JOURNAL OF FINANCIAL PLANNING: MARCH 2021

Ross A. Riskin, DBA, CPA/PFS, CCFC, is an associate professor of taxation and the director of the CFP® and ChFC® programs at the American College of Financial Services. His research and professional expertise are focused on tax planning with respect to college and student loan advising.

NOTE: Click or tap on Figures and Tables below for PDF of the image.

VIDEO: Click or tap below for a YouTube video introduction by the author.

While higher education costs continue to increase, so does the complexity surrounding funding and financing these costs for clients. The good news is that parents and students have access to many different savings vehicles, some of which are specifically designed to fund education-related goals and provide significant tax advantages, such as Coverdell Education Savings Accounts (CESAs) and Qualified Tuition Programs (529 College Savings Plans). Additionally, different financing options are provided by both the federal government and private lenders to students as well as parents. According to a 2019 report from Sallie Mae and Ipsos, 66 percent of families relied on parent income and savings, 65 percent of families relied on student income and savings, 82 percent of families relied on grants and scholarships, 21 percent of families relied on parent borrowing, and 38 percent of families relied on student borrowing to help pay for higher education costs.1

While the majority of non-borrowed funding from both parents and students in their study came from current income, it is clear that families and students utilized other funding vehicles designed for education-related uses such as college savings plans (21 percent of families in 2019)2—along with those that are not traditionally intended for education-related uses such as retirement savings withdrawals (9 percent of families in 2019).

Similarly, when looking at borrowed sources, 35 percent of students used federal student loans and 11 percent of parents used federal PLUS loans, which are designed to cover education-related costs. Seven percent used credit cards, and four percent used retirement account loans to cover education-related costs. While student loans continue to be a hot topic from economic, political, and social perspectives, and recent research has focused on the individual outcomes and macroeconomic effects of student borrowers, this report focuses on a different group of borrowers: parent borrowers—specifically, parent PLUS loan borrowers. After providing a primer and exploring recent trends related to this type of education debt, this report will focus on what advisers need to be aware of when working with parents, regardless of financial status, who wish to borrow to pay for higher education costs.

A Primer on Parent PLUS Loans

In 1980, the federal government introduced the Parent Loans for Undergraduate Students (PLUS) program a program designed to increase access to financing for less affluent families looking to support their children in paying for college costs. When originally introduced, borrowers could not borrow more than $4,000 per year, with an aggregate cap of $20,000, but the lending cap was greatly relaxed by Congress in 1992. Although there were—and still are—limits in place, arbitrarily chosen annual and aggregate borrowing caps, such as the ones that apply to undergraduate student loan borrowers,3 no longer exist. Instead, the amount parents can borrow is now limited to the cost of attendance (COA) for the school, less any aid the student receives. For example, if a freshman student is admitted to a school that costs $60,000 and he or she only qualifies for a federal direct unsubsidized loan in the amount of $5,500, the parent of the student can borrow the remaining $54,500 through the federal parent PLUS loan program. Even though the federal government currently acts as the lender of PLUS loans, prior to 2010 parents and graduate students could borrow directly from the federal government through the Direct Loan Program. The federal government also worked in tandem with the private sector and allowed private lenders to issue PLUS loans to parents and graduate students that were guaranteed by the federal government through the Federal Family Education Loan program (FFEL).4 Since July 2010, new parent PLUS loans have only been issued by the federal government through the Direct Loan program.

Borrowing Trends

Avery and Turner (2012) noted the drastic increase in lending in the PLUS loan program rose from $2 billion in 1990 to $12 billion in 2009. They also noted that the private education loan market exploded from issuing $1.5 billion in 1995–1996 to $21.8 billion by 2007–2008. Mazzeo (2007) performed an extensive study of private student loan offerings and noted that many were marketed as supplements to federal loans. It was also noted that some parents may have preferred private lending options over PLUS loans since the private loans would be made in the student’s name. According to Ma, Baum, Pender, and Libassi (2018), when comparing the volume of parent PLUS and federal undergraduate loans relative to 2007-2008, they found an increase in borrowing volume of 142 percent over that time period for PLUS loans, as compared to 102 percent for undergraduate loans.

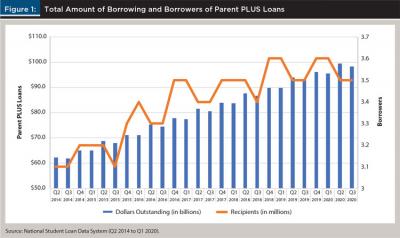

As of Q3 2020, there was $98.3 billion outstanding in parent PLUS loans taken on by 3.5 million borrowers (Figure 1). According to this aggregate dataset from the National Student Loan Data System (NSLDS), the number of borrowers has fluctuated between 3.1 and 3.6 million, while the amount of loans outstanding has risen by $36.1 billion since Q2 2014. Although the vast majority of loans are still held in the form of unsubsidized Stafford loans, subsidized Stafford loans, and consolidation loans, parent PLUS loan balances have experienced the second largest percentage increase at 58 percent over this time period.5 While $98.3 billion represents the total amount of outstanding PLUS loans, this doesn’t truly represent the total amount of parent borrowing through this system. It is possible that parent borrowers have consolidated their loans—either with other qualifying education debt taken on for their own education, or with multiple parent PLUS loans—and these figures are captured in the consolidated debt total in the amount of $550.2 billion that is held by 11.6 million borrowers as of Q3 2020 (NSLDS). Unfortunately, these loans that were consolidated cannot be identified, so the current reported PLUS loan figure should act as a conservative estimate.6 Looney and Yannelis (2015) noted that, over time, graduate loans and Parent PLUS loans have increased as a share of total federal borrowing and that the growth in the number of borrowers has increased as well.

According to Sallie Mae and Ipsos, the greatest average amount of debt-related financing for parents came from parent PLUS loans ($10,601), followed by home equity loans/HELOCs ($7,972), and private education loans ($5,725).7 When examining the percentage of parents that are using these various methods of financing, 11 percent reported using parent PLUS loans, 8 percent reported using private education loans, and 5 percent reported using home equity loans/HELOCs. It’s interesting that despite recent tax law changes that reduced the effectiveness of using this type of debt to finance higher education costs, utilizing home equity still remains popular.

Norvilitis and Batt (2016) ran a study that examined other predictors of student loan balances and attitudes towards debt. In the sample of students surveyed, 25 percent reported that their parents were paying for all their tuition, while 35 percent reported that their parents were helping them with tuition payments in some capacity. They found that while parent variables have significant bivariate correlations, they do not contribute to loan totals, although they do approach significance in predicting loan initiative and loan acceptance. Furthermore, they indicated that parents may help shape attitudes, but students may not ultimately choose to follow their parents’ advice, especially when it comes to financial matters. Now that borrowing trends have been identified, the remainder of this paper will focus on four issues related to parent PLUS loans—and how advisers can work through each to help parents make more informed financing decisions.

Issue 1: Lack of Financial Aid Award Letter Standardization

In order for parents to start the process of applying for a parent PLUS loan, the Free Application for Federal Student Aid (FASFA) must be filed. According to Fletcher, Webster, and Wenhua (2020), based on responses from in-depth interviews they conducted with 49 parent borrowers, nearly two-thirds of the parents they surveyed learned about parent PLUS loans from either the college’s financial aid office or by going through the process of completing a financial aid application form (FAFSA). Unfortunately, the lack of uniformity and consistency in these award letters can pose problems for both parents and students.

Burd et al. (2018) revealed some interesting findings that tie closely to the research motivations of this report. Among the findings that showcase wide disparity of what information is reported by colleges on their financial aid award letters was a focus on the misleading packaging of parent PLUS loans. They noted that these loans carry the most risk of all the federal loan programs, since they are capped at the COA, minus other aid from each school, and eligibility is based solely on credit history as opposed to an ability to repay, which can easily allow some parents to borrow excessive amounts year after year. In their survey of 515 schools, 128 included parent PLUS loans on their award letters—67 of these used unique terms to describe the loan and 12 of them failed to use the word “loan” in the description of the parent PLUS loan. The study also found that approximately 15 percent of institutions presented the parent PLUS loans as an item of aid, which is misleading since parents must apply and be approved for this type of aid. It can also cause confusion and make award packages appear more generous than they actually are. As a result of this lack of uniformity, schools may be able to utilize practices that encourage well-qualified borrowers who would likely be better off exploring the private student loan market, and less-qualified borrowers who may not have the financial means, to repay these parent PLUS loans.

Evans, Boatman, and Soliz (2019) measured the framing and labeling effect to see if student loan participation changes based on how the financing option is presented to students. They found that simply labeling a contract a loan reduced the likelihood of selecting that option by 8 to 11 percent, and these effects are more pronounced among black and Hispanic high school students who are twice as likely to avoid the loan option when it is labeled as a loan. Their research does not suggest that lower loan participation is necessarily bad since this could also reflect the optimal choice for a student; however, it is interesting to think about this as it compares with research from Burd et al. (2018), since the framing and labeling used in financial aid award letters could result in confusion and suboptimal choices for borrowers. Although Evans, Boatman, and Soliz (2019) only analyzed the borrowing preferences of undergraduate students, future research should examine how this framing is understood by parent borrowers as well. Given this lack of standardization and the fact that this may be a parent’s first time seeing terms like ‘PLUS loan,’ advisers should be involved in the financial aid award letter review process to help clients determine which types of aid are appropriate to apply for, accept, or deny in order to fund this goal in an optimal manner.

Issue 2: Expensive and Lack of Cost Transparency

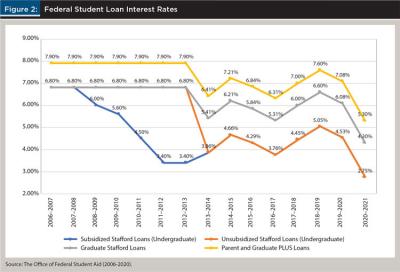

The interest rate on PLUS loans disbursed between 7/1/2020 and 6/30/2021 is 5.30 percent and is calculated by adding 4.6 percent to the last 10-year Treasury note auction that took place in May 2020 (Figure 2). The interest rate resets for all federal PLUS and Stafford loans on July 1 each year and they are all pegged to the 10-year Treasury note rate. However, the 4.6 percent premium charged on PLUS loans made to parents and graduate students is more than double the amount charged to undergraduate and graduate students through the Stafford loan program—2.05 and 3.60 percent, respectively. Mankiw (1986) justified the need to impose higher interest rates on student loans since the student borrower’s plans to repay are unknown; however, he noted that this may cause two problems: raising rates on all borrowers can create an adverse selection problem where well-intentioned borrowers may become resentful and bad borrowers will still be granted loans. But this is not of great concern because the federal government is ultimately responsible for the repayment of this debt, as opposed to the institutions of learning themselves.

In addition to higher interest rates, PLUS loans also impose relatively high origination fees—an additional cost imposed on the borrower to help the lender cover the cost of administering and servicing the loan. Figure 3 shows that PLUS loans have origination fees in the amount of 4.228 percent (for the 2020-2021 academic year), which is almost four times greater than those imposed on undergraduate and graduate Stafford loan borrowers—1.057 percent (2020-2021). Origination fees for parent PLUS loans have experienced minor fluctuations since the 2013-2014 academic year and were previously fixed at 4 percent. Prior to the 2006-2007 academic year, origination fees on Stafford loans were also set at four percent, but they decreased significantly in the years following.

It is important to note that the mechanics of applying an origination fee to student loans differ from how they are traditionally applied to other types of debt, like a mortgage. For example, if an individual borrows PLUS loans in the amount of $100,000 that impose a 4.228 percent origination fee, the borrower will only receive $95,772, but will be responsible for repaying the original amount of $10,000. Conversely, if an individual borrows a mortgage in the amount of $100,000 and the loan carries an origination fee of 1 percent, the borrower usually has the option of paying this fee upfront or will have the additional cost of $1,000 added to the mortgage balance, so the borrower would be responsible for repaying $101,000 over the life of the loan.

Barr (2017) noted that enforcing even small surcharges or loan origination fees is regressive and may also incentivize borrowers against early repayment since the fee is fixed. High origination fees have two important implications for parent borrowers. The first is that high origination fees imposed on large loan amounts can potentially create a cash flow problem as the amount of funds they initially receive may not be enough to cover the actual education costs.8 The second is that the cost of the origination fee increases the cost of the loan and, as a result, both the annual percentage rate (APR) and the effective annual rate (EAR) of the loan also increase, depending on the actual repayment term.

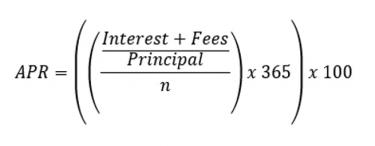

Equation 1 states the formula used to calculate the APR on a loan. The APR will increase as the interest rate or origination fee increases, and it will decrease as the loan repayment period increases. A problem that arises from a transparency perspective is that borrowers may not understand or be aware of how the origination fee factors into these calculations since the U.S. Department of Education does not currently display APR figures—whereas private lenders are required to under Regulation Z of the Truth in Lending Act.9 One reason for not displaying APR figures for this type of debt may be because the repayment terms for federal student loans can vary drastically. Some borrowers may be participating in the standard 10-year repayment plan, while others may be using an extended or income-driven repayment plan, for which it would be impossible to calculate an accurate APR figure.

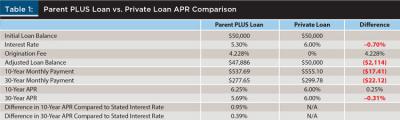

Borrowers who wish to compare private loan alternatives with a parent PLUS loan should be able to make an apples-to-apples comparison, which is not currently the case. For example, consider a parent borrower who decides to borrow $50,000 through the PLUS loan system (Table 1). Assuming current interest rates and origination fees, the APR is computed to be 6.25 percent and 5.69 percent when using 10-year and 30-year repayment terms, respectively. This type of information is important to disclose to parents who may only be focused on, or used to, comparing monthly payment amounts or interest rates instead of total loan costs over the term of the loan.

Comparing the monthly payment amounts is also a bit skewed because, due to the large origination fee, this implies that the borrower needs to cover this shortfall upfront, which is actually more costly in present value (PV) terms than spreading this payment over the 10-year or 30-year repayment terms. If a parent were to compare this to a private loan that charges 6 percent, he or she would have larger monthly payments over 10 years with the private loan but would be subject to a higher interest rate and would pay more in PV terms with the parent PLUS loan over that same 10-year period.

While other forms of debt may impose origination fees—most commonly, mortgages—the education loan market is an example of where two separate markets exist. In general, one imposes origination fees (the federal student aid program) and the other does not (the private student loan market). Although issues exist with relying on APR because it does not incorporate the effects of compounding, PLUS loan borrowers who do not understand how to properly factor in origination fees (in order to determine both the APR and EAR on their loans when evaluating financing alternatives or options) may incur additional costs. Until changes are made, advisers should be sure to educate their clients on how origination fees can impact the overall cost of the loan and that they should not solely rely on evaluating financing alternatives by comparing the stated interest rates of federal and private education loans.

Issue 3: Low Barriers to Borrowing

Federal student loans borrowed by undergraduate students are interesting in that students can borrow these without providing any evidence of their ability to repay. The assumption that students will earn a degree or certification and obtain gainful employment essentially replaces traditional lending criteria used to evaluate credit worthiness. However, for parents to be eligible to borrow PLUS loans, the only lending criteria that applies is that the borrower may not have an adverse credit history. According to the Office of Federal Student Aid, a borrower is considered to have an adverse credit history if they are more than 90 days delinquent on an outstanding debt balance greater than $2,085 as of the date the credit report is run when applying for the PLUS loan, or if the borrower has been subject to default, bankruptcy, foreclosure, repossession, tax lien, wage garnishment, or the write-off of a federal student aid debt during the five years preceding the date of the credit report. Borrowers who have an adverse credit history may obtain an endorser, similar to a co-signor,10 who agrees to repay the loan should the borrower not be able to.

Additional factors that are generally taken into consideration when determining a borrower’s financial status and ability to repay, such as debt-to-income ratio and FICO score, do not apply at all for prospective parent PLUS loan borrowers. Therefore, it is possible for individuals who do not possess an adverse credit history—or, possibly, possess no credit history at all—to obtain financing through this program, even if their existing debt-to-income ratio exceeds conventional limits or if they have extremely low FICO scores.

Regardless of a parent borrower’s financial standing, advisers are in a position to provide clarity and guidance during this emotional process. When working with less-affluent clients or offering pro bono services, an assessment of the parent’s ability to repay this debt should be performed given the uniqueness of this situation in which the lender does not assess the borrower’s ability to repay in a conventional way. Conversely, if a borrower’s credit score is high enough and his or her debt-to-income ratios are low enough, he or she should be able to secure a more favorable financing option in the private market.11 However, the ease of access to this type of federal funding may contribute to higher borrowing levels, even among higher-income parents who should be able to access more cost-effective sources of funding. Therefore, advisers working with more affluent families should make sure private loan options are being considered as well, especially if the parent borrower has excellent credit, as they may be able to qualify for loans that carry lower interest rates.

Issue 4: Limited Repayment Options

While borrowers should be concerned about interest rates, they should be equally concerned about which repayment options are available to them. This is where education loans differ from other forms of consumer debt. Student borrowers of federal education loans are able to participate in eight different repayment plans,12 four of which are classified as income-driven repayment plans designed to allow borrowers to repay their debt based on their ability to pay; this concept is in line with Friedman’s original theory on financing higher education costs (Barr 2016). The monthly payment under these types of plans is calculated using three factors. Borrower income, family size, and state of residence are used to determine discretionary income, for which 10, 15, or 20 percent of this amount will be applied in calculating the borrower’s monthly payment, depending on which repayment plan is selected and which types of loans are borrowed.

Income-driven repayment plans provide two major benefits to borrowers. The first is a required monthly payment amount tied to the borrower’s discretionary income. This provides insurance in the form of a floor amount for those borrowers who still wish to repay their loans over the standard 10-year repayment period, but who may encounter a situation in which they either become unemployed or experience a drastic reduction in earnings. The second benefit is that borrowers who participate in these income-driven repayment plans and have a remaining loan balance at the end of the repayment term (20 or 25 years) will receive forgiveness of this debt if all the requirements are met.

When examining the repayment options available for parent PLUS loan borrowers, they are only able to participate in one income-driven repayment plan: the income-contingent repayment plan (ICR). Furthermore, a parent PLUS loan borrower must first consolidate their existing federal loan debt into a direct consolidation loan before enrolling in the ICR plan. When compared to other income-driven repayment plans, such as income-based repayment (IBR), pay as your earn (PAYE), and revised pay as your earn (REPAYE), which are available to student borrowers, the ICR plan uses the least generous formula to compute the monthly payment amount.13 The lack of access to these other IDR plans—and the required additional step of consolidating existing loans—act as impediments for parent borrowers, especially for those with large disparities between current income and total outstanding debt.

Conclusion

In summary, the federal government provides access to PLUS loans for parents who wish to finance all or a portion of their children’s higher education costs; however, the costs of borrowing are not communicated in a way that allows prospective borrowers to accurately compare this type of debt with private loan alternatives. Furthermore, the lack of standardization in financial aid award letters can cause confusion for parents when they are determining how best to fund any financial shortfall. Pairing low barriers to borrow with non-existent aggregate borrowing limits—and restricting access to more favorable income-driven repayment plans that are generally available to student borrowers—can result in overborrowing and adverse financial consequences for less affluent parents. Even as higher education and the ways parents and students approach the planning process continue to change, evaluating the options available to finance these costs will become even more complicated. As a result, advisers should be cognizant of the opportunities and pitfalls that are associated with utilizing parent PLUS loans to finance higher education costs in order to improve financial outcomes for their clients and move one step closer to solving the student loan crisis.

Endnotes

- See the 2019 “How America Pays for College” report from Sallie Mae and Ipsos. Available at www.salliemae.com/assets/research/HAP/HowAmericaPaysforCollege2019.pdf.

- According to the College Savings Plan Network, the number of accounts and assets under management in all 529 college savings plans reached $14.2 million and $371.5 billion, respectively, as of 12/31/2019.

- Annual borrowing limits are imposed on undergraduate borrowers of Stafford loans, and the maximum lifetime borrowing limit is capped at $31,000 for dependent students and $57,500 for independent students.

- The Federal Family Education Loan (FFEL) program was introduced in 1966 and was an example of a public-private partnership in which federally guaranteed loans were issued through private lenders to student and parent borrowers.

- PLUS Loans made to graduate students have experienced the largest percentage increase in outstanding debt totals at approximately 110.3 percent between Q2 2014 and Q3 2020.

- This report is primarily focused on parent PLUS loans borrowed under the William Ford Direct Loan program, yet it is important to note that some parent PLUS loan debt is still held under the older FFEL program.

- See endnote No. 1.

- It is possible for parents to request an additional funding amount from the lender to ensure no cash flow problems occur. For example, they could borrow enough to ensure that the new amount received from the loan covers the funding gap.

- See Regulation Z (12 CFR 1026) at www.consumerfinance.gov/rules-policy/regulations/1026/1/#a.

- The student on whose behalf the parent is borrowing cannot be the endorser on the parent PLUS loan.

- According to Sallie Mae, as of March 7, 2020, advertised APR figures on private student loans ranged between 2.75 and 10.65 percent for fixed- and variable-rate education loans.

- Those options are: Standard, Graduated, Extended Fixed, Extended Graduated, ICR, IBR, PAYE, and REPAYE.

- To calculate the monthly payment under the ICR plan, 20 percent of discretionary income is used, while 10 percent of discretionary income is used for borrowers under the PAYE and REPAYE plans. Either 10 or 15 percent of discretionary income is used for borrowers under the IBR plan, depending on whether the borrowers qualify as new borrowers. In addition, the ICR plan uses 100 percent of the federal poverty guidelines, while IBR, PAYE, and REPAYE plans use 150 percent of the federal poverty guidelines in these calculations.

References

Avery, Christopher, and Sarah Turner. 2012. “Student Loans: Do College Students Borrow Too Much—Or Not Enough?” Journal of Economic Perspectives 26 (1): 165–192.

Barr, Nicholas. 2016. “Milton Friedman and the Finance of Higher Education,” in Cord, Robert A., and Hammond, J. Daniel (eds), Milton Friedman: Contributions to Economics and Public Policy Ch. 23: 436-463. New York, N.Y., and Oxford, U.K.: Oxford University Press.

Barr, Nicholas. 2017. “Funding Post-Compulsory Education.” In: Johnes, Geraint, Johnes, Jill, Agasisti, Tommaso and López-Torrez, Laura, (eds.) Handbook on the Economics of Education. Cheltenham, U.K.: Edward Elgar Publishing.

Burd, Stephen, Rachel Fishman, Laura Keane, Julie Habbert, Ben Barrett, Kim Dancy, and B. Williams. 2018. “Decoding the Cost of College: The Case for Transparent Financial Aid Award Letters.” New America June 5.

Evans, Brent J., Angela Boatman, and Adela Soliz. 2019. “Framing and Labelling Effects in Preferences for Borrowing for College: An Experimental Analysis.” Research in Higher Education 60 (4): 438–457.

Fletcher, Carla, Jeff Webster, and Wenhua Di. 2020. “PLUS Borrowing in Texas: Repayment Expectations, Experience, and Hindsight by Minority-Serving Institution Status.” Trellis Company. Available at www.trelliscompany.org/wp-content/uploads/2020/01/PLUS-Borrowing-in-Texas.pdf.

Looney, Adam, and Constantine Yannelis. 2015. “A Crisis in Student Loans? How Changes in the Characteristics of Borrowers and in the Institutions They Attended Contributed to Rising Loan Defaults.” Brooking Papers on Economic Activity 2: 1–89.

Ma, Jennifer, Sandy Baum, Matea Pender, and CJ Libassi. 2018. “Trends in Student Aid 2018.” The College Board. Available at research.collegeboard.org/pdf/trends-student-aid-2018-full-report.pdf.

Mankiw, N. Gregory. 1986. “The Allocation of Credit and Financial Collapse.” The Quarterly Journal of Economics 101 (3): 455–470.

Mazzeo, Christopher. 2007. “Private Lending and Student Borrowing: A Primer.” Hess, Frederick M., Footing the Tuition Bill Washington, D.C.: AEI Press.

Norvilitis, Jill M., and Meghan J. Bat. 2016. “Beyond Financial Need: Predictors of Student Loans and Student Loan Attitudes.” Journal of Student Financial Aid 46 (3): 4.