Journal of Financial Planning: May 2023

Randy Gardner, J.D., L.L.M., CFP®, CPA, RLP, AEP (Distinguished), is the founder of Goals Gap Planning LLC.

Julie Welch, CFP®, CPA/PFS, AEP (Distinguished), is the managing shareholder of Meara Welch Browne, P.C., an accounting firm in the Kansas City, Missouri, area.

Randy and Julie just released the 2023 version of 101 Tax Saving Ideas (Eleventh Edition).

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

NOTE: Please click on the image below for a PDF version.

President Joe Biden promotes his economic policies by saying they favor small business. In particular, he points to the infrastructure bill, the Inflation Reduction Act, and the SECURE 2.0 Act as expanding government spending on projects that small businesses perform, increasing jobs, and cutting costs for the working class. Some of the provisions, as well as provisions in other tax legislation, are in the form of positive and negative tax changes that we can bring to the attention of our clients. Unless otherwise stated, these changes are effective in 2023.

Positives for Small Businesses

The Inflation Reduction Act’s Research and Development Payroll Tax Offset

Many businesses do not generate revenue until years after the start of the development of a product or service. Business expenses generally are not deductible until the first dollar of revenue is received. The exception to this rule was research and development (R&D) expenses but, starting in 2022 based on a change in the Tax Cuts and Jobs Act (TCJA), firms that invest in R&D will no longer be able to currently deduct their R&D expenses. While this is a negative, these businesses may still amortize their costs over five years (15 years for work conducted outside of the United States).

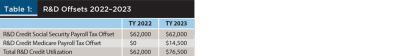

Under the Inflation Reduction Act, a qualified small business (QSB) may still obtain a tax benefit by claiming an R&D credit offset of payroll tax liability. A QSB is defined as a trade or business that: (1) is no more than five years past the period for which it had no gross receipts; and (2) has gross receipts for the election year of less than $5 million. Starting in 2023, a QSB’s payroll tax offset can be up to $2.5 million over five years, and the QSB can apply the credit against a QSB’s liability for the employer portion of Social Security tax (up to $250,000) and Medicare tax (up to $250,000). Prior to 2023, the credit applied only to the Social Security portion of the payroll taxes.

For example, a startup business with an R&D credit that pays $62,000 of employer Social Security taxes and $14,500 of employer Medicare taxes would be able to use the R&D credit to offset $62,000 of the employer Social Security taxes in 2022, and $76,500 of the employer Social Security and Medicare taxes in 2023. This benefit was originally added to allow startup businesses performing R&D to be able to get a current benefit rather than waiting until the business had taxable income and income tax to be able to utilize the credit.

SECURE 2.0 Act Retirement Plan Changes

The SECURE 2.0 Act includes many provisions impacting small businesses.

SIMPLE and SEP Roth IRAs. One of the most helpful changes is allowing small businesses to offer Roth simplified employee pension (SEP) plans and Roth SIMPLE plan contributions. Financial advisers often recommend to their clients that they fund three buckets: an already taxed brokerage account, a tax-deferred retirement account, and a nontaxable retirement account, such as a Roth account. Many small business owners earned too much income to make Roth IRA contributions, or the $6,500 limitation was not enough to fill the bucket as desired. Large businesses offer qualified plans, such as 401(k) plans and Roth 401(k) plans, that allow their employees to fill the third bucket. Now small businesses can also offer their employees the ability to do so with Roth SEPs and Roth SIMPLEs.

Contribution limit for SIMPLE plans. A SIMPLE IRA plan may only be sponsored by a small employer (100 or fewer employees), and the employer is required to either make matching contributions on the first 3 percent of compensation deferred or an employer contribution of 2 percent of compensation (regardless of whether the employee elects to make contributions). Under current law, the annual contribution limit for employee elective deferral contributions to a SIMPLE IRA plan is $15,500 (2023) and the catch-up contribution limit beginning at age 50 is $3,500.

Starting in 2024, the annual deferral limit and the catch-up contribution amount at age 50 are increased by 10 percent for employers with no more than 25 employees. Based on the 2023 limitations, this 10 percent increase would increase the limits to $18,150 for employee elective deferrals and $3,850 for catch-up contributions. Note that the actual amounts for 2024 will be based on the 2024 limits. Employers with 26 to 100 employees are permitted to provide higher deferral limits, but only if the employer either provides a 4 percent matching contribution or a 3 percent employer contribution. These changes also apply to SIMPLE 401(k) plans. This change allows employees of these companies to defer more of their compensation into their retirement plan.

Additional nonelective contributions to SIMPLE plans. Current law requires employers with SIMPLE plans to make employer contributions to employees of either 2 percent of compensation or 3 percent of employee elective deferral contributions. Starting in 2024, employers may make additional contributions to each employee of the plan in a uniform manner, provided that the contribution may not exceed the lesser of up to 10 percent of compensation or $5,000 (indexed). This change allows employers of these companies to contribute more to the retirement plan accounts for their employees.

Higher catch-up limit to apply at age 60, 61, 62, and 63. Starting in 2025, SIMPLE plan catch-up contributions limits are increased to the greater of $5,000 or 150 percent of the “standard” catch-up amount in 2025 for individuals who have attained ages 60, 61, 62, and 63. If the standard catch-up amount for 2025 was $3,500, it would be $5,250 (150 percent of $3,500) (indexed for inflation). The increased amounts are indexed for inflation starting in 2026.

Although these changes to SIMPLE plans do not increase the deferral and matching opportunities to the levels of 401(k) plans, they offer small business employees the opportunity to save more, especially as they near retirement, than they can under current law without the employer having to adopt a more administratively burdensome plan.

Tax treatment of certain nontrade or business SEP contributions. Household workers, such as nannies, housekeepers, and groundskeepers, are employees like those at small businesses. They often do not work for agencies and do not have access to a retirement plan. The employers of household workers can now offer SEP plans to their household workers.

Starter 401(k) plans for employers with no retirement plan. Beginning in 2024, employers who do not already offer retirement plans will be permitted to offer a starter 401(k) plan or safe harbor 403(b) plan to employees who meet age and service requirements. The limit on annual deferrals will be the same as the IRA contribution limit, and employers may not make matching or nonelective contributions to starter plans. By not requiring employers to match contributions, small businesses can offer a retirement plan to their employees without excessive costs.

Small immediate financial incentives for contributing to a plan. Another provision in the Secure 2.0 Act is that businesses can offer immediate financial incentives, such as low-dollar gift cards, not paid for with plan assets, to encourage employees to make elective deferrals to retirement plans. This change is beneficial because it might generate more participation from employees, allowing owners to increase elective deferrals for themselves.

Retroactive first-year elective deferrals for sole proprietors. For single-owner small businesses, new solo 401(k) plans can receive employee contributions up to the due date of the tax return for the initial year. It allows for “after the fact” planning. Now you can set up a new solo 401(k) plan and fund it with both a profit-sharing contribution and a 401(k) deferral after the end of the year but before you file your tax return, including extensions.

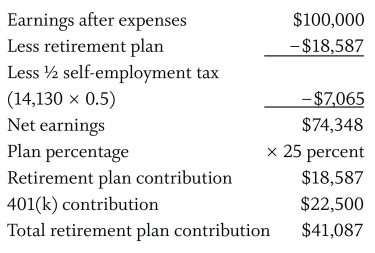

For example, in 2023, you make $100,000 after expenses from your business. Your self-employment tax on this income is $14,130 (($100,000 × 0.9235) × 0.153)). With a solo 401(k) plan, you can contribute and deduct $39,087, which you compute as follows:

If you are age 50 or older, the 401(k) contribution can be increased by the $7,500 catch up contribution, making the total retirement plan contribution in the above example $48,587 ($41,087 + 7,500), almost one-half of the $100,000 of earnings!

Military spouse retirement plan eligibility credit for small employers. Military spouses often do not remain employed long enough to become eligible for their employer’s retirement plan or to vest in employer contributions. Small employers (with no more than 100 employees) can claim a tax credit with respect to their defined contribution plans if they:

- Make military spouses immediately eligible for plan participation within two months of hire;

- Upon plan eligibility, make the military spouse eligible for any matching or nonelective contribution that they would have been eligible for otherwise at 2 years of service; and

- Make the military spouse 100 percent immediately vested in all employer contributions.

The tax credit equals the sum of (1) $200 per military spouse, and (2) 100 percent of all employer contributions (up to $300) made on behalf of the military spouse, for a maximum tax credit of $500.

This credit applies for three years with respect to each military spouse—and it does not apply to highly compensated employees. Thus, if the military spouse is more than a 5 percent owner (including constructive ownership) of the employer or earns more than $150,000, the credit is not available. An employer may rely on an employee’s certification that such employee’s spouse is a member of the uniformed services.

Pooled employer plan and multiple employer plan modifications. A pooled employer plan (PEP) may designate a named fiduciary (other than an employer in the plan) to collect contributions to the plan. This fiduciary would be required to implement written contribution collection procedures that are reasonable, diligent, and systematic.

Multiple employer plans (MEPs) provide an opportunity for small employers to band together to obtain more favorable retirement plan investment results and more efficient and less expensive management services. These providers are relieved of the one-bad-apple rule so that the violations of one employer do not affect the tax treatment of employees of compliant employers.

Modification of credit for small employer pension plan startup costs. For those small businesses without current retirement plans in place, the SECURE 2.0 Act enhances the credit for starting an eligible retirement plan by extending the number of years the credit can be taken and increasing the credit to 100 percent (dropping to 75 percent in the third year, 50 percent in the fourth year, and 25 percent in the fifth year) of startup costs and employer contributions, with a maximum of $1,000 per employee, for employers with 50 or fewer employees. The credit is phased out for employers with between 51 and 100 employees. No credit is allowed for employer contributions for employees with wages over $100,000. This provides a financial incentive for small employers to establish retirement plans for their employees.

Expanding automatic enrollment in retirement plans. Looking ahead, for all new 401(k) and 403(b) retirement plans beginning after 2024 for large employers, employers will need to automatically enroll employees in the plans once they become eligible to participate at no less than 3 percent and no more than 10 percent of their salaries. The employee contribution amount is then increased by 1 percent every year thereafter (up to 10 percent but not more than 15 percent). Employees do have the option to opt out of automatic enrollment. However, small businesses are not subject to this rule. There is an exception for small businesses with 10 or fewer employees, businesses that have been in business for less than three years, church plans, and governmental plans.

Negatives for Small Businesses

Not all of the changes in recent legislation have been favorable.

Inflation Reduction Act Extends Excess Business Loss Limitations

One unfavorable change is the treatment of small business net operating losses. Before the TCJA, businesses could carry losses they incurred from their operations back to earlier years. The tax refunds from these carrybacks helped businesses survive the slow periods by providing much needed cash flow. The TCJA disallowed these carrybacks. The TCJA also imposed new limitations on losses that could be claimed in the current year that might previously have offset wage and investment income on the small business owner’s return. Although this excess business loss limitation was originally slated to begin in 2018, it was postponed to 2021 by the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). Part of the revenue raised by the Inflation Reduction Act resulted from the extension of this excess business loss limitations for two more years through 2028.

An excess business loss for the tax year is the excess of the taxpayer’s aggregate deductions attributable to the taxpayer’s trades or businesses, determined before this limit and any deduction allowable as a net operating loss or as a qualified business income deduction, over the sum of the taxpayer’s aggregate gross income or gain attributable to such trades or businesses, plus $578,000 for MFJ ($289,000 for all other filers).

For example, in 2023, Ann, a single taxpayer, incurs $500,000 of deductions from her sole proprietorship business in which she materially participates. Ann’s gross income from the business is $200,000. Ann has an excess business loss of $11,000 ($500,000 − ($200,000 + 289,000)). Ann treats the $11,000 excess business loss as part of her net operating loss carryforward in future years.

It is also important to note that while net operating loss carryforwards that arise after 2020 have an unlimited carryforward period, such post-2020 carryforwards are now only able to offset up to 80 percent of taxable income in a carryforward year. Thus, planning is necessary to analyze the impact this change has on the small business owner’s tax situation.

SECURE 2.0 Act Revenue-Raising Changes to Catch-Up Contributions

Under prior law, catch-up contributions to a qualified retirement plan could be made on a pre-tax or Roth basis (if permitted by the plan sponsor). Going forward, all catch-up contributions to qualified retirement plans are subject to Roth tax treatment, meaning the employee is denied a tax deferral for the contribution. Perhaps beneficial to small businesses and their employees, an exception is provided for employees with compensation of $145,000 or less (indexed).

In closing, recent tax legislation has impacted planning for small businesses and their owners. Some favorable changes in the retirement planning area encourage more businesses to institute retirement plans for their employees. However, some of the recent changes require additional planning to analyze the impact on the small business owner’s tax situation.