Journal of Financial Planning: January 2020

Joseph Orsolini, president of College Aid Planners Inc., is an expert in college planning who specializes in the unique financial needs of parents who plan on sending their children to college. He helps families of all income levels with the college planning process, college savings, tax preparation, and retirement advice. As a nationally respected authority on college planning, he has been featured in The Wall Street Journal, Bloomberg, Kiplinger’s, FOX Business, Savingforcollege.com, U.S. News & World Report, and others.

As a financial planner, you’ve probably encountered plenty of concerned clients with high school kids. These parents have been bombarded with depressing news about skyrocketing student loan debt in recent years. Many of them are wringing their hands wondering how they and their children will ever be to able afford college.

Should these clients be worried? Absolutely. Should their kids be alarmed? Of course. But these folks are not the only ones who should be concerned. We all should be. After all, the student loan bubble is becoming every American’s problem.

Startling Statistics

I work in the college planning business. So when I read the news, I pay close attention to certain stories. Lately, I keep stumbling across startling statistics about folks born between 1982 and 2004. As you know, this is the millennial generation. Today, most millennials are in their mid-20s to mid-30s. Let’s take a look at a few of these millennial stats.

Restaurant spending and car purchases plummet. Historically, 25- to 34-year-olds were the No. 1 spending group in restaurants. In past decades, these young professionals were eating out all the time. However, since 2012, this age group has plummeted to the bottom of restaurant spending. They are now dead last.1

Is it because this generation has adopted healthier, more “socially responsible” eating habits? Perhaps. Yet there are plenty of restaurants out there that appeal to this group, from sustainable farm-to-table eateries to organic and vegan bistros. Even fast food chains are offering more nutritious menu options these days. I believe this trend is more about the lack of disposable income.

Here’s another interesting statistic: millennials drive 23 percent fewer miles and buy 11 percent fewer cars than Gen-Xers, the generation before them, according to a report from the U.S. PIRG Education Fund.2 Are millennials being more environmentally conscious by walking, biking, or taking public transportation? Sure, some of them. But perhaps most of them simply cannot afford a car.

The boomerang generation. A mind-blowing number of millennials (who are grown adults now, mind you) are still living at home. According to the U.S. Census Bureau, 35 percent of 18- to 34-year-olds are living with their parents.3 This is why the group is often called the “boomerang generation.”

When you live at home with your parents, you don’t have a car, and you can’t afford to eat out at a restaurant, you probably don’t score many dates. If you aren’t dating, you don’t get married. What’s the result? The U.S. now has the highest average first-time marriage age in national history: 28 for American women and 29.8 for American men. That’s up from age 22 for women and 24.7 for men in 1980.4

All joking aside, millennials are capable of scoring dates, and many of them are in long-term relationships. However, it seems this generation is making the conscious decision not to get married. These young couples are opting to live together, but they are postponing or altogether bypassing marriage. About 15 percent of unmarried young adults (ages 18 to 34) are living with a partner, according to the Census Bureau.5 It’s probably no coincidence that we may have the lowest fertility rates in this country since the 1950s.6

Real estate reality. Here’s another interesting fact: historically, after American couples get married and have kids, they buy houses. In past generations, people typically bought their first house at age 31 or 32.7 However, in this age group today, fewer people are getting married and having kids. Most of them can’t afford (or aren’t interested in) a pricey McMansion in the suburbs. It’s a slow creep right now, but I predict in the next three to four years, this will be the next bubble to burst. The real estate market is going to plummet.

This is what’s been going on with the millennial generation—and these trends are sending shockwaves through our economy.

The Millennial Impact

After reading these stats, you might say, “Man, it sure sucks to be a millennial.” Well, sure, that may be true. After all, many of them have come of age during one of the most brutal recessions in U.S. history. They face soaring student loan debt and a highly competitive job market, which might explain why they are struggling to achieve financial independence.

But if you read the news, you’ll notice some disturbing trends snaking through our economy. For instance, Walgreens, Motorola, Allstate, McDonald’s, and other giant corporations are moving large pieces of their operations into the city. After 47 years in the suburbs, McDonald’s moved its corporate headquarters from a suburban campus to downtown Chicago in 2018.8

One of the reasons behind this trend is companies are having a difficult time recruiting millennial talent. This generation generally prefers to live in the city (if they’re not still at home with mom and dad). They’re not married, they don’t have kids, and in a lot of cases they don’t have cars. So, they don’t want to live in the suburbs, where there’s limited public transportation. These companies are all moving into the cities to chase down young employees.

Sounds like a millennial problem, right? Not necessarily. Let’s say you used to have a 20-minute commute from Naperville to work at the McDonald’s suburbs headquarters in Oak Brook. Thanks to the corporation’s big move, you’re now on a seven-year waiting list to get a parking space at the Naperville train station so you can commute to downtown Chicago. In other words, “millennial problems” are becoming your problems and your clients’ problems. The trends created by this generation are having a major impact on every aspect of our nation’s economy.

Ending the Cycle

What is the driving force behind these trends? In my opinion, it’s the student loan debt crisis. The economic crash of 2008 kicked it off, and we’re now more than 10 years into this huge debt cycle. The crew of 18-year-olds who started college in 2008 are now 28 years old. Thanks to their student loan debt, they can’t afford to move out of their parents’ home, they’re not getting married, they’re not having kids, and they’re not buying houses.

Between 1982 and 2011 college tuition and fees have increased by a whopping 570 percent, according to Bureau of Labor Statistics data. In 2018, outstanding student debt surpassed $1.5 trillion for the first time9 (yes, that’s trillion, not billion).

How can we help put an end to this vicious cycle? As financial planners, I believe it’s our responsibility to educate clients about financially smart college planning. How do we do this? First and foremost, we have to bust some age-old college planning myths:

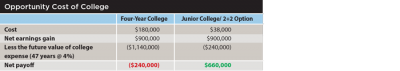

Myth 1: You earn nearly $1 million more with a college education. At first glance, this statement is true. Bureau of Labor Statistics data show that the typical high school graduate earns $1.7 million throughout their career. On the other hand, the average college grad earns $2.6 million during their lifetime—that’s $900,000 more than the folks who don’t go to college.10 It’s a huge win, right? Not so fast.

Let’s say a student attends a four-year college with a price tag of $180,000. When you factor in the future value of college expenses, the college grad actually loses $240,000 in the long run.

On the other hand, let’s say a student attends community or junior college for the first two years and then transfers to a university for the second two years. The total cost of education adds up to $38,000. (This is called the 2+2 option. The student still earns a BA but saves loads of money.) In this scenario, the grad’s net payoff is $660,000.

In other words, there is a cost/benefit to higher education. This is why it’s important to ensure your clients make informed, financially smart college choices.

Myth 2: Students who attend highly selective colleges are more successful. This is simply not true. As the late Alan Krueger, who was an esteemed labor economist and professor at Princeton, pointed out in one of his many papers: “Students who attended more selective colleges do not earn more than other students who were accepted and rejected by comparable schools but attended less selective colleges.”11

Think about the highest educated person in your life. Is this person a doctor? A lawyer? What college did he or she attend? More than likely it wasn’t Harvard or Yale. For the vast majority of students, these highly selective colleges simply are not worth the expense.

If your client has a high school kid with aspirations of completing medical school, law school, or some other graduate program, my advice is: get your undergraduate degree on the cheap and put your money into graduate school.

Myth 3: Sending my kid to college will get them out of my house for good! This is not the case. Remember, more than one-third of 18- to 34-year-olds are still living with their parents.

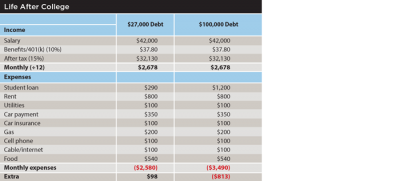

Why are these young adults back home with their parents? Because they graduated from college saddled with devastating debt—particularly those who made financially poor college choices. Even if they land a job earning $42,000 a year, many of these college grads can barely stay afloat thanks to their lofty student loan payments (see the table on this page for an example).

The moral of this story for your clients is simple. Don’t bury your children in life-altering debt. Otherwise, they will never move out and won’t get married…and you might as well forget about grandchildren!

Student loan debt isn’t just the problem of recent college grads and their parents. It’s everyone’s problem. This crisis is having an impact on our nation’s economy, real estate market, and the very fabric of our culture. As financial planners, it falls on our shoulders to educate clients on how to make wise, financially sound college choices.

Endnotes

- See the Nov. 4, 2012 article, “Millennials Are Eating Out Less,” by Bruce Horovitz in USA Today at usatoday.com/story/money/business/2012/11/04/millennials-eating-habits-npd-group/1665923, and the April 22, 2019 article, “Millennials to Be the Biggest Food and Beverage Spenders in 10 Years,” by Julie Littman in Restaurant Dive at restaurantdive.com/news/millennials-to-be-the-biggest-food-and-beverage-spenders-in-10-years/552877.

- To access the report, “A New Direction: Our Changing Relationship with Driving and the Implications for America’s Future,” visit uspirg.org/sites/pirg/files/reports/A%20New%20Direction%20vUS.pdf.

- See census.gov/data/tables/time-series/demo/families/adults.html for details.

- See census.gov/data/tables/time-series/demo/families/marital.html for details.

- See the Nov. 15, 2018 article, “Living with an Unmarried Partner Now Common for Young Adults,” by U.S. Census Bureau statistician Benjamin Gurrentz at census.gov/library/stories/2018/11/cohabitaiton-is-up-marriage-is-down-for-young-adults.html.

- See the May 22, 2019 article, “Is U.S. Fertility at an All-Time Low? Two of Three Measures Point to Yes,” by Gretchen Livingston from the Pew Research Center at pewresearch.org/fact-tank/2019/05/22/u-s-fertility-rate-explained.

- See “Today’s First-Time Homebuyers Older, More Often Single,” from Zillow at zillow.mediaroom.com/2015-08-17-Todays-First-Time-Homebuyers-Older-More-Often-Single.

- See related articles in the Chicago Tribune (chicagotribune.com/business/ct-mcdonalds-oak-brook-architect-0609-biz-20160608-story.html) and CNBC (.cnbc.com/2018/06/09/mcdonalds-opens-new-250-million-headquarters-heres-what-it-looks-like-inside.html).

- See bls.gov/cpi/factsheets/college-tuition.htm for details.

- See the April 2018 article, “Measuring the Value of Education,” by Bureau of Labor Statistics economist Elka Torpey at bls.gov/careeroutlook/2018/data-on-display/education-pays.htm.

- See “Estimating the Payoff to Attending a More Selective College,” by Stacy Berg Dale and Alan B. Krueger available at nber.org/papers/w7322.pdf.