Journal of Financial Planning: April 2016

Most financial planning practitioners strive to create a practice that meets or exceeds their clients’ expectations. However, many practice management methodologies fail to adequately take into account the practitioner’s personal career expectations for income, autonomy, and purpose. The barrage of mundane and unrewarding tasks that fill the practitioner’s day are at odds with these objectives. While the need for effective and efficient staffing is apparent to most practitioners, staffing and time management continue to represent major obstacles to client and planner satisfaction, particularly for the solo practitioner and those serving a mass affluent to affluent client base.

This article outlines a four-step diagnostically driven A.I.D.E. (Analyze, Identify, Define, Execute) process for developing a strategic plan to enhance infrastructure capacity, enabling planners to effectively realize more rewarding and sustainable practices for themselves and their clients.

Step 1: Analyze Professional Expectations

Although the reasons for entering and remaining in the financial planning profession are unique for each planner, individual variances can be accounted for using the two rudimentary types of motivational drivers established by Richard Ryan and Edward Deci’s Self-Determination Theory (see their January 2000 article “Intrinsic and Extrinsic Motivations: Classic Definitions and New Directions” in Contemporary Educational Psychology)—intrinsic motivators (autonomy, competence, relatedness) and extrinsic motivators (rewards, recognition, opinions).

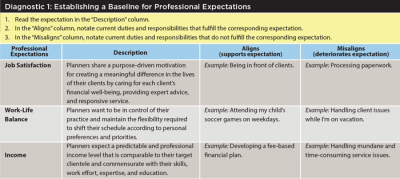

This article uses both types of motivational drivers as the basis for establishing a method of grouping the unique motivational factors sought after by financial planners into categories we refer to as “professional expectations.” The three professional expectations categories are: job satisfaction, work-life balance, and income. See Diagnostic 1 for a tool designed to establish a baseline for professional expectations.

After you’ve established a baseline for professional expectations, complete the following resolution-focused process to further analyze the relationship between planner expectations, practice-related tasks or responsibilities, and areas of practice management:

- The _____________ [aligns expectation] is most often compromised by ______________ [task/responsibility].

- The _____________ [task/responsibility] relates to the ________________ area of practice management.

- Define and implement a corrective process.

Step 2: Identify Relationships between Planner Energy Output and Profitability

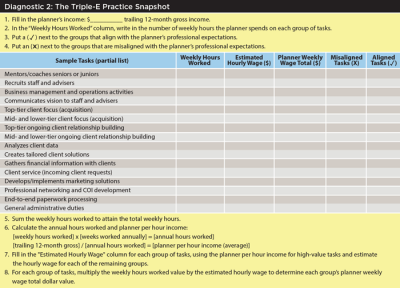

The 2014 FPA Research and Practice InstituteTM time management and productivity study, “Doing More with Less,” found that only 13 percent of advisers feel in complete control of their time, and just 10 percent feel in complete control of their business. “Trying to do too much” was ranked as the most significant challenge. Planners could gain meaningful insights into their personal time management by connecting current task/energy output with expectations and profitability.

Diagnostic 2 provides a worksheet to help determine where a planner’s energy may be misplaced.

Step 3: Define Core Competencies and Staffing Support Roles

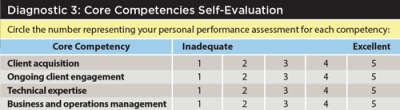

To effectively manage and grow their practices, today’s digital-age financial planners should have mastery over four areas of practice management: client acquisition, ongoing client engagement, technical expertise, and business and operations management.

By integrating these competencies to create a multi-dimensional service offering, planners could greatly enhance their ability to maintain superiority over proliferating technology-based solutions that are cheaper, more convenient, and increasingly capable of meeting the sophisticated needs of consumers. See Diagnostic 3 for a core competencies self-evaluation.

Traditionally, planning professionals dedicate the bulk of their time, money, and resources toward equipping themselves with the technical expertise and client acquisition skills required to attract clients and provide services and products. This front-end focus leaves planners to develop ad hoc solutions in the areas of ongoing client engagement and business and operations management. The general lack of resources, support, training, and leadership provided by firms in these areas contributes to the plight of planners working with significant infrastructure constraints.

At a 2012 financial industry conference, Richard Weylman of the Weylman Center for Excellence in Practice Management suggested that more affluent clients require 12 scheduled contacts annually. To meet this requirement, a planner with 100 clients needs 1,200 contacts each year with existing clients. Weylman also suggested that advisers allocate 19 hours per week toward new client acquisition activities.

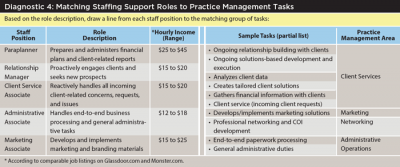

Use Diagnostic 4 to match roles to tasks. The purpose of this exercise is to establish a prototype for the tasks that align to each staff position. Groups of tasks are categorized into client services, marketing, networking, and administrative operations.

Step 4: Execute Infrastructure Capacity Plan

Similar to working on the engine of a car while driving 100 miles per hour, the process of increasing capacity while maintaining normal daily activities can be challenging and overwhelming. Executing a course of action to increase practice infrastructure requires planners to reorganize existing patterns of operation. By establishing a priorities-aligned plan that creates a relationship between capacity growth and projected increases in productivity, planners can increase their overall change readiness.

See Diagnostic 5 for steps to building a plan. Complete the table in Diagnostic 5 using the following steps:

- Compile the corresponding entries from Diagnostic 2: trailing 12-month gross income, planner per hour income (avg.), hours worked weekly (avg.), and annual hours worked (planner).

- Circle the hours listed (planner hours from Diagnostic 2) in the “Weekly Hours Worked” column for each group of tasks with a pre-filled staffing role.

- Calculate profitability enhancements: (1) Calculate the updated weekly wage total for each grouping of tasks by multiplying the circled value in the “Weekly Hours Worked” column by the pre-filled median salary range for the corresponding staff position, and write the dollar value in the “Staff Weekly Wage Total” column; (2) Recalculate the planner’s weekly wage total for each group of tasks by multiplying the circled value by the planner per hour income listed in Step 1, and write each dollar value in the corresponding “Planner Weekly Wage Increase” column; (3) Calculate the planner’s weekly net profitability increase for each staffed position and write each dollar value in the corresponding “Net Planner Weekly Wage Increase” column, using the following formula:

[planner weekly wage] – [staff weekly wage] = [net planner weekly wage increase].

Using an objective method for determining the order in which to hire staff is critical. Technically, the greatest wage increase listed in the “Net Planner Weekly Wage Increase” column in Diagnostic 5 signifies the first role that a planner should hire or realign existing staff. However, this is dependent upon the accuracy of the planner’s weekly hours worked for each group of tasks. To acquire accurate data, planners should track daily activities over multiple weeks.

Building a staffing infrastructure plan that is aligned with a planner’s professional expectations provides a contextual understanding of the specific practice needs and related business value of a targeted position. Additionally, the planner is equipped with defined staffing duties and responsibilities, enhancing his or her ability to hire the right person for the job. For the staff member, the transparency around responsibilities and accountability creates a less frenetic work environment and offers a clearer path for achieving professional expectations.

Conclusion

The dizzying speed of change in the service industry and an uncertain future makes any attempt to adapt practice operations to each external factor chaotic and unmanageable. However, by using the focused and steady lens provided by their professional expectations, planners can enhance the speed and effectiveness with which they observe, anticipate, and respond to ever-changing industry conditions—remaining strategically aligned and in sync with their clients.

Joseph Brocato is the managing sales director for MetLife Premier Client Group of Southern California in Pasadena, Calif. He uses his extensive background in instructional design and expertise in practice management to help advisers grow their teams, client satisfaction, and profitability.

Paul R. Justin, CFP®, CLU®, ChFC®, is the managing partner for MetLife Premier Client Group of Southern California, helping experienced financial advisers grow their businesses. He has been a CFP© certificant since 1992 and has served as president and chairman of FPA of San Diego.