Journal of Financial Planning: June 2015

Mario A. González-Corzo, Ph.D., is an associate professor at the department of economics and business at Lehman College of The City University of New York (CUNY), where he teaches economics and finance. He is also a member of the adjunct faculty at Columbia University and Rutgers University.

Executive Summary

- This paper provides a broad overview of the asset ownership characteristics of U.S. Hispanic households. In general, Hispanic households exhibit lower levels of financial asset ownership than the rest of the population across all asset classes.

- Financial asset ownership among Hispanics is influenced by several socioeconomic factors. Social networks, the prevalence of a collective belief system, and cultural and experiential barriers are also direct contributors to the comparatively low levels of financial asset ownership among Hispanics.

- This paper provides several strategies that can be implemented by financial institutions and intermediaries to increase financial asset ownership among Hispanics.

- Financial planners can play a critical role in increasing financial asset ownership by (1) increasing financial education and financial literacy among Hispanics; (2) promoting, supporting, and implementing policies and initiatives that include more Hispanics into the formal financial system; and (3) providing individualized and customized financial planning strategies that incorporate the unique needs of Hispanics living in the U.S.

Financial planners should pay close attention to national trends in financial asset and financial product ownership (Xiao 1995). Holdings of one asset class may be directly influenced by ownership of another type of asset or financial product. For instance, Xiao found that owning a checking account decreases the likelihood of owning savings accounts, cash value life insurance, certificates of deposit, bonds, and stocks by 38 percent to 69 percent. Possession of a checking account was also found to decrease the chance of owning money market accounts by 190 percent; interestingly, it had no effect on owning savings plans and retirement accounts.

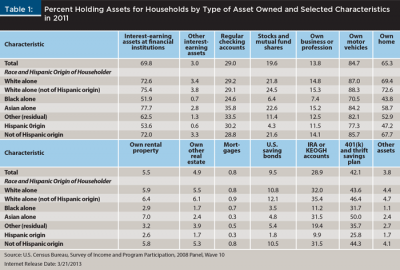

Hispanics have lower levels of asset ownership compared to other segments of the U.S. population (Choi 2013; Cobb-Clark and Hidelbrand 2006; Yao, Gutter, and Hanna 2005). These findings are corroborated with the figures shown in Table 1 that reflect data reported by the U.S. Census Bureau.

According to the U.S. Census Bureau (2013), 53.6 percent of Hispanic households living in the U.S. held interest-earning assets at financial institutions in 2011, compared to 75.4 percent of non-Hispanic white households (termed white households in this paper), 77.7 percent of Asian households, and 51.9 percent of black households.

Also in 2011, 4.3 percent of Hispanic households held shares of equity securities and mutual funds, compared to 24.5 percent of white households, 22.6 percent of Asian households, and 6.4 percent of black households. Similarly, 1.8 percent of Hispanic households owned savings bonds, compared to 12.1 percent of white households, 4.8 percent of Asian households, and 3.5 percent of black households. Approximately 9.9 percent of Hispanic households owned IRA or KEOGH accounts in 2011, compared to 35.4 percent of white households, 31.5 percent of Asian households, and 11.2 percent of black households.

Finally, 25.8 percent of Hispanic households had 401(k) thrift savings plans in 2011, compared to 46.4 percent of white households, 50 percent of Asian households, and 31.7 percent of black households. Percentages of U.S. households owning selected financial assets and non-financial assets in 2011 are presented in Table 1.

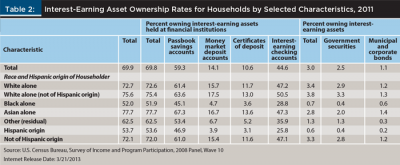

Differences between Hispanic households and others are highlighted in Table 2. As shown, a lower percentage of Hispanic households held interest-earning assets across all categories reported by the U.S. Census Bureau (2013), compared to white households and Asian households. The percentage of Hispanic households that held interest-earning assets at financial institutions in 2011 was also lower than the percentage of black households in all categories except passbook savings accounts held at depository institutions.

Factors Influencing Financial Asset Ownership among Hispanics

Financial asset ownership is closely associated with family saving behavior (Xiao 1995; Xiao and Anderson 1993). Several studies have found household income to have a positive effect on saving (Avery and Kennickell 1991; Chang 1994; Davis and Schumm 1987; Foster 1981; Hira 1985; Hefferan 1982; Motley 1970).

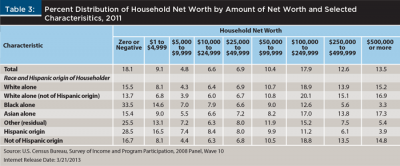

In addition to income, household net worth is thought to be strongly associated with financial asset ownership (Williams and Manning 1972). Table 3 highlights these relationships by showing the percent distribution of household net worth in the U.S. in 2011 by race.

As data in Table 3 indicate, a larger percentage of Hispanic households (28.5 percent) had zero or negative net worth, compared with white households (13.7 percent) and Asian households (15.4 percent). However, the percentage of Hispanic households with zero or negative net worth (28.5 percent) was lower than the percentage of black households in the same category (33.5 percent). On the other side of the spectrum, 21.2 percent of Hispanic households had a net worth of $100,000 or higher, compared to 52.1 percent of white households, 48.1 percent of Asian households, and 21.5 percent of black households.

In the case of low-income households, Carney and Gale (2000) found patterns of wealth accumulation, manifested through financial asset and financial product ownership, to also be influenced by: (1) consumption needs, which is the low probability of reducing current consumption to finance future savings by low-income households; (2) the lack of institutional mechanisms to save because most financial products and services are geared toward middle- income and upper-income consumers; (3) the existing correlation between low income and observed determinants of wealth (for example, educational attainment and home ownership); and (4) government policies, such as means tested programs that impose strict asset limits, resulting in a high implicit tax on asset accumulation.

Another factor affecting financial asset ownership among Hispanics living in the United States is the relatively high percentage of this population segment that lacks an established credit history or profile. Stegman, Quercia, and Lobenhofer (2001) indicated that 22 percent of Hispanic borrowers living in the United States had no credit score, compared to 4 percent of whites and 3 percent of blacks. Having a credit score or profile is an essential requirement for successful participation in the formal financial system by providing access to credit market instruments, such as residential and commercial mortgages and secured and unsecured personal and business loans. Having an established credit score or profile is also a critical step in the path toward greater financial asset ownership. Maintaining a robust credit score allows individuals and households to bypass fringe financial intermediaries as a way to benefit from the mobilization of credit.

Financial Risk Tolerance

Financial risk tolerance, which is defined as a person’s willingness to take on additional risk or uncertainty in exchange for higher expected returns, also plays a key role in financial asset ownership among Hispanics in the U.S. Coleman (2003) found that blacks and Hispanics are less likely to take high risks. She also noted that blacks and Hispanics show a greater preference for taking no financial risks, compared to whites with similar socioeconomic characteristics. This implies that race and ethnicity likely play a determinant role in shaping a person’s risk tolerance and risk aversion (Odgen, Odgen, and Schau 2004; Yao et al. 2005). According to Dilworth-Anderson, Burton, and Johnson (1993), race and ethnicity are representative of a group’s shared legacy and cultural values. A group’s cultural values and degree of socialization are likely to influence group members’ preferences and willingness to take financial risk.

Risk tolerance is also affected by the degree of acculturation of a given group or population segment. A significant portion of U.S. Hispanics have relatively low levels of acculturation (Malone, Baluja, Costanzo, and Davis 2003; Ramírez and De la Cruz 2003), which affects their exposure to risk-bearing asset classes and their willingness to tolerate higher levels of investment risk. Due to limited exposure to information about investment products and financial assets, lower levels of household net worth (Aizcorbe, Kennickell, and Moore 2003), low degrees of acculturation, and lower risk tolerance, a significant portion of the U.S. Hispanic population have significantly lower levels of financial asset ownership compared to their non-Hispanic counterparts.

As Campbell and Viceria (2002) indicated, the willingness to take financial risk is also influenced by financial status, life-cycle stage, and general household socioeconomic characteristics. Risk tolerance and financial asset ownership are also affected by labor force participation, employment status, and the stability of employment contracts. Yao et al. (2005) indicated it is possible that households with less stability from labor-derived earnings may be less willing to take higher or additional investment risks. This would certainly help explain asset ownership patterns for Hispanic households.

Cultural Values and Economic Barriers

Networks of family and friends and cultural values are another determinant of financial asset ownership among Hispanics. In contrast to their non-Hispanic counterparts, Hispanic nuclear families are embedded in a complex, extended network of families and friends based on a collective belief system (Giese and Snyder 2009). Hispanic households are characterized by shared financial responsibilities, although individual and personal savings are commonly encouraged (Falicov 2001). Strong family connections are reflected in Hispanic culture. Falicov noted that family rituals and celebrations often include extended family members, which collectively contribute to the associated expenses.

Financial asset ownership among Hispanics in the U.S. is also influenced by a sense of cultural and experiential barriers. According to Osili and Paulson (2005), the principal cultural and experiential barriers encountered by U.S. Hispanics include a limited command of the English language and a lack of confidence in financial markets and institutions. Caskey (2002) indicated that limited familiarity with the roles and functions of financial products, and not fully understanding how banking and financial products work, also have a direct impact on the participation of U.S. Hispanics in financial markets and their rates of financial asset ownership.

Many Hispanic households, including those with relatively high income levels, greater English language proficiency, and cultural assimilation, are unfamiliar with financial assets and lack experiential exposure to wealth management and financial planning. With regard to wealth management and financial planning, this segment of the U.S. Hispanic population lacks a direct relationship with either wealth management firms or individual financial planners. Due primarily to the lack of familiarity and insufficient experiential references, the concept of financial planning as the process of developing strategies to assist consumers in managing their financial affairs to meet life goals remains elusive for the majority of Hispanic households living the U.S. This includes those with higher net worth, higher levels of educational attainment, and higher levels of cultural assimilation.

Finally, existing structural and economic barriers affect financial asset ownership among U.S. Hispanics. Although Hispanic households in the U.S. demonstrate a relatively high propensity to save, their use of savings accounts remains relatively low compared to other population segments (Ibarra and Rodríguez 2005–2006; U.S Census Bureau 2013).

According to the Federal Deposit Insurance Corporation (2012), an estimated 20.1 percent of all U.S. Hispanic households do not have a bank account; this figure exceeds 40 percent in the case of foreign-born Hispanics. This can partially be explained by the inability of the banking sector to offer the types of products that would attract greater savings, the lack of confidence about banking institutions among Hispanics, and their limited knowledge about basic banking products and services (Ibarra and Rodríguez 2005–2006). Because possession of a bank account is a predictor of non-bank financial asset ownership, the relatively low use of traditional banking products and services by U.S. Hispanics has a direct influence on their rates of financial asset ownership.

Strategies to Increase Financial Asset Ownership

Projected U.S. demographic trends suggest that implementing strategies to increase financial asset ownership among Hispanics living in the U.S. is becoming an increasingly important strategic objective for financial institutions, particularly relationship-oriented financial intermediaries.

According to Passel and Cohn (2008), the U.S. Hispanic population will increase to 128 million by 2050. Hispanics are projected to represent 29 percent of the U.S. population by 2050, compared to 17 percent in 2013. As the fastest-growing ethnic group, they will account for 60 percent of the country’s population growth during the 2005–2050 period.

The outlook for household growth reflects similar trends. A recent report by the Joint Center for Housing Studies at Harvard University (McCue 2014) estimated that growth among the number of Hispanic households in the United States between 2015 and 2025 will account for the largest share of the nation’s forecasted household growth during this period. From a revenue and relationship management perspective, engaging with this growing population segment represents a potentially lucrative opportunity for financial planners.

Socioeconomic considerations impact the implementation and promotion of strategies and policies to increase financial asset ownership among Hispanics. Asset ownership can have a positive effect on household economic well-being (Lerman and McKernan 2008). Financial assets can generate income by increasing periodic cash flows through dividends and interest payments and realized capital gains. Financial assets also provide a cushion against temporary household income disruptions. For example, Cho (1999) found a positive correlation between financial asset ownership and the economic well-being of women during the first year after a marriage disruption.

Financial assets held as “buffer stocks” may help smooth household consumption in the short-term, particularly for low-income households (Deaton 1991; Lerman and McKernan 2008). In fact, asset building that focuses on minimizing the effects of shocks, such as disability or unemployment, is one of the principal reasons to save and accumulate financial assets. Another strategy to smooth consumption is to use financial assets to hedge risks. One method to achieve this goal is to hold assets within diversified portfolios that are negatively correlated with asset holdings obtained through an employer, such as employer stock (Lerman and McKernan).

Holding liquid financial assets can also play an important role in facilitating a household’s ability to make initial deposits (or down payments) for a home, business, or automobile (Lerman and McKernan 2008). Households with higher rates of financial asset ownership are usually offered better financial terms and conditions when making major purchases or acquisitions; they are also better equipped to take advantage of special financing opportunities, which can be beneficial when reallocating resources to start new business ventures or pursue attractive, and potentially lucrative, self-employment opportunities. In the case of low-income households in particular, financial asset ownership can improve a household’s economic self-sufficiency by eliminating the need for income support programs.

Financial institutions and intermediaries, particularly those desiring to capture a greater share of the fast-growing Hispanic market segment in the U.S., can implement several strategies to increase financial asset ownership among this population group. Several of these strategies are outlined in the following sections.

Strategy 1: Increase Financial Education and Literacy

Financial literacy includes an individual’s ability to understand the fundamental principles of consumer finance and the basic elements and features of banking products and services, as well as key financial instruments such as stocks, bonds, mutual funds, and other investments (Devlin 2003).

The proliferation of defined contribution retirement plans has increased the need for financial literacy and financial planning. Most individuals, regardless of their racial or ethnic origin, lack familiarity with basic financial concepts, particularly when it relates to equities, debt securities, mutual funds, and the time value of money (Hogarth and Hilgert 2002; Stango and Zinman 2006; Sun, Barborza, and Richman 2007).

According to Helman, Copeland, and VanDerhei (2006), the method used to acquire financial knowledge can impact financial planning and investment behavior substantially. Hogarth, Beverly, and Hilgert (2003) found that the majority of consumers who typically make retirement planning and investment decisions rely on personal experience, followed by the advice of friends and family members and media products, such as brochures and home videos, to acquire financial literacy. Retirement savings and investment behavior depend on having access to investment information, suggesting that access to investment information can have an impact on financial asset ownership (Lusardi and Mitchell 2004).

Based on a comprehensive survey of retirement planning behavior by race and ethnicity, Sun, Barborza, and Richman (2007) found that only 22 percent of Hispanic participants, including Latinos, attempted to engage in one of the most basic activities associated with retirement: estimating how much money they would need to retire. They also found that “among the Latino respondents who reported planning behavior, 35 percent developed a [retirement financial] plan” (p. 62). This suggests that there is a profound need to increase financial literacy and familiarity with financial and retirement planning among Hispanics living in the U.S.

With regard to retirement and financial planning behavior by race and ethnicity, Sun et al. (2007) found that Hispanics and Latinos are more likely to rely on informal planning resources, including family and friends, compared to whites and blacks. Similarly, Hispanics are less likely to use formal planning resources such as attending a financial planning seminar or using financial calculators, online financial planning services, or Excel worksheets (Sun et al.). For instance, 5 percent of Hispanics included in the survey had attended a financial or retirement planning seminar, compared with 42 percent of whites and 57 percent of blacks. Less than one quarter of surveyed Hispanics indicated that they were likely to use basic financial planning tools such as financial calculators, retirement planning worksheets, or financial planning software. This compared unfavorably to whites (29 percent) and blacks (32 percent).

Strategy 2: Promote, Support, and Implement Policies and Initiatives

Due to a series of existing barriers, mainstream financial institutions are often unable to meet the needs of large segments of the U.S. Hispanic population. Those excluded from the traditional financial sector include a relatively small but important share of wealthy Hispanic entrepreneurs living in the U.S. who, for a wide range of reasons, do not participate in the formal financial system at rates comparable with wealthy individuals of different ethnicities. Compared to the rest of the population, Hispanics tend to pay more for basic financial services, such as check-cashing and money transfers. Hispanics are often directed to subprime lenders, payday lenders, and other parallel financial institutions (Ibarra and Rodríguez 2005–2006).

Increasing the Hispanic participation rate in the formal financial service marketplace, their level of financial literacy, and familiarity with financial products and services is likely to have a positive impact on financial asset ownership among this growing segment of the U.S. population.

Higher rates of financial asset ownership among this group is likely to increase their demand for professionally delivered financial services. This represents an attractive opportunity for financial planners interested in capturing potential asset management fees and revenues that will emerge as this demographic group integrates more fully into the formal U.S. financial sector (Ibarra and Rodríguez 2005–2006; Tomás Rivera Policy Institute 2007). Financial planners can play a major role in supporting, promoting, and implementing a series of strategies to achieve this goal. According to the Tomás Rivera Policy Institute (TRPI), these should include:

Encourage mainstream financial institutions to offer customized products and services, such as low-fee checking accounts, free ATM transactions, low-cost bill payments, money transfer services, and electronic banking services in Spanish.

Organize Spanish language savings, retirement planning, and financial planning workshops in association with community-based organizations, chambers of commerce, local colleges and universities, and local branches of the U.S. Small Business Administration.

Create low-cost savings accounts similar to a 401(K) plan; these are known as Lifelong Learning Accounts (LiLAS), which are portable, employer-matched savings accounts that allow employees to set aside a percentage of their earnings to cover future training and education costs.

Develop and use low-cost alternative mechanisms to establish and quantify the creditworthiness of non-traditional borrowers. Some examples of this include the FICO Expansion score, which uses non-traditional credit data—including deposit account records, payday loan transactions, and purchase payment plans—to asses a borrower’s credit score. Other examples include: (1) the “Anthem” non-traditional credit score developed by First American, which relies on rental payments, child care expense payments, utility bill payments, insurance premium payments, and other expenditures; (2) traditional scoring models to establish a non-traditional borrower’s credit score; (3) a product called Debit Bureau that relies on checking account and ATM transactions; and (4) the Payment Reporting Builds Credit (PRBC) reporting system, which allows customers to build a credit profile by recording payments for rent, mortgage, utilities, and other outlays.

Strategy 3: Provide Individualized and Customized Comprehensive Financial Planning

One significant finding from the research conducted by Sun et al. (2007) is that Hispanics, particularly those part of the emerging affluent class, are more likely to consult professionals for financial help compared with non-Hispanics. Another relevant finding is that Hispanics generally prefer more individualized retirement and financial planning services that are built around strong client relationships, customized financial plans, and specialized products and services. This represents a unique opportunity for financial planners wishing to serve this growing population segment.

Affluent Hispanic households are defined as those with median annual incomes of $100,000 or more (U.S. Census Bureau 2013). According to TRPI (2007), the number of Hispanic households with annual income over $100,000 grew 126 percent between 1991 and 2000 (compared to 77 percent for the rest of the U.S. population). The number of Hispanics who earn $100,000 or more and have at least $500,000 in assets has grown eight times faster than the non-Hispanic market (TRPI).

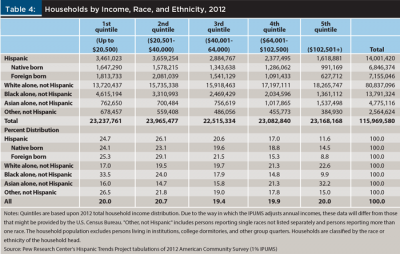

As Table 4 indicates, in 2012, 11.6 percent of Hispanic households living in the U.S. earned more than $102,501, compared to 22.6 percent of white households, 9.9 percent of black households, and 32.2 percent of Asian households. This represents a total of 1.6 million households, compared to 1.4 million households in 2005, which represents an increase of 14.7 percent, or 207,144 households, during this period according to Pew Research Center’s “Statistical Portrait of Hispanics in the United States, 2012."

Although affluent Hispanic households share many of the cultural traits of their lower-income counterparts, these traits manifest themselves differently. For instance, wealthy Hispanics, unlike lower-income Hispanics, are usually disinclined to rely on revolving lines of credit. Those who use credit cards tend to pay the outstanding balance in full. Affluent Hispanics are high-frequency users of debit cards, are relatively new to homeownership (only 45 percent of all Hispanic households own their homes), and are less likely to use home equity lines of credit (TRPI 2007).

Affluent Hispanics are typically younger than their non-Hispanic affluent counterparts (Haar 2007). According to the Pew Research Center, the median age for U.S. Hispanics is 28 years, compared to 42 years for whites, 33 years for blacks, and 36 years for Asians. Affluent Hispanics are computer and internet savvy at similar rates as non-Hispanics (Haar). Although wealthy Hispanics tend to use online and telephone banking services on a regular basis, they prefer to solve customer service-related issues in person by visiting a bank branch or meeting in person with their banker, accountant, or financial adviser (TRPI 2007).

Unlike non-Hispanics, the savings of wealthy Hispanics are often in the form of remittances or international cash transfers, which in many instances are used to invest in residential properties and businesses abroad (Orozco and Castillo, 2008; TRPI 2007). Affluent Hispanics demonstrate their desire to ensure their family’s financial future by purchasing life insurance policies and U.S. government securities, rather than investing in equities, corporate bonds, index funds, derivatives, and mutual funds (Choudhury 2002; TRPI).

Wealthy Hispanic households are generally self-made entrepreneurs who started their businesses with relatively small amounts of financial capital, often borrowed from a close-knit circle of family members and friends. As such, they tend to have very strong personal and emotional ties to their businesses, which are often considered as family enterprises. Regardless of the number of years in operation and their magnitude and size, nearly all businesses operated by affluent Hispanics are considered part of the founder’s legacy to be passed down through inheritance to their children. However, in some instances, the founder’s children may not share this view. Therefore, business-owning Hispanics tend to be more pragmatic and practical in the context of succession planning. They typically are more open to selling the family business or to bringing in outside investors as a way to expand and diversify (TRPI 2007).

Strong levels of loyalty to family, business, and community, are also pervasive among affluent Hispanics (Prudential 2014; TRPI 2007). Hispanic entrepreneurs and business owners normally rely on the advice of Hispanic financial professionals, including accountants, lawyers, and financial planners. Linking with these professionals usually occurs through referrals by relatives, friends, neighbors, and other business owners. However, those with higher levels of acculturation, educational attainment, social capital, and wealth tend to also rely on professional advice from highly qualified and competent non-Hispanic service providers (TRPI).

With regard to establishing and following formal financial plans, it is worth noting that although affluent Hispanics are usually financial savvy and well organized, only 33 percent have a personal financial plan, while 59 percent have an estate plan (TRPI 2007). Those that have established personal financial plans typically have done so using a piecemeal approach. Others lack a comprehensive approach to financial planning and often operate using outdated financial plans (TRPI). Furthermore, wealthy Hispanics typically rely on multiple advisers who rarely consult each other to discuss their clients’ evolving financial planning needs or to devise coordinated recommendations to help their clients achieve their long-term financial goals (Prudential 2014).

The lack of a coordinated approach to provide wealthy Hispanics with comprehensive financial advice represents one of the principal challenges confronted by financial planners catering (or wishing to cater to) this growing demographic. However, this condition also offers an opportunity for entrepreneurially minded financial planners to develop long-term relationships based on the development of comprehensive financial plans focused on the evolving financial needs of clients who value commitment and loyalty. This can be achieved by providing affluent Hispanic clients with consolidated financial planning services that extend beyond asset allocation and portfolio selection. Such a comprehensive and consolidated financial planning approach should involve other key professionals with whom wealthy Hispanic clients have a strong affinity and a close relationship.

Implications for Financial Planners

Increases in the percentage of the U.S population expected to enter retirement with insufficient resources to maintain their living standards, the shift from direct benefit to direct contribution employer-sponsored retirement plans, higher life expectancy, reductions in government provided retirement benefits, and the increased sophistication of the financial marketplace over the last two decades have contributed to a greater need for professional financial advice (Iannicola and Parker 2010).

In the case of the U.S. Hispanic market, demographic trends, along with projected increases in wealth, should be an incentive for financial planners to target this market niche. A recent study by the Federal Reserve Bank of St. Louis found that the inflation-adjusted wealth owned by Hispanic households in the U.S. is expected to triple by 2025 if wealth-building trends revert to the levels experienced during the last two decades (Emmons and Noeth 2014). Led by population growth, and to a lesser extent by increases in household income, U.S. Hispanic households are projected to own between $2.5 trillion and $4.4 trillion in wealth, which represents between 2.6 percent and 3.2 percent of the nation’s total wealth, by 2025.

In addition to providing customized and comprehensive financial advice, financial planners who are particularly interested in expanding beyond their traditional client base should devise strategies to address social barriers encountered by prospective Hispanic clients. At the individual level, many wealthy Hispanics, particularly those with lower levels of acculturation, often have a limited understanding of the value of professional advice. They sometimes exhibit mistrust because of perceived adviser conflicts of interest and therefore avoid using the services of professional financial advisers, and instead often seek financial advice from informal sources, such as family, business associates, and friends (Iannicola and Parker 2010).

Many financial planners may lack the necessary social relations and community-based connections to access and serve the affluent Hispanic market. A social disconnect between wealthy Hispanic clients and the financial planning profession may also exist, due in part to the still relatively low percentage of Hispanics employed in this field. According to the Bureau of Labor Statistics, there were 19,916 financial advisers of Hispanic origin in the U.S. in 2013, representing just 5.2 percent of the 383,000 financial advisers in the country in that year.

By implementing the strategies outlined here that are designed to increase the financial literacy of Hispanic households, it may be possible to educate existing and potential clients about the process and value of financial planning. This will help build stronger social and community connections. This, in turn, should lead to more financial planners providing customized and comprehensive financial advice in this market segment.

Financial planners, regardless of ethnicity or race, will be able to directly impact financial asset ownership and meet the evolving demands for professional financial advice among the growing, and promising, affluent Hispanic market segment.

References

Aizcorbe, Ana M., Arthur B. Kennickell, and Kevin B. Moore. 2003. “Recent Changes in U.S. Family Finances: Evidence from the 1998 and 2001 Survey of Consumer Finances.” Federal Reserve Bulletin 89 (1): 1–32.

Avery, Robert B., and Arthur B. Kennickell. 1991. “Household Saving in the U.S.” Review of Income and Wealth 37 (4): 55–84.

Campbell, John Y., and Luis M. Viceria. 2002. Strategic Asset Allocation: Portfolio Choice for Long-term Investors. New York: Oxford University Press.

Carney, Stacey, and William G. Gale. 2000. “Asset Accumulation among Low-Income Households.” Brookings Institution Working Paper.

Caskey, John P. 2002. The Economics of Payday Lending. Madison, WI: Filene Research Institute.

Chang, Regina Y. 1994. “Saving Behavior of U.S. Households in the 1980s: Results from the 1983 and 1986 Survey of Consumer Finance.” Financial Counseling and Planning 5 (1): 45–64.

Cho, Esther. 1999. “The Effects of Assets on the Economic Well-Being of Women after Marital Disruption.” Center for Social Development, Working Paper No. 99-6. Saint Louis, MO: Center for Social Development, Washington University.

Choi, Laura. 2013. “Household Net Worth and Asset Ownership among the Economically Vulnerable.” Community Development Research Brief, Federal Reserve Bank of San Francisco.

Choudhury, Sharmila. 2002. “Racial and Ethnic Differences in Wealth and Asset Choices.” Social Security Bulletin 64 (4): 1–15.

Cobb-Clark, Deborah, and Vincent A. Hidelbrand. 2006. “The Portfolio Choice of Hispanic Couples.” Social Science Quarterly 87 (5): 1344–1363.

Coleman, Susan. 2003. “Risk Tolerance and the Investment Behavior of Black and Hispanic Heads of Household.” Financial Counseling and Planning 14 (2): 43–52.

Davis, Elizabeth P., and Walter R. Schumm. 1987. “Savings Behavior and Satisfaction with Savings: A Comparison of Low and High Income Groups.” Home Economics Research Journal 15 (4): 247–256.

Deaton, Angus. 1991. “Saving and Liquidity Constraints.” Econometrica 59 (5): 1221–1248.

Devlin, James. 2003. “Monitoring the Success of Policy Initiatives to Increase Consumer Understanding of Financial Services.” Journal of Financial Regulation and Compliance 11 (2): 151–163.

Dilworth-Anderson, Peggye, Linda M. Burton, and Leanor B. Johnson. 1993. “Reframing Theories for Understanding Race, Ethnicity, and Families.” In Sourcebook of Family Theories and Methods: A Contextual Approach, edited by Pauline Ross, William Doherty, Ralph LaRossa, Walter Schumm, and Suzanne Steinmetz, 627–646. New York: Plenum Press.

Emmons, William R., and Bryan J. Noeth. 2014. “Hispanic Population’s Share of Wealth Likely to Increase by 2025.” In the Balance, Federal Reserve Bank of St. Louis 8: 1–4.

Falicov, Celia. 2001. “The Cultural Meanings of Money: The Case of Latinos and Anglo-Americans.” The American Behavioral Scientist 45 (2): 1–10.

Federal Deposit Insurance Corporation (FDIC). 2012. “National Survey of Unbanked and Underbanked Households."

Foster, Ann C. 1981. “Wives’ Earnings as a Factor in Family Net Worth Accumulation.” Monthly Labor Review 104 (1): 53–57.

Giese, Gina, and David Snyder. 2009. “An Outlook on the Growing Hispanic Market Segment and the Abilities of the U.S. Banking Industry to Effectively Penetrate the Hispanic Market Segment.” Journal of Business & Economics Research 7 (1): 103–114.

Haar, Jerry. 2007. “The Hispanic Wealthy: The Next Big Wave in Financial Services.” Hispanic Business. October 5.

Hefferan, Colien. 1982. “Determinants and Patterns of Family Saving.” Home Economics Research Journal 11 (1): 47–55.

Helman, Ruth, Craig Copeland, and Jack VanDerhei. 2006. “Will More of Us Will Be Working Forever?” Employee Benefit Research Institute 2006 Retirement Conference Survey, Issue Brief No. 292.

Hira, Tahira K. 1985. “Determinants of Household Asset Ownership.” Paper presented at the Southeastern Regional Association, Family Economics and Home Management, Social and Economic Resources: Managing in a Complex Society Conference.

Hogarth, Jeanne M., and Marianne A. Hilgert. 2002. “Financial Knowledge, Experience, and Learning Preferences: Preliminary Results from a New Survey on Financial Literacy.” Consumer Interest Annual 48 (1): 1–7.

Hogarth, Jeanne M., Sondra G. Beverly, and Marianne A. Hilgert. 2003. “Patterns of Financial Behavior: Implications for Community Educators and Policymakers.” Federal Reserve Community Affairs Research Conference.

Iannicola, Dan, and Jonas Parker. 2010. “Barriers to Financial Advice for Non-Affluent Consumers.” The Financial Literacy Group, Society of Actuaries.

Ibarra, Beatriz, and Eric Rodríguez. 2005–2006. “Closing the Wealth Gap: Eliminating Structural Barriers to Building Assets in the Latino Community.” Harvard Journal of Hispanic Policy 18 (1): 25–38.

Lerman, Robert, and Signe-Mary McKernan. 2008. “The Effects of Holding Assets on Social and Economic Outcomes of Families: A Review of Theory and Evidence.” A Report in the Series, Poor Finances: Assets and Low income Households. Washington, D.C.: The Urban Institute.

Lusardi, Annamaria, and Olivia Mitchell. 2004. “Saving and the Effectiveness of Financial Education.” In Pension Design and Structure: New Lessons from Behavioral Finance, edited by Olivia Mitchell and Stephen P. Utkus. New York: Oxford University Press.

Malone, Nolan, Kaari F. Baluja, Joseph M. Costanzo, and Cynthia J. Davis. 2003. “The Foreign-Born Population: 2000.” Washington, D.C.: U.S. Census Bureau.

McCue, Daniel. 2014. “Baseline Household Projections for the Next Decade and Beyond.” Joint Center for Housing Studies, Harvard University.

Motley, Brian. 1970. “Household Demand for Assets: A Model of Short-run Adjustments.” Review of Economics and Statistics 52 (3): 236–241.

Odgen, Denise, James R. Odgen, and Hope Schau. 2004. “Exploring the Impact of Culture and Acculturation on Consumer Purchase Decisions: Toward a Microcultural Perspective.” Academy of Marketing Science Review 3 (1): 1–22.

Orozco, Manuel, and Nancy Castillo. 2008. “Latino Migrants: A Profile on Remittances, Finance, and Health.” Inter-American Dialoge. April.

Osili, Una O., and Anna Paulson. 2005. “Individuals and Institutions: Evidence from International Migrants in the U.S.” Federal Reserve Bank of Chicago.

Passel, Jeffrey S., and D’Vera Cohn. 2008. “U.S. Population Projections: 2005–2050.” Pew Research Center.

Prudential. 2014. “The Hispanic American Financial Experience.” www.prudential.com/media/managed/hispanic_en/prudential_hafe_researchstudy_2014_en.pdf.

Ramírez, Roberto, and G. Patricia De la Cruz. 2003. “The Hispanic Population in the United States: March 2002.” U.S. Census Bureau.

Stango, Victor, and Jonathan Zinman. 2006. “How a Cognitive Bias Shapes Competition: Evidence from Consumer Credit Markets.” Working paper available at SSRN.com.

Stegman, Michael, Roberto G. Quercia, and Jennifer S. Lobenhofer. 2001. “Automated Underwriting: Getting to Yes for More Low-Income Applicants.” Paper presented at the Conference on Housing Opportunity, Research Institute for Housing America Center for Community Capitalism, Chapel Hill, University of North Carolina.

Sun, Wei, Gia Barborza, and Karen Richman. 2007. “Preparing for the Future: Latino’s Financial Literacy and Retirement Planning.” The Business Journal of Hispanic Research 1 (2): 54–68.

Tomás Rivera Policy Institute. 2007. “Increasing Wealth in the Latino Community.” TRPI Conference Summary Report.

U.S. Census Bureau. 2013. “Wealth and Asset Ownership."

Williams, Flora L., and Sarah L. Manning. 1972. “Net Worth Change of Selected Families.” Home Economics Research Journal 1 (2): 104–113.

Xiao, Jing J. 1995. “Patterns of Household Financial Asset Ownership.” Financial Counseling and Planning 6 (1): 99–106.

Xiao, Jing J., and Joan G. Anderson. 1993. “A Hierarchy of Financial Needs Reflected by Household Paper Assets.” Consumer Interests Annual 39: 207–214.

Yao, Rui, Michael S. Gutter, and Sherman D. Hanna. 2005. “Financial Risk Tolerance of Blacks, Hispanics, and Whites.” Financial Counseling and Planning 16 (1): 51–62.

Citation

González-Corzo, Mario. 2015. “Strategies to Increase Finacnial Asset Ownership among U.S. Hispanics.” Journal of Financial Planning 28 (6): 52–61.