Journal of Financial Planning: November 2020

Kyoung Tae Kim, Ph.D., is an associate professor in the Department of Consumer Sciences at the University of Alabama.

Travis P. Mountain, Ph.D., is an assistant professor in the Department of Agricultural and Applied Economics at Virginia Tech University.

Sherman D. Hanna, Ph.D., is a professor in the Department of Human Sciences at The Ohio State University.

Namhoon Kim, Ph.D., is a junior research fellow at the Korea Rural Economic Institute.

Editor’s note: This article is a shortened version of the authors’ research originally published in Financial Services Review. The Journal of Financial Planning republishes, with permission, shortened versions of research originally published in Financial Services Review as part of a partnership between FPA and the Academy of Financial Services to bring relevant research from Financial Services Review to Journal readers. The original version published in Volume 28, No. 1 of Financial Services Review may be found in the Journal’s digital archives. Financial Services Review retains all copyrights to this published research.

Life insurance is an important component of risk management and insurance planning, and is also important in other financial planning issues, including employee benefits, income tax planning, and estate planning.

But the importance of life insurance seems to be decreasing in terms of ownership rates, and the relative number of life insurance agents.1 Also, in the list of principal knowledge topics for the CFP® exam, the weight for risk management and insurance decreased from 14 percent (Hanna et al. 2011) to 12 percent.2

A Wall Street Journal article3 suggested that due to consolidation and decreasing ownership rates, the life insurance agent may be going the way of the dinosaur. However, life insurance is still a vital safety net for U.S. households. The premature death of a wage-earner is one of the more serious financial risks a household faces. Income replacement and burial expenses are the top two reasons households own life insurance.4

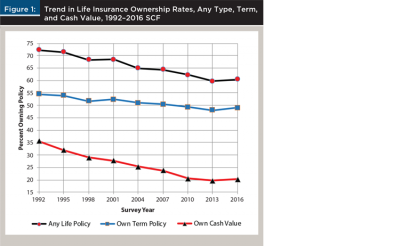

The main purpose of our research was to determine what factors contributed to the decline of life insurance ownership among U.S. households. We analyzed a combination of 1992 to 2016 Survey of Consumer Finances (SCF) datasets and found that ownership of life insurance decreased until 2013 and then stayed about the same in 2016. We analyzed the extent to which changes in the composition of U.S. households might have contributed to the decreases in any term and cash value life insurance and investigated the role of financial planner use. Figure 1 displays the historical downward trend in life insurance ownership. The proportion of households owning some type of life insurance peaked at 72 percent in 1992 and reached a low of 60 percent in 2013. Both term and cash value ownership had similar downward trends.

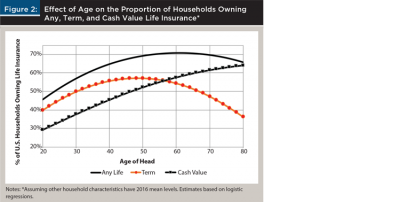

Logistic regression results of the likelihood of three different types of life insurance ownership from the 1992–2016 SCF dataset, controlling for various household characteristics, indicated there was a negative relationship between the survey year and the likelihood of life insurance ownership for any life insurance and cash value life insurance. However, the relationship was not significant for term life insurance ownership. The combined effect of the age variables implies that at the 2016 mean values of other independent variables, the likelihood of owning any life insurance increased with age until age 61, then decreased with age; ownership of term life insurance increased with age until age 48, then decreased with age; and ownership of cash value life insurance increased with age for all ages in the sample. Figure 2 shows the calculated relationship between age of the head and the likelihood of ownership of each type of life insurance.

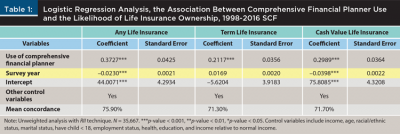

Additional regression results indicated that the utilization of a comprehensive financial planner was positively associated with ownership of any, term, and cash value life insurance policies (See Table 1). In particular, households that used a comprehensive financial planner had 45.2 percent higher odds of owning any life insurance, and 24 percent and 35 percent higher odds for term and cash value policies, than those that did not use a financial planner.

The effect of the time trend in the logistic regression means that even if the characteristics of households in the U.S. had not changed between 1992 and 2016, there would have been a substantial decrease in ownership of any life insurance and of cash value life insurance during that period. However, the ownership of term life insurance might not have decreased if household characteristics had not changed. Insuring human wealth is an appropriate life insurance objective (Chen, Ibbotson, Milevsky, and Zhu 2006) but even at the current ownership rates, the amount of life insurance is not enough to replace lost human wealth for many households (Mountain 2015). While the cash value policy decline may reflect rational decision-making due to changes in tax laws and the increase in tax advantaged investment options, these patterns could change with changes in the federal income tax and with any substantial changes in the federal estate tax.

If the ownership rates continue to decline, more and more families will face financial hardship and economic distress if a spouse or partner dies prematurely. In terms of the potential benefits of financial planning advice based on normative economic models, risk management is an important component of the value of advice (Hanna and Lindamood 2010), and for many families, life insurance still should be a salient component of a financial plan. Financial planners and educators can better inform their clients and the population as to the merits of life insurance. Additionally, alternative products, adjustments to the current life insurance products, or additional saving will need to fill the void of the disappearing life insurance.

Given our conclusion that the decreases in ownership of any life insurance and in ownership of cash value life insurance were not due to changes in household characteristics between 1992 and 2016, it is plausible that future changes in federal income tax and estate tax policies could lead to future increases in life insurance ownership. For example, proposed increases in federal income tax rates might make cash value life insurance more attractive. Even if no near-term tax legislation is passed, most individual income tax changes in the Tax Cuts and Jobs Act of 2017 are due to sunset January 1, 2026. The increases in income tax rates might nudge households to reconsider cash value life insurance policies.

Endnotes

- See The Wall Street Journal article by Leslie Scism, “Death of the Insurance Salesman at MetLife,” available at www.wsj.com/articles/in-end-of-an-era-metlife-looks-to-part-with-insurance-agents-1456399695?mod=rss_Health.

- See the 2015 Principal Knowledge Topics from CFP Board available at www.cfp.net/become-a-cfp-professional/2015-job-task-analysis/2015-principal-knowledge-topics.

- See endnote No. 1.

- See the 2015 Insurance Barometer Study from LIMRA and Life Happens. Available at www.orgcorp.com/wp-content/uploads/2015-Insurance-Barometer.pdf.

References

Chen, Peng, Roger G. Ibbotson, Moshe A. Milevsky, and Kevin X. Zhu. 2006. “Human Capital, Asset Allocation, and Life Insurance.” Financial Analysts Journal 62 (1): 97–109.

Hanna, Sherman D., and Suzanne Lindamood. 2010. “Quantifying the Economic Benefits of Personal Financial Planning.” Financial Services Review 19 (2): 111–127.

Hanna, Sherman D., HoJun Ji, Jonghee Lee, Jiyeon Son, Jodi Letkiewicz, HanNa Lim, and Lishu Zhang. “Content Analysis of Financial Services Review.” Financial Services Review 20 (3): 237–251.

Kim, Kyoung Tae, Travis P. Mountain, Sherman D. Hanna, and Namhoon Kim. 2020. “The Decrease in Life Insurance Ownership: Implications for Financial Planning.” Financial Services Review 28 (1): 1–16.

Mountain, Travis P. 2015. Life Insurance and Financial Vulnerability. Ph.D. dissertation, The Ohio State University.