Journal of Financial Planning: April 2013

Executive Summary

- The objectives of this article are to introduce the characteristics of the formula for financial planning and explore the value of having a single formula.

- The article proposes using the financial planning formula as a guide for providing services

to clients. - The author considers how the formula could be used by prospective clients to determine they are receiving true financial planning services.

Marc Freedman, CFP®, is president of Freedman Financial, a Peabody, Massachusetts, community-based financial planning and wealth management firm, and is a former member of FPA’s national board of directors.

Editor’s Note: The following is an excerpt from Marc Freedman’s book, Oversold and Underserved: A Financial Planners Guidebook to Effectively Serving the Mass Affluent, published by FPA Press and now in its fourth printing.

Could there be a magic formula that embodies the delivery of financial planning?

It has taken a long while, but finally, “financial planning” has become a recognizable expression among those who need, those who deliver, and those who support financial planning. Yet, for a term like “financial planning” to be regarded as one that can stand on its own and not be viewed as a subset of investment management, we need a minimum benchmark so that everyone can identify when financial planning is delivered or when it is a variation of something else. Fortunately, CFP Board created a six-step process to help us understand developing a financial plan:

- Identify goals and objectives

- Collect data

- Analyze data

- Develop a plan

- Implement strategies

- Monitor the plan, make necessary adjustments

While I wholeheartedly endorse this staged approach when building a financial plan, I don’t believe it is the best descriptor for the “ing” part—the financial planning function. I believe we need a clear formula so anyone (the public and providers) can state with conviction, “That is financial planning.” This is the reason I have attempted to build a formula for financial planning. I have built this formula with the mass affluent client in mind. While I believe it could translate well in any market group, my thinking and presentation below are intended to benefit the mass affluent population—and those who serve them.

Introducing the Formula

I am far from a “quant” guy. So, I decided to combine my background in marketing with a collection of financial components in the hope that I could create a simple enough formula to be understood by anyone. The formula acknowledges the importance of both the quantitative and qualitative sides of financial planning. It incorporates the human condition and realities of pure finance. It also attempts to place a balanced emphasis on the elements of a planning relationship. I hope the formula ultimately will be viewed as a primary reference point that planners rely upon when they begin to wonder whether their advice leans more heavily toward one particular subset of the equation and unintentionally neglects to include the other important parts.

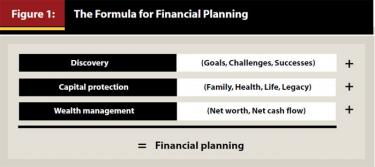

See the formula in Figure 1.

I believe that for clients to say they received financial planning, they must feel confident that the planner:

- Asked questions about their goals, challenges, and successes. (I call this discovery.)

- Explored how effectively clients have elected to protect their family, health, life, and legacy. (I call this capital protection.)

- Discussed issues that affect the quantitative elements of their financial life, with particular attention to how changes in cash flow, market volatility, inflation, and other factors will affect the client’s expectations. (I call this wealth management.)

What is your general impression of the formula? Is it possible to deliver financial planning when you focus solely on wealth management (WM) and ignore discovery (DY) and capital protection (CP)? What if you focused solely on discovery and capital protection? Are you doing financial planning now?

Think about these other formulas and consider some of the outcomes:

- Discovery + Capital Protection → (yields) Estate Planning, Risk Management, Charitable Planning

- Discovery + Wealth Management → (yields) Investment and Cash Flow Management, Wealth Accumulation, Income Planning

- Capital Protection + Wealth Management → (yields) Insurance and Investment Sales

- Discovery (all alone) → (yields) Therapy, Leadership, Advice

Therefore, could the collective components of discovery plus capital protection plus wealth management be an equation that defines financial planning?

FP = DY + CP + WM?

Let’s dig a little deeper into each segment of the formula:

Discovery (DY)

Financial planning needs to start with a conversation that explores a client’s relationship with his or her money. Failing to address these issues prior to implementing any strategy puts your credibility as a planner at risk. Think about it. If someone were to ask, “Have you placed your clients’ interests first?” would you be able to confidently answer this question with integrity? If you neglect to understand their goals first, how can you suggest a strategy that serves their needs? As a financial planner, is it really possible to make implementation recommendations without fully understanding how they affect everything else in the client’s life?

To effectively serve the needs of the mass affluent, it is inexcusable to make recommendations before asking about and agreeing upon their goals and objectives. Clients who choose not to share this information are probably best served in transactional environments because they are more apt to make impulsive decisions.

Generally, you should expect that discovery questions will address at least these basic issues:

- Long- and short-term goals

- Personal and financial successes

- Challenges your client faced and those they may expect to encounter in the future

Sometimes, conversations surrounding the discovery process can get quite personal. Frankly, that’s where the leadership component comes into play. If you are unwilling to ask the important questions, you’re likely to have relationships with your clients that rarely get to the heart of the matter. The best financial planners know that challenging your clients with provocative questions ultimately leads to uncovering the core of our clients’ true financial plans.

Goals + Successes + Challenges + Opportunities

Goals (Gl), successes (Sc), challenges (Ch), and opportunities (Op) are examples of the subsets that are part of the discovery portion of the formula for financial planning. The deeper you dig into your clients’ connections with their money, the better they will be served. Never stop asking your clients about their hopes, wishes, and concerns. I can’t emphasize enough how important it is that you explore the discovery segment of the formula before ever offering solutions for your clients’ quantitative needs.

Essentially, the discovery component of the financial planning formula becomes the cornerstone every time you converse with your client.

Capital Protection (CP)

A primary goal of successful financial planning is to help clients achieve a greater quality of life. Insurance planning and risk management advice serve as the “peace of mind” component in your relationship. Financial planning must include continual guidance, advice, and sound strategies in areas that affect:

- Life risks (l)—Premature death, long-term disability, or even having to care for a family member could have drastic implications on your clients’ ability to achieve their goals. What conversations and strategies do you introduce and monitor to deliver peace-of-mind solutions?

- Family’s risks (f)—Divorce, second marriages, children with special needs, and marriages that can alter a family’s estate plans can all affect the ways in which you protect your dreams from being derailed. What guidance will you offer when it’s time to protect the family from spendthrifts, the financial complexity of blended families, and those who may not have the ability to manage money on their own?

- Wealth risks (w)—Changes in inflation, personal spending, employment, market conditions, tax law, and more will affect your clients’ ability to achieve their financial goals. What risk-minimization techniques will you employ to smooth out the choppiness when detours in your planning occur?

- Legacy risks (lg)—Unless they plan to spend their last dollar on the day they die, it is imperative that clients prepare for the transfer of their wealth, their personal property, and possibly the guardianship of their offspring. Ensuring a client’s wishes are explored, documented, and reviewed is essential for planners.

Think of capital protection as the glue that adheres the emotional components in your clients’ lives to the analytic side of their financial wealth. When capital protection issues are addressed and maintained, clients share confidence in their ability to protect their family, their health, their income, their wealth, and their legacy.

Death, disability, medical costs, and long-term health care are typical items that clients worry about, but that I don’t believe we, as planners, spend enough time talking about—especially as years pass in relationships with our clients. Your clients want direction and guidance on these matters. They seek your leadership and expect you to raise questions and offer ideas for protecting these points of vulnerability. Financial planning cannot be delivered without the implementation of capital protection strategies.

Wealth Management (Growth – Inflation (Net Worth – Net Cash Flow))

Growth(g) – inflation(i) — As the projections and analyses of planning strategies come into the conversation, planners need to continually review the net assumed growth rate used for a client’s total aggregated net worth. Building projection models based on net growth of a client’s overall wealth is significantly more valuable than crafting strategies that focus more exclusively on the performance of individual investments and/or accounts.

Multiplying your client’s net projected growth rate by their net worth plus net cash flow, you can truly begin to show a client the changes in their financial wealth. We all know that costs increase; but with proper planning, so too will your client’s net worth.

Net worth (NW)—This is a snapshot of a client’s life. Without having a clear picture of the comprehensive assets and liabilities of a client’s financial status, is it appropriate to implement investment strategies for them? Moreover, as a financial planner, you have a responsibility to verify your client’s data within the net worth statement. Never allow your clients to simply tell you what they have. How can we both “know our client” and “place the interest of our clients first” without having a mutually authenticated representation of our clients’ financial positions?

Cash flow (CF)—This requires a careful assessment of how a client uses his or her financial resources to cover expenses, taxes, and ongoing savings. Exploring the choices about where clients draw funds from to cover costs is incredibly important for assessing their ability to either increase or shrink the overall value of their net worth. It enhances your ability to build better planning scenarios. You can serve as your clients’ champion when you have a solid handle on how money is used in their lives—and how it could affect their ability to achieve goals.

Taxes

So where are taxes in the formula? I believe taxes are an important component of a client’s ability to achieve financial peace of mind, but they can generally be found inside the expense area of a client’s cash flow (and tax sheltering can be found in the net worth component). With good planning, taxes must be addressed as internal factors that planners consider when addressing each client issue. We have found that clients usually think about taxes as something they pay or a refund they receive in April. Planners need to look at taxes from several angles. Whether it is a calculation of your tax withholding on a pay stub, consideration on the taxes due from the sale of securities, or deciding whether to select a tax-free, tax-deferred, or fully taxable security for your client, taxes are part of the process—they are an important factor in the formula, but only one of multiple factors that planners must consider in the process.

And for all of you quants, here’s a marketing guy’s more technical interpretation:

FP = DY(Gl + Sc+Ch +Op) + CP([l + f + w + lg])+ WM (g – i (NW + NCF)

Another Perspective

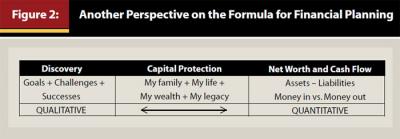

Consider a more graphical way to explain the formula for financial planning. If you view the discovery side of the equation as qualitative issues and the net worth and cash flow components as quantitative issues, capital protection serves as the buffer that adds peace of mind to your clients’ ability to achieve their goals in the event of an unexpected personal tragedy. (See Figure 2.)

The formula for financial planning is far from scientific, but can fully integrated financial planning be delivered without including all of its components?

Planners, in general, are working harder at weaving the discovery element into client conversations.

But all too often, we find that the capital protection component is either a forgotten conversation or one that gets delayed to another financial professional. Without the inclusion and ongoing review of capital protection issues, you place yourself and your clients at risk. CFP professionals have an obligation to place the interests of their clients first. Neglecting to include strategies that address the importance of capital protection is an area we need to better incorporate into our practices.

Formula for Financial Planning at Work

Just imagine how empowered your clients would feel if they could articulate the following statements about the relationship they have with their financial planner. Here are a few examples. “My planner…

- revisited my goals and objectives with me. I continue to be excited about my future and have a vision of where I am going.”

- asked me new, probing questions about recent challenges and successes in my life. She made it so comfortable for me to tell her anything about money.”

- revisited the rationale for the protection vehicles I have in place. I know that if something unexpected happens to me, my family will be protected and financially secure.”

- updated my overall net worth statement and showed me how much it has changed. I view my financial world from a much different perspective now that he has taught me to look at my net worth as opposed to the individual mutual funds in my portfolio.”

- asked about my current cash flow and talked with me about a few major expenses I will have this year. I know that she will help me select where best to draw money from when I need it, and consider the most tax-appropriate strategy for me.”

- examined my tax return and offered me a couple of ideas on how I could position money more wisely. I am so happy he helped me change my payroll withholdings.”

- introduced me to a new investment that seems to align with my goals. I am so lucky to have a financial planner who really wants to understand my whole financial life and is willing to offer advice to me whenever I feel I need it.”

If a client left your meeting with peace of mind around these points, would you have honored the formula for financial planning? Could you imagine regularly visiting with your clients when only a fraction of your time consists of discussing investment returns, asset allocation, hypothetical reports, Monte Carlo analysis, or a new product idea? A planner who focuses only on segments of the formula for financial planning risks not fully understanding a client’s needs. Without forcing yourself to reflect on the formula, it is easy to get wrapped up in micro issues, such as the components of a client’s portfolio or a long-winded discussion about the current return on a particular investment.

When we get too comfortable with our client relationships, it’s easy to forget about, or completely neglect, new goals that your clients need to explore. We tend to drift back to the quantitative side of the equation and forget about the emotions. Just imagine how intrigued your clients would be if they knew the bulk of your conversations assured them you would rely on the formula for financial planning.

Planner Exercise—Seeing Financial Planning from the Client’s Perspective

Imagine, just for a moment, you weren’t a financial planner. You knew very little about the profession, but you knew you needed to seek advice from someone. Prior to your initial consultation, you did an Internet search on the words “financial planning” and came across the formula for financial planning. You chose to print it out and have it accessible as a reference point for your meeting. You also read that the CFP certification seems to be the gold standard of planners in the profession, and you decided to select five CFP certificants to interview. Based on the formula for financial planning, read the five examples below and determine which ones would be offering financial planning to you.

- You are meeting with a planner for the first time because you’ve just received an inheritance. During your 30-minute visit, the planner offers an investment strategy and a recommendation for your consideration.

- You are seeking long-term care insurance protection because you’ve recently watched a parent suffer in a nursing home. The planner prepares a proposal for long-term care coverage based on what you told him you could afford while you wait.

- You are seeking advice on how best to save money for your child’s education costs, but the planner is more interested in exploring whether your 401(k) plan allows for in-service rollovers. The planner has clearly dismissed the primary reason you scheduled the appointment.

- You visit with a planner who asks you about your goals and objectives. Because you’ve never explored them before, the planner shares some rules of thumb and offers to build you a financial plan based on these rules.

- You’re visiting with a financial planner for the first time and instead of listening to why you are there, they jump to conclusions with answers to your questions before you have had a chance to fully share your thoughts.

Can you think of any financial planners who might represent any of the above five examples? If these examples truly exist (and I assure you, they do), how can the public accurately understand financial planning?

Delivering financial planning effectively takes an enormous amount of practice. Admittedly, it is much harder to offer financial planning than it is to sell a solution to a client. But when you gain the skills to deliver a well-balanced conversation with your client, you not only earn a client for life, but you’ve secured another raving fan who will espouse the virtues of your “different” approach. More than anything, this improves the public’s understanding of how financial planning can be effectively delivered.

The mass affluent are oversold and underserved. This market segment, while truly appreciative of a professional who can deliver solutions to their issues, is more likely to build lifelong relationships with someone who is willing to:

- Discover their dreams, reflect on their successes, and tackle their challenges

- Build peace of mind by protecting their lives, families, wealth, and legacies

- Analyze the intricacies of their financial life and offer solutions to help them achieve success

The methods of compensation that you use to deliver financial planning to the mass affluent are not nearly as important as giving them the assurance that your firm is committed to the planning formula. Whether you choose to work solely as a fee-only adviser, or as someone who might deliver both commission-based solutions and/or fee-based advisory services, the mass affluent market is asking for your help. I promise that if you allow the formula for financial planning to serve as your guide, no one will ever question whether you are a genuine financial planner.

Conclusion

The formula for financial planning is a tool for helping planners identify the cross section of issues needed to craft strong financial planning relationships. It is critical that planners heighten their knowledge of capital protection issues and raise them as forefront issues in the overall scheme of the client relationship. Allow the formula for financial planning to serve as your guide. Your clients will better understand your role as a financial planner and will be able to better articulate the elements of financial planning.