Journal of Financial Planning: April 2015

Wade D. Pfau, Ph.D., CFA, is a professor of retirement income at The American College and the 2012 and the 2014 recipient of the Journal’s Montgomery-Warschauer Award. He hosts the Retirement Researcher blog at www.retirementresearcher.com.

How much can clients sustainably spend in retirement? A typical starting point to answer this question is Bill Bengen’s research published in the Journal in 1994. More generally, though, we can approach answering this in two different ways. First, we can consider dedicated income sources, such as building ladders of individual bonds or using income annuities. Second, we can consider spending rates for diversified investment portfolios in which market volatility will play a much bigger role in determining retirement sustainability. In this column, I look at current pricing for each type of strategy to give advisers a better sense of the appropriate starting points and available building blocks for a retirement income plan.

Reaching back to Bengen’s original research, the question to be answered was: what percentage of retirement date assets can a client withdraw, such that if they continue to spend this same amount (after making adjustments for inflation), they will not deplete their portfolio for at least 30 years? With a portfolio allocated to large-cap U.S. stocks and intermediate-term government bonds, the U.S. historical data suggests that the answer was just over 4 percent in the worst-case, 30-year historical period for a client earning precisely the underlying index returns and not paying any investment management fees. This is only a starting point.

Sustainable Spending from Dedicated Income Sources

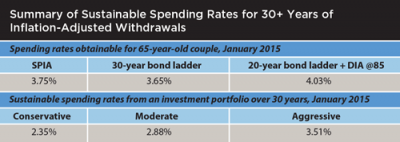

The table below first shows the cost of funding retirement with dedicated income sources. The three strategies shown in the table for a 65-year-old couple include: (1) buy a joint/100 percent survivor’s life-only single premium immediate annuity (SPIA); (2) buy a ladder of bonds maturing over the next 30 years; and (3) buy a ladder of bonds maturing over the next 20 years and purchase a deferred income annuity (DIA) that will continue the same income level and trend in years 21 and beyond.

The SPIA strategy is able to support income calibrated to something much closer to the couple’s actual remaining life expectancy based on an underlying portfolio consisting mostly of fixed income. Unlike the traditional 4 percent rule, this strategy adjusts for today’s interest rates, which along with increasing longevity can explain why SPIA rates are lower today than they have been in the past.

The client would not have liquidity for the assets used to purchase a SPIA, and there would be no further upside potential. The advantage is that the SPIA eliminates market and longevity risk for the client (subject to any credit risk for the issuing insurance company). At present, a 3.75 percent sustainable spending rate with inflation and longevity protection is available with a SPIA, with life-only and joint, and 100 percent survivor’s payments.

The next strategy is to build a 30-year ladder of bonds. These calculations require data for the entire yield curve with bonds maturing in each year over the subsequent 30-year time horizon. To calculate sustainable spending with a bond ladder involves determining how much it will cost to purchase bonds providing the desired spending pattern, and then calculating the initial payout rate implied by this cost. A 30-year bond ladder with TIPS could support a 3.65 percent withdrawal rate for CPI-adjusted spending growth. The bond ladder provides liquidity for unused assets, but there is no protection beyond 30 years.

The final strategy is to combine a 20-year bond ladder of TIPS with a deferred income annuity that provides inflation adjustments once income begins. Relative to a simple 30-year bond ladder, this hybrid strategy is actually quite attractive, getting the sustainable withdrawal rate up to 4.03 percent. Despite giving up liquidity for a smaller portion of assets (25 percent of assets would be required for the DIA purchase), the client could sustain almost 7 percent more income than with a SPIA. The trade-off is that there is still inflation risk, as no company at present offers a DIA that provides inflation protection for the initial payout made in the future.

For this calculation, I assume a 1.8 percent inflation rate to calibrate initial income in 20 years, as this is the current breakeven inflation rate predicted over 20 years by the yield differences between TIPS and Treasuries. To the extent that inflation differs from this expectation over the next 20 years, there could be a significant jolt to the real spending power provided by the strategy in year 21 of retirement.

Sustainable Spending from Volatile Investment Portfolios

The next strategies include specific allowances for portfolio depletion because they are based on volatile investment portfolios (stock and bond funds). This is the domain of Bengen’s 4 percent rule. What is a sustainable withdrawal rate from an investment portfolio over 30 years? Though the average return may be high, a significant decline in the portfolio’s value in early retirement, caused by poor market returns, can lead to wealth depletion for any sort of withdrawal strategy that doesn’t cut spending sufficiently in the aftermath. Thus, the answer has to be conservative (and 4 percent was quite conservative relative to some of the other numbers being thrown around in the 1990s).

The table reports sustainable spending rates ranging from 2.35 percent to 3.51 percent for conservative, moderate, and aggressive clients. The conservative couple uses a 25 percent stock allocation and seeks a 95 percent chance that the portfolio will not be depleted within 30 years. The moderate couple uses a 50 percent stock allocation and seeks a 90 percent chance that the portfolio will not be depleted within 30 years. The aggressive couple uses a 75 percent stock allocation and seeks an 80 percent chance that the portfolio will not be depleted within 30 years. Aggressive behavior means both investing and spending more aggressively. The aggressiveness in spending is realized through the greater allowance for failure (i.e. portfolio depletion).

The analysis assumes that withdrawals are made at the start of each year, a 0.5 percent portfolio administrative fee is deducted at the end of each year, and market return simulations that incorporate lower interest rates today along with a gradual move toward historical market average returns. This makes allowances for the fact that interest rates and inflation are currently far from their historical averages (which is particularly important for retirees because of sequence risk—early returns matter disproportionately), but it also respects historical averages and does not force returns to remain low for the entire retirement period.

It is important to recognize why sustainable spending rates for these strategies are less than with dedicated income. Sustaining an income stream from a volatile portfolio is a complicated task that creates a great deal of downside risk as well as upside potential. A 2.35 percent withdrawal rate leaves a 5 percent chance for failure, but on the other hand, it could potentially be the case that a client would end up fine using an 8 percent withdrawal rate. We cannot know in advance what the specific sequence of returns will be, and so sustainable withdrawal rates must inherently be conservative to allow for the spending rate to work in the vast majority of cases. While there is additional upside potential implicit with these strategies, initial projected spending rates can be less than with dedicated income.

Naturally, aggressive clients can comfortably spend more than conservative clients, though they are implicitly accepting a greater chance that their spending will have to deviate from the strategy in the unfortunate direction. Keeping liquidity and upside potential (a chance to either raise future spending or to leave a larger legacy) is offset by the “cost” of maintaining these options by starting retirement with a lower spending rate than with dedicated income.

It is not obvious that the 4 percent rule can be expected to work when retiring at a time in which interest rates are so low, at least for clients who are also paying fees. Even an aggressive retiree should consider beginning their retirement with a spending rate less than 4 percent when seeking inflation-adjusted spending.

Nonetheless, many clients will be drawn to the upside potential of the investment portfolio.

Advisers and clients should evaluate the advantages and disadvantages of each income tool when deciding which to use, and they may like to consider incorporating tools from each side that help manage different retirement risks.