Journal of Financial Planning: May 2022

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

NOTE: Please click on the below image for a PDF version.

Many clients are escaping the volatility of the securities markets by investing in alternative investments such as real estate. They avoid the cost of property managers by marketing single-family homes and separate living units in their own homes on Airbnb and Vrbo.

For clients using these approaches with their rentals, the IRS Chief Counsel’s office recently issued Chief Counsel Advice (CCA) 202151005 providing guidance concerning rental income and the self-employment tax. CCAs do not carry the same weight as the Internal Revenue Code, regulations, and court decisions as they do not have precedential value but, similar to a private letter ruling, they do reflect the IRS’s perspective on a given issue.

The CCA addressed two issues. First, the IRS examined whether the characterization of an activity as a “rental activity” under the passive loss rules determines whether the activity is “rentals from real estate” excluded from net earnings from self-employment for self-employment tax purposes. Second, the IRS explored when, in situations not involving a real estate dealer, rentals of living quarters are considered “rentals from real estate” excluded from the self-employment tax.

Self-Employment Tax Applicable Law

The CCA notes that IRC Section 1402(b) defines self-employment income by reference to net earnings from self-employment, with certain modifications. The term “net earnings from self-employment” means the gross income derived by individuals from any trade or business they carry on, less the deductions that are attributable to such trade or business.

However, rentals from real estate, together with deductions properly deductible and attributable to the rentals from real estate (“net rental income”), are excluded from the calculation of self-employment tax, unless these amounts are received in the course of a trade or business as a real estate dealer.

IRS regulations provide that rental income from living quarters, where no services are rendered for the occupants, are generally considered rentals from real estate. However, payments for the use or occupancy of rooms or other space where services are also rendered to the occupant are included in determining net earnings from self-employment. Generally, services are considered rendered to the occupant if they are primarily for the occupants’ convenience and are other than those usually or customarily rendered in connection with the rental of rooms for occupancy.

In Rev. Rul. 57-108, the IRS ruled that a landlord who rented furnished vacation beach dwellings and rendered services “for the comfort and convenience of his guests in connection with their recreational activities”—including maid services, swimming and fishing instructions, mail delivery, furnishing of bus schedules, and information about local churches—rendered services primarily for the occupants’ convenience. Consequently, the net rental income from the vacation beach dwellings was subject to self-employment tax.

In Bobo v. Commissioner (TC, 1978; acq. 1983-2 C.B. 4), the Tax Court considered a mobile home park that provided leased trailer park units with utility hookups, sewage facilities, and laundry facilities. Even though the trailer park furnished laundry services that were “clearly rendered for the convenience of the tenant and not to maintain the property in a condition for occupancy,” the tenants’ payments for the laundry services were not “substantial enough to classify all the tenants’ [rental] payments as received for services to the occupants.” The Tax Court held that the net rental income from the rental of the trailer park units was not subject to self-employment tax.

Note: both Rev. Rul. 57-108 and the Bobo case were decided before the 1986 legislative enactment of the passive loss rules.

Situation 1: Online Vacation Home Rentals

The CCA then applied the applicable law to two fact situations. In the first situation, the taxpayer is an individual who owns and rents in the course of a trade or business (but not as a real estate dealer) a fully furnished vacation property via an online rental marketplace, similar to Airbnb or Vrbo. The taxpayer provides linens, kitchen utensils, and all other items to make the vacation property fully habitable for each occupant. In addition, the taxpayer provides daily maid services, including delivery of toiletries and other sundries, access to dedicated Wi-Fi service for the rental property, access to beach and other recreational equipment for use during the stay, and prepaid vouchers for ride-share services between the rental property and the nearest business district. For the year at issue, the activity is not a passive activity because the average period of customer use of the vacation property is seven days or less, and the taxpayer materially participates in the activity.

The IRS Holding in Situation 1. The net rental income in Situation 1 is not excluded from the self-employment tax because the taxpayer provides substantial services beyond those required to maintain the space in a condition suitable for occupancy, similar to the taxpayer in Bobo. The services go beyond those clearly required to maintain the space in a condition for occupancy and are of such a substantial nature that the compensation for these services can be said to constitute a material portion of the rent.

Note: significantly, the CCA stated that the characterization of this activity as not a passive activity does not affect whether the activity is excluded from the self-employment tax, implying that if the rental activity had been a passive activity, the rental income would still be subject to the self-employment tax.

Situation 2: Rental of a Room and Bathroom

In the second situation, the taxpayer is an individual who owns and rents, in the course of a trade or business, a fully furnished room and bathroom in a dwelling via an online rental marketplace. The taxpayer is not a real estate dealer. The occupants only have access to the common areas of the home to enter and exit the room and bathroom and have no access to other common areas such as the kitchen and laundry room. The taxpayer cleans the room and bathroom in between each occupant’s stay. Again, the activity is not a passive activity because the average period of customer use of the vacation property is seven days or less, and the taxpayer materially participates in the activity.

The IRS Holding in Situation 2. The net rental income from the second situation is not subject to the self-employment tax because the taxpayer does not provide substantial services beyond those required to maintain the space in a condition suitable for occupancy. Services the taxpayer provides to clean and maintain the property to bring it to a suitable condition for occupancy are not relevant because such services are not furnished primarily for the convenience of the property’s occupants. Specifically, the services provided for the convenience of the occupants must be of such a substantial nature that compensation for them can be said to constitute a material part of the payments made by the occupants. Here, the additional services were not so substantial as to constitute a material part of the payments. The CCA then again states that the characterization of this activity as not a passive activity does not affect whether the activity is excluded from the self-employment tax.

Three Key IRS Points

- Whether real estate rental income is subject to the self-employment tax depends on:

a. The extent of services provided by the landlord for the convenience of the occupants; and

b. Whether the services provided are so substantial that they constitute a material part of the rental payments. - The self-employment tax can apply whether or not the rental activity is a passive activity or the individual is a real estate dealer.

- Losses that are limited by the passive activity loss rules do not offset the rental income from other rental activities that produce positive earnings subject to the self-employment tax.

The Bigger Picture—Qualified Business Income

The IRS’s stance in this CCA may relate to the qualified business income deduction. Two years ago, in IRS Notice 2019-7 and Rev. Proc. 2019-38, the IRS created a safe harbor allowing taxpayers with rental activities to qualify for the 20 percent qualified business income (QBI) tax deduction. Under the safe harbor, a “rental real estate enterprise” is treated as a trade or business for purposes of IRC Section 199A if at least 250 hours of services are performed each tax year with respect to the enterprise. Hours include services performed by owners, employees, and independent contractors; and time spent on maintenance, repairs, rent collection, payment of expenses, provision of services to tenants, and efforts to rent the property. However, hours spent in the owner’s capacity as an investor, such as arranging financing, procuring property, reviewing financial statements or reports on operations, and traveling to and from the real estate, are not considered hours of service for the enterprise.

The safe harbor requires that separate books and records be maintained for the rental real estate enterprise. Also, property leased under a triple net lease or used by the taxpayer for a significant portion of the year as a residence under the vacation home rules would not be eligible for the safe harbor.

It is likely many taxpayers expanded their services to qualify for the QBI deduction. For rental properties producing net rental income, the IRS seems to be connecting the two concepts. If landlords are offsetting the taxation of rental income with the QBI deduction by offering expanded services, the IRS feels justified in assessing the self-employment tax on the rental income.

Clients Need to Do the Math

As clients evaluate the extent of services to provide to their tenants, they need to consider whether they want to have the rental income qualify for the QBI deduction and possibly risk being subject to the self-employment (SE) tax.

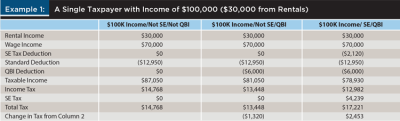

The taxpayer in Example 1 has $70,000 of wage income and is in the 22 percent federal marginal income tax bracket. Column 2 shows the base-situation tax owed if the QBI deduction is not claimed and the rental income is not subject to the SE tax. The tax liability is $14,768. If the 20 percent QBI deduction of $6,000 (20 percent × $30,000 of rental income) is claimed, Column 3 shows a tax saving of $1,320 (22 percent × $6,000). However, if the rental income is subject to the 15.3 percent SE tax and the QBI deduction is claimed, Column 4 shows a $2,453 increase in tax. This taxpayer may want to re-evaluate the level of services offered to the tenants in order to avoid the SE tax.

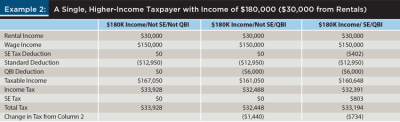

The taxpayer in Example 2 has $150,000 of wage income and is in the 24 percent federal marginal income tax bracket. This level of income is above the FICA cap of $147,000, meaning the SE tax rate is only 2.9 percent for the Medicare portion of the SE tax. This level of income also keeps the taxable income below the $170,050 ($340,100 for married couples filing jointly) phaseout of the QBI deduction. Column 2 shows the base-situation tax of $33,928 owed if the QBI deduction is not claimed and the rental income is not subject to the SE tax. If the QBI deduction of $6,000 (20 percent × $30,000 of rental income) is claimed, Column 3 shows a tax saving of $1,440 (24 percent × $6,000). However, if the rental income is subject to the SE tax and the QBI deduction is claimed, Column 4 shows a $734 decrease in tax, not an increase as we saw in the first example. In other words, higher-income taxpayers do not need to be as concerned about the SE tax because they are above the FICA cap and are only subject to a 2.9 percent tax rate.

With the issuance of CCA 202151005, the IRS appears to be laying the groundwork for assessments of SE tax on rental income. We need to contact our clients with rental income and discuss with them the risks of providing services to tenants and how to structure their rental activities to avoid the imposition of this additional tax.