Journal of Financial Planning: November 2015

Matt Hougan is president of ETF.com, where he oversees the company’s editorial, data and analytics efforts, and conferences.

These are wild times for the market. As I write this column, the MSCI Emerging Markets Index is trading at a six-year low. If you bought emerging markets exposure at any time this decade, you’ve lost money.

As an investor, this hurts. But there are easy ways to turn market lemons into lemonade, following a few simple rules.

Step 1: Find cheaper funds. When the market pulls back, evaluate your portfolio to see if you are still invested in the best, lowest-cost fund.

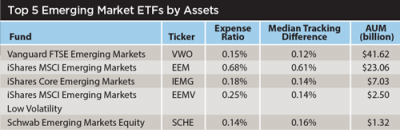

One of the largest emerging markets ETFs in the world, the iShares MSCI Emerging Markets ETF (EEM), has more than $23 billion in assets under management, but consider the expenses and tracking performance of the most popular broad-based emerging markets ETFs (see the table).

EEM stands out like a sore thumb. If the $23 billion invested in EEM switched over to SCHE, investors would save $125 million per year in fees.

You may or may not want to pick SCHE. The index SCHE tracks exclude South Korea as an emerging market, while that country is the second largest holding in EEM. But if you love Korean exposure, why not switch to IEMG, which has a portfolio nearly identical to EEM? In fact, IEMG has a better portfolio than its much larger peer, since it includes small cap stocks that are excluded from EEM. It just charges about one-quarter as much for the privilege.

A lot of the money invested in EEM has been invested in it for years. If that money is in a taxable account, investors have been trapped; they couldn’t sell and switch into a lower-cost fund, because they would realize significant capital gains. With emerging markets scraping a six-year low, investors have a unique opportunity to switch without tithing to the tax man.

Step 2: Harvest losses. With more than 1,700 ETFs available, it is easy to sell out of one fund, harvest the losses, and buy a competing product that provides similar (but not identical) exposure.

Using the example above, if you hold an emerging markets ETF that is trading down, you can swap into any of the competing funds and make out just fine. Over the past month, if you exclude the minimum volatility ETF, the four funds mentioned above returned within 0.5 percent of one another. Tax-loss harvesting rules allow you to swap back into your preferred product after 30 days, or you can stick with your new exposure going forward.

Step 3: Stick to your rebalancing schedule, but not necessarily for the reason you usually do so. Traditionally, rebalancing your portfolio is a way to keep your risk tolerance in check. But when risky areas like emerging markets are suffering, rebalancing helps keep enough growth and risk in your portfolio.

Emerging market stocks are inherently volatile. If you look at the long-term returns for EEM, the longest-running emerging markets ETF, you’ll see periods of massive increases and also massive pullbacks, but the long-term outlook remains strong. In its recently released 10-year forecast of asset class returns, PIMCO ranked emerging markets first among all asset classes, with a forecast 7.55 percent annualized return, compared to 4.50 percent for U.S. equities and 5.25 percent for Europe.

Emerging markets now make up 6 to 7 percent of the MSCI ACWI Index, but account for more than half of global GDP on a purchasing power parity basis. Your allocation should probably lie somewhere between that for your equity sleeve.