Journal of Financial Planning: April 2015

Clarence C. Rose, Ph.D., is a professor of finance and the director of the Center for Financial Education in the College of Business and Economics at Radford University in Radford, Virginia. He has published numerous papers on personal financial planning, Social Security retirement decision making, real estate finance and investment analysis, and investment strategies.

Executive Summary

- As a result of the changing pension environment in the United States, for a growing number of retired Americans, Social Security benefits provide the major source of retirement income, the only guaranteed source of retirement income, and one of the few sources of retirement income subject to cost-of-living adjustments.

- Despite the critical importance of Social Security retirement benefits, approximately 60 percent of all U.S. workers elect to begin Social Security at age 62, the youngest eligible age to begin, permanently reducing the amount of future Social Security retirement benefits.

- Making the right decision regarding when to begin Social Security retirement benefits can have a major impact on an individual’s total retirement income, spousal benefits, and the benefits of the individual’s eventual survivors.

- This paper builds on previous research by demonstrating that delaying the start of benefits from age 62 to age 66 produces a higher rate of return on the benefits postponed than delaying all the way to age 70. However, delaying the start of benefits beyond age 66, all the way to maximum of age 70, continues to positively impact the future standard of living for recipients.

For individuals who have a realistic choice of deciding when to retire, and for those not being forced into early retirement because of lack of employment opportunities, poor health, the need to care for a spouse, or any other possible reasons for early retirement, the decision of when to claim Social Security retirement benefits should be carefully examined. The Social Security retirement decision can have a major impact on the future lifetime benefits and the standard of living in retirement.

Using basic investment cash flow analysis techniques, this paper examines the rate of return on investment on delayed benefits compared to the increase in future benefits received as a result of delaying the start of Social Security from age 62 to age 66, and from age 62 to age 70 for individuals and married couples using the spousal benefit. This paper also examines the impact of the delay on the recipient’s future standard of living as measured by the percentage of income replacement in retirement at various levels of earned income.

The Importance of the Social Security Retirement Decision

The Social Security retirement benefit is the major source of retirement income for the majority of retirees. Approximately 90 percent of individuals 65 years of age and older receive Social Security retirement benefits. For roughly 74 percent of unmarried individuals and 52 percent of married couples who collect Social Security retirement benefits, their income from Social Security is at least half of household total income in retirement (Ruffenach 2014).

The average monthly Social Security retirement benefit as of January 2015 for retired individuals was reported by the Social Security Administration to be approximately $1,328, and for married couples where both partners receive benefits, the combined average monthly Social Security retirement benefits were $2,176 (Novack 2014). The average Social Security retirement benefit statistics for 2015 indicate that the total income in retirement for many Americans is very modest.

Retirement income research indicates that while most individuals begin receiving Social Security benefits at age 62, the majority of retirees have the need for additional income to maintain their standard of living in retirement. Approximately 60 percent of baby boomers continue working after beginning retirement in order to generate additional income during the retirement years (Court, Farrell, and Forsyth 2007).

Many factors contribute to the income shortage in retirement for retirees. The extended life expectancy in the United States means that more retirees will deplete their retirement resources and experience lower standards of living during their retirement years (Van Soling and Henkins 2010). The trend of moving away from defined benefit retirement plans to more defined contribution retirement programs has shifted almost the entire retirement decision-making process to individuals (Kim and DeVaney 2005).

In today’s retirement environment, many employees do not have access to an employer sponsored retirement plan. When employees do have access to an employer sponsored retirement plan, the employees generally must decide whether or not to participate in the plan, and many do not. Those who do, however, are faced with the decisions of how much to invest, where to invest the money, and eventually how much to withdraw without running out of money in retirement. Also, many employers have cut back on fringe benefit expenses wherever possible by shifting a greater portion of the costs of benefits to employees, leaving employees with less take-home pay to spend or save.

In addition to the changing retirement environment, several factors over the years have increased the financial and economic values of delaying Social Security retirement benefits. Some of these factors include Social Security policy changes that have increased the reductions for claiming Social Security retirement before reaching full retirement age, and the gradual increase in the full retirement age from 65 to age 67. Also, longer life expectancies and record low interest rates have increased the expected present value of lifetime Social Security retirement benefits for claiming benefits later rather than sooner (Shoven and Slavov 2013).

Prior Research on the Claiming Decision

According to the Social Security Administration (SSA), if someone lives to the average life expectancy for their age, they will receive about the same lifetime Social Security retirement benefits whether they choose to start receiving reduced benefits early at age 62, delay the start to the current full retirement age of 66, wait for the maximum increased benefits at age 70, or begin at any age in between. However, each recipient’s monthly Social Security retirement benefits will differ based upon two important factors: (1) the individual’s earnings subject to Social Security taxes, adjusted for inflation, during the individual’s 35 highest earning years; and (2) when the individual starts to receive the benefits.

To determine an individual’s average indexed monthly earnings, the SSA adds together the income subject to the Social Security tax for the highest 35 earnings years. The total is then divided by 420—the number of months in 35 years—to determine the average indexed monthly earnings. If an individual has not paid Social Security taxes for at least 35 years, zero earnings are entered into the calculations for each year in which no Social Security taxes were paid. As a result, delaying the start of benefits and continuing to work in order to replace low earnings and/or no earnings years can increase benefits (Social Security Administration 2014a).

Higher wage earners, as measured by the average indexed monthly earnings, receive higher Social Security retirement benefits; however, the proportional benefits received and the rate of return on the total Social Security taxes paid during working years are less, as the average indexed monthly earnings rise (Martin, Rose, and Beach 2012).

Prior research on the Social Security retirement decision has established that certain individuals and married couples can gain substantially by delaying the start of Social Security retirement benefits. One main conclusion is that the gains are particularly large for primary wage earners in married couples because it boosts the survivor benefit that the secondary earner would be able to receive in the event of widowhood (Shoven and Slavov 2014).

Also, delaying Social Security retirement benefits can reduce income taxes during retirement (Mahaney and Carlson 2007), and because of the guaranteed lifetime annuity provided by Social Security retirement benefits, delaying the start of benefits can increase the insurance value of Social Security retirement income (Sun and Webb 2009).

Considerable research has been conducted to determine the expected present value of the timing of the Social Security retirement decision. The literature includes strategies using the “claim and suspend” strategy and the “claim now, claim more later” strategy. Both strategies can be used by certain married couples using the spousal benefit to receive higher lifetime benefits (Munnell, Golub-Sass, and Karamcheva 2013). The “claim and suspend” strategy works best when one spouse’s earnings are small relative to the other’s benefits. This strategy allows an individual who has reached full retirement age to claim benefits and immediately suspend them, which allows the other spouse to claim the spousal benefit while the higher income spouse continues to work and earn delayed retirement credits.

With the “claim now, claim more later” strategy, the more equal the lifetime earnings between spouses, the more the couple has to gain. In this strategy, a married individual at or past full retirement age claims a spousal benefit while delaying his or her own retirement benefit in order to build up delayed retirement credits. For certain married couples, the right strategy can increase lifetime benefits and the expected present value of the future benefits (Munnell et al. 2013).

Another important part of a Social Security retirement decision analysis is using the appropriate discount rate to determine the present value of the outcomes of various Social Security claiming strategies. Higher discount rates favor starting benefits early, while lower discount rates favor delaying benefits. Social Security is an inflation indexed obligation of the U.S. government. As a result, the most appropriate discount rate appears to be the interest rate on Treasury Inflation Protected Securities (TIPS), which are also inflation indexed obligations of the U.S. government. When selecting the appropriate time horizon to match a stream of Social Security retirement benefits, researchers recommend the rate on 20-year TIPS (Shoven and Slavov 2014).

Today’s record low interest rates favor delaying the start of benefits in order to increase the present value of the higher future retirement benefits as a result of the delay. When appropriate discount rates were higher, under different economic conditions, the present value analysis favored starting Social Security retirement benefits early rather than delaying (Rose and Larimore 2001).

Timing the Decision

For the primary insured, starting Social Security retirement benefits at age 62 results in a permanent reduction of 25 percent in monthly benefits compared to delaying to the current full retirement age of 66. For individuals receiving the spousal benefit, starting the spousal benefit at age 62 results in a permanent reduction in monthly benefits of 30 percent compared to delaying to the full retirement age of 66. The early retirement of the primary insured at age 62 also results in a permanent reduction in benefits for the spouse receiving the spousal benefit, and an eventual qualified survivor benefit, compared to delaying the start to a later date, such as age 66 or beyond.

Delaying Social Security retirement benefits past age 66 results in an 8 percent increase in retirement benefits for each year of delay up to age 70. The larger future payments resulting from delaying represent an actuarial adjustment to account for the fact that an individual who claims later is likely to receive benefits for a shorter time period. However, there is no additional increase in Social Security retirement benefits for postponing the start of retirement benefits past age 70, nor is there an increase for postponing the start of spousal benefits past the full retirement age of 66 (Social Security Administration 2014b).

Considerable research has been conducted on the timing of the Social Security retirement decision. Current research supports postponing the start of Social Security retirement benefits, when possible, to increase the economic value of the retirement decision. In today’s retirement decision-making environment, using the current record low interest rates and the increase in life expectancies, delaying the start of Social Security retirement is particularly beneficial for the primary insured in a married couple (Shoven and Slavov 2014).

The age at which Social Security retirement benefits begin has an important impact on the amount of future monthly benefits. However, keep in mind that early retirement permanently reduces future benefits compared to waiting until age 66 or beyond, and according to the SSA (2014b), almost 60 percent of U.S. workers elect to begin Social Security retirement benefits at age 62, which is the youngest eligible age to begin. Approximately 75 percent of all workers start receiving Social Security retirement benefits before reaching the current full retirement age of 66. Only about 25 percent of all U.S. workers wait until full retirement age or later to begin receiving benefits.

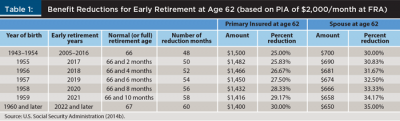

Table 1 illustrates the current and future scheduled Social Security retirement benefit percentage reduction for early retirement.

From the year 2017 to 2022, early Social Security retirement will gradually become more costly in reduced benefits for future retirees. Beginning in 2017, receipt of benefits at age 62 will result in gradual increases in the amount of benefit reductions from 25 percent to 30 percent for the primary insured. Benefit reductions will increase from 30 percent to 35 percent for individuals receiving a spousal benefit. The full retirement age will gradually increase to age 67 in the year 2027 for all individuals born in 1960 or later. The earliest retirement age to begin Social Security retirement will remain age 62 (Social Security Administration 2014b).

For married couples, each spouse may receive Social Security retirement benefits based upon his or her own employment record or the spousal benefit, whichever is greater. Spousal benefits are calculated as a percentage of the primary wage earner’s benefits based upon when benefits begin up to age 66, the current full retirement age, and the age of the spouse when the spousal benefits begin. For the spouse at full retirement age, the spousal benefit reaches the maximum amount of 50 percent of the primary earner’s benefit at age 66, provided that the primary earner waits until full retirement age or later to begin his or her Social Security retirement benefit. For married couples expecting to use the Social Security spousal benefit, the early retirement of the primary insured will permanently reduce the future Social Security retirement benefits for both partners (Social Security Administration 2014b).

In order for a spouse to begin the spousal benefit, the primary insured must have already applied for Social Security retirement benefits. When the primary insured desires to delay the start of his or her own Social Security retirement benefits, after the spouse begins benefits, the primary insured may apply for benefits and immediately suspend the decision in order to effectively allow the spouse to start receiving the spousal benefit before the actual Social Security retirement benefits of the primary insured begin. To qualify for the spousal benefit in retirement, the partners must have been married for 10 years or longer (Social Security Administration 2014a).

Determining the Return on Investment for Delaying Benefits

In this study, to examine the return on investment as a result of postponing the start of Social Security retirement benefits for individuals and for married couples using the spousal benefit, the monthly income benefits received from Social Security retirement were compared at age 62, versus at age 66 and at age 70. Investment cash flow analysis was used to calculate the return on the annual benefits not received compared to the increase in future benefits as a result of the delay. Instead of receiving a smaller benefit sooner, the recipient receives a higher benefit at a later date.

Applying the current reductions for early retirement, at age 62 the recipient receives 75 percent of the full retirement amount available for his or her earnings record at age 66 and adds an 8 percent increase to the benefits for each year of delay from age 66 to age 70. The percentage of reductions for early retirement and the percentage of increases for delaying the start of benefits from age 66 to age 70 are the same at all income levels. Therefore, the rate of return on investment for delaying the start of benefits is the same at all income levels.

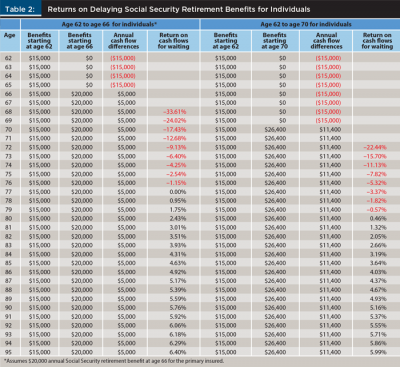

For this analysis, all reported expected future Social Security retirement benefits were calculated in today’s dollars. Table 2 summarizes the return on delaying Social Security retirement benefits from age 62 to age 66 and from age 62 to age 70 for individuals.

The investment analysis calculations show that the rate of return on the benefits not received by individuals as a result of delaying from age 62 to age 66 is negative until the recipient reaches age 77. After age 77, the return is positive and increases each year thereafter. The actual rate of return for delaying the start of Social Security retirement benefits for each individual will depend on how long the individual lives.

Assuming that an individual lives to his or her average life expectancy, age 84 for men and age 86 for women, delaying the start of Social Security retirement benefits from age 62 to age 66 results in a rate of return on the benefits not received of 4.31 percent for men and 4.92 percent for women based upon the higher future Social Security retirement benefits as a result of the delay.

Delaying the start of Social Security retirement benefits from age 62 to age 70 for individuals results in a negative return on investment until age 80. After age 80 the annual return gradually increases each year thereafter. Assuming that an individual lives to his or her average life expectancy (84 for men and 86 for women), the rate of return on investment for delaying the start of benefits from age 62 to age 70 is 3.19 percent for men and 4.03 percent for women.

To summarize, based upon current life expectancies, when comparing the delay of benefits from age 62 to age 66 and from age 62 to age 70, the expected return is greater for delaying benefits from age 62 to age 66 than from age 62 to age 70.

For financial planning purposes, because Social Security retirement benefits are inflation indexed obligations of the U.S. government, when comparing the rate of return on delaying the start of benefits to the rate of return on TIPS (which are also inflation indexed obligations of the U.S. government), the rate of return for delaying Social Security retirement is very high from a risk-versus-return perspective. The 4.31 percent return for men for delaying the start of benefits from age 62 to age 66, who live to life expectancy, and the 4.92 percent return for women, are real rates of return and would be subject to cost-of-living adjustment.

According to data reported in The Wall Street Journal (2015), at the end of the first week of January 2015, TIPS offered real rate of return yields before inflation adjustments of 0.42 percent on five-year bonds, 0.48 percent on seven-year bonds, 0.51 percent on 10-year bonds, and 0.72 percent on 20-year bonds.

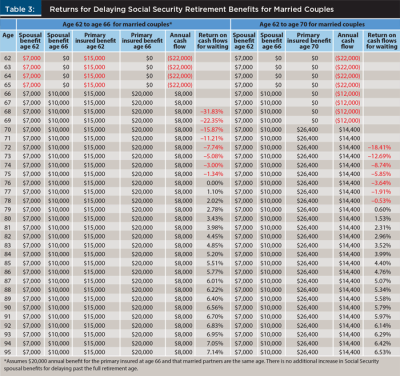

Table 3 summarizes the return on investment for delaying the start of Social Security retirement benefits for married couples from age 62 to age 66, and from age 62 to age 66 for the spouse receiving the spousal benefit and age 70 for the primary insured. For this analysis, the partners were assumed to be the same age.

Delaying the start of Social Security retirement benefits from age 62 to age 66 for married couples using the spousal benefit results in a negative rate of return until age 76. The rate of return then becomes positive and increases each year thereafter. If both partners live to age 84, the current life expectancy for men, the annual rate of return on investment for the married couple will be 5.2 percent as a result of the delay and continues to increase each year. The actual rate of return generated from the future increase in Social Security retirement benefits, as a result of delaying, depends upon how long the couple lives in retirement and increases the longer the couple lives.

For financial planning purposes, the risk return trade-off for delaying benefits for married couples using the spousal benefit is higher than for individuals and may be considered very high to outstanding as an inflation-protected investment compared to TIPS and other safe retirement distribution investments available today.

Also, because there is no additional increase for delaying the start of the spousal benefit past the full retirement age, spousal benefits should start at the full retirement age of 66 in order to maximize the Social Security retirement benefits received by the partners.

In the investment analysis summarized in Table 3, delaying benefits to age 66 for the spouse, and to age 70 for the primary insured, the married couple will experience a negative rate of return until age 79. After age 79, the return is positive and gradually increases each year thereafter. If both the husband and the wife live at least until age 84 (the current life expectancy for men), a rate of return of 3.99 percent is earned. When comparing the delay of the start of benefits for married couples from age 62 to age 66, and from age 62 to age 66 for the spouse and age 70 for the primary insured, the return on the delay is higher for married couples when delaying from age 62 to age 66. The rate of return increases the longer the couple lives in retirement.

Similar to individuals, if delaying the start of Social Security retirement benefits beyond age 62 is a viable option for married couples using the spousal benefit, the time period from age 62 to age 66 produces higher rate-of-return results. The investment cash flow analysis indicates that for individuals and married couples, especially for those who are in good health and have a family history of longer-than-average life expectancy, postponing the start of Social Security retirement benefits can be a very good financial decision as measured by the expected rate of return on the delayed benefits. It is important to note that the Social Security retirement benefits used in this analysis were calculated in today’s dollars. The actual future benefits received by individuals and married couples would be subject to future annual cost-of-living adjustments, which would increase the actual returns received.

Standard of Living Considerations

Another important financial planning consideration for delaying the start of Social Security retirement benefits is the percentage of income replacement in retirement that Social Security can provide relative to the total income available to the recipients before retirement. Financial planners typically recommend that individuals have between 70 and 80 percent or more of the final working year’s earnings in income replacement during their retirement years along with provisions to increase retirement income to keep pace with inflation.

To calculate the percentage of income replacement that Social Security retirement benefits can provide for individuals and married couples using the spousal benefit, the Social Security quick calculator (Social Security Adminitration 2014c) was used to estimate benefits at selected ranges of average annual earnings levels from $30,000 to $130,000.

For married couples, the income replacement provided by Social Security retirement benefits includes both the primary insured’s benefit and the spousal benefit starting at age 62 and for each year of delayed retirement up to age 66 for both the partners. In the analysis for married couples, after age 66, only the primary insured’s retirement benefits continue to increase to age 70. There are no additional increases for delaying the start of the spousal benefit past full retirement age.

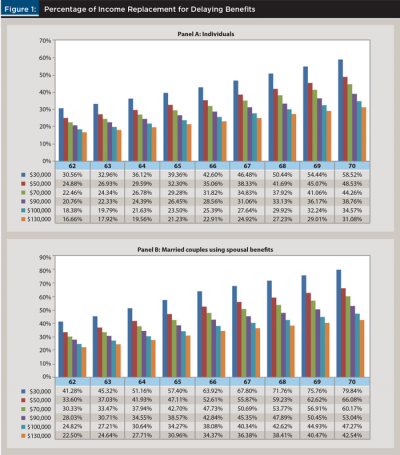

The percentage of income replacement was calculated by dividing the reported expected annual Social Security retirement benefit by the reported annual earnings of the primary insured entered into the Social Security quick calculator for individuals and married couples using the spousal benefit. The percentage of income replacement for individuals and married couples that Social Security retirement benefits can provide at various levels of earnings, depending upon when benefits begin, is presented in Figure 1.

As can be seen in Figure 1, all levels of earnings for individuals and married couples using the spousal benefit realize steady increases in the percentage of income replacement in retirement compared to working years’ earnings when delaying the start of Social Security retirement beyond age 62. The best opportunities available for increasing the percentages of income replacement in retirement exist at lower income levels.

The percentage of income replacement analysis at various levels of earnings indicates that when delaying the start of Social Security retirement beyond age 62 is a realistic option, careful consideration should be given to the effects of Social Security early retirement on the permanent reduction in future benefits and the effects of the delay on the recipient’s income replacement in retirement and future standard of living.

Also, with interest earnings at record low rates for many retirement distribution alternatives, and life expectancies on the rise, an increasing concern for many retirees is the depletion of their retirement savings during their retirement years. Because Social Security retirement benefits are a guaranteed source of retirement income and subject to cost-of-living adjustments, delaying the start of benefits can help address the longevity risk with each year of delay and at all income levels. Delaying benefits increases the income replacement percentage in retirement and increases the amount of retirement income subject to cost-of-living adjustments, helping recipients keep pace with inflation during the retirement years and reduce the longevity risk.

Another important consideration is the trade-off between the utility of consumption of income at different ages during the retirement years. While a higher income in retirement resulting from delaying Social Security retirement benefits can be very important, each individual and married couple must decide when the time is right to begin benefits based upon their total retirement financial resources, health, expected longevity, and personal retirement goals. Having enough money to maintain a desired standard of living in retirement is very important, and it is also very important to have good health and the ability to enjoy the retirement years.

The Annual Income Limitations Test

Before the decision to begin Social Security early retirement benefits is made, consideration should also be given to the possibility of the need or the desire for continued employment after the start of Social Security retirement benefits.

If a recipient continues to work when receiving Social Security retirement benefits prior to reaching full retirement age, the annual earnings limitations test applies. In 2015, an individual may earn up to $15,720 without affecting his or her benefits. For every $2 earned over $15,720, his or her benefits are reduced by $1 (Novack 2014). Each recipient’s own employment earnings affect only his or her benefits. One spouse’s earnings during the early retirement period do not affect the benefits of the other spouse or any beneficiary of the covered worker.

Income Tax Considerations

The taxation of Social Security retirement benefits may be an important consideration for many individuals and married couples. Internal Revenue Service Publication 915, Social Security and Equivalent Railroad Retirement Benefits, explains the federal income tax rules for Social Security benefits and provides worksheets for determining the taxable amount, if any, for Social Security recipients.

In essence, one half of the amount of Social Security benefits reported on the taxpayer’s SSA-1099 Forms, plus all other taxable income, such as pensions, wages, interest, dividends, and capital gains distributions, minus the taxpayer’s adjusted gross income expenses and deductions on lines 23 through 32 IRS Form 1040, determines the taxable portion of the Social Security benefits received. Using the calculations, the amount above $25,000 for single individuals and married persons filing separate returns is subject to federal income taxation. The amount is $32,000 for married couples filing a joint return.

For Social Security recipients whose retirement incomes are above the exemption amounts, the portion of Social Security benefits subject to taxation will gradually increase up to a maximum of 85 percent of the benefits being subject to federal income taxation. For higher income individuals and married couples, the 85 percent maximum taxable income limit on Social Security retirement benefits is a tax savings compared to 401(k), 403(b), and traditional IRA distributions.

Conclusion

For many individuals and married couples, Social Security retirement benefits are a major source of retirement income. Careful examination of when individuals and married couples begin to receive Social Security retirement benefits may improve their standard of living during the retirement years.

Delaying the start of Social Security retirement benefits can provide a very reasonable rate of return on the benefits delayed and a higher percentage of income replacement in retirement. While no one knows how long he or she will live in retirement, for individuals and married couples who have an option of delaying Social Security retirement benefits, postponing the start of benefits may produce very positive retirement planning results.

References

Court, David, Diana Farrell, and John E. Forsyth. 2007. “Serving Aging Baby Boomers.” The McKinsey Quarterly 4 (11): 103–113.

Kim, Haejeong, and Sharon DeVaney. 2005. “The Selection of Partial or Full Retirement by Older Workers.” Journal of Family and Economic Issues 26 (3): 371–394.

Mahaney, James L., and Peter C. Carlson. 2007. “Rethinking Social Security Claiming in a 401(k) World.” Pension Research Council Working Paper No. 2007-18.

Martin, Deryl W., Clarence C. Rose, and Steven L. Beach. 2012. “Early Retirement Decisions and the Returns on Social Security for the Average U.S. Wage Earner.” Journal of Financial Service Professionals 66 (3): 1–7.

Munnell, Alicia, Alex Golub-Sass, and Nadia Karamcheva. 2013. “Understanding Unusual Social Security Claiming Strategies.” Journal of Financial Planning 26 (8): 40–47.

Novack, Janet. 2014 (October 22). “Social Security Benefits Rising 1.7 Percent for 2015, Top Tax Up 1.3 Percent.” Forbes.

Rose, Clarence C., and L. Keith Larimore. 2001. “Social Security Benefit Considerations in Early Retirement.” Journal of Financial Planning 14 (6): 116–121.

Ruffenach, Glenn. 2014 (June 23). “What You Don’t Know About Social Security But Should.” The Wall Street Journal.

Shoven, John B., and Sita Nataraj Slavov. 2013. “Does It Pay to Delay Social Security?” Journal of Pension Economics and Finance 13 (2): 121–144.

Shoven, John B., and Sita Nataraj Slavov. 2014. “Recent Changes in the Gains from Delaying Social Security” Journal of Financial Planning 27 (3): 32–41.

Social Security Administration. 2014a. “What You Need to Know When You Get Retirement or Survivors Benefits.” SSA Publication No. 05-10077, ICN 468300. www.ssa.gov/pubs/EN-05-10077.pdf.

Social Security Administration. 2014b. “Benefit Reduction for Early Retirement.” Office of the Chief Actuary. www.ssa.gov/OACT/quickcalc/earlyretire.html.

Social Security Administration. 2014c. “Quick Calculator Benefit Estimates.” www.ssa.gov/cgi-bin/benefit6.cgi.

Sun, Wei, and Anthony Webb. 2009. “How Much Do Households Really Lose by Claiming Social Security at Age 62?” Center for Retirement Research at Boston College Working Paper No. 2009-11.

The Wall Street Journal. 2015 (January 6). “Treasury Inflation-Protected Securities: Key Interest Rates.” C8.

Van Soling, Hanna, and Kene Henkins. 2010. “Living Longer, Working Longer? The Impact of Subjective Life Expectancy on Retirement Intentions and Behavior.” European Journal of Public Health 20 (1): 47–51.

Citation

Rose, Clarence. 2015. “The Return on Investment for Delaying Social Security Beyond Age 62.” Journal of Financial Planning 28 (4): 50–58.