Journal of Financial Planning: November 2021

Byrke Sestok, CFP®, is co-owner and financial planner at Rightirement Wealth Partners. He is president of FPA of Greater Hudson Valley, and a current member and past chair of the OneFPA Advisory Council.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

“A Comparison of the Tax Efficiency of Decumulation Strategies” by Geisler, Harden, and Hulse was published in the March 2021 issue of the Journal of Financial Planning, and the research is invaluable to our profession. This article seeks to put that research in motion to better serve our clients. To be concise here, it is assumed you have read the research.

It is clear that the “conventional wisdom” of decumulating taxable accounts (TA) first, tax-deferred accounts (TDA) second, and tax-exempt accounts (TEA) last is not actually wise for the vast majority of clients. Geisler et al. (2021) conclude that client-focused decumulation strategies have better outcomes than prior cookie-cutter approaches. Implementing their scientifically derived thoughts into practice is complex, but when done well, it positions holistic financial planners as extremely valuable to retiring Americans.

To put this research to work, I have created a thought flowchart based on a married couple filing jointly on Medicare at age 65. Please adjust your thoughts appropriately for different filing status.

Income

First, consider federal tax brackets. I’ll argue that three bands currently exist. The 10 percent and 12 percent brackets make up the first band and extend to $172,750 AGI. The second band has a 10 percent jump and consists of the 22 percent and 24 percent tax brackets and extends to $329,850 AGI. The third band has an 8 percent jump and includes the 32 percent, 35 percent, and 37 percent tax brackets.

Second, consider Medicare IRMMA brackets. The base premium of $148.50 applies to MFJ incomes below $176,000 and encapsules the 10 percent, 12 percent, and 22 percent federal tax brackets. However, as MAGI moves up to the second IRMMA bracket that extends to $222,000, a premium increase of $1,425.60 annually ($59.40 x 12 x 2) kicks in and also creates a new breakpoint in the middle of the federal 24 percent tax bracket. The third bracket for IRMMA extends to $330,000 and almost coordinates with the end of the 24 percent tax bracket. Above that, the IRMMA brackets cover the rest of the federal brackets and don’t really factor into our income decisions as planners. Please note that MAGI is different than AGI and at its foundation adds back in tax-exempt income (typically muni bond income) and some deductions and credits.

To summarize, when planning out client income, the important AGI numbers to pay attention to are $172,000, $222,000, and $329,850 for the majority of clients.

Assets

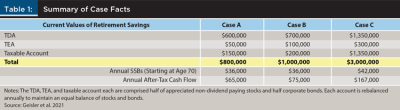

Geisler et al. (2021) needed to make assumptions for asset location between TDA, TEA, and TA in order to have clear parameters for research. Based solely on my 20-year personal experience as a planner serving mostly the mass-affluent, the allocations used are not terribly realistic (see Table 1). Without early planning, very few retirees have any meaningful TEA assets (accumulation planning for retirement should include TEA, but this paper does not cover accumulation).

When TEA balances are small or nonexistent, I’ve found a greater likelihood that TA balances will exist across all three cases presented, however for Cases A and B, those accounts are also likely to be tied to the clients’ psychological comfort of holding a cash reserve and not likely to be spent to zero. The investable net worth of Case C also has a significantly higher TEA balance and an unlikely even split between TDA and TA than is my experience.

I mention the above because evaluating asset location is an important step when developing a decumulation strategy. Geisler et al. (2021) illustrate how sound strategy for all scenarios involves filling income need gaps from TA prior to the start of Social Security benefits (SSB) with the goal of effective taxation at 0 percent. However, optimal strategy is challenged when small or nonexistent TA balances exist from which to draw. In cases similar to A and B, planners should evaluate the long-term expected net taxation. The proposed research strategies may need to be modified to initiate some taxation at the 10 percent and 12 percent tax brackets from the beginning of the decumulation phase and possibly accept some of the tax torpedo as a trade-off for what will be forced taxation when SSBs are initiated and further accelerated at age 72 with required minimum distributions (RMD). In cases similar to C with larger TDA and smaller TA, seeking to avoid the tax torpedo in any form may be less net tax profitable than seeking to fill up the 22 percent tax bracket to the IRMMA level of $222,000 while Roth IRA converting any possible assets. Significant TDA growth long term can result in RMD balances that drive federal taxation levels into the 24 percent and 32 percent tax brackets and the fourth and fifth IRMMA brackets.

Proper long-term analysis can shed light on tax advice that is often overlooked by the tax adviser who focuses on current year tax reduction only and further emphasizes the significant value a financial planner provides to clientele.

Client Behavioral Aspects to Consider

Geisler et al. (2021) help illustrate that the default is infrequently the optimal decumulation strategy. The considerations presented here further emphasize this reality. Clients and their tax advisers tend to default to paying the least tax possible in the current year. We are effectively challenging the status quo when presenting advice that results in more tax now and we should be prepared for resistance from clients.

Drawing upon prior research (Klontz and Klontz 2009), developing a sound understanding of clients’ money scripts helps identify the extent to which they will accept advice that results in depletion of TA. It’s reasonable that clients will reject scenarios that leave no savings available outside of retirement accounts. Planners operating on these theories should consider the inability to predict a future that may require TA and consider yielding somewhat when mathematics encounters the human experience. The art of planning includes accepting some error in client choice to help the client to make optimal decisions more consistently.

It is mentioned in this research that clients often have desires to bequeath assets to children or other heirs. It is important to explore these desires because advice provided may conflict and be rejected. Sometimes clients will not be conscious of these desires when resisting sound advice. Understanding bequeathal motivations will help planners modify thinking to truly create advice that is optimal to the client.

A significant part of this research relies on the client delaying SSB until age 70. Many clients focus on the length of time and amount of money they have paid into Social Security and just want to start collecting as soon as they can. Ignoring legitimate considerations involving shorter familial longevity history or known medical issues that could result in premature death, resistance to delaying SSB to full benefit age and age 70 is still likely to exist. Planners should discuss SSB collection beliefs prior to suggesting decumulation strategies and educate clients regarding the additional value delaying SSB collection can provide.

Closing Thoughts

This paper builds upon Geisler et al.’s controlled research to help planners create a framework of thinking for developing decumulation strategies. The math of federal income tax brackets and Medicare IRMMA drives initial construction. Space did not permit the additional considerations required for state income taxation and associated tax brackets.

Prior to implementing any decumulation strategy, advice should be coordinated with clients’ tax advisers to ensure income thresholds for federal tax and IRMMA will not be exceeded. Clients who hold TA investments in ETFs and mutual funds that can release surprising capital gains toward the end of the year present additional challenges when recording income received with existing brackets. Some implementation decisions may need to be delayed until the end of Q4.

Decumulation strategies require annual planning. Beyond the obvious complexities of incorporating the research from Geisler et al. (2021) and derived planning thoughts, planners are challenged with changes to the IRC, evolving client goals and desires, unknown longevity, unknown investment results, and uncertain inflation to name a few. While serving as a fiduciary is priority one, a fine byproduct of the complexities of sound decumulation planning is amplification of the value financial planners will provide on an annual basis to their clients.

Finally, this paper is an ongoing development of considerations for decumulation planning. Discussion of and challenges to these broad planning concepts are welcomed to improve advice for a wide body of clients. As this paper ages, readers are strongly encouraged to seek more recent research and theorization that may be available.

References

Geisler, Greg, Bill Harden, and David S. Hulse. 2021. “A Comparison of the Tax Efficiency of Decumulation Strategies.” Journal of Financial Planning 34 (3): 72–89.

Klontz, Brad, and Ted Klontz. 2009. Mind Over Money: Overcoming the Money Disorders That Threaten our Financial Health. New York: Broadway Business.