Journal of Financial Planning: July 2021

Peter Stahl, CFP®, is founder of Bedrock Business Results (bedrockresults.com) and the WealthWatch (yourwealthwatch.com) resource center, providing training, resources, and client phone consultations on the convergence of healthcare and financial planning. You can reach him HERE.

The financial services industry continues its focus on the merits of comprehensive wealth management, moving beyond traditional accumulation and retirement income strategies in order to better meet client needs.

Topics such as Medicare, health savings accounts (HSAs), and retirement healthcare costs are in the early stages of incorporation into the financial planning process. As we move through 2021, healthcare conference content, planning software, articles, and overall planner proficiency have certainly risen. This is an encouraging trend, but much work remains. Retirement healthcare costs will constitute one of the largest retirement expenditures for most of our clients. Medicare is the mandatory means of insurance coverage and most individuals find the system confusing and overwhelming.

This article addresses three areas of convergence between retirement healthcare and the financial planning process: (1) Medicare; (2) wealth accumulation for retirement healthcare; and (3) custodial care.

The focus is on content and timing, describing the most important considerations a planner should understand within these three areas and when in the financial planning process the strategies should be implemented.

Medicare Fundamentals and Considerations

The most important Medicare considerations facing your clients are the choices they make to build optimal insurance coverage and the decision concerning enrollment timing. Before addressing these areas, it is important to describe a few Medicare fundamentals.

First, Medicare is mandatory. While there is not a specific law stating one must enroll in our nationally administered health insurance program, significant penalties exist for those who either do not enroll or are late in enrolling. For example, if you want to collect your Social Security retirement benefit, you must be enrolled in Medicare Part A. There are private insurance policies created to supplement Medicare, but none are an alternative to the foundational core coverages offered by Medicare.

The second principle to understand is that Medicare is means tested. Those with higher incomes will pay more for coverage. Additional detail will be described later in the article. In summary, Medicare is one of the few financial planning topics that virtually all of your clients will address. What guidance should you provide and when should it be delivered?

Most clients will choose between two Medicare coverage models. The first model consists of enrolling in original Medicare Parts A and B and then choosing private insurance companies to provide a Medicare Supplement and Part D prescription drug plan.

Medicare Part A covers core needs—such as hospital stays, skilled care (e.g., a rehabilitation facility), and end-of-life hospice care. Medicare Part B covers physician services, outpatient surgery, and preventative care. Parts A and B do have deductibles and co-pays, some of which are substantial. The most common gap is Part B coverage at 80 percent of expenses, leaving the patient responsible for the other 20 percent without a limit. “No limit” are usually two words to avoid with health insurance coverage. The Medicare supplement policy fills in the major coverage gaps such as the aforementioned 20 percent liability. It also provides substantial coverage for hospital and rehabilitation facility visits. It is worth noting that you are only guaranteed to qualify for a Medicare supplement policy when you sign up for Medicare Part B.1 If you choose not to purchase a supplement at that time, health conditions may prohibit you from obtaining a policy later in life. You will do your clients a great service by making sure they understand this as they build a coverage model.

Rounding out the first coverage model is a prescription drug policy. This policy can have a modest deductible as well as co-payments but does provide extensive coverage for prescription drugs. One of the most appealing aspects of this coverage model is the fact that you can receive treatment from any physician in the country who accepts Medicare.

The second coverage model still has you enrolled in Medicare Parts A and B, but the coverage is packaged with a private insurance company known as a Medicare Advantage Plan, also called Medicare Part C. There are a wide variety of Advantage Plans to choose from (such as an HMO or PPO), but the common thread with this coverage model is the client is restricted to a network of healthcare providers. Most often this is a regional network. Prescription drug coverage is usually bundled in the overall plan. The idea is to lower your healthcare costs by visiting primary care physicians and specialists within the network in which the insurance company has negotiated pricing. It is important to understand that if you choose to seek care out of this network, your co-payments will be substantially higher.

These coverage models are distinct in many ways, and much additional detail exists. The most important difference is the second coverage model is focused on delivering care within a regional network of healthcare providers while the first coverage model allows care from any provider who accepts Medicare.

When Should You Proactively Contact Clients Regarding Medicare?

There are a few obvious times when planners should proactively contact clients to discuss Medicare. Since age 65 is the most common age for Medicare eligibility, reaching clients in the months leading up to their 65th birthday with Medicare information and resources is a valuable service. Some clients will need to enroll during the initial enrollment period that surrounds age 65.

Providing resources on coverage choices, costs, and key dates is essential. Some individuals will be eligible to stay on group health insurance coverage until that coverage ends and then enroll in Medicare. Confirming the ability to defer Medicare enrollment as age 65 approaches brings peace of mind. In this situation, re-engage with cost, coverage, and key dates a few months before group health insurance ends. Generally speaking, if an individual is covered by group health insurance from an employer with 20 or more employees, and the insurance coverage is as extensive as Medicare, they can defer Medicare enrollment at age 65.

Substantial, lifelong, late enrollment penalties do exist for those that miss the appropriate enrollment period. This understandably creates anxiety for clients that you can alleviate.

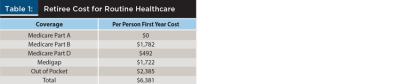

The cost for routine retirement healthcare will depend on a number of factors, like health and wealth. Table 1 details the annual breakdown for a 2021 retiree. Most individuals will not pay a premium for Medicare Part A coverage because they have paid a Medicare payroll tax throughout their working years. Part B and Part D each have a premium. The premium is increased based on income. Medicare calls this increase an Income-Related Monthly Adjustment Amount (IRMAA). Also included is a national average for a Medicare Supplement and out-of-pocket expenses. The out-of-pocket expenses include co-pays, deductibles, and uncovered expenses such as vision and dental care. The $6,381 annual cost estimate is per person as there are no joint Medicare policies.

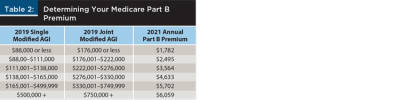

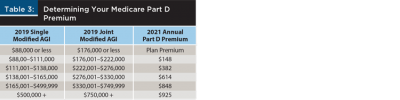

The IRMAA charges are detailed in Tables 2 and 3. Medicare uses modified adjusted income from two years prior to determine the IRMAA charges. Municipal bond interest is added to “AGI” to reach modified adjusted gross income—worth noting when working with clients that maintain significant municipal bond positions when transitioning to Medicare.

The two-year look back is a frequent topic during client consultations with affluent households. For example, a 2021 retiree was often near the peak of their career in 2019. The 2019 income level places them well into the higher tiers of IRMAA charges. With a transition to retirement in 2021, income is often substantially lower. Medicare will use current income to determine Medicare premiums if the individual has a “life changing event” as listed on form SSA-44. Table 4 gives a list of these events. Form SSA-44 is filed to document or even estimate current income and request that Medicare premiums be based on this current income. Note that capital gains and required minimum distributions do not qualify as life changing events. Work stoppage (retirement) and work reduction (partial retirement) do qualify! Marriages, resulting in a shift from single to joint filing, also may warrant use of SSA-44. Too many clients unknowingly sign up for Medicare without professional assistance and miss this opportunity to reduce costs by thousands of dollars.

Even without IRMAA charges, the base figure of $6,381 in annual healthcare costs, inflated at 4.9 percent over just a 20-year retirement, totals $208,000. Double that figure for a married couple. This will constitute one of the largest retirement expenditures for most of our clients. Once again, this is the cost estimate for routine healthcare, which does not factor in long-term care expenditures. This figure also assumes an income level triggering the lowest Medicare Part B and Medicare Part D premiums. Higher income clients subject to IRMAA will need to increase the cost estimate. Conversely, the base figure includes a national average for out-of-pocket expenses, largely driven by dental, vision, and higher-cost prescription drugs. A healthy client may be able to lower cost estimates for this line item.

Healthcare inflation is historically higher than CPI inflation. HealthView Services forecasts 5.9 percent in their 2021 research report.2 Milliman quotes a CPI plus 2 percent figure of 4.9 percent.3 Building a specific line item for healthcare costs into the financial plan is prudent. Inflating this estimate at a rate higher than the overall budget is also wise.

One unique impact of IRMAA is how it can reduce one’s Social Security Retirement benefit. For those who are on Medicare and have begun their Social Security, Medicare Part B and usually Part D premiums are taken directly from the Social Security payment. This reduction includes IRMAA charges. Many clients’ largest financial assets are held in qualified accounts. As life expectancies lengthen, RMDs in the later years of life can drive clients into higher IRMAA brackets, thus reducing Social Security payments. Table 5 shows an individual retiring with a $1,000,000 IRA and a $30,000 annual Social Security payment. Explaining this declining trajectory to an 85-year-old client would certainly create a challenging conversation.

One way planners can avoid this scenario is to modify wealth accumulation strategies during peak accumulation years. One strategy is to build sources of tax-free retirement income. This may be as simple as choosing a Roth 401(k) for employee deferrals in lieu of traditional 401(k). Roth retirement income does not impact IRMAA. If a planner believes there is a reasonable likelihood of higher future tax rates coupled with large RMDs, building sources of tax-free income is prudent. The second example in Table 5 illustrates the same individual entering retirement with the $1 million equally split between traditional IRA and Roth IRA.

The decision to choose a Roth versus traditional IRA or 401(k) has numerous factors, including the comparison of current tax rates to unknown future rates. IRMAA considerations must be included in the analysis.

Exploring the HSA

Another less conventional source of tax-free retirement income is an HSA. These accounts are available in conjunction with a qualified high-deductible health insurance policy. Most clients use these accounts to pay for current healthcare expenditures. A better strategy is to pay for current healthcare expenses from the emergency fund and invest the HSA for retirement. A full description of HSA accounts and strategies is beyond the scope of this article, but the general concept is to make pre-tax contributions into the HSA, enjoy tax-free growth on the fully invested account, and then make tax-free withdrawals for qualified healthcare expenses during retirement.

Note that tax-free HSA distributions do not impact IRMAA. Medicare Parts A, B, C, and D premiums all qualify as qualified health expenses along with the numerous co-payments, deductibles, and uncovered items your clients face during retirement. Healthcare expenditures during accumulation years should be made from your clients’ emergency fund. Qualified expenditures made from the emergency fund create lifetime tax-free distributions from the HSA.

For example, a married couple, age 48, had a fully funded, fully invested HSA account they opened in 1994 (including catch-up contributions at age 55-plus). That HSA would be valued at $362,184 in 2020 at age 64.

Hindsight is 20/20 as this has been a missed opportunity for most clients. It does, however, illustrate the opportunity that exists for those advisers who discover HSA account owners within their practice and employ this strategy during peak earning years.

Factoring in the Cost of Custodial Care

The costs, coverages, and planning strategies described have costs related to routine healthcare. One additional area to address is a plan for custodial care. Custodial care is rightly defined as help with activities of daily living. Most often this help is provided by family members or hired professionals in the home. Approximately one-third of the time, this care is provided in a more formal setting such as a nursing home.4 Custodial care is generally not covered by Medicare.

The overall likelihood of needing care and the extreme cost of this care is well documented.

To properly understand the impact of custodial care and to convince clients to create a plan for care, the focus should shift from this statistical focus on the care recipient to the care provider. Care is most often provided by family members. If an aging spouse cares for a husband or wife, the emotional and physical impact can be overwhelming. An equally common scenario involves an adult child who is caring for an aging parent. This individual is most often a daughter, either the oldest or the one living closest to the aging parent. This daughter is usually married with children and managing a career.5 As humbling as it is to need custodial care, the devastating impact is often on the care provider as she attempts to manage family and career while functioning as the primary custodial care provider.

An ideal plan of care will include a long-term care insurance policy, either in a traditional format or one of the many, innovative hybrid products available. This will create a robust, tax-free cash flow when the need for care arises. The role of the care provider shifts to one of a care coordinator. The coordinator role remains a major commitment, but having the financial resources to employ professional care—either at home or in a nursing home—makes the task manageable.

The urgency to address custodial care prior to retirement has never been greater. A classic inflationary environment exists within this industry. The number of care recipients is growing as the largest segment of the U.S. population is currently age 57 to 75. The pool of care providers, however, is shrinking as parents have fewer children. These children are less likely to live close to their parents compared to a generation ago. The resulting inflation creates an increase in the cost and availability of professional care providers. This is evidenced in rising hourly rates for home care providers and rising fees for nursing homes. Employing home healthcare workers may require committing to multiple days per week and an overall minimum number of hours.

Summary

To properly address retirement healthcare within your clients’ financial plan, you need to do several things. First, discuss sources of tax-free income during clients’ peak accumulation years. Also, provide information on Medicare approaching age 65 and during the transition to retirement. Next, build a cost estimate customized according to health, wealth, and healthcare inflation. Lastly, motivate clients to address custodial care by discussing the impact on care providers.

Endnotes

- A few states offer broader Medicare Supplement availability.

- See “2021 Retirement Healthcare Costs Data Report,” from HealthView Services at hvsfinancial.com/wp-content/uploads/2020/12/2021-Retirement-HC-Costs-Report-op-final.pdf.

- See the Milliman white paper “Health Care Costs in Retirement—2019 Update,” at kefferfinancialplanning.com/files/HealthCareWhitePaper.pdf.

- See “Medicaid’s Role in Nursing Home Care 2019,” from Kaiser Family Foundation at https://www.kff.org/infographic/medicaids-role-in-nursing-home-care/.

- See “Women and Caregiving: Facts and Figures,” from the Family Caregiver Alliance at caregiver.org/women-and-caregiving-facts-and-figures.