Journal of Financial Planning: April 2016

The cost of college has outpaced inflation, and student debt is rising at an alarming rate; families are looking for help. The problem is, college funding is complicated and it has its own language. In addition, colleges are great marketers to emotional adolescents and their parents. Everyone is familiar with academic reach, but no one discusses financial reach. Maybe that is why the Federal Reserve Bank of New York reports that U.S. student loan debt is more than $1.2 trillion dollars.

From a financial adviser’s standpoint, financial planning for college is an underserved market for various reasons. It is complex and somewhat of a mystery due to the subjectivity of the financial aid process. Parents’ perception of the process, hope of free money, and the emotional rollercoaster of the admission process are other reasons financial advisers often keep their distance.

Times Are Changing

More clients are expecting their financial advisers to provide advice on college financial decisions. For some families, it is the most important financial decision they will make for their child or grandchild. In many cases, it will be the most expensive.

At the same time, parents are questioning the value of the college investment. This is not a question of getting a college degree, but the question of finding the best college value for their money (see Kim Clark’s article beginning on page 28 for more on finding the best value). This could be a motivating factor for why parents are looking to financial advisers for answers.

Here is a list of a few college planning strategies and ideas to incorporate into your financial planning practice.

Address Complexity

To properly pay for college, your clients need to evaluate the financial aid process, educational tax strategies, college saving plans, debt structure, and various loan repayment options. For years, much of this information was a mystery because it was controlled by the colleges. Over the years, the U.S. government has added programs such as 529 plans and various loan repayment plans to help families pay for the increasing cost of college. These programs have helped in adding transparency to the process, but they have also added complexity to the financial decision-making process.

A continued obstacle for advisers and their clients is that the sources of information on these various programs are segmented. Websites like Student

Aid.ed.gov, SavingforCollege.com, and EFCPlus.com are good starting points. A few college planning networks can also be helpful. I have found that the National College Advocacy Group (NCAGonline.org) offers a good mix of college finance and academic insights that can help you and your clients get started and stay informed.

Develop a College Funding Approach

Just like in other areas of your financial planning practice, you will need to determine the level of service you wish to provide. Learning the terminology and strategies may require a significant amount of time, similar to learning the latest retirement planning strategies. A college funding solution will require:

Financial aid positioning. To understand the college financial aid position, a financial adviser needs to know how the “expected family contribution” or EFC is generated. By knowing the details of the EFC number, an adviser can determine specific college funding strategies. Most people think that the EFC is one number, but it is actually four separate calculations summed to one number. Most online calculators only provide the one number, but EFCPlus.com and CollegeBoard.org offer quick calculators that are good for estimates.

Family timeline. A family timeline is critical, because it will show whether the EFC number will change each year. This exercise is often overlooked, but it can have a big impact on the net cost of a college, especially for middle-income families. The timeline will include the ages of the parents and the grades of the children as they move toward college graduation. The timeline should display the year when the EFC changes. For families with multiple children in college at the same time, they may actually qualify for need-based aid in multiple years. This could make that more expensive college more affordable.

Focus on the outcome. The college decision is a highly emotional one for both the student and the parent. Colleges provide financial information for one year at a time. Parents can spend thousands for test prep, application essay writing, and college coaching with the goal of being admitted to the right college. In reality, more than 30 percent of students will transfer within the first two years, and the national graduation rate is currently less than 40 percent after four years, according to the National Student Clearinghouse Research Center. By helping families focus a little more on the financial outcome, better decisions may be possible.

Positive results. Families often do not consider the financial outcome. With the cost of some colleges tipping $70,000 per year, understanding the financial outcome of higher education needs to become part of any financial plan. At my firm, we use our EFC PLUS method to create a four-year cash flow analysis by college, which helps the client envision the financial outcome. It helps the client visualize the reality of the financial commitment and can result in a stronger client relationship.

The Importance of Debt Structure

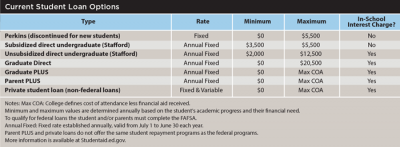

We often see headlines of loan forgiveness and the plenitude of financial aid. It sounds simple and easy, but education debt can impact a person’s life for decades. Understanding the different debt options and who is legally responsible for this debt is the first step toward a debt structure strategy. These decisions will then determine the loan repayment and forgiveness options available after graduating. For many students and families, it will take multiple types of loans to pay for this investment. These include a subsidized direct loan, unsubsidized direct loan, Parent PLUS, and private student loans (see the table on page 24 for details).

Determining the proper loan structure and options will be easier once a four-year cash flow analysis is completed. By having the cash flow analysis, a family can better determine how to use their resources. Structuring college debt is very different from other personal debt, primarily because the annual loan limits are based on the student’s academic progress.

By structuring the debt the best way, the student can maximize various loan repayment and forgiveness options. Currently, nine federal loan repayment methods and numerous loan forgiveness plans are available.

College Savings Plan

For some advisers, their quick answer to college planning is a 529 plan. This answer is correct in most cases, but I find that most clients today are expecting more advice. I use the analogy of a client asking about retirement and you answering that the client needs an IRA. A 529 plan is a great start for a family thanks to the tax, estate planning, and financial aid benefits. Depending on the owner, clients will need to know who it will impact for financial aid positioning. Based on each client’s situation, there may be other options such as saving bonds, Coverdell (educational) IRAs, or gifting strategies.

Developing a proper portfolio held in the parents’ and/or grandparents’ names is another option that can add flexibility, and with the proper tax-gifting strategies, can offer some of the same benefits of a 529 plan. This is an advance strategy that requires knowledge of the gifting rules, in-kind transfers, and kiddie-tax rules.

Link to IRS/Prior-Prior

To initiate the financial aid process, the family must submit the Free Application for Federal Student Aid, or FAFSA. The FAFSA process is now linked to the IRS system via a tool called the data retrieval tool (DRT). Starting in October, the FAFSA will become available much earlier than the traditional January 1 start date. This is a significant change in the process for both colleges and parents. The financial aid process will now use the tax year two years ahead of the student’s admission. This change is called prior-prior. For example, a high school senior who will graduate in spring 2017 and start college in fall 2017 will use the tax year 2015 for their base financial aid year.

This change presents a planning opportunity. For proper financial aid positioning, parents will need to review their financial aid position prior to December 31 of the student’s high school sophomore year. Financial advisers and most families may be unaware of how far in advance this planning needs to occur.

Adding college planning to a financial planning practice will require an investment of time but the rewards could be significant. Financial advisers are seeing the importance from the client demand standpoint. You could enhance your value as an adviser by assisting both parents and grandparents in their pursuit of paying for college. For many clients, their most treasured asset is their children. If you, their adviser, could help them navigate through the college financial storm, your value will be immeasurable.

Fred Amrein is founder of Amrein Financial and College Affordability. He is an author and the developer of EFC PLUS, a comprehensive college funding calculator. His expertise covers saving for college to student loan forgiveness. More information on college affordability is available on his website www.EFCPlus.com.

Learn More

Join college planning expert Fred Amrein for an FPA webinar:

College Funding: Answering the College Affordability Question

April 13, 2 to 3 p.m. ET

1 CFP CE

Learn:

• Financial aid positioning

• The importance of cash now and debt structure

• Proper use of college funds

• Grandparents’ role in the process

Visit OneFPA.org and click on “Virtual Learning” to register.

Also, hear Amrein speak at the FPA Annual Conference—BE Baltimore, where he will present two sessions on college planning: “The Most Efficient Ways to Save and Pay for College,” and “Managing Student Debt: Strategies for Getting Out from Under.” Visit FPA-BE.org to learn more.