Journal of Financial Planning: February 2015

Christopher J. Finefrock, CFP®, is vice president of investment marketing at ValMark Securities, specializing in product research and case design. He works with independent financial professionals, helping them build processes for integrating insurance, broker-dealer, and investment advisory products and services to help their clients achieve their retirement goals.

Suzanne M. Gradisher, J.D., MTAX, CPA, is an assistant professor of business law at the University of Akron. She is the director of the university’s CFP Board of Standards Inc. registered program and faculty adviser for the school’s FPA student chapter. She has focused her research in accounting and tax issues and most recently in financial planning and law.

Caleb M. Nitz, CFP®, is vice president of insurance marketing at ValMark Securities where he helps independent financial professionals build processes for integrating insurance, broker-dealer, and investment advisory products and services.

Executive Summary

- An estimated 8.36 million people need some type of long-term care (LTC) service annually.

- The American Association for Long-Term Care Insurance (AALTCI) recommends that individuals purchase LTC policies in their mid-50s.

- The cost for LTC is increasing and currently averages $43,472 annually for adult day service center, to $87,600 for a private nursing home room. Studies show that most Americans are not financially prepared for LTC needs.

- This study evaluates various LTC solutions, including traditional LTC, variable annuity combination products, fixed annuity combination products, variable life insurance combinations, universal life combinations, and “hybrid” LTC.

- Results suggest the areas of differentiation include: cost per unit of coverage, case design flexibility, certainty of coverage, liquidity, investment upside, death benefit to heirs, and degree of medical underwriting required.

The long-term care (LTC) landscape is changing and has made noteworthy shifts since the early 2000s. According to the National Association of Insurance Commissioners (NAIC), traditional LTC insurance sales dropped by 65 percent from 2000 through 2010. More recently, the Life Insurance and Market Research Association (LIMRA) reported a 20 percent decline in sales of traditional LTC insurance from 2012 to 2013. Meanwhile, significant increases (58 percent) have been seen in hybrid and life combination products. Given this changing landscape, and the fact that no comprehensive financial plan is complete without addressing LTC, financial planners need to be knowledgeable on the various solutions available.

The American Association for Long-Term Care Insurance (AALTCI) recommends that individuals take out a policy in their mid-50s. This may, at first glance, seem early considering that the vast majority of claims occur when people are in their 70s or 80s. However, those who hold out too long before purchasing may not qualify if their health diminishes. Another reason to be proactive about LTC insurance is that premiums correspond to age. For every birthday, the annual premiums typically go up 2 to 4 percent. Once clients reach their 60s, premiums jump 6 to 8 percent every year.1

This paper examines the growing need for LTC insurance and the factors that affect a client’s need: age, health, disability, and living arrangements. The paper also reviews the current cost of LTC insurance and how Medicare, Medicaid, and private insurance may or may not fit into the financial planner’s consideration when conducting LTC planning. Characteristics of policies, such as the cost per unit of coverage, design flexibility, certainty of coverage, liquidity, investment upside, and death benefits for heirs are also reviewed. There is no one best solution for LTC insurance. Each possible solution has advantages and disadvantages that need to be evaluated in order to arrive at the best recommendation based on each individual client’s needs.

Overall Need for LTC Planning

The U.S. Administration on Aging (2013) reported that persons aged 65 years or older living in the United States numbered 43.1 million in 2012, which is an increase of 7.6 million or 21 percent since 2002. About one in seven Americans, or 13.7 percent of the U.S. population, will reach age 65 over the next two decades, increasing by 24 percent between 2002 and 2012.

As Americans age, it is more likely they will need some type of LTC service. In fact, at least 70 percent of people over age 65 will require some LTC service at some point in their lives, according to the U.S. Department of Health and Human Services (2014). In addition, life expectancy of this demographic age group continues to increase. Persons reaching age 65 have an average life expectancy of an additional 19.2 years (20.4 years for females and 17.8 years for males, according to the U.S. Department of Health and Human Services). Not surprisingly, in the over-65 population, women outnumber men (24.3 million older women to 18.8 million older men). With women living longer than men, they have higher rates of disability and chronic health problems, which are discussed below. As a result, women are far more likely to need LTC.

Disability. Possible reasons for needing LTC include being involved in an accident, having a chronic illness that causes a disability, or contracting a disease such as Alzheimer’s. According to the U.S. Department of Health and Human Services (2014), between age 40 and 50, on average, 8 percent of the working population will have a disability that could require LTC services, and nearly 70 percent of people age 90 will have a disability requiring the need for some type of LTC service.

According to the U.S. Census Bureau (2013), the number of those aged 90 or older has almost tripled since 1980, reaching 1.9 million in 2010. This age group is expected to increase to more than 7.6 million over the next 40 years. Also, in 2012, the Alzheimer’s Association reported that there were 5.4 million Americans with Alzheimer’s disease.

Health status. The type of LTC needed is also dependent upon a client’s physical and mental status. Financial planners should consider and assist their clients in anticipating future needs early on. Chronic conditions such as congestive heart disease, diabetes, and high blood pressure increases the likelihood of the need for LTC services, according to the U.S. Department of Health and Human Services (2014).

Questions concerning a client’s family history of chronic conditions should be investigated and planned for accordingly. In addition to family history, financial planners should also question each client’s diet and exercise habits to determine if their current behavior may affect the likelihood of requiring LTC services. This can serve to minimize the need for traumatic moves in the future by helping to ensure that the client’s safety and health needs are being met.

Living arrangements. Another concern financial planners should explore is their clients’ living arrangements. An individual who lives alone is more likely to require LTC services than individuals who are married or living with a partner, according to the U.S. Census Bureau (2013), which also reported that in 2012 more than one in four households was made up of just a single person. This is greater than at any time in the past century and a warning sign that many more individuals may need LTC insurance in the future.

Costs of LTC Services

The average annual cost of LTC services varies by state. The national average cost for one year for an adult day service center is $43,472, and $87,600 for one year of a private nursing home room (Genworth Financial 2014). Based on the average length of stay in a nursing home of three years, a person needing care today would need a minimum of $130,000 to pay for adult day care services. Someone needing a private nursing home room would need more than $260,000.

LTC is a huge expense, and few individuals know how they will pay for it. A study from Genworth Financial (2014) finds that most Americans are not financially prepared to meet their LTC needs. The Genworth study found more than 90 percent of American adults do not have LTC insurance.

In the 2014 Retirement Confidence Survey published by the Employee Benefit Research Institute (Helman, Adams, Copeland, and VanDerhei 2014), six in 10 workers reported that they and/or their spouse have less than $25,000 in total savings and investments (excluding their home and defined benefit plans); 36 percent of respondents indicated having less than $1,000.

The Genworth study also uncovered that 70 percent of those surveyed believe that the Affordable Care Act will cover their LTC needs. Unfortunately, and contrary to popular belief, the Patient Protection and Affordable Care Act failed to resolve this issue. Medicare and private health care insurance programs do not pay for the majority of LTC services. Private health care and Medicare only cover medically necessary care by focusing on medical care, such as doctor visits, prescription drugs, and hospital stays (U.S. Department of Health and Human Services 2014). Coverage may also extend to short-term services for conditions that are expected to improve, such as physical therapy to help regain function after a fall or stroke.

If an individual cannot afford the costs of LTC services through their accumulated assets because of asset and income deficits, he or she may become eligible for assistance through Medicaid. Medicaid is a joint federal and state government program that helps people with low income and assets pay for some or all of their health care bills. Medicaid covers medical care, like doctor visits and hospital costs, LTC services in nursing homes, and LTC services provided at home, including visiting nurses and assistance with personal care (U.S. Department of Health and Human Services 2014). Unlike Medicare and private health care insurance, however, Medicaid does pay for custodial care in nursing homes or at home.

Managing LTC Risk in a Financial Plan

Planning for the expected costs associated with LTC needs is an often overlooked or underappreciated part of financial planning, especially retirement planning. No financial plan is complete without provisions for handling the possibility of a LTC event. Failure to plan for the expected costs of LTC is not due to a lack of tools. Fortunately, a variety of financial products can be used to effectively manage LTC risk in a financial plan.

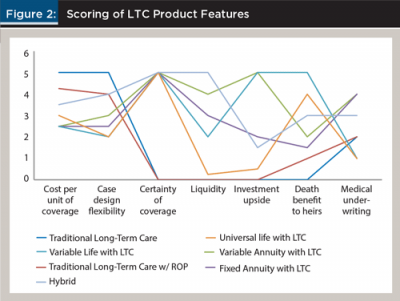

This paper examines several different solutions LTC insurance providers have developed. The pros and cons of each will be examined. In the analysis, we will focus on seven key areas that differentiate these solutions and the client demographic that generally resonates with each.

The following LTC solutions will be evaluated: (1) traditional LTC; (2) variable annuity combination products; (3) fixed annuity combination products; (4) variable life insurance combinations; (5) universal life combinations; and (6) “hybrid” LTC. Each product has various applications, and in a vacuum, none will be a “go-to” solution in every situation. The goal of this paper is to provide objective insights on where each of these solutions may fit in the planning process. The seven areas used for comparisons are: (1) cost per unit of coverage; (2) case design flexibility; (3) certainty of coverage; (4) liquidity; (5) investment upside; (6) death benefit to heirs; and (7) degree of medical underwriting required.

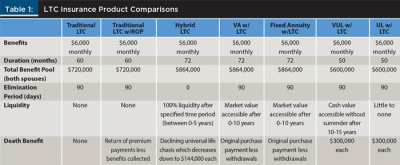

As previously stated, 70 percent of people turning age 65 can expect to need some form of LTC during their lives. In the following cost comparisons

(Table 1) we used a 65-year-old, healthy couple for price and case design comparisons. For case design purposes, benefits and durations were kept as similar as possible.

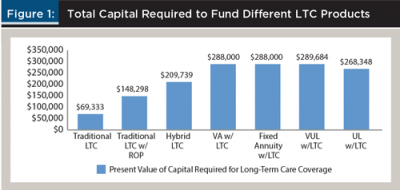

It is important to normalize the cash flow when comparing the costs of LTC products (Figure 1). For example, some products are structured as single premium policies (lump sum), some require premiums to be paid in all years, while others are assumed to be paid for a limited duration.

To normalize the data, we discounted the premium flows to uncover the true cost of each product. For discounted cash flow purposes, we used the average 10-year Treasury note over the past 52-week period (2.45 percent), plus 200 basis points for a total of 4.45 percent.

Additionally, we used joint life expectancies for purposes of calculating the duration of cash outflows. Life expectancy for two 65-year-old healthy clients, at the time of the analysis using 2008 mortality tables, was 29.5 years. This approach allows products to be examined on their cost structure alone, ignoring all other features and design parameters as shown in Figure 1.

Figure 1 shows the extreme variance in costs between traditional LTC insurance and combination solutions. This cost discrepancy stems from the ancillary benefits provided through combination products, including premium certainty, liquidity, upside potential, death benefits, and underwriting requirements.

The days when cost was the only driver associated with the decision to purchase LTC insurance have ended. Today’s consumers have signaled a willingness to allocate more money to LTC solutions if they can also hedge against other risks in or near retirement. The marketplace has shifted and the pitfalls associated with some of the lowest-cost products have been exposed. Many clients are now seeking a prudent assessment of the various costs and benefits of combination products. The following discussion highlights some of the most important features of these new products.

Case Design Flexibility

With regard to flexibility, there are two areas of focus: flexibility in case design (years of coverage, elimination period, payout method, and duration of coverage) and flexibility when the policy is in force (certainty of premium, liquidity, death benefits, and market upside). The type of policy selected will play a major role in meeting the current and future needs of a policyholder.

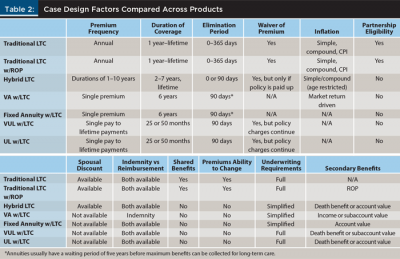

It is important to consider the pros and cons of each policy and the ultimate goals of the client before selecting which product is most suitable for a client’s plan. For example, traditional LTC offers the most case design flexibility; however, traditional policies offer the least flexibility in terms of certainty of premium, liquidity, death benefits, and market upside. On the other hand, a hybrid LTC and combination product allows for the least case design flexibility while providing the most flexibility in investment upside, liquidity, and death benefits. These issues are summarized in Table 2.

Case design is traditionally dictated by a client’s overall financial position and goals. Case design issues include sources of funding, assets available to supplement LTC expenses, spouses and/or family members, and a family’s overall health history.

For example, consider a widow who is receiving spousal pension and Social Security benefits in excess of her current standard-of-living need who also has limited investable assets. Traditional LTC coverage, or insurance with a rider, may be the best option for her given the fact that she has excess cash flow (compared to her living expenses) and no survivor to provide home care as her health declines.

Conversely, consider the same widow who lives comfortably off of her pension and Social Security benefits but also has certificates of deposit maturing at a rate of less than 1 percent. An annuity with LTC coverage or a hybrid LTC policy may fit best here. Different scenarios will lead planners to very different case designs, depending on the goals of the widow.

Case design flexibility varies widely among products and insurance carriers. Areas such as premium frequency, duration of coverage, inflation protection availability, spousal discounts, waiver of premium, a premium’s ability to change, and shared benefits are a few of the key topic areas to focus on when comparing various product solutions. Table 2 compares these case design factors across products.

Certainty of Coverage

Certainty of coverage has two applications. The first area of certainty pertains to premium payments remaining constant during the life of the policy. The second concerns an insurance provider’s ability to pay the claims of policyholders.

One of the major drivers for the decline in demand for traditional LTC insurance during the past decade is concerns about insurance carriers’ unilateral ability to change the premiums of existing clients. This is due to most traditional LTC policies being “guaranteed renewable.” Guaranteed renewable simply means that a policy is guaranteed to stay in force as long as the premiums are paid; however, the premium amount is not guaranteed.

In the price analysis in Figure 1, traditional LTC insurance is four times less expensive than some of the alternatives. It is important to remember, however, that premiums beyond the first year are not guaranteed. When analyzing the carriers’ adoption rate of raising premiums, we found that of 58 carriers who had written policies, only four companies (or 6.9 percent) had never initiated a rate increase to policyholders. Moreover, more rate increases are on the horizon as the industry leader in sales has recently stated that they may have to suspend new sales if rate increases on current policies are not approved by state insurance commissioners. Such a rate increase would affect policyholders who were issued contracts between 1974 and 2007. Policyholders will end up paying $200 to $300 million dollars in new annual premiums, an 18 to 27 percent increase in premiums (Lankford 2011).

Combination products are typically sold either as non-cancellable or as fully paid up at issue. Combination policies generally provide LTC insurance, as well as an additional type of coverage. These additional coverage types include life insurance, cash liquidity, and investment flexibility. These products usually are built on an annuity or life insurance platform. Non-cancellable policies guarantee both the benefits and premiums for the life of the policy, providing security to the policyholders so that they know the benefits will be available and at what cost.

The second factor associated with certainty consists of the claims paying ability of the insurance provider. This consists of using solutions from companies that make prudent financial decisions and are committed to continued service to existing policyholders. For example, in California, only 12 carriers are actively selling LTC insurance. An additional 46 carriers (which represents nearly 80 percent of policies in force) have existing policies, but are no longer writing new business.2 As a result, a carrier’s financial strength and track record in the LTC marketplace should be weighted heavily when considering a product.

Liquidity

Liquidity has become a topic of discussion among financial planners and consumers in the current economic landscape. Many consumers have reduced the risk of their investment portfolios by increasing their existing cash reserves. In effect, they are waiting for an opportunity to invest. As planners struggle to find investments that offer guaranteed yield in a low interest rate environment, they have identified opportunities to provide benefits other than yield for their clients. These benefits come in the form of principal protection, liquidity, death benefits, and LTC coverage. This strategy has worked well for clients that normally would self-insure with a side fund instead of purchasing a standalone LTC policy. Given the importance of liquidity, the liquidity feature of each solution is discussed in more detail below.

Traditional LTC insurance offers no liquidity to a consumer. Each year, the premiums paid are used to pay for the cost of insurance within the policy. Should a policyholder decide they no longer need coverage and let their policy lapse, there is no surrender value. Traditional LTC policies with a return-of-premium (ROP) option will allow the beneficiary of the policyholder to receive the cumulative total of premiums paid if the policyholder dies before using all of his or her benefits. This feature will allow the beneficiary to receive the difference between the premiums paid by the policyholder minus the benefits received.

Conversely, nearly all combination products offer some form of liquidity. Fixed and variable annuities with LTC riders offer either a fixed rate of return or an investment subaccount within the policy. Should a policyholder surrender their policy, they would receive the account value minus any remaining surrender charges. These annuity product surrender charge periods usually range between four and 10 years, depending on the contract.

Life insurance with LTC riders work in a similar fashion. Contract values are either invested in a fixed general account or a separate variable subaccount. However, these policies generally have surrender periods of 10 to 20 years. In addition, some life insurance contracts are structured in a way that cash value growth is extremely unlikely.

It is also important to note that these policies offer liquidity primarily as a secondary benefit. Unlike a checking or savings account that can be freely accessed by withdrawing or adding funds, these contracts typically allow for the withdrawal of funds resulting in a proportionate reduction in the future LTC and/or death benefits. For example, if a policyholder withdraws $10,000 from a combination product with $100,000 of cash value (10 percent), the LTC benefit, which may be $400,000, would also be reduced by 10 percent or $40,000.

Some products contractually offer liquidity. Hybrid LTC insurance has traditionally, by contract, guaranteed a policyholder access to their initial investment within a certain time period. The length of time before an investor will be indemnified upon surrender ranges between zero and five years.

When examining this feature within a policy, it is important to take note of how claims affect liquidity. Most contracts that offer liquidity will reduce the contract liquidity/surrender value dollar for dollar as claims are received. The reduction of death benefits within these contracts works in a very similar fashion when LTC benefits are received. In other words, even though a combination product offers LTC coverage, a death benefit, and liquidity benefits, a policyholder may only have access to the maximum value of each individual benefit reduced by benefits received from other sources of money within the policy.

Products built on a life insurance chassis generally have a residual death benefit, even if the maximum amount of LTC coverage is collected from the policy. This residual death benefit is usually 10 percent of the original death benefit. For example, if a policyholder had a $300,000 life combination product and incurred a LTC event for 50 months, withdrawing $6,000 per month from the policy to pay for LTC expenses, he or she would have extracted the full $300,000 of benefits from the policy; however, at death the client would still be entitled to the residual death benefit of $30,000, which results in a total benefit associated with the policy of $330,000.

Investment Upside

Investment upside is the likelihood that a LTC vehicle will participate in market gains that will result in the surrender value exceeding the premiums paid, if the client chooses to surrender the policy. In all investments, there is a trade-off between risk and return, therefore LTC products with upside potential generally cost more per dollar of coverage due to the insurer allowing the investor to participate in the market.

Another trade-off in case design is often market upside and liquidity. This is a result because most products with investment upside are structured to be held for a long period of time, limiting liquidity during the initial years of the investment.

Traditional and conventional return-of-premium policies have no investment upside because the premiums are never invested for the benefit of the policyholder. As such, the policies have no cash value. A universal life policy with a LTC rider has very little potential to gain cash value due to the current interest rate environment and cost of insurance charges within the policy.

Hybrid policies and fixed annuities are traditionally built to maintain principal but never gain significant cash value. Hybrid policies often result in cash values falling below 100 percent of the premiums invested; however, these policies have additional riders that guarantee the surrender value will be equal to the purchase payments either immediately or within a certain period of time after issuance.

Fixed annuities with LTC riders currently have guaranteed crediting rates between 1 and 3 percent, while costs for a LTC rider can range between 0.6 and 1.4 percent, depending on the age of the client.

Two product solutions that have upside potential include variable universal life insurance with a LTC rider and variable annuities with LTC riders. Every premium payment into one of these policies is separated into one of two buckets. The first is used to pay for the cost of insurance and distribution of the product. The second is invested into variable subaccounts similar to mutual funds. If the subaccounts experience positive market performance, then the cash value of the policy will increase on a tax deferred basis. However, this rising cash value does not have an effect on the value of the LTC benefits of the policy. The guaranteed death benefit dictates the value of the LTC benefits.

Variable annuities work in a similar fashion and are usually structured as single-premium vehicles. However, some annuity riders allow market gains to be locked in on an annual basis for LTC purposes. In other words, if a client purchases a $100,000 lump sum annuity with LTC coverage, the LTC pool would be $300,000. If the market increased by 30 percent during the first year and the cash value grew to $130,000, those market gains would be locked in, and the LTC pool would then be a minimum of $330,000, regardless of future market performance.

Death Benefits to Heirs

Secondary death benefits have grown in popularity over the last decade due to an ongoing concern that annual LTC premiums paid are forever lost if death occurs prior to a LTC claim being made. As previously discussed, the probability of one spouse who is at least age 65 requiring some form of LTC assistance is 70 percent. Because of this, certain LTC product solutions may offer a death benefit to a surviving spouse or heirs of the contract if little to no benefits are received from the contract during the insured’s lifetime.

Traditional LTC with return-of-premium options allows a beneficiary of the policyholder to receive the cumulative total of premiums paid if the policyholder dies before using all of their benefits. This feature will allow a beneficiary to receive the difference between the premiums paid by the policy holder minus the benefits received. While this is not a true death benefit, it does provide funds to the surviving spouse or heir(s) in the event the policyholder does not utilize the coverage.

Combining life insurance and LTC coverage helps meet the needs of clients who have a legitimate risk of needing future care, but also hold the mindset that the likelihood of a claim does not apply to them. At its core, a death and LTC benefit combination can be used to hedge survivorship risk.

For example, a life insurance with a LTC rider solution could replace a lost pension or reduction in Social Security benefits upon the death of a first spouse. A combination policy could provide health coverage if a spouse becomes ill and requires care. This gives a policyholder and their caregiver options for paying for necessary care rather than spending down a retirement nest egg. This becomes especially important when considering that in order for a sick spouse to qualify for Medicaid coverage, the assets of a healthy spouse cannot exceed $113,640 in 2014. In most cases, this is an insufficient amount to sustain a lifestyle for a surviving spouse. Without some kind of LTC coverage for the first spouse, the surviving healthy spouse could easily see their retirement savings diminished by LTC expenses.

Medical Underwriting Required

Underwriting is one of the only elements of an insurance contract that may be negotiated by a financial planner or policyholder. Because underwriting will ultimately affect the type of coverage obtained and the cost that will need to be paid, financial planners should explore the various options before making client recommendations.

Most combination (hybrid) products do not require full medical underwriting. Rather, insurance carriers offer standard male or female rates to all policyholders who apply for coverage. To eliminate the possibility of adverse selection, insurance carriers will require applicants to answer “yes” or “no” to a list of 15 to 25 questions about their health history. Insurance carriers will also perform a prescription drug screen. Once an applicant has been identified as a good candidate for LTC insurance, there typically is a 30- to 60-minute phone interview with a medical underwriter to explore questionable areas in the applicant’s health history. A cognitive impairment screening test may also be given. This process is usually faster and less invasive than full underwriting.

Life insurance with a LTC rider will usually require full medical underwriting for both morbidity and mortality risks. The stricter underwriting requirement results from these products paying benefits in the event of sickness or death. This is considered the most elaborate style of underwriting, but for healthy individuals it can result in advantageous premiums because of the ability to receive preferred or preferred best underwriting. Some argue that simplified underwriting is more advantageous to an insurance applicant than a full medically underwritten policy, but it truly depends on the health history of the applicant. For example, because of tight constraints on hybrid LTC products, and lack of underwriting negotiation, many health insurance applicants are declined coverage. Had they pursued a fully medical underwritten policy they would have been able to secure coverage.

Comparing Product Features

The current LTC insurance marketplace is not a one-size-fits-all market. Figure 2 provides an objective view of how different product features are scored against other product types. A rating of 5 is considered to be the best possible solution for that area, whereas a 0 means the feature is not available in that product. The good news is the LTC market is becoming more flexible in relation to the features and designs available to meet an individual’s unique needs. The bad news is, there is a shortage of experts who know these product designs and pricing structures intimately. The more educated you can be as a planner, the better you can serve your clients.

Endnotes

- See www.aaltci.org/long-term-care-insurance/resource-center.

- Data retrieved from: https://www.insurance.ca.gov/01-consumers/105-type/95-guides/05-health/01-ltc/rate-history-inactive.cfm.

References

Alzheimer’s Association. 2012. “Alzheimer’s Disease Facts and Figures.”

Alzheimer’s and Dementia: The Journal of the Alzheimer’s Association. March 2012: 8: 131–168.

Genworth Financial. 2014. Genworth Financial Cost of Care Survey. Retrieved from www.genworth.com/dam/Americas/US/PDFs/Consumer/corporate/130568_032514_CostofCare_FINAL_nonsecure.pdf.

Helman, Ruth, Nevin Adams, Craig Copeland, and Jack VanDerhei. 2014. “The 2014 Retirement Confidence Survey: Confidence Rebounds—for Those with Retirement Plans. Retrieved from www.ebri.org/pdf/briefspdf/EBRI_IB_397_Mar14.RCS.pdf.

Lankford, Kimberly. 2011. “Long-Term-Care Rate Hikes Loom.” Kiplinger’s. Retrieved from www.kiplinger.com/article/insurance/T036-C000-S002-long-term-care-rate-hikes-loom.html.

U.S. Administration on Aging. 2013. Highlights. Retrieved from www.aaltci.org/long-term-care-insurance/resource-center.

U.S. Census Bureau. 2013. “America’s Families and Living Arrangements: 2012 Population Characteristics.” Retrieved from www.census.gov/prod/2013pubs/p20-570.pdf.

U.S. Department of Health and Human Services. 2014. “Long-Term Care: The Basics.” Retrieved from www.longtermcare.gov/the-basics.

Citation

Finefrock, Christopher, Suzanne Gradisher, and Caleb Nitz. 2015. “Long-Term Care Insurance: Comparisons for Determining the Best Options for Clients.” Journal of Financial Planning 28 (2) 36–43.