Journal of Financial Planning: May 2015

Vivek K. Pandey, DBA, CFA, FRM, is a professor of finance at the University of Texas at Tyler. He received his doctorate in finance from Mississippi State University.

Chen Y. Wu, Ph.D., is an assistant professor of finance at the University of Texas at Tyler. He received a bachelor’s and a master’s degree in engineering from the University of California, Berkley. He also holds a master’s degree and a doctorate degree in finance from Carnegie Mellon University and Arizona State University, respectively.

Executive Summary

- High frequency trading (HFT) provides infrastructure for trading at speeds unimaginable only a decade ago. It marks an evolution in the brokerage industry.

Using high speed infrastructure and special, but opaque, relationships with some exchanges, some high frequency traders (HFTs) are able to glean order flow information ahead of other traders and profit from it. - The current arrangement is beneficial for HFTs and exchanges, but detrimental for investors. Stock exchanges are under pressure from regulators and pending lawsuits to modify their behavior.

- A relatively new stock exchange, IEX, has taken the lead in devising a system that denies preferential access to any trader (including HFTs) by providing an order routing system that eliminates the time lags between when an order reaches various exchanges. This is changing the incentive structure for stock exchanges and many may change their behavior in the future.

- In the meantime, to preserve the wealth of their clients, financial planners are advised to route large orders through IEX. IEX maintains a publicly available list of participating brokers and dealers. Small orders need not be routed through IEX, but one must take the precaution of using limit orders at the quoted bid or ask price.

In the 2014 book Flash Boys: A Wall Street Revolt, author Michael Lewis brought the actions of many high frequency traders (HFTs) to attention. This has since sparked a debate in the media and in financial circles regarding the usefulness of high frequency trading (HFT). (For clarification, throughout this manuscript, high frequency traders are referred to as HFTs while the practice of high frequency trading is referenced as HFT.)

Proponents of high frequency trading tout the technique as being important in providing enhanced liquidity and efficiency to financial markets. Opponents regard HFTs as an unnecessary tax on an already efficient market where they tack on the expense associated with an extra layer of middlemen.

In his book, Lewis highlighted some unethical practices in the HFT industry that result from HFTs collusion with some stock exchanges (and dark pools) that grant these HFTs preferential access to their order books. Some exchanges have special order types that allow traders to remain on top of the order queue at all times. Others may flash their order flows to HFTs a few microseconds (Lewis noted that the blink of an eye reportedly takes 100 milliseconds or 100,000 microseconds) before making it available to other traders.

HFTs do not bear the responsibility of making the markets, and as a result, they are able to post and cancel orders thousands of times in a given day. Joubert (2014) stated, “I agree that market manipulation is unethical, but HFT is not the devil, it is the use of high frequency tactics in unethical practices … ."

HFT provides the infrastructure for trading at speeds unimaginable only a decade ago. However, the problem is not in the speed. As Dick (2014) explained, “The real advantages aren’t reliant on speed at all. The real advantages are built on relationships. And this is where the market starts to get ‘shady’” (p. 14).

Making Markets More Efficient?

HFT does represent an evolution in the marketplace. Given the competitive advantages it provides compared to traditional trading, HFT is likely here to stay. The larger issue at debate is whether it is useful in making markets more efficient and liquid. Nanex Research (2014) reported that the National Best Bid and Offer (NBBO) spreads have not narrowed since the Regulation National Market System (Reg NMS) was legislated in 2007 in an effort to promote fair price competition across securities markets.

Lewis (2014) explained that front-running of large institutional orders by HFTs was made possible as an unintended consequence of Reg NMS. Instead, NBBOs have simply become less stable. Hence, it is possible that the appearance of enhanced liquidity in the marketplace is illusionary.

Cartea and Penalva (2012, p. 1,401) demonstrated that although the intermediation of trades provided by HFTs increases the volume of trades, this additional volume is caused by “… trades carefully tailored for surplus extraction and are neither driven by fundamentals nor is it noise trading."

In a recent study sponsored by the U.S. Commodities and Futures Trading Commission, Raman, Robe, and Yadav (2014) observed that in futures markets, the anonymity provided by electronic trading to HFTs makes them behave much like fair weather friends only. They tend to withdraw from market making activities during times of high volatility, high order imbalances, and high bid-ask spreads. This tends to reduce market liquidity when it is much needed.

Hendershott, Jones, and Menkveld (2011) attributed HFT with making markets more informationally efficient with narrower spreads and improved liquidity. Cumming, Zhan, and Aitken (2012) attributed HFT with demonstrably lower end-of-day price dislocation (deviation from fundamentals), especially on days when it is more likely to occur due to manipulation, such as on options expiration dates.

Understanding the Downside

The perceived usefulness of HFT is not uncontested, however. The ability of HFTs to place and cancel thousands of orders at high speeds has created instability in NBBO spreads (Nanex Research 2014). Cartea and Penalva (2012) demonstrated that other traders’ reactions to HFT practices have the net effect of raising (lowering) the purchase (sale) price to investors. Raman et al. (2014) and Clark-Joseph (2013) contended that HFTs introduce fleeting and spurious liquidity to the markets by not bearing market making responsibility.

The HFT infrastructure also has the potential to be misused. Some HFTs engage in questionable practices, often assisted by preferred access granted to them by some public and private exchanges. This leaves the retail investor at a disadvantage, often bearing higher trading costs by not obtaining the best price execution. The following is a list of what many would agree are questionable practices:

Some HFTs place and cancel thousands of small orders a day to tease information about order flows from public and private exchanges. Then they use this information to profit by front-running larger orders (Lewis 2014). This is possible because a large institutional order— broken into smaller lots and routed to several stock exchanges—reach different exchanges at different times, if only a few milliseconds apart.

Some public and private exchanges provide HFTs with preferential access either by flashing their order flows to them before other investors and/or allowing them to stay on top of the order queue with special order types (Dick 2014; Lewis 2014).

The current arrangement allows some proprietary HFTs to pursue market manipulating strategies that were traditionally prohibited, as well as some new questionable strategies made possible by the HFT infrastructure, according to a Mayer Brown Legal Update (De Simone, Roche, and Rossi 2014).

Some of the more common forms of market manipulation strategies described by De Simone et al. include:

“Spoofing and layering,” involves entering multiple non-bona fide orders at generally increasing (decreasing) prices in order to create a false sense of market activity and to move a stock’s price where the trader intends to induce others to buy (sell) at a price altered by the non bona-fide orders.

“Marking the close,” involves placement and execution of orders moments before the close of a trading day to artificially affect the closing price of a security.

“Painting the tape,” involves placement of multiple successive small buy orders to simulate demand.

“Quote stuffing,” involves flooding the market with a large number of orders and cancellations in rapid succession, thereby generating a large number of new best bids and offers, each lasting just microseconds. This is a form of market manipulation usually designed to trick market participants and compromise informed decisions on their part.

“Order fade” or “price fade” is uniquely a HFT practice that involves rapid cancellation of orders in response to other trades. This results in the disappearance of volume from an exchange after the execution of one trade.

Resulting Equilibrium

Given current incentives, many exchanges find it profitable to provide preferred access to HFTs. Some HFTs are glad to pay for their preferred access, and in fact, demand such access because it allows them to generate enormous profits. Lewis (2014) reported that in 2008 the CEO of one HFT firm told some university students that his firm had gone four years without a single day of trading losses.

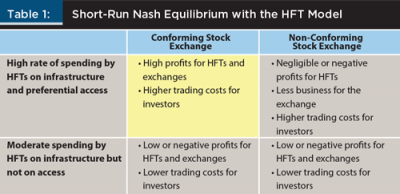

The opacity of the relationship arrangements between HFTs and stock exchanges (both public and private) results in high profits for exchanges that provide preferential access to HFTs (conforming stock exchange). Non-conforming exchanges see less business. The resulting equilibrium results in higher trading costs for investors, as they do not get their trades executed at the best price.

Table 1 shows the short-run Nash equilibrium (yellow shaded box) given the current arrangements in the stock markets. In game theory, a Nash equilibrium refers to a solution where two or more players, with full knowledge of equilibrium strategies of other players, see no benefit to switching their strategy. Here, HFTs and conforming stock exchanges gain, while investors, lacking other options, are stuck bearing higher trading costs.

The Long-Run Scenario

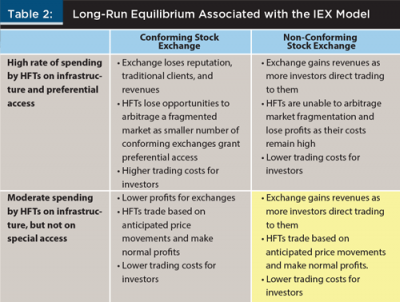

Game theory literature asserts that opportunistic behavior has limited rewards in the long term over iterated games (Hill 1990). This is because reputation has economic value. According to Hill, “… the value created by exchanges involving actors of questionable reputation is significantly reduced by the need to set up safeguards to limit opportunism” (p. 505).

Crawford (1997) introduced an adaptive learning model where sophisticated players may take adaptive actions in a dynamic setting. While equilibrium in a single stage of a game may be dominated by opportunistic behavior, it may not be consistent with the equilibrium in a repeated set of identical games. In the present context, the opportunistic behavior and the collusion between some exchanges and some HFTs could start to yield lower economic value over repeated iterations as informed investors take adaptive actions.

With reputation at stake, the pressure on exchanges and HFTs has been mounting. Raman et al. (2014), in their study sponsored by the U.S. Commodities and Futures Trading Commission, suggested that exchanges and regulators should consider requiring some market-making obligations from HFTs. Some conforming exchanges are already under legal scrutiny. Several class action lawsuits are currently underway filed by private plaintiffs against HFT firms as well as against stock and commodities exchanges (De Simone et al. 2014).

Regulators have also stepped up their scrutiny of HFT practices. The Securities and Exchange Commission (SEC), the U.S. Commodities and Futures Trading Commission, the Federal Bureau of Investigation, and the New York Attorney General’s office have all recently indicated that they are investigating practices used by HFTs and exchanges.

On May 1, 2014, the SEC penalized the New York Stock Exchange for a number of violations that included the manner in which it offered “co-location” services (De Simone et al. 2014). Co-location services are primarily used by HFTs. On October 16, 2014, Athena Capital Research LLC agreed to pay $1 million to settle an SEC administrative charge without admitting or denying any guilt (Rossi, Deis, Roche, and Przywara 2014). The firm had been accused of using high frequency algorithms for price manipulation in its favor.

It is important to note that current SEC regulations do not prevent exchanges from offering co-location and direct data feed services. Reg NMS, however, prohibits exchanges from independently transmitting their own data to anyone sooner than they transmit it to a data processor for inclusion in the consolidated tape. The process of consolidating data from multiple exchanges has the potential to introduce a time lag between when market participants see an individual exchange’s data feed and when they see the consolidated tape. In an April 2014 Congressional testimony, SEC Chair Mary Jo White asserted that changing bids on the basis of an exchange data feed approved by the SEC did not constitute insider trading “if properly used” (De Simone et al. 2014). This may give HFTs a legal argument that market information based on co-location and direct data feeds is public information. However, various forms of market manipulation by HFTs and other forms of collusion with exchanges still remain under legal scrutiny by several regulatory bodies.

The SEC has been called on to enact new laws to combat the ills of HFT. On November 19, 2014, the SEC enacted Regulation Systems Compliance and Integrity (Regulation SCI) to improve the market system’s security and the integrity of the securities markets’ infrastructure, including those used by HFTs (SEC 2014). However, these rules are largely intended to minimize the impact of systems failure on securities markets. At this time, it appears that the SEC does not intend to enact separate laws to address the improprieties involving HFT. The SEC intends to conduct a holistic review of problems in broader securities markets and, sometime next year, it hopes to introduce rules intended to protect investors from predatory trading practices (VerHage and Gasparino 2014).

Changing the Game: An Emerging Solution

As Dick (2014) asserted, it is not trading at high speeds but rather trading with special relationships (between HFTs and exchanges) that poses a threat to retail investors. Lewis (2014) chronicled the evolution of IEX, which has devised a system that does not grant special access to any trader. IEX is able to route orders to multiple exchanges simultaneously in order to avoid front-running in a fragmented marketplace.

IEX was established by a group of people led by Brad Katsuyama, who, while working with the equities trading group at Royal Bank of Canada, was concerned that a large number of his orders went unfilled at posted prices. His team discovered how some HFTs were using their high-speed infrastructure and privileged access to exchanges to front-run client orders. In response, the team created IEX, a non-conforming exchange in that it does not conform to demands by HFTs. Among IEX’s clients are some well-known institutional investors, such as Goldman Sachs, Morgan Stanley, and Credit Suisse.

For orders routed through IEX, HFTs can still trade at high speeds and anticipate price movements, but they are unable to glean order flows before other traders. Nor are they able to glean information from quotes at one exchange a few microseconds before that quote appears on another exchange. Rather than allowing HFTs to dictate the terms of the arrangements, the exchange moves first in denying them preferred access. This changes the outcome of the dynamic game.

Reputation can prove potent in trust-based institutions and financial markets. Over the long term, other exchanges may need to emulate the non-conforming (with HFTs) attitude adopted by IEX or lose business. Table 2 demonstrates this long-run outcome in the yellow shaded box.

What Should Financial Planners Do?

The current dysfunction in financial markets should not affect financial planning for most individual client situations. However, high net worth and institutional clients could lose much to rents extracted by HFTs if they are not vigilant. The following guidelines can assist financial planners in preserving the wealth of their clients:

If a client’s stock market investments are limited to large company domestic stocks, HFTs have only made the markets more efficient (Hendershott et al. 2011). Even so, small orders should only be placed using a limit order at the posted bid and ask quotes. Most 100-share orders do get filled at posted quotes. Even as HFTs scour various exchanges to detect large order flows, they do end up filling some small orders as they stay ahead of the queue.

Clients interested in small company stocks should exercise just as much caution by only using limit orders at posted quotes. This is because even relatively small orders can cause significant order imbalances in order flows.

Individual and institutional clients placing large orders should ask their brokers to route their trades through IEX. IEX maintains a list of retail and institutional brokers connected to their trading platform on its website (www.iextrading.com/services/#subscribers).

In due course, more exchanges are likely to adopt non-conforming standards, giving all retail investors and their advisers more options. Conforming exchanges will lose revenue as more orders are routed to non-conforming exchanges.

Over time, as suggested by Raman et al. (2014), HFTs may also be tasked by regulators to provide some mandatory market-making activity, reducing their ability to cut and run when market liquidity is most needed, such as during times of high volatility.

References

Cartea, Álvaro, and José Penalva. 2012. “Where Is the Value in High Frequency Trading?” Quarterly Journal of Finance 2 (3): 1401–1446.

Clark-Joseph, Adam D. 2013. “Exploratory Trading.” Unpublished paper. Cambridge, Mass: Harvard. www.nanex.net/aqck2/4136/exploratorytrading.pdf.

Crawford, Vincent P. 1997. “Theory and Experiment in the Analysis of Strategic Interaction.” In Advances in Economics and Econometrics: Theory and Applications, Seventh World Congress, edited by David Kreps and Kenneth Wallis 206–242. New York: Cambridge University Press.

Cumming, Douglas J., Feng Zhan, and Michael J Aitken. 2012. “High Frequency Trading and End-of-Day Price Dislocation.” Social Science Research Network working paper.

De Simone, Joseph, Jerome J. Roche, and Matthew Rossi. 2014. “Increased Public and Private Scrutiny of High-Frequency Trading.” Mayer Brown Legal Update, May 14. www.mayerbrown.com.

Dick, Dennis. 2014. “In the Dark: The Latest Hype about High-Frequency Trading Overlooks Deeper Problems.” CFA Institute Magazine 25 (3): 14–15.

Hendershott, Terrence, Charles M. Jones, and Albert J. Menkveld. 2011. “Does Algorithmic Trading Improve Liquidity?” The Journal of Finance 66 (1): 1–33.

Hill, Charles W. L. 1990. “Cooperation, Opportunism, and the Invisible Hand: Implications for Transaction Cost Theory.” Academy of Management Review 15 (3): 500–513.

Joubert, Jacques. 2014. “Resistance to High Frequency Trading (HFT) Strategies,” The South African Financial Markets Journal, May. financialmarketsjournal.co.za.

Lewis, Michael. 2014. Flash Boys: A Wall Street Revolt. New York: W. W. Norton & Company.

Nanex Research. 2014. “The Tighter Spreads Lie.” www.nanex.net/aqck/2805.html.

Raman, Vikas, Michel A. Robe, and Pradeep K. Yadav. 2014. “Electronic Market Makers, Trader Anonymity, and Market Fragility.” Social Science Research Network working paper.

Rossi, Matthew J., Gregory Deis, Jerome J. Roche, and Kathleen M. Przywara. 2014. “U.S. SEC Brings First Enforcement Action for Market Manipulation Through High-Frequency Trading.” Mayer Brown Legal Update, October 23. www.mayerbrown.com.

SEC. 2014. “SEC Adopts Rules to Improve System Compliance and Integrity.” Securities and Exchange Commission Press Release, November 19. www.sec.gov.

VerHage, Julie, and Charlie Gasparino. 2014. “SEC Likely Won’t Enact Stand-Alone High-Frequency Trading Rules.” Fox Business News, October 23. www.foxbusiness.com/economy-policy/2014/10/23/sec-likely-wont-enact-stand-alone-h8igh-frequency-trading-rules.

Citation

Pandey, Vivek, and Chen Wu. 2015. “Investors May Take Heart: A Game Theoretic View of High Frequency Trading.” Journal of Financial Planning 28 (5) 53–57.