL still applies, the return on investment just on the tax savings may be comparable to other tax alpha approaches.

A wealthy client with an existing trust structure has already protected wealth, made tax management decisions, and holds life insurance for wealth replacement. Unwinding these components for AAVUL would lead to unnecessary costs and revisiting complex planning.

And, some clients are too old or sick to get a reasonable underwriting rating for cost-effective insurance. Options exist, for example a private placement or registered (no load) variable annuity, or underwriting the policy on a health ier spouse or child, but these options add planning complexity.

Building a Firm’s Strategic Value

Beyond using AAVUL as a flexible planning tool, an advisory firm that employs AAVUL may realize business benefits.

Unlike other insurance products today where premium is removed from an adviser’s AUM, the adviser is the AAVUL portfolio’s builder, manager, and monitor. The associated premium paid (commonly funded from the taxable portfolio) remains under the adviser’s AUM.

AAVUL can also serve as a multi-generational planning solution under the adviser’s ongoing management and monitoring. With AAVUL, the premium payer and the insured can be different. For example, a parent can fund an AAVUL policy written on a child’s life, and the adviser can manage the portfolio on behalf of both generations. Note that families exceeding the unified credit will benefit from advanced planning tactics.

Advisers face a constant need to allocate their time efficiently. When considering a new planning approach, investment product, or service capability, this question is always present: “Is it worth my time?” Advisers serving high net worth clients may find that investing the time to learn about AAVUL is worthwhile, considering the potential client benefits.

Kirk Loury is president of Advisable Wealth Engines and its affiliates including Wealth Planning Consulting Inc. He is a thought leader in AAVUL, investing and planning technology, and adviser practice management.