Journal of Financial Planning: October 2016

The cost of health care in retirement gets a fair share of publicity. Enough so that many people say it’s their No. 1 retirement concern. But health care is only the fourth-highest spending category for people between ages 65 and 74, after housing, transportation, and food. It moves up to second place for people 75 and older, but it still lags far behind the cost of housing, according to data from the U.S. Bureau of Labor Statistics’ Consumer Expenditure Survey.1

To put this in perspective, people spend more than twice as much for housing during retirement as they do for health care. Yet when surveyed about their retirement concerns, they rarely mention the cost of housing, transportation, or food, but they almost always mention the cost of health care.

A sampling of surveys shows how anxious people are about health care costs in retirement. The 2015 Wells Fargo/Gallup Investor and Retirement Optimism Index surveyed people age 45 and older and found that health care costs were tied with “having enough savings” as the top retirement concern. Fidelity’s 2015 Couples Retirement Study survey found that almost three-quarters of the 1,051 couples surveyed were worried about not having enough money to pay for unexpected medical costs. And Nationwide Financial’s 2015 Fourth Annual Health Care and Long-Term Care Study surveyed more than 1,200 pre-retirees age 50 and older earning more than $150,000 a year and found that almost 70 percent of them thought that health care costs could derail their retirement.

Why are people so worried about retirement’s fourth-largest spending category (or second-largest for those 75 and older)? Partly it’s because medical expenses are unpredictable; paying for an unforeseen serious illness can wreak havoc with a retirement plan. And people often know from their own experience that health care spending increases at faster rates than other types of spending, and that at some point this cost growth may put pressure on their budgets.

Both concerns—serious illnesses and high rates of health care inflation—are beyond clients’ control. That’s different than their housing costs, where they know of ways to manage expenses: they can downsize to smaller homes, take out reverse mortgages, and rent out spare bedrooms. Or if they want to reduce their transportation costs, they can drive fewer miles and delay buying new cars.

With health care costs, however, clients are less sure of what to do. Consequently, they worry.

Fifty-three percent of pre-retirees surveyed by Nationwide said it’s important that their financial adviser talk to them about health care costs in retirement, yet only 10 percent of survey respondents said they have talked to a financial adviser about how to manage those costs.

Here is the gap, then. Clients are worried about retirement health care costs and yet few appear to be getting suggestions from their advisers or planners about ways to manage these costs.

Planners can begin to bridge this gap with three relatively simple steps: (1) make one-time estimates of how much clients might pay for their retirement health care; (2) encourage retired clients to monitor and re-evaluate their coverage each year during Medicare’s annual open enrollment period; and (3) suggest that clients track their health care expenses.

Before exploring these steps in more detail, it’s important to explain their importance.

Benefits of Estimating Retirement Health Care Costs

Despite being worried about the cost of health care, most individuals have not given much thought to the actual numbers. According to the Employee Benefit Research Institute’s 2016 Retirement Confidence Survey, just 27 percent of workers and 37 percent of retirees have estimated how much they would likely need for retirement health expenses.

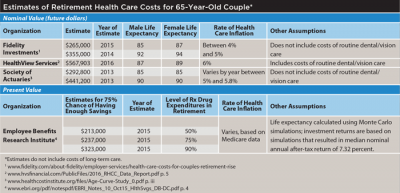

Estimates are not predictions, of course, and any given estimate may eventually turn out to be far off the mark. That’s why it is good for retirees to see several estimates that show a range of possible outcomes.

The estimates in the first table above were made by experts who are knowledgeable in the nuts and bolts of retirement health care spending. And still, they vary a great deal because they are based on different assumptions about health care inflation rates, lifespans, types of coverage, and the number and kinds of prescription drugs retirees take. When people understand how much variation there can be in their health care spending, much of it due to factors beyond their control, they may have more reason to manage the things they can control.

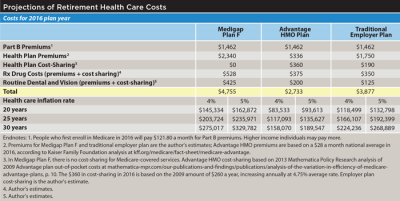

Clients also need to understand that the majority of their health care spending will likely occur in later retirement. In the estimates in the second table on page 28, 65 year olds who live another 30 years will pay more than one-fourth of their retirement health care costs after their 90th birthdays, or during the last one-sixth of the 30-year period. That’s true regardless of the type of coverage they have or whether health inflation averages 4 percent or 5 percent.

Although clients may know that health care inflation grows more quickly than other kinds of inflation, they may be less aware of how much more they will spend during later retirement for co-payments, prescription drugs, and services not covered by Medicare. The combination of health care inflation and greater use of medical services could mean that for some, the cost of health care in later retirement may begin to crowd out other kinds of spending.

A 2015 analysis of 11,000 Medicare patient records by the AARP Public Policy Institute found that people age 85 and older paid 55 percent more in out-of-pocket costs than retirees ages 65 to 69.2 Because those costs were incurred in the same year (2011), health care inflation was not the reason for the differences in spending. Instead, older retirees’ greater use of medical services and the higher age-adjusted premiums for those with Medigap policies caused the increased spending.

If younger retirees understand this late-spending pattern, some may decide to choose a less expensive type of coverage in early retirement when their health is good and their costs are low. And they may commit to monitoring their coverage more closely, particularly during later retirement when there is more at risk.

In summary, making one-time estimates has three benefits: (1) clients will be aware of the potential costs and may be motivated to manage them; (2) by seeing several estimates, clients will understand that costs may vary widely; and (3) in discussions with their financial planners, clients may come to realize that the bulk of their health care spending will probably occur in later retirement. These basic points provide a framework for managing retirement health care costs.

The Importance of Monitoring Coverage

Other than by rationing their care, the only control that retirees have over their health care spending is the coverage they choose. But retirees rarely re-evaluate their coverage after their initial Medicare enrollment. In principle, this is no different than choosing retirement investments at age 65 and never rebalancing the portfolio or checking to see how the investments are performing.

According to a series of focus groups conducted by the Kaiser Family Foundation, the majority of retirees have never changed their health plans. Many retirees in the focus groups did not review their coverage during open enrollment because they said they were frustrated by Medicare’s complexity.3

The reluctance to re-examine coverage and change plans increases as people age. The Medicare Payment Advisory Commission’s 2013 Status Report on Part D indicated that only 10 percent of people age 80 or older voluntarily change plans each year, compared to a 15 percent change rate for those ages 65 to 69. Therefore, in later retirement when the financial stakes are highest, retirees are least likely to re-evaluate their coverage and change plans.

When retirees do not re-examine their coverage, they raise the odds that they will pay more than they need to. Premiums, cost-sharing amounts, and provider networks of health plans change annually. Plans that are good choices this year may be poor choices next year.

Part D plans have the greatest cost variation of any type of Medicare coverage, with up to four-fold price differences for identical sets of drugs.4 Throughout the year, Part D plans add and remove drugs from their formularies while shifting other drugs to different pricing tiers. In many cases retirees are protected from price hikes resulting from these ongoing changes for the remainder of the year in which the changes are made. But unless they switch plans during annual open enrollment, they may face much higher costs the following year.

One way to see how rapidly Part D plans change is to look at the percentage of plans that are the lowest-cost options for two years in a row. According to one analysis of patient records, only 12 percent of the lowest-cost Part D plans in one year were also the lowest-cost plans for those same drugs the following year. Thus, by remaining in the same plans for two years straight, 88 percent of the patients in the study would have been in overpriced plans in the second year, overpaying for their prescription drugs by amounts ranging from $276 to $562 per year.5

People’s needs also change. Retirees may start taking different drugs or seeing new doctors. And if the new drugs are not covered or the new doctors are not in-network, costs may rise sharply. Also, people’s aversion to risk may increase as they age. Young retirees in excellent health may be willing to enroll in Medicare Advantage plans with high $7,500 out-of-pocket limits, but as they grow older, see their doctors more often, and use additional medical services, their out-of-pocket risks will grow.

Insurance companies are aware of retirees’ tendency to remain in the same plans, and evidence suggests that they count on it. Two studies have found that some stand-alone prescription drug plans set their premiums artificially low to attract people when they first enroll in Medicare. In the following years those plans had large premium increases, operating under the assumption that most enrollees would not switch. Meanwhile, the companies introduced new low-premium plans to attract incoming enrollees.6

Employer-sponsored retiree plans may require less monitoring because they do not change as much as other kinds of Medicare supplemental coverage. Although many employer plans have reduced their benefits over the years, they are usually the best options for retirees who have access to them. Typically, the employer pays a portion of the premium and has a financial incentive to screen out overpriced coverage.

Below are three steps that financial planners can take to help retired clients manage their health care costs:

Step One: Make a One-Time Estimate of Retirement Health Care Costs

For clients who are already enrolled in Medicare, financial planners can project the clients’ current costs over different time periods using different rates of health care inflation, as shown in the table of projections on page 28. These types of projections may have credibility with clients because they are based on what the clients are currently paying. In contrast, the estimates in the table on the top of page 28 are based on national average costs that can be as much as 15 percent higher or 15 percent lower than costs in a particular region or state.

The starting points for projections can be either last year’s costs or this year’s costs adjusted to reflect a 12-month period. Retirees can call their insurance companies to find out how much they’ve paid in cost-sharing—deductibles, co-payments, and co-insurance payments. Then they can add the premiums they have paid, including Part B premiums. And if they wish, they can add estimates of how much they have paid for services that Medicare does not cover, including routine dental and vision care, hearing aids, and over-the-counter drugs.

What rates of health care inflation should financial planners use when making projections? There’s no consensus. The Medicare Trustees project that per-person costs will increase at a 4.3 percent average annual rate through 2025.7 HealthView Services, a firm that sells software for making health care cost estimates, uses a 5.1 percent health care inflation rate.8 Financial planners may want to choose two or three rates in order to project different scenarios.

Projections may not work as well for clients who are not yet enrolled in Medicare because they do not know what their costs will be. Most financial planning software has a module for estimating retirement health care costs for pre-retirees. Another option is for financial planners to discuss with clients the estimates and projections shown in the tables on page 28.

Step Two: Encourage Clients to Re-Evaluate Their Plans Each Year

Virtually all retirees who do not have employer plans will reduce their costs if they re-evaluate their coverage each year, changing plans when they can save enough to make the changes worthwhile (they may understandably not want to change plans for minor savings). Even in years when they do not change plans, they will know they have good coverage.

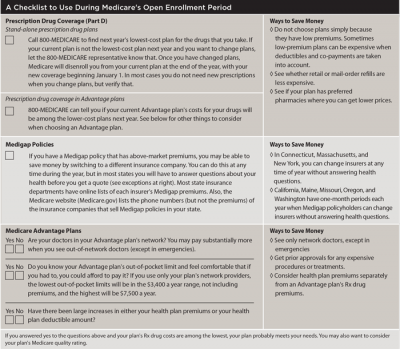

One approach financial planners can take to remind retired clients to re-evaluate their health plans each year is to send an email in early October with a reminder of Medicare’s upcoming annual open enrollment period (October 15 to December 7). The email could include the names and contact information of agencies that provide expert, no-cost assistance (see the sidebar on page 32).

An additional step is to send clients a checklist of what to look for when they re-evaluate their plans. If the checklist is easy to complete, some retirees may get in the habit of reviewing their plans each year, making it more likely that they will continue to do so in later retirement.

Planners may want to customize the checklist to match the type of coverage that clients have, adding criteria that are important to them. A sample checklist is shown above, and it includes the following three types of coverage:

Part D plans. By calling 800-MEDICARE during annual open enrollment, people can find the coming year’s lowest-cost Part D plans for the drugs that they take. That’s true for stand-alone prescription drug plans as well as for Medicare Advantage plans that include drug coverage. The 800-MEDICARE representatives take the names and dosages of callers’ drugs and find the lowest-cost plans while callers remain on the line. If people can save enough money to make changing plans worthwhile, they can ask the representatives to enroll them in the lowest-cost plans. Otherwise, they remain in their current plans.

When people switch plans, their new coverage will go into effect on January 1. And once they have enrolled in different plans, Medicare will disenroll them from their current plans at the end of the year. In most cases, they will not need new prescriptions, but they should verify that with their new plans.

Besides 800-MEDICARE, other agencies (shown in the sidebar) will also help retirees find the lowest-cost plans. Unlike 800-MEDICARE, these other agencies are not able to enroll callers in different plans. Retirees will need to call the plans they want to enroll in, using the toll-free numbers provided by the agencies. When they enroll in other plans, Medicare will disenroll them from their current plans at year-end.

Medigap policies. People who have Medigap policies with higher-than-market premiums may be able switch to a lower-premium insurance company during the year. But in most states, they will have to answer questions about their health before they can get a quote from another insurance company (assuming they are past the six-month open enrollment period that begins when they first get Part B).

If their health is good, they may be able to save several hundred dollars a year by changing to a low-premium insurer. Medigap premium comparisons and insurance companies’ toll-free numbers can be found on the websites of most state insurance departments. Also, the Medicare website, Medicare.gov, lists the names and phone numbers of companies that sell Medigap policies in each state, but it does not list each company’s premiums.9

Eight states give people a guaranteed right to switch to another Medigap insurer without having to answer questions about their health. Connecticut, Massachusetts, and New York have year-round open enrollment as well as prohibitions against insurance companies using health status to determine premiums. California, Maine, Missouri, Oregon, and Washington have a one-month period each year when people can switch their Medigap policies to a lower-premium company without answering health questions.

Generally, it’s not wise to change to a different Medigap insurance company for minor premium savings that may be reversed the following year. Sometimes the differences in premiums are the result of insurance companies’ timing of their annual increases, so that small savings may last for only a month or two. Substantial savings of several hundred dollars a year, on the other hand, should not be affected by the differences in the timing of premium increases.

Medicare Advantage plans. When people evaluate (or re-evaluate) Medicare Advantage plans, they need to take several things into account. They should try to find plans that (1) have all of their physicians in the network; (2) have reasonable health plan premiums and medical deductibles; (3) have relatively low costs for the prescription drugs that they take; (4) have out-of-pocket limits that are not too high; and (5) have a minimum four-star Medicare quality rating.

These are only some of the considerations. The Medicare Rights Center has compiled a list of 28 questions for people to ask before enrolling in an Advantage plan (see medicareinteractive.org/get-answers). Retirees are most likely to find counselors who have the time to help them sort through their Advantage plan options at one of the Medicare counseling agencies that are part of the nation-wide State Health Insurance Assistance Program (SHIP).

For many retirees, there may not be an Advantage plan that satisfies all of their criteria. The only Advantage plans that have all of their doctors in their networks, for instance, may also have high costs for the prescription drugs that they take. Thus, they may have to make trade-offs if they are going to enroll in Advantage plans.

Step Three: Encourage Retired Clients to Track Health Care Costs

As described earlier, in most cases people can find out how much they have spent for Medicare-covered services by making one or two phone calls. Someone with a Medigap policy and stand-alone drug plan, for instance, would call two insurers while someone with a Medicare Advantage plan would call only one.

By tracking their costs, retirees can see how fast those costs are rising. Are they increasing by 4 percent a year or by 8 percent a year? And if it’s 8 percent, is it because the retiree started taking one or more additional drugs, or because of a hospitalization, or something else? Understanding what caused a sharp cost increase can help retirees better manage their costs.

Some clients may choose not to do any of these steps, perhaps because they have excellent employer-sponsored plans. Others may choose to do one, two, or all three. In any case, they will know that their financial planners have offered to help them in an area

where many of them have indicated that they would like assistance.

David Armes, CFP®, is principal of Dover Healthcare Planning LLC, a fee-only firm that helps people evaluate and compare their Medicare options. He previously served as a volunteer Medicare counselor.

Endnotes

- See “A Closer Look at Spending Patterns of Older Americans” by Ann Foster in the March 2016 issue of Beyond the Numbers, a publication of the U.S. Bureau of Labor Statistics, www.bls.gov/opub/btn.

- See “Medicare Beneficiaries’ Out-of-Pocket Spending for Health Care” by Claire Noel-Miller, Ph.D., in the October 2015 issue of AARP Public Policy Institute’s Insight on the Issues at aarp.org/content/dam/aarp/ppi/2015/medicare-beneficiaries-out-of-pocket-spending-for-health-care.pdf.

- See the Kaiser Family Foundation report “How Are Seniors Choosing and Changing Health Insurance Plans” by Gretchen Jacobson, Christina Swoop, Michael Perry, and Mary C. Slosar, posted May 13, 2104 at kff.org/medicare/report/how-are-seniors-choosing-and-changing-health-insurance-plans.

- See the Kaiser Family Foundation report “It Pays to Shop: Variation in Out-of-Pocket Costs for Medicare Part D in 2016” by Jack Hoadley, Juliette Cubanski, and Tricia Neuman, posted December 2, 2015 at kff.org/report-section/it-pays-to-shop-variation-in-out-of-pocket-costs-for-medicare-part-d-enrollees-in-2016-findings.

- See “Potential Opportunity Cost of Neglecting to Annually Reassess Medicare Part D Standalone Prescription Drug Plan Offerings” by Mark Walberg and Rajul Patel in the November/December 2009 issue of the Journal of the American Pharmacists Association.

- See the MIT job market paper “Supply Response to Consumer Inertia: Strategic Pricing in Medicare Part D” by Yufei Wu, posted January 11, 2016 at economics.mit.edu/files/11046, and the NBER working paper “Consumer Inertia and Firm Pricing in the Medicare Part D Prescription Drug Insurance Exchange” by Keith M. Ericson, issued September 2012 at www.nber.org/papers/w18359.

- See the Kaiser Family Foundation report “The Facts on Medicare Spending and Financing” posted July 24, 2015 at kff.org/medicare/fact-sheet/medicare-spending-and-financing-fact-sheet.

- See HealthView Services’ 2016 Retirement Health Care Costs Data Report at www.hvsfinancial.com/PublicFiles/2016_RHCC_Data_Report.pdf.

- Start at Medicare.gov, and click on “Find health & drug plans,” then in the right-hand navigation, click on “Find and compare Medigap policies.” On the next screen enter your ZIP code, and on the following screen choose the plan you have (for example, Plan F) and click “View companies that offer Medigap Plan F,” to see a list of insurers and their toll-free numbers.

Learn More

Journal in the Round: A Closer Look at Planning for Retirement Healthcare Costs

Author David Armes is joined by fellow healthcare planning expert Dr. Katy Votava to share their insights into estimating and managing costs, including those related to Medicare, Medicaid, and long-term care. Their discussion is followed by a live Q and A, moderated by FPA's retirement planning Knowledge Circle hosts. October 26, 2016 2PM Eastern. Free for FPA Members ($49 value). Click HERE to register.