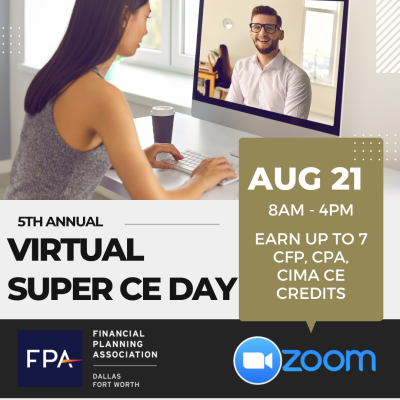

Join Us for the 5th Annual FPA DFW Super CE Day!

📅 Thursday, August 21 | 💻 Virtual via Zoom

Earn up to 7 hours of CE credit for CFP®, CPA, and CIMA® designations — all in one day!

The Super CE Day features a dynamic lineup of speakers and timely topics designed for today’s financial professionals. Attend one session or stay for all — your registration includes access to every session and the flexibility to come and go as your schedule allows.

- A Zoom link will be sent out 1-2 business days prior to the event.

- You are not required to pre-select the sessions you plan to attend. You will simply use one link to access any/all sessions through the day.

- A CE code will be provided at the end of each session. To confirm your attendance of the sessions you attend you most keep track of the codes for the sessions you attend and submit them at the end of the day via a link that we will send you.

8:00 - 8:10 AM: Sign on + Welcome, Housekeeping & Announcements

8:10 AM - 9:00 AM: Diversification and Why Alternative Investments Matter More in 2025 (1 CE)

Blake Lugash I Realty Capital Partners

In today's unpredictable economic landscape, traditional investment strategies may fall short in addressing inflation, market volatility, and macroeconomic uncertainty. Alternative investments - particularly real estate - offer a compelling solution for financial advisors seeking to diversify client portfolios. This session will explore the strategic role of real estate within a diversified investment plan, focusing on its potential to deliver inflation protection, flexible investment horizons, and higher return potential. Attendees will examine four real-world case studies spanning industrial, residential land development, and mixed-use sectors, each illustrating how targeted real estate investments can respond to shifting economic drivers. This session will also outline how Realty Capital Partners supports advisors and clients with white-glove investor services to efficiently access and manage these opportunities. Learning objectives: (1) Explain the value of alternative investments and their importance within a cilent's portfolio, particularly in environments characterized by macroeconomic uncertainty, inflation, and market volatility; (2) Identify the advantages of commercial real estate investments, including inflation protection, higher return potential, timeline flexibility, and resilience in economic downturns; (3) Analyze multiple case studies demonstrating different asset types and strategies in alternative real estate investing; (4) Evaluate how real estate can be effectively integrated into a comprehensive financial plan for long-term client success.

9:00 - 9:10 AM: Break

9:10 - 10:00 AM: Super-Sized Considerations for Small Caps in an Equity Allocation (1 CE)

Matthew Dubin I Avantis Investors

Much has been written about disappointing returns of small cap companies. A decrease in the number of IPO's and the percentage of small cap companies with negative profits are among the top reasons cited for small caps' "inevitable" demise. We will explore whether these concerns have merit and what allocators should contemplate as they construct equity allocations. Learning objectives include: (1) Discussion on the decrease in number of public small cap names, the small cap "premium" post 1981, and number of US small cap companies with negative ratings. (2) We will examine small cap valuations and earnings growth versus other market segments and the recent impact of Magnificent 7. (3) Proposal of ways to improve returns within small cap allocations.

10:00 - 10:10 AM: Break

10:10 - 11:00 AM: Mastering the Art of Communicating Your Value Proposition (1 CE)

Dustin Gersch, CFP®, AAMS®, CRPC®, RICP® I Gersch Wealth Partners

Powered by Avantax

Many financial advisors find it challenging to effectively convey their value to clients, often relying solely on verbal explanations. Just as images on a restaurant menu can guide your choices, visual aids can significantly enhance your ability to communicate and close deals. In this interactive session we'll delve into the power of visual storytelling to articulate your value proposition clearly and compellingly. Learning objectives: (1) Visual Communication Mastery: Understand the critical role of visual aids in effectively communicating your value proposition to clients. (2) Closing Techniques: Acquire actionable strategies to enhance your ability to communicate value and close business. (3) Tool Integration: Explore how to integrate financial planning tools to bolster your value proposition.

11:00 - 11:10 AM: Break

11:10 - 12:00 PM: Practical Due Diligence for Active Mutual Funds (1 CE)

Emily Frazier, CKA I Spectrum Financial, Inc. (pre-recorded)

Not all mutual funds are created equal, particularly those that fall under "active management". This session aims to equip advisors with practical guidelines to effectively evaluate active fund managers, ensuring a strong fit for their portfolios or models. Learning objectives: (1) Understanding of the Fund. (2) Assessing Fund size and implications. (3) Evaluating Fund liquidity for portfolio compatibility. (4) Understanding security selection processes.

12:00 - 1:00 PM: Break/Lunch

1:00 - 1:50 PM: ETF Liquidity and Trading (1 CE)

Ryan Claybourn I Texas Capital

Sourcing liquidity for Exchange Traded Funds requires a knowledge of the multiple levels of liquidity as well as the mechanics of the primary and secondary marketplaces where ETFs transact. This program will define the liquidity profile of the ETF vehicle, the marketplaces where liquidity can be accessed, and how to access that liquidity effectively. Learning objectives: (1) The 3 levels of liquidity for ETFs. (2) The Creation/Redemption mechanism of ETFs and the impact of that process on a fund's liquidity profile. (3) Accessing ETF liquidity in primary and secondary markets and best practices for trading ETFs.

1:50 - 2:00 PM: Break

2:00 - 2:50 PM: Convert Compliance Obligations Into Growth Opportunities with AI (1 CE)

Era Jain, CEO I Zeplyn I AI

Powered by Visory

Compliance regulation is going to force you to retain most client communications, so why not maximize the use of the data you’re already gathering? Led by former Google AI engineer and Zeplyn Co-founder and CEO Era Jain, this session will cover how leading financial advisors are using their archived communication beyond checking the compliance box. You’ll discover how introducing AI into your practice can enhance the client experience, improve productivity and performance, and scale your practice with client insights. You’ll also learn the common concerns clients and the industry have about AI and how to address them head-on. Learning objectives: (1) Understand the common concerns your clients and the industry have about AI, and how to address them head-on; (2) Discover the top three ways AI can leverage client data to create immediate, scalable value; (3) Learn how to establish a framework for a strong advisor-AI partnership.

2:50 - 3:00 PM: Break

3:00 - 3:50 PM: MLG Legacy Fund (1 CE)

Billy Fox, CPA & Nathan Clayberg, Senior VP I MLG Capital

Unlock the power of truly passive investing with our in-depth session on “Achieving Passivity Through 721 Contributions in Private Real Estate Vehicles.” This session is designed for advisors seeking to transition from active management to a hands-off, income-generating strategy—without triggering a substantial tax liability. Learn how Section 721 exchanges can enable you to contribute appreciated real estate into private REITs or real estate partnerships, defer capital gains taxes, and maintain equity participation—all while gaining the freedom and scalability of passive ownership. Don’t miss this opportunity to elevate your investment strategy with advanced tax-efficient tools. Learning objectives: (1) Tax Deferred Exchange; (2) Simplifying Estate Plans; (3) Minority Partner Discounts; (4) Tax-Advantaged Income/Fresh Cost Basis; (5) Diversification; (6) 1031 Exchange.