Journal of Financial Planning: December 2022

Jason K. Branning, CFP®, RICP, (left)and M. Ray Grubbs, Ph.D., (right) are principals with ReAP, LLC, a retirement education firm based in Ridgeland, MS. Additionally, Jason is an investment advisory representative of Asset Dedication, LLC, an SEC-registered investment adviser, and Ray is professor emeritus at Millsaps College in Jackson, MS.

NOTE: Click images below for PDF versions.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

The goal of this article is to provide an actionable framework for contingency planning for individual retirees through the modern retirement theory (MRT) perspective. Contingency planning encompasses a retiree’s risk management processes, techniques, and strategies, along with a choice architecture. Our goal is to provide insights that are mitigating to those conditions within longevity that can impair or impact a retiree’s ability to remain retired. We offer three risk categories—known, unknown, and unknowable—as an organizational scaffold that demands an intentional choice be made by the retiree. Then, to guide an individual retiree’s decisions about contingency planning, we put forth an active risk selection matrix. The 3-R matrix can be used for guiding and evaluating risk choices through risk recognition, risk reduction, and acceptance of residual risk.

To live is to be at risk. Risk is the possibility of something bad happening.1 Preparing for negative conditions and outcomes is imperative given the wide range of conditions that can be experienced within a person’s lifespan. Modern society is not the first to attempt to express, understand, and postulate models for handling risk. For the ancient Greeks, an image of fortune and/or risk was embodied in the goddess Tyche (Roman goddess Fortuna). Tyche was depicted as “winged, wearing a crown, and bearing a sceptre and cornucopia; appearing blindfolded and with various devices signifying uncertainty and risk.”2 As well, the ancient Hebrew King Solomon instructed readers to, “Divide your portion to seven, or even to eight, for you do not know what misfortune may occur on the earth.”3 A primary task of advisers is to assist clients with ways to deal with ubiquitous risks to their material condition.

Some have defined risk as a permanent impairment to an investor’s mission.4 For the individual who views financial security in retirement as an absolute goal, we would reword this definition to say that “risk” means: “anything that permanently impairs or impacts an individual’s lifetime plan.” Longevity and conditions within longevity are individually unknowable, therefore a contingency fund must be part of any retirement plan. Anything that negatively impacts a retiree’s base fund, which supports the retiree’s essential lifestyle, should be considered a subject to be discussed and addressed by the contingency fund.

For modern retirement theory,5 a boundary should be noted that exists between base lifestyle and contingency planning that must be addressed before retirees cross into discretionary or legacy planning. The boundary is simply in place seeking to support the absolute goal of an individual retiring and staying retired. If the first goal of retirement is to create needed income for mandatory expenses, then the second goal is to build into the mandatory expenses, methods and strategies to protect the first goal.

Contingency, as a concept in retirement planning, concerns something that might possibly happen in the future—something that will cause problems or make further arrangements necessary.6 One of the significant issues for the individual retiree is that certain risks are often unknowable. Our aim is to offer ways for retirees to make better decisions in spite of the individually unknowable.

Many advisers discuss the need for an emergency fund as the solution for contingencies. An emergency fund is one piece of contingency planning but does not go far enough in preparing individuals for retirement shocks. This is where a contingency fund is needed. A contingency fund should help clients: reduce regret in the future when things go wrong, protect a retiree’s essential lifestyle, and offer a decision matrix leading to actions.

Reducing Regret

First, given the consequential nature of retirement, a contingency planning framework should help reduce regret. The fear of regret is powerful. In Thinking Fast and Slow, Daniel Kahneman explains, “The fear of regret is a factor in many of the decisions that people make (‘Don’t do this, you will regret it’ is a common warning), and the actual experience of regret is familiar.”7 Kahneman continues, “You can also take precautions that will inoculate you against regret. Perhaps the most useful is to be explicit about the anticipation of regret. If you can remember when things go badly that you considered the possibility of regret carefully before deciding, you are likely to experience less of it.”8 Methodically building a contingency fund is a way to help clients anticipate forces that create regret during retirement.

Mathematician Leonard Savage developed the “minimax regret” criterion as a decision-making strategy in 1951.9 The idea is to choose whatever action promises to entail the least amount of regret, where regret is often measured as the opportunity cost of a decision. The theory is that, after the decision has been made and the consequences have all manifested themselves, the right decision will be known. The difference between what could have been gained compared to what was actually gained is the amount of regret the decision maker will feel. The decision is to choose whichever option promises to minimize the maximum regret the decision-maker will feel.

Contingency planning is at its core about risk management that seeks to minimize regret. An individual retiree has a retirement sheet (balance sheet assets + cash flow), which can be subjected to various shock tests like a historical audit, Monte Carlo analysis, or framework analysis such as asset–liability matching. The pertinent question for retirement centers on the robustness of the individual’s retirement sheet to facilitate lifetime income and withstand unknowable contingencies during lifetime. Ultimately, a retiree strives to be insulated from financial hardship insofar as that is possible with planning. An individual’s concern is how they can retire and remain retired, undaunted by the risks that abound.

Secondly, retirees have a few options when they face risks about how to minimize regret and protect their essential lifestyle; they can assume a risk, avoid a risk, mitigate a risk, or transfer a risk. Setting up a contingency fund can offer a risk management framework to help a retiree decide how they best protect their lifestyle through choosing which risks they are most concerned with and then choosing the best strategy based upon their preferences.

The American College’s retirement income certified professional (RICP) program identifies six vast risk categories and 18 specific risks. Thinking about retirement risks and identifying risks is important, yet our motivation and concern is how do retirees take actions to protect their retirement? What should guide retirees as they make decisions about these risks?

The MRT contingency fund framework compels individuals to exercise judgement by identifying risks and actively selecting which risks to assume, mitigate, transfer, or avoid. Additionally, the process and method for unknown risk assessment is different than an unknowable risk assessment. Nassim Taleb’s black swan theory deals with unknowable risks from past experience. These risks are characterized in three parts: “rarity, extreme impact, and retrospective (though not prospective) predictability.”10

Thirdly, the individual can use the power of group probabilities to mitigate certain risks with insurance, while, at the same time, hoping never to utilize insurance benefits. Any mitigated risk has both a price or expense and an opportunity cost. Therefore, insurance premiums or strategies are exchanged as the price to mitigate or transfer a specific risk and a willingness to forgo the use of the premium.

A mitigated risk also offers individuals the benefit of enhanced economic security if a life-altering event causes that mitigated risk to be realized. Economic harms that can be identified as posing jeopardy to the retiree’s absolute goal of remaining retired should be mitigated. Retirement contingency planning is different from general planning because of the sensitivity of the retirement plan at the moment of retirement. An individual’s retirement plan is most vulnerable during the 10 years surrounding retirement: five years before and five years after.11

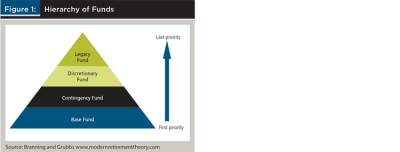

In modern retirement theory, primary risks are identified and offset through a liability matching protocol of a hierarchy of funds (see Figure 1).12 The base fund protects income such as individual bonds held to maturity over a specified planning horizon of five to 10 years using what is commonly referred to as a bond ladder. The second fund is the contingency fund. This is not specifically an emergency fund, though an emergency fund is part of contingency planning to deal with short-term minor emergencies, such as car repairs, pet illnesses, etc. Specifically, the MRT contingency fund seeks to address those major risks that can vastly disrupt, diminish, or destroy the individual’s goal of remaining retired. Individuals planning for contingencies in retirement require a process to prioritize, evaluate, and guide them in preparing for unknown and unknowable future risks. Risks are not just about probabilities for the individual based on an occurrence’s likelihood derived from group averages, but also the consequential nature of specific possibilities (a long life, a long-term care event, etc.).

Finally, the contingency fund action plan rests on a 3-R risk evaluation process as a discernment scaffold to address individual retiree risks. As an aide to retirees planning against contingencies, modern retirement theory proposes that individual risks be sifted through a 3-R risk assessment heuristic: (1) recognition, (2) reduction, and (3) residual.

Recognize Risks

Sorting risks into categorical silos and then by order of magnitude requires an intentional process of identification and classification. MRT submits a framework modification from the American College’s RICP curriculum that categorizes three contingency risks as known, unknown, and unknowable (to an individual).

Using this context calls retirees to actions and decisions about how they choose to handle a particular risk: avoid, assume, mitigate, or transfer it. Once decisions are made, retirees will have a clear rationale for their decisions. For example, the individual retiree can know why they have $50,000 in cash as an emergency fund or why they have chosen to use their home equity to offset market downturns or pay for long-term care costs.

Known risks present conditions that can be mitigated or hedged through calculations for large groups by institutions, i.e., risk pooling. Known risks use large datasets through group probabilities to offer insights for individuals. However, these insights are not individual decision rules. Individual risk differs from grouped risk. Individuals must make informed choices with external inputs. Often this leads an individual to insure against a particular risk, even if the probability of the risk is low.

Identifying known risks allows individuals to quantify the value and merit of insuring certain risks to their future. For example, if an individual lives near a fault line, paying earthquake insurance premiums on a home would be advised. Similarly, the government mandates flood insurance for homes in flood plains.

Broad categories of uncertainty for an individual retiree that need contingency planning consideration are:

- Longevity

- Income Protection: Disability, Professional Liability, Retirement Income

- Property Protection: House, Auto, Earthquake, Flood, Umbrella, etc.

- Morbidity Protection: Disability (pre-retirement), Health Insurance, LTC

- Mortality Protection: Life Insurance

Rather than the oft stated three to six months of expenses as an emergency fund for retirees, a new perspective is warranted. Individual retirees should calculate the maximum out-of-pocket expenses on all insurance policies, plus any cash needed to cover mandatory expenses for a period of up to 12 months.

Reduce Risk

Upon identifying and classifying an individual retiree’s risks, the unknown, probability-based risks can be reduced or willingly retained. Individual retirees may choose risk reduction techniques that mitigate, transfer, or avoid. Any risk may be retained, and risk mitigation is an effort to lessen the impact of a meaningful probability event for the retiree. The aim of MRT’s contingency fund is to personalize risk choices for the retiree.

Residual Risk

Residual risk is a fact of life taking us back to the reality that to live is to be at risk. The question is whether a retiree is aware of and has accepted the reality of ongoing risk. Residual risk is not always a negative. For example, historically, risk assets in the broad stock market have rewarded risk takers if the horizon is long enough. Retirees and advisers should review risks annually, as risks shift over time.

Conclusion

Creating a robust retirement plan must include planning for contingencies. Contingency planning follows, and yet is necessarily connected to, essential income planning of the base fund. A 3-R framework can help retirees take action. The 3-R framework matrix allows retirees to build and understand their individual contingency fund. Every retiree’s contingency fund should be monitored and reviewed at least annually.

The authors are thankful for the comments and insights from Stephen Huxley of Asset Dedication.

Endnotes

- Cambridge Dictionary. s.v. “Risk.” Accessed July 14, 2022. https://dictionary.cambridge.org/dictionary/english/risk.

- Encyclopaedia Britannica. s.v. “Tyche.” Accessed May 1, 2022. www.britannica.com/topic/Tyche.

- Ecclesiastes 11:2. New American Standard Bible. 2020.

- Towers Watson. 2012. “The Irreversibility of Time: Or Why You Should Not Listen to Financial Economists.” https://investmentmagazine.com.au/wp-content/uploads/2012/11/Martin-Goss-TOWERS-WATSON-White-Paper.pdf.

- Branning, Jason, and Michael Grubbs. 2009. “Modern Retirement Theory: Reaching Client Goals in Every Market.” Available at SSRN: https://ssrn.com/abstract=3419038 or http://dx.doi.org/10.2139/ssrn.3419038.

- Cambridge Dictionary. s.v. “Contingency.” Accessed July 14, 2022. https://dictionary.cambridge.org/us/dictionary/english/contingency.

- Kahneman, Daniel. 2011. Thinking, Fast and Slow. New York: Farrar, Straus and Giroux: 346.

- Ibid: 352.

- Wikipedia. s.v. “Regret (decision theory).” Accessed July 15, 2022. https://en.wikipedia.org/w/index.php?title=Regret_(decision_theory)&oldid=1096562923.

- Taleb, Nassim Nicholas. 2007, April 22. “The Black Swan: The Impact of the Highly Improbable.” The New York Times. Accessed September 28, 2020. www.nytimes.com/2007/04/22/books/chapters/0422-1st-tale.html.

- Pfau, Wade D. 2015. “The Lifetime Sequence of Returns: A Retirement Planning Conundrum.” Available at SSRN: http://dx.doi.org/10.2139/ssrn.2544637.

- Branning, Jason, and Michael Grubbs. 2010. “Using a Hierarchy of Funds to Reach Client Goals.” Available at SSRN: https://ssrn.com/abstract=3419104 or http://dx.doi.org/10.2139/ssrn.3419104.

- Branning and Grubbs made the case for framing preferred retirement income characteristics as “stable, secure, and sustainable” in the December 2017 issue of the Journal of Financial Planning. Read more about 3-S income in “Crafting Retirement Income That Is Stable, Secure, and Sustainable.”