Journal of Financial Planning: October 2022

Jamie P. Hopkins, Esq., LLM, CFP®, ChFC, CLU, RICP, is the managing partner of wealth solutions at Carson Group. He is a finance professor of practice at Creighton University’s Heider College of Business. Carson Coaching is the official coaching partner of the Financial Planning Association.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

NOTE: Click on the image below for PDF version

Take a quick look at your thumbprint. It’s not like anybody else’s thumbprint—it’s unique to you. The same is true with your clients’ tax planning—it should be unique to them and done in a proactive, versus reactive, manner.

Many of our clients think taxes are just about tax filing—which is reactive because they’re looking back at the past year to deal with what’s going on, versus looking ahead to the next one to five years to understand the tax implications that we could be running into.

As with thumbprints, nobody has the exact same tax situation. Because your clients will all have different tax situations, it’s important for you to have a consistent process for tax planning as it relates to your clients’ retirement.

Morningstar research found that tax efficiency planning was among the top ways to improve clients’ retirement income.1 The study found that retirement income increased by 8.2 percent by just incorporating this type of planning.

To provide this value to clients, you must have a process that you execute. And the first step in the process is always to know your clients’ goals and their definition of happiness in retirement.

Tax planning is interconnected to many things for your clients, and you need to know about all those other things—their goals, income needs, contingent expenses, and legacy goals.

The rest of the process is up to you, but laying the foundation with your clients’ goals is critical to successful tax planning. It’s also critical to know some nuances about tax planning—especially after the Tax Cuts and Jobs Act of 2017 and the SECURE Act in 2019—and potential approaches to tax planning in retirement to best help them.

A Dive into Taxes: A Few Examples

As you know, your clients’ tax situation will change based on their situation, but what always remains the same is that we have a graduated tax system. As income goes up, so do taxes, depending on the type and source of income.

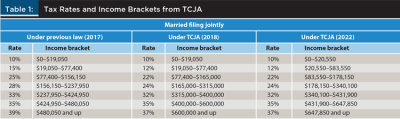

Tax brackets changed under the Tax Cuts and Jobs Act of 2017, which provided a tax cut for corporations and most people. For most single filers and married filing jointly filers, TCJA expanded the income bracket ranges and reduced the tax rates that apply to some of those income brackets. Overall, this resulted in lower potential income taxes for Americans. However, it is not universal that taxes fell for everyone, as some deductions and credits were pulled back (like capping the state and local tax (SALT) deduction at $10,000), which even when coupled with lower tax rates did cause some people to pay higher overall taxes post TJCA.

Let’s look at the changes in tax rates and income brackets from TCJA (Table 1).

Looking back at historical income tax rates, the 24 percent range and the highest income ranges are extremely appealing, at least when compared to historical income tax rates. At 37 percent in the highest bracket, the rates are very low compared to historical tax rates.

What this means for many is it is a good time to accelerate and not push off income. Yes, I know people don’t like paying taxes, but it could be an advantageous time to realize income and pay taxes today, as opposed to pushing off taxes by deferring income into the future. There are a few factors to consider here.

- Clients’ long-term objectives. Certain types of salary deferral arrangements can be great from a long-term growth standpoint. Even if tax rates might be lower today than in the future, it can still make sense to defer.

- When they need money. It can make sense to create liquidity by paying taxes today and investing in a less restrictive access account. For instance, certain types of nonqualified deferred compensation programs might only allow access to the funds upon death, disability, or retirement. But a traditional taxable investment account allows access at any point.

- The creditor or debtor protections that go along with the deferring income. For instance, 401(k)s offer strong creditor and bankruptcy protection features that taxable or other investments might not receive.

There are challenges in getting clients to want to pay taxes now instead of later. First, paying taxes can feel like a loss—you’re telling someone to pay money and take that emotional loss today for a future benefit. This can be a behavioral and emotional challenge. Second, many tax planning decisions are based on the current laws and tax rates, which can change in the future. As such, we can make educated decisions about the impact, but we cannot be fully sure of the long-term outcomes.

Another challenge in tax planning is that clients misunderstand how income taxes work. Some think that you pay taxes on all the income at the tax rate under which they fall—so they think that if they make $50,000 in 2022, they’re paying 12 percent on all of it, if they make $350,000 in 2022, they pay 32 percent on all of it, and if they make $650,000 in 2022, they pay 37 percent on all of it.

In reality, when clients get that first $20,000, they’re paying 10 percent on that in 2022, then when they get to $50,000 you are paying 10 percent on the first $20,550 and 12 percent on the remaining $29,450. Taxes are incrementally layered in as income goes up. We don’t apply that 37 percent downward on the entire amount of income; we’re only applying it on those dollars we earn over $647,850 in 2022 for married filing jointly.

Let’s look at an example using only federal tax rates. If your client had $500,000 in income (which puts them in the 35 percent tax bracket), they’ll pay 10 percent on the first $20,550 ($2,055); 12 percent on $62,999 ($7,559.88); 22 percent on $94,599 ($20,811.78); 24 percent on $161,949 ($38,867.76); 32 percent on $91,799 ($29,375.68); and 35 percent on $68,099 ($23,834.65). This example would have a total tax liability of $122,504.75, which is a 24.5 percent effective tax rate.

This example doesn’t account for itemized deductions, exclusions, capital gains, or the standard deduction. It also doesn’t include FICA or other potential federal taxes. However, it’s vastly lower than one might first gauge when thinking the $500,000 income range falls into the 35 percent tax rate bracket.

While there are many types of deductions that can bring down one’s taxes, the standard deduction is the most common. For single or married filing separately, the standard deduction in 2022 is $12,950; for married filing jointly and surviving spouses, it’s $25,900; for heads of household, it’s $19,400; and anyone age 65 or older or anyone legally blind gets an additional $1,750 for single filers and $1,400 for married filing jointly filers. So if your client and their spouse are both legally blind, they get an additional $2,800 deduction added to their standard deduction of $25,900.

Since the standard deduction nearly doubled with the TCJA, it changed the landscape of tax filing. Not as many clients itemize—less than 10 percent of filers itemize currently. While itemizing is important, clients have to have enough itemized deductions to pass over that standard deduction threshold in order to benefit from itemizing.

Let’s take that same example of the client with $500,000 in income. That’s the total household income for them and their spouse and they’re filing jointly. They’re both age 65 with a $28,700 standard deduction, making their taxable income $471,300.

Now they’ll pay 10 percent on the first $20,500 ($2,055); 12 percent on $62,999 ($7,559.88); 22 percent on $94,599 ($20,811.78); 24 percent on $161,949 ($38,867.76); 32 percent on $91,799 ($29,375.68); and 35 percent on $471,300 ($13,789.65). This makes for a total tax liability of $112,459.75, which is a 22.5 percent effective tax rate. This is about $10,000 less in taxes because of the standard deduction. The standard deduction is primarily bringing down taxes at that 35 percent range because we have a progressive graduated tax system and we had less taxable income to start with after the standard deduction.

There are other considerations, of course, like state taxes, other deductions, and FICA taxes. But the point is that together with your clients, you can do some planning and bring their taxes down. A simple tax analysis exercise can help clients see where their income is going, align their goals, and uncover where their assets are held and a variety of tax planning opportunities.

Other Tax Issues to Consider

We’re going to look at four areas that are important in planning for retirement taxes.

Tax diversification. I usually use a three-bucket approach here: taxable money (example, investing in the stock market), tax-deferred money (example, money in a 401(k)), and tax-free assets (examples are certain types of life insurance, health spending accounts, or Roth accounts).

Tax diversification can mean different things to different people, but I look at it as a way to reduce the risk of any one of these tax buckets being changed by public policy in the future. It doesn’t remove tax policy risk, but it can mitigate some. For example, if clients put all their money in the tax-deferred bucket and the government raises taxes 30 percent in 10 years, that’s going to be painful for those clients at the time of distribution. But if you’re using a more diversified approach, perhaps separating some assets into tax-free Roth accounts, tax-deferred 401(k)s and IRAs, and putting some into after-tax but taxable accounts that get long-term capital gains treatment, you could minimize some of the impact of rising future tax rates.

Tax diversification is important because taxes will continue to change. In recent years we’ve had not just the TCJA, but the SECURE Act, the CARES Act, and most recently the SECURE Act 2.0. For instance, some benefits of tax-advantaged money in 401(k)s and IRAs were reduced by the SECURE Act’s shortened distribution periods for inherited accounts.

Roth conversions are important when it comes to tax diversification. Generally, Roth money goes in after-tax, gets tax-deferred growth, and clients can pull the money out tax-free if the account has been open five years and there’s a triggering event (death, disability, first-time home-buying expenses, or reaching age 59½). If someone’s tax-deferred bucket gets overfilled, a Roth conversion can be a way to rebalance across different accounts.

Explore Roth conversions in your clients’ low-tax years. Currently, Roth IRAs also don’t have RMDs once clients reach age 72, but will be subject to RMDs for inherited accounts.

Clients can also use a Roth account in a 401(k) or 403(b) plan to save. Some plans allow for in-plan conversions, but most will just allow you to contribute. So some clients should shift their savings from tax-deferred to a Roth account if they need tax diversification or if their current tax rate is very low.

One account that can be appealing from a tax-planning perspective is the health savings account (HSA). If clients want to use a high-deductible health plan, they can make tax-deductible contributions to HSAs, invest in a tax-deferred account, and still have funds come out tax-free in retirement to pay for medical expenses. They can also keep receipts of their medical expenses and take tax-free HSA distributions to pay for them years later. In retirement, HSAs can be used to cover out-of-pocket medical expenses or Medicare premiums. HSAs are among the top tax benefits, and they’re still underutilized.

Social Security taxes. There are two important aspects of Social Security when it comes to taxes. First, Social Security is paid for and funded by a payroll tax (FICA and SECA taxes). Second, Social Security benefits in retirement can be subject to income taxes. About 40 percent of people who receive Social Security benefits will have to pay income taxes on them.

For single individual filers with above $35,000 of provisional income and married filing jointly clients with provisional income of $44,000 (provisional income is modified adjusted gross income plus tax-exempt interest plus half of Social Security benefits), up to 85 percent of their benefits will be subject to tax. Keep in mind that this is not their tax rate, but how much of their benefits that would be subject to tax.

If your clients claim Social Security benefits while they’re still working and under the full retirement age, they’ll be subject to the earnings limits. For example, if you have a 63-year-old client who’s still working, for every $2 they earn above $19,560, $1 of Social Security benefits is suspended. Say this client earns $29,560. Since they’re under the FRA, they’re entitled to $800 of benefits a month ($9,600 for the year). Their benefits would be reduced by $5,000 and they’d only receive $4,600 of their benefit that year.

This feels like a “tax” to some clients, but they’re just deferring those benefits. In the future, their benefits will be recalculated, and they’ll receive that $5,000 spread out over their future benefits.

Also note that clients’ RMDs can push them into a higher tax bracket and cause their Social Security benefits to be subject to taxation. We sometimes call this the Social Security tax torpedo—when one dollar of RMDs could force the RMD dollar to be taxed upon distribution and increase the amount of Social Security benefits subject to taxes, which brings us to the next point.

RMDs and forced taxation. Clients begin to lose control to some degree of their taxable income when RMDs begin at age 72. Clients must take money out of their tax-deferred accounts—401(k)s, pensions, and IRAs. Generally, the withdrawals are treated as ordinary income in retirement.

RMDs are determined once a client hits age 72 by dividing the account balance as of December 31 of the previous year by the life expectancy factor in the Uniform Lifetime Table for the age they turn in the current year. The tables were adjusted in 2022 to account for people living longer, so RMDs will get smaller now.

Here’s an example: your 75-year-old client has a $1 million IRA at the end of 2021. Her IRS factor is 24.6. Her RMD is $1 million / 24.6, which is $40,650, so she won’t be in a high tax bracket. But if she has a $5 million IRA, her RMD would be $203,252, which could potentially put her in the 32 percent tax bracket. Going back to our previous section, if she had a $2,000 a month Social Security, her total income is $64,650, so 85 percent of her benefits are taxable. This also illustrates the importance of tax diversification. If this client had assets in things other than the tax-deferred bucket, it wouldn’t feel so bad.

Medicare Surcharge or IRMAA. Two important things to know about the Medicare premium income-related monthly adjust amount (IRMAA) is that our Medicare premiums after age 65 are adjusted based on the income that clients had two years prior (2022 IRMAA will be based on 2020 income); and $1 over each threshold could move clients to the new premium, unlike our graduated federal income tax rate.

For example, if your clients (married filing jointly) make $175,000 in 2020. Their premiums would be $3,146.28 versus the $2,306.28 for married filing jointly clients who make $170,000 or below. Because they made $5,000 above the threshold, they’re paying nearly $2,000 more in Medicare premiums. Say another couple client made $214,014. That’s $14 over the range. This couple would pay $4,419.48, versus $3,146.28 if they made under $214,000.

Clients likely aren’t paying attention to this because the premiums don’t adjust for two years, so we need to pay attention for them. This can also impact other tax planning strategies we just discussed, like Roth conversions or RMDs. If clients convert more money after age 63, their Medicare premiums could increase if they jump over a threshold. As such, you need to be watching for those IRMAA ranges for any clients nearing 65 or later.

More Changes Coming

The SECURE Act 2.0 is likely coming. It passed the House Ways and Means Committee with unanimous support in early May, which likely means it will pass through the Senate. There are around 30 provisions that could impact retirement and tax planning. While that’s an article for another day, some things to pay attention to include:

- Mandatory automatic enrollment provisions for 401(k) and 403(b) accounts with escalation starting at 3 percent and scaling to 10 percent by 1 percent a year unless clients opt out.

- 403(b)s will be allowed in multiple employer plans.

- Creation of a national online database of lost retirement accounts.

- Removing the 25 percent cap on qualified longevity annuity contract.

- Moving the RMD age to 75, scaling up from 72 over a decade.

- Matching contributions to retirement accounts for student loan payments.

- Index the catch-up limit for qualified retirement accounts and IRAs.

- Increase the catch-up limit at ages 62–64 to $10,000 and up to $5,000 for SIMPLE plans.

- Allow small incentives (like a gift card) to enroll in a retirement plan.

Many of the provisions are geared to encourage clients to move to Roth accounts so that more tax revenue can be generated today. As such, the bill includes provisions that all catch-up contributions would be Roth contributions starting January 1, 2023; that employer matches cannot be Roth contributions; and allowing both SIMPLE and SEP IRAs to take on Roth account offerings.

This is a good bill for retirement, fixing a lot of small issues, but it will change how many things work.

In Sum

Tax planning is more than tax filing. And tax planning for and in retirement should always start with your clients’ goals. From there, you can determine what paths to take and what methods to implement. However, no matter what methods you use, tax diversification is critically important to minimize the risks clients face, as is keeping abreast of any policy changes that could impact your clients.

Tax planning is proactive. Be proactive with your clients’ tax planning today to ensure they have the happiest and most financially free retirement possible.

Endnote

- See Blanchett, David, and Paul Kaplan. 2013, August 28. “Alpha, Beta, and Now…Gamma.” Morningstar. www.morningstar.com/content/dam/marketing/shared/research/foundational/677796-AlphaBetaGamma.pdf.