Journal of Financial Planning: November 2023

By Alexandria Nadworny, CFP®, CTFA, and John W. Nadworny, CFP®

Alexandria Nadworny, CFP®, CTFA, and John Nadworny, CFP®, are wealth advisers at Sequoia Financial Group. The special needs planning team at Sequoia has worked with families with complex life situations for decades to provide options and strategies to plan for their needs and goals, and to provide a full life for their family member with special needs. John is a recognized thought leader in the field and co-author of the book The Special Needs Planning Guide: How to Prepare for Every Stage of Your Child’s Life (Brookes Publishing), now in its second edition. More information about the team and special needs planning may be found at www.specialneedsplanning.com.

NOTE: Click on the images below for PDF versions

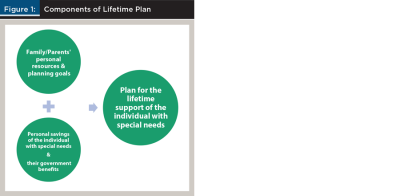

Financial planning for families of people with special needs is planning for the span of two generations; many individuals with disabilities will need support and assistance throughout and beyond their parents’ lifetimes. Depending on a family’s financial circumstances, the optimal planning process would integrate a family’s personal resources and planning goals with the personal savings of the individual with special needs and the government benefits for which they qualify. Even for families with significant wealth, maintaining an individual’s eligibility for certain government benefits is important as it may be very difficult to replicate the benefits of these programs using personal resources.

A key planning priority for all families to consider acting upon prior to their child legally reaching adulthood is to protect their eligibility for means-tested government benefits. Means-tested benefits, including Social Security income (SSI) and Medicaid, have limitations on eligibility based upon the income and assets of the individual.

An important action to protect eligibility is to maintain a minimal amount of savings, not to exceed $2,000, in the person with special needs’ name. It is important to check for balances in UGMA/UTMA accounts, gifts, savings bonds, inheritances, and the cash value of a life insurance policy with the individual named as the owner. A 529 (education savings) account owned by the parents with the child with a disability listed as beneficiary would not be a countable asset for the beneficiary.

Owning more than $2,000 will disqualify an individual from SSI and could impact their eligibility for Medicaid. SSI provides a person with a monthly income benefit. In most states, a person applying for SSI will automatically be enrolled in Medicaid. In addition to providing health insurance benefits, Medicaid is the major funding source of the various programs that support individuals with disabilities.

While maximizing and protecting government benefits is a key planning goal, it is equally important to recognize and understand the person’s abilities as well as their disability. If the individual can work, the income earned may reduce the level of their public support. However, having a plan that involves minimizing a person’s income may be counterproductive as the connections and contributions that employment provides help create a meaningful life as well as encouraging a person’s independence.

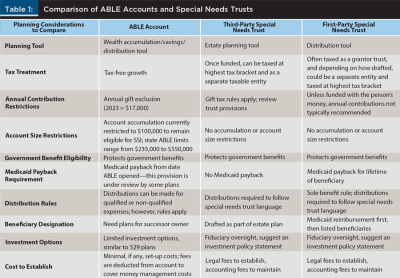

Special needs trusts (SNTs) and ABLE accounts are planning tools utilized to provide money for a person with special needs while also protecting their eligibility for government benefits. In most cases, an SNT is an estate planning tool, while the ABLE account is a wealth accumulation/savings tool. For high-net-worth families, the SNT may also be used as a lifetime gifting vehicle.

Special Needs Trust Basics

A special needs trust is a legal document and is a critical part of estate planning for families of people with special needs. An SNT is not intended to pay for the basic costs of living such as rent or utilities if the beneficiary receives means-tested government benefits. Special needs trusts may instead be used for expenses public benefits do not pay for, such as vacations, pets, home furnishings, assistive technology, and therapies not covered by Medicaid. There is no limit to the amount of money that can be in an SNT.

Third-Party Special Needs Trusts

When estate planning is done properly and in advance, a third-party SNT, also known as a supplemental needs trust, may be created to receive funds from the estate of the grantor and others, usually family members and friends. This type of trust allows the individual with special needs to receive assets, does not interfere with their eligibility to receive means-tested federal government benefits, and avoids Medicaid payback. While establishing an SNT is important and avoids the potential for Medicaid payback, what is most important is how the trust is funded.

The primary beneficiary of the third-party SNT is the individual with a disability, and contingent beneficiaries, selected by the grantor, can be listed. If funded properly, the SNT will provide for the beneficiary’s future financial security, protect their eligibility for government benefits, and make additional money available to supplement their needs.

First-Party Special Needs Trusts

A first-party SNT is funded by the assets of the person with a disability. A first-party SNT is often required if planning is not done in advance and the person with special needs inherits assets or receives settlement funds. Creating and funding a first-party SNT will enable the person to retain eligibility for government benefits. In the case where the individual has lost benefits as a result of having more than $2,000 in assets, creating and funding a first-party SNT will allow them to regain eligibility for benefits one month following the trust’s funding. The primary beneficiary is the person with disabilities, however, at the beneficiary’s death, there is a Medicaid payback, and Medicaid is reimbursed for benefits received by the individual during their lifetime. If there is money remaining in the trust after the payback, it is distributed to the contingent beneficiaries.

ABLE Account Basics

ABLE accounts, also known as 529A accounts, are tax-advantaged savings accounts for individuals with disabilities. An ABLE account is owned by the beneficiary and, in addition to offering tax-free growth, is a useful repository for their savings and gifts (limits apply) and a conduit to pay for qualified disability expenses (QDEs) to improve their health, independence, and/or quality of life. These QDEs include education, housing, utilities, transportation, employment training and support, assistive technology, personal support services, healthcare expenses, financial management, and administrative services.

There are eligibility requirements to be an ABLE account owner, including onset of disability prior to age 26, although this will be amended to age 46 in 2026. Anyone meeting this age requirement and qualifying for SSI and/or SSDI is eligible to open an account. In addition, there are other means of attaining eligibility, including receiving a letter of disability certification from a licensed physician. An individual may have only one ABLE account. There is also an annual contribution limit to the account that is limited to the annual gift exclusion amount ($17,000 for 2023), although there are exceptions for wage earners.

Like 529 plans, ABLE plans are created and administered by state agencies. For additional details about the account and to learn about different state plans, visit the ABLE National Resource Center at www.ablenrc.org/.

ABLE Accounts and SNTs—Not Exactly Apples to Apples

As detailed above, the ABLE and the SNT may both serve the purpose of protecting eligibility for government benefits but are very different planning tools. That said, the side-by-side comparison in Table 1 may help planners establish the appropriate strategy for a family’s specific circumstances.

Case Study: Planning for Sara

Below is an advanced case study illustrating the use of UTMA, first-party and third-party SNTs, the ABLE account, and an ILIT in special needs planning.

Sara is a young girl who is beloved by her generous family. From birth and throughout her childhood, she received gifts from her grandparents deposited into an UTMA. As Sara approached age 12, her UTMA had accumulated $200,000; however, her grandparents now had knowledge and an understanding of her diagnosis and a change in gifting strategy was required. When Sara turned 12, it became clear that she was not going to be gainfully employed and would have access to Medicaid programs, as well as an SSI benefit, when she turned 18. Instead of continuing to fund the UTMA, the grandparents began funding an ABLE account.

When she turned 18, her grandparents created a first-party special needs trust and funded it using the UTMA funds. A first-party SNT was created because when Sara reached adulthood, the money in the UTMA would be re-registered to her name and make her ineligible for SSI and Medicaid.

At the age of 18, Sara was found eligible for SSI. Sara’s parents’ long-term plan was to buy a condominium for her to live in, and Sara also applied for a Section 8 rental voucher. After age 18, her grandparents stopped adding to the ABLE account but began transferring $17,000 per year from the first-party SNT to her ABLE account until the ABLE account balance reached $100,000.

While living in her family home, Sara paid her share of household expenses using her SSI income and a monthly distribution from her ABLE. Using the additional funds from the ABLE enabled Sara to receive the full SSI benefit and avoid the one-third in-kind support and maintenance reduction that would have occurred had she utilized the SSI income alone.

When Sara turned 28, she received the Section 8 rental voucher. Her parents bought a condominium and received an exception under the Section 8 voucher rules allowing them to rent the condominium to Sara and receive the Section 8 payment. They used the money in Sara’s ABLE account to pay for the utilities and other expenses related to the condo. As the balance in the ABLE account was reduced, contributions to the ABLE from the first-party SNT resumed, although the ABLE balance was kept below the $100,000 limit. Note: Housing expenses from an ABLE account need to be distributed in the same month the housing expense is charged.

Sara’s other set of loving and generous grandparents initiated a gifting strategy of their own. They began gifting to an irrevocable life insurance trust (ILIT) to pay the premiums for a survivorship policy that will later fund a third-party SNT for Sara. Her parents were the insured, and the trust would be funded when the funds are needed the most—when Sara’s parents passed away. This asset was also removed from the parents’ and grandparents’ estates, making it a tax-efficient way to plan for the next generation.

Sara’s parents had also done planning of their own and had created a third-party SNT as part of their estate plan, allowing Sara to inherit a portion of their estate when they pass away.

We would be remiss in not featuring, amongst the most important decisions in planning for Sara, the selection of a trustee and authorized signer on her ABLE account. While no one can replace a parent, it is suggested to identify a team of family, friends, and professionals to step in and carry on the roles and responsibilities that a parent has had during their child’s lifetime.

This material is for informational purposes only and is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy, or investment product. Diversification cannot assure profit or guarantee against loss. There is no guarantee that any investment will achieve its objectives, generate positive returns, or avoid losses. Sequoia Financial Advisors, LLC, DBA Special Needs Financial Planning makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties. Certain assumptions may have been made by these sources in compiling such information, and changes to assumptions may have material impact on the information presented in these materials. Sequoia Financial Advisors, LLC, DBA Special Needs Financial Planning does not provide tax or legal advice. Investment advisory services offered by Sequoia Financial Advisors, LLC, DBA Special Needs Financial Planning. Registration as an investment adviser does not imply a certain level of skill or training.

Prior to investing in an ABLE account, investors should consider whether the investor’s or designated beneficiary’s home state offers any state tax or other benefits that are only available for investments in such state’s ABLE program. Please consult with your tax adviser before investing.

SIDEBAR:

Planning Scenarios Utilizing the ABLE Account

1. A parent wants to have a dedicated savings account for their child with a disability.

Planning action: Open an ABLE account and fund the account with up to $17,000 per year. The annual maximum contribution is indexed to the annual exclusion.

2. A child with a disability receives a gift from friends and relatives. Planning action: Open an ABLE account, making sure that the cumulative deposits per year do not exceed the annual exclusion.

3. An individual with disabilities earns income that would result in savings in excess of $2,000.

Planning action: Open an ABLE account and transfer the earnings to the ABLE. If the owner has additional savings, they may add an additional amount up to the annual gift exclusion.

4. A grandparent wants to include a grandchild in an annual gifting program. Planning action: Open and fund an ABLE account each year up until the annual exclusion.

5. A parent has funded their child’s UTMA account, and the individual reaches adulthood. Planning action: Open an ABLE account and transfer the funds (up to $17,000 in 2023) into the ABLE account. Note: Funds in a UTMA account will not disqualify a child from government benefits until they reach adulthood. In most states this is age 21, but check specific state regulations.

6. A client’s son with a disability turns 21 on December 1, and the parent has $33,000 in an UTMA account. This will disqualify him for any means-tested government benefits.

Planning action: Open an ABLE account prior to December 31 and fund the account with $17,000 (the 2023 annual gift exclusion). On January 1, 2024, fund the ABLE account with the remaining balance of $16,000 in the UTMA account. ABLE account contributions are counted by calendar year while government benefits are assessed on a 12-month eligibility basis.

7. A person with a disability is the beneficiary of a funded 529 plan. Planning action: Each year, an amount up to the annual gift exclusion may be transferred from the 529 to an ABLE account. Open an ABLE account and request the form used to transfer funds from a 529 to an ABLE from the ABLE plan administrator. The plan administrator can also tell you whether the rolling over of funds is counted on a calendar year or a rolling 12-month basis. The accounts must have the same beneficiary, or the beneficiary of the 529 plan may be a family member of the beneficiary of the ABLE.