Journal of Financial Planning: November 2018

Financial life planning is at its best and most effective when a planner facilitates a defined process on behalf of a motivated and fully engaged client. However, before the client reaches the level of trust and comfort needed for a high-quality engagement, he or she instinctually assumes, ascribes, and expects a certain set of traits and behaviors from the planner. Those client assumptions are based on a range of factors tied to the client’s personal history and to the many potential roles that can be filled by a financial life planner. The overarching role, however, is being a leader. As John Quincy Adams is credited as saying, “If your actions inspire others to dream more, learn more, do more, and become more, you are a leader.”

Based on that perspective and recent research1, recognizing the leadership role and its accompanying responsibilities is a major step toward creating better financial planners and more effective and impactful planning engagements. Understanding the leadership requirements inherent in a financial planning engagement provides a basis by which planners can personally benchmark their leadership capabilities. With that knowledge, planners can endeavor to improve their leadership capabilities and increase their effectiveness.

This article will review the interplay between the status and roles of a financial planner, along with a review of the leadership theories and accompanying characteristics that can be directly applied to the practice of a financial life planner.

The Many Roles of a Financial Life Planner

The concept of role theory is that we carry with us many statuses at one time; for example—being a father, son, spouse, friend, and financial planner. Some of those statuses are given to us, such as being a son. Others are achieved or worked for, such as spouse or financial planner.

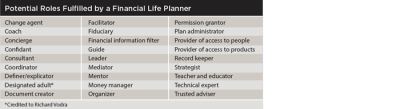

Each status is accompanied by many potential roles, and each role has with it an associated set of rights, duties, expectations, and behaviors. Consider all the roles of being a financial planner (see the table above), while understanding the planner is first and foremost a leader, with the other roles all being second.

The misunderstanding of being a leader first leads to frustration—or in role theory terms, “role strain”—for some planners. Role strain is the sum of conflicting difficulties a person experiences in all their roles. Consider the issue of holding the roles of money manager, trusted adviser, and fiduciary, and how strain occurs due to a lack of clarity and even disagreement on what is expected in each role.

Strain can also occur because of the competition and conflict between roles. In those situations, understanding one’s master status and role as a leader provides a level of clarity through the lens of a set of leadership characteristics that can be followed throughout the relationship and engagement.

Applicable Leadership Theories

The academic field of leadership has embraced a number of theories to explain the concept and practice of leadership. Most theories are grounded in either leadership as a process or relationship, a combination of traits or characteristics, or as certain behaviors and/or skills. In the role of financial life planner, lessons can be drawn from four distinct leadership theories:

Adaptive leadership (AL) is rooted in mobilizing people through a sustained period of disequilibrium, for them to tackle tough challenges and thrive.2 The iterative and evolving process involves three steps: (1) observing events and patterns; (2) interpreting what is being observed; and (3) designing interventions based on those observations.

Ultimately, AL is built on authenticity and transparent communication, and is grounded in the belief that excellence is within everyone. The collaborative task brought about by asking questions no one else is willing to ask, and seeking truth, then becomes to discover the answers needed to bring about change that enables the capacity to thrive.

Authentic leadership (AUL) may be thought of as a metaphor for professionally effective, ethically sound, and consciously reflective practices. It is knowledge based and values informed.3 The four components are: (1) self-awareness; (2) an internalized moral perspective; (3) balanced processing; and (4) relational transparency (being open and honest in presenting one’s true self to others). Authentic leaders lead with the head and the heart, have a passion for work, and a compassion for people.4

Servant leadership (SL) is both a philosophy and a set of practices. Servant leaders seek to draw out, inspire, and develop the best and highest within people from the inside out, and have a natural feeling of wanting to serve that manifests itself in the care taken by the servant to make sure other people’s highest-priority needs are being served. The best test of SL is “Do those served grow as persons; do they, while being served, become healthier, wiser, freer, more autonomous, and more likely themselves to become servants?”5

Transformational leadership (TL) is based on the capacity to develop and promote values and goals. Success comes from the ability to encourage followers to rise above low-level transactional considerations and instead pursue a higher-order sense of morality and purpose.6 TL is concerned with emotions, values, standards, ethics, and long-term goals.

TL includes four factors: (1) idealized influence: provides vision and sense of mission, instills pride, gains respect and trust; (2) inspirational motivation: communicates high expectations and inspires by being committed to a vision; (3) individualized consideration: provides a supportive climate and a genuine concern for individual needs; and (4) intellectual stimulation: stimulates followers to be creative and innovative, to challenge their own beliefs and values, and challenges them to aspire to higher levels of performance.

Leadership Characteristics and Qualities

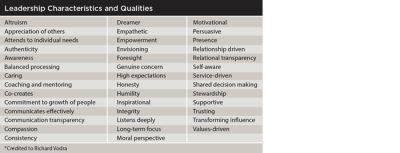

Within the leadership theories described are a core set of characteristics that define a leader, regardless of the leadership setting (see the table below).

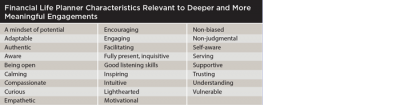

They contain within them traits that have been identified through research as key components to successfully creating financial life planning engagements that are steeped in deeper and more meaningful conversations. More specifically, it was found that the planner’s way-of-being, using a defined process, spiritual intelligence, specific set of actions and skills, and consideration of the space where the planning engagement was taking place accounted for a heightened planning experience for both the client and the planner.7 The table below shows a sampling of the planner characteristics identified from the research.

Based on the considerable overlap between the two tables, one can see the characteristics of a planner serving in the role of a leader also supports many of the planner qualities leading to a heightened and more effective financial life planning engagement.

Creating a Personal Leadership Assessment

The leadership characteristics described help define that which is essential to be a planning professional who facilitates an inspired financial planning8 experience. The message is clear, as you sit across the table from a client, you are expected to be the leader of the relationship. As I shared in my 2008 book, What Your Happiest Friends Already Know: The Ultimate Guide to Connecting Your Money and Values with Your Life, from this newly identified position, you can help clients be free from financial stress and worry, so they are then able to focus on creating and living happier, more inspired purpose-driven lives. Given that lofty goal, the next step for a financial planning professional is to commit to learning how to become a better leader.

Becoming a better leader begins with a personal assessment of your leadership capabilities. While many assessments exist to help with this endeavor, here is a simpler approach: use the list in the table of leadership characteristics and qualities to create an assessment. List each characteristic; use a one-to-five Likert scale with one being “no” or “never,” and five being “yes” or “always” and ask yourself (and your clients if you dare): at what level do I/you display that characteristic within the confines of a planning engagement? Note the scores, paying attention to the areas you feel the most urgency to improve. Then let the work begin.

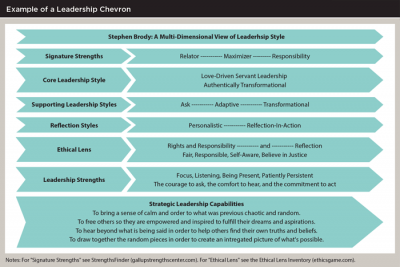

As an added goal, I suggest developing a personal leadership chevron that can be used to identify leadership strengths and capabilities (see the example below). The tool evolves over time as you grow and develop, and can serve as a pillar underpinning ones’ professional foundation.

In closing, four questions remain:

- As a professional and someone whose clients are depending on you to take them from where they are to where they hope to be, what kind of leader are you?

- Will you take the time to work as hard on being a leader as any true financial professional works on remaining technically competent?

- When your clients look across the table, will your actions instill in them the faith and trust that is needed for them to engage in the deeper and more meaningful conversations that lead to a more impactful financial life planning engagement?

- Are you being the type of leader that you would want to work with those you love?

I urge you to answer the questions, then compare the answers to who you hope to be as a planner. Lastly, begin to consciously move in the direction of who you have the potential to be, and of doing the work you were put here to do.

Endnotes

- See Stephen Brody’s 2016 doctoral dissertation, “Assessing Spirituality in Financial Life Planning” at hdl.handle.net/10504/108224, and his March 2018 Journal article, “Understanding the Role of Spirituality in Financial Life Planning”.

- See the 2009 book The Practice of Adaptive Leadership: Tools and Tactics for Changing Your Organization and the World, by Ronald A. Heifetz, Alexander Grashow, and Marty Linsky (Harvard Business Press).

- See the 2001 article “In Pursuit of Authentic School Leadership Practices” by Paul T. Begley in the International Journal of Leadership in Education, volume 4, issue 4, pages 353–365.

- See the 2003 book Authentic Leadership: Rediscovering the Secrets to Creating Lasting Value by Bill George (Jossey-Bass).

- See the 1970 essay “The Servant as Leader” by Robert Greenleaf (Paulist Press).

- See the 2010 book The New Psychology of Leadership: Identity, Influence, and Power by S. Alexander Haslam, Stephen D. Reicher, and Michael J. Platow (Psychology Press).

- See endnote No. 1.

- See endnote No. 1.

Stephen C. Brody, CFP®, ChFC®, RLP®, EdD, has been a practicing financial life planner for 31 years. He is the creator of Inspired Financial Planning, a model for facilitating deeper and more meaningful client conversations. He is an author, financial educator, and mentor to rising financial life planners.