Journal of Financial Planning: March 2019

Randy Gardner, J.D., LL.M., CPA, CFP®, is the founder of Goals Gap Planning LLC, a member of the Garrett Planning Network, and an adjunct professor at the American College of Financial Services.

Leslie Daff, J.D., is a state bar certified specialist in estate planning, trust, and probate law, and the founder of Estate Plan Inc.

You have probably participated in numerous conversations with friends or family members who are having health issues, and every day we hear news reports describing the health crises in America—opioid overdoses, depression, cancer, and heart disease. Even though health is an important factor in our clients’ financial pictures, financial planners—as a profession—remain reluctant to bring up the subject of health with our clients.

In the revised Code of Ethics and Standards of Conduct (cfp.net/code), effective October 1, 2019, CFP Board mandates that we ask our clients about qualitative and subjective information, including their health. But what should we ask? This column attempts to provide guidance on that question.

The Financial Benefits of Good Health

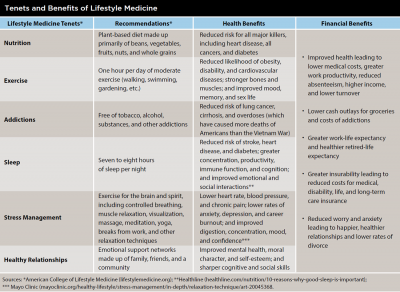

Last fall, we attended a medical conference. No, we are not doctors, but we wanted to learn more about healthy living, and we have always believed that the medical profession—with its goal of client well-being and its emphasis on ethics, education, and research-based treatment—has a lot in common with the financial planning profession. This conference was on lifestyle medicine, the newest medical specialty recognized by the American Medical Association. The focus of the specialty is the prevention and reversal of disease through lifestyle changes. The specialty’s main tenets are set out in the sidebar.

It occurred to us that all the tenets being discussed at the conference had a direct impact on personal financial planning. If we could improve the day-to-day health from birth to death of our clients, not to mention their productivity and longevity, what impact would that have on our clients’ financial well-being?

Consider the following:

Nutrition. How much money would we save at the store if we eliminated meat, dairy, and processed foods from our diets? How much would it save us in insurance and health care costs? Would the financial costs of living longer be covered by the reduction in health care and long-term care costs?

Exercise, sleep, and relaxation. If we exercised moderately for an hour a day, meditated, and slept eight hours, how much more work would we get done? How much more income could we make if we were more alert, made better decisions, and were in a better mood?

Addictions. In my experience, every family has been affected by addiction, whether it is a chain-smoking parent dying in his or her 40s from lung cancer, or a family terrorized by a mean drunk; but it doesn’t stop there. How much does smoking, alcohol, drug, opiate, gambling, shopping, or other addictions remove from our clients’ monthly cash flows?

Healthy relationships. Have you or someone you know been in a relationship that kept them awake all night, turned his or her life upside down, or made it impossible to focus on work? How many of our clients have been financially devastated by divorce or child-related issues?

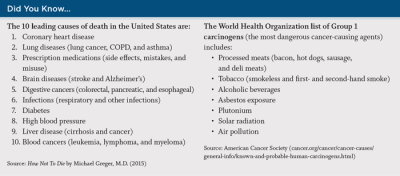

Broader societal crises. Pollution of our air and water by the meat and dairy industries, absenteeism and disability due to illness, higher employer insurance costs, overcrowded hospitals, DUI deaths, time lost to rehab, collateral damage to family finances and relationships from the poor health or death of a loved one, poor judgments due to diminished capacity, anger, divorce, mental illness, violence, and job loss all negatively impact a client’s health.

We may agree that there is a financial connection between our health habits and our finances, but what do we do about it?

Ask Yourself and Your Clients the Health Questions

Consider the examples below that demonstrate the spectrum of possible approaches we might take with clients. Health questions are contrasted with investment questions that many of us already ask.

Approach 1: Shallow Inquiry

Investment question: How are your investments doing?

Health question: How is your health?

Advantages: Not intrusive, but may result in a dismissive answer, such as, “Fine.”

Disadvantages: May not meet the CFP Board’s ethical standard.

Approach 2: Targeted Inquiry

Investment question: Is there anything about your investments I should know as I prepare your financial plan?

Health question: Is there anything about your health habits I should know as I prepare your financial plan?

Advantages: Not intrusive and probably meets the CFP Board’s ethical standard.

Disadvantages: May not provide enough information to improve the client’s situation.

Approach 3: Questionnaire and General Education

Investment question: Based on your answers to the risk tolerance questionnaire, you can expect… .

Health question: Based on your answers to the health questionnaire, you can expect… (see the sidebar for suggestions on a health questionnaire).

Advantages: Opportunity to promote healthy behaviors with a financial motivation.

Disadvantages: Clients may not be receptive to questions or advice outside of the narrowly construed financial area; planners may be uncomfortable asking clients to complete a health questionnaire.

Approach 4: Behavior Modification Through Specific Recommendations

Investment question: Please provide your investment statements. By modifying your investment portfolio, your financial plan will improve in the following ways… .

Health question: Please provide a copy of the results of your most recent physical. By modifying your health behaviors, your financial plan will improve in the following ways… .

Advantages: Opportunity to promote healthy behaviors with specific recommendations, which will be monitored.

Disadvantages: Clients may not be receptive to questions or advice outside of the narrowly construed financial area; planners may be uncomfortable asking clients to share health information.

Approach 5: Behavior Management with Professional Intervention

Investment question: Investment policy statement and discretionary authority.

Health question: Establish specific health goals with professional intervention (physical trainer, psychologist, rehab, or referral to a doctor).

Advantages: Opportunity to make a significant difference in our clients’ lives through intervention.

Disadvantages: Clients may not be receptive to suggestions outside of the narrowly construed financial area; planners may be uncomfortable working with medical professionals.

Financial planners and advisers who manage investment assets do not hesitate to direct the conversation toward Approach 5 (the creation of an investment policy statement and discretionary authority) when the clients do not have the inclination or ability to manage the assets themselves. We are not suggesting that planners give medical advice or intervene with every client. The appropriate approach will differ for each client and will usually be to provide general education about the connection between health habits and finances. However, we should not hesitate to act in the client’s best interests by referring the client to a healthcare provider when a health issue or addiction poses a threat to our client’s life or financial future.

The medical profession focuses on the treatment of health issues presented at doctors’ offices, emergency rooms, and urgent care centers, but no profession has fully stepped forward in encouraging healthy behaviors that prevent the illnesses being treated. Health insurance companies have started to incentivize healthy behaviors with discounts from the cost of health insurance in the workplaces they cover.

Perhaps it is time for financial planners to proactively boost awareness of the connections between health, wealth, and happiness. Carolyn McClanahan, M.D., CFP®, has written extensively on the subject. To explore this topic further, check out Michael Greger’s book How Not To Die and website NutritionFacts.org; and the documentaries “Forks Over Knives,” “What the Health,” and “The Game Changers.”

Many of us are getting to the ages when friends and family members are receiving diagnoses of terminal illnesses, undergoing major surgeries, burning out in their careers, and going through heart-wrenching divorces. It is common to hear people say, “I wish I had done (or not done) this, so I could have avoided (negative diagnosis/surgery/event).” Their experiences are warnings. Why wait until a life-threatening disease or bottoming out occurs to make changes?

Our health is our greatest wealth. If we ask the questions, educate, and motivate our clients to behave differently, we can help them in ways that will create—literally—a long-term relationship.

Sidebar

Ideas for a Health Questionnaire

- Did you have your annual physical (yes)?

- What is your cholesterol level (150 or less), blood pressure (120/80 or less), and pulse (less than 65)?

- How many servings of dairy and meat do you have in a week (ideally none, but difficult to do)?

- How many minutes of moderate exercise do you get daily (60 or more)?

- Is your health or the accomplishment of your financial goals affected by any of the following addictions: tobacco, alcohol, drugs, medications, gambling, or shopping (no)?

- How many hours of sleep do you get on average (more than seven)?

- How many minutes per day do you manage your stress (20 or more)?

- How frequently do you spend quality time with your spouse, significant other, family, or friend(s) (more than twice per week)?

Even though we are not providing medical care, the answers to some of these questions are confidential and should be protected, similar to the safeguards we use with other sensitive personal information we gather.