Journal of Financial Planning; November 2014

Terrance K. Martin Jr., Ph.D., is an assistant professor in the department of economics and finance at the University of Texas–Pan American.

Michael Finke, Ph.D., CFP®, is professor and director of retirement planning and living in the department of personal financial planning at Texas Tech University.

Executive Summary

- Although most Americans believe they are not saving enough for retirement, few are able to increase retirement saving on their own due to a lack of knowledge and inertia.

- The goal of this study is to evaluate and contrast retirement planning strategies and financial planner value in order to determine the impact on retirement wealth accumulation.

- This study creates four distinct household groups based on whether respondents report consulting a financial planner for retirement and/or estimating retirement income needs: comprehensive planner, planner, self-directed, and no plan.

- Using a quantile regression to estimate the marginal differences in accumulation at various levels of retirement savings, results show that estimating retirement needs and working with a planner increases retirement savings significantly more than the other strategies.

- Results provide evidence of the value of comprehensive financial planning over a self-directed retirement plan. Findings indicate that the use of a planner or adviser who does not create a retirement plan has little impact on accumulation within qualified accounts.

Consumption and savings decisions made in the earlier stages of the life cycle can have a disproportionately large impact on retirement preparedness. These saving decisions have had an even greater impact on U.S. household welfare over the last two decades, as the responsibility for funding retirement has shifted from employers to employees (Milevsky, Chen, and Zhu 2007). According to the Employee Benefit Research Institute (EBRI), only 38 percent of all private workers participate in employer sponsored defined contribution plans, and just 14 percent of Americans are confident in their ability to retire comfortably (Helman, Copeland, and VanDerhei 2012).

Greater employee responsibility for funding retirement means that individuals, rather than pension professionals, must estimate how much saving is needed to provide an adequate retirement income (Poterba, Rauh, Venti, and Wise 2007). A lack of financial knowledge and sophistication among many American workers may contribute to inefficient retirement savings (Lusardi and Mitchell 2009). Most American households cannot maintain a constant level of consumption in retirement with their current retirement savings (Bernheim 1993; Mitchell and Moore 1998; Yuh, Montalto, and Hanna 1998), and one-third of retirees obtain 90 percent of their income from Social Security, according to 2012 data from the Social Security Administration.

This shift in retirement funding responsibility, coupled with the complexity of the investment process, should increase demand for professional financial advice (Milevsky et al. 2007). Professional financial planners can help households accurately estimate the amount of retirement income needed to fund household retirement goals. Additionally, a financial planner can provide a financial plan that involves establishing the steps needed to meet a retirement goal and facilitate regular interaction to evaluate progress. A financial planner may also increase a worker’s awareness of the consequences of low savings, reduce the psychic costs of making complex choices, and help improve investment performance and tax efficiency within household portfolios.

However, little evidence exists in the current literature that the use of financial planners improves household financial outcomes. The metric most commonly used to assess adviser value is gross investment performance (Bergstresser, Chalmers, and Tufano 2009; Kramer 2012). Because markets are generally efficient and adviser channel funds have higher fees, previous research concluded that advice has little value (Bergstresser et al. 2009) or that advisers are merely “babysitters” whose inferior performance is tolerated by households who would rather not bother with caring for investments themselves (Hackethal, Haliassos, and Jappelli 2012). Few papers differentiate between advisers who do and do not provide comprehensive financial advising services, such as retirement planning, nor do they estimate welfare-enhancing services outside of generating risk-adjusted investment performance.

This paper contributes to the literature on the value of financial planners by evaluating the impact of retirement income planning advice on retirement saving. Both the 2004 and the 2008 waves of the National Longitudinal Survey of Youth (NLSY79) were used to estimate the total retirement savings and the change in accumulated retirement wealth between 2004 and 2008. We hypothesized that the process of estimating retirement income needs can motivate a household to save more, and that working with a planner can help a client formulate a more realistic estimate of how much they should save and help them maintain a saving plan that results in higher savings rates.

Retirement Saving and Wealth Accumulation

Retirement wealth accumulation is motivated by a household’s desire to smooth consumption beyond working years. Many are not successful, which leads to a welfare loss from reduced consumption in old age (Bernheim, Skinner, and Weinberg 2001). Bernheim (1993) concluded that actual savings rates are 9 percent to 19 percent lower annually than optimal for young households aged 35 to 45. Bernheim, Forni, Gokhale, and Kotlikoff (2000) found that the median household would need to increase their savings rate by as much as 20 percent to replace pre-retirement levels of consumption.

Employee participation in defined contribution plans in the U.S. is optional. Studies of employee participation in employer sponsored retirement plans show that many do not participate, that those who do participate often do so at a default savings rate that is too low, and that retirement saving decisions change little over time because of an unwillingness to actively change contribution rates (Choi, Laibson, and Madrian 2006).

Financial knowledge is critical to the process of accumulating retirement wealth (Jacobs-Lawson and Hershey 2005). The ability to make financial choices that are consistent with preferences is limited by someone’s ability to collect and process information (Simon 1955). Complex retirement decisions are a challenge for households that lack financial knowledge (Finke, Huston, and Winchester 2011). Lack of knowledge can also potentially result in a household’s decision to not participate in financial markets (Campbell 2006). Financial literacy surveys consistently show that most American workers do not have the investment knowledge to make effective retirement savings decisions (Lusardi and Mitchell 2009).

One problem with low financial literacy is that households may not possess the analytical tools needed to calculate how much they must save each month in order to meet retirement spending goals. The process of calculating retirement income needs often results in a realization that an individual has not been saving enough for retirement. This can change retirement saving behavior. A study of university employees found that a modest 10 percent increase in the likelihood of calculating retirement income need was related to $16,600 in additional retirement savings for respondents over 40 (Mayer, Zick, and Marsden 2011). A possible source of value provided by seeing a financial planner is to be led through the process of estimating the difference between current and optimal retirement saving behavior.

Professional Advice and Retirement

Households faced with the responsibility for funding their own retirement can choose to rent the services of a financial expert to help them make better choices. An expert, such as a financial planner, has invested in specific knowledge about financial products and theory they can draw from to help a client develop a plan to achieve retirement goals.

A financial planner who employs a comprehensive approach to financial planning may incorporate any one or more of the six main planning areas into an analysis: cash management, risk management, investments, retirement, tax planning, and estate planning (Warschauer 2008). As an example, a discussion on retirement planning typically includes an analysis of the assets needed to generate a sufficient income replacement, a recommended pre- and post-retirement portfolio, and a regular savings plan to meet the retirement accumulation goal.

Unfortunately, in the empirical literature on financial advice, there is little evidence that financial planners improve welfare outcomes. Using Dutch data, Kramer (2012) found no evidence that advised accounts achieve higher risk-adjusted returns than self-directed accounts. Broker-sold funds exhibit evidence of greater underperformance from return chasing and no superior market timing (Bergstresser et al. 2009). Dahlquist, Martinez, and Söderlind (2011) found that advised accounts offer, on average, lower net returns and inferior risk/return characteristics. Compensation incentives appear to drive much of the underperformance of advised accounts; as previously noted, there has been little effort to differentiate by adviser compensation and breadth of financial advice in the literature.

There is, however, some evidence showing households that use the services of comprehensive financial planners execute investment strategies that are more consistent with economic theory (Bodie and Crane 1997). These studies show evidence of improved investment performance (Hung and Yoong 2010). Professional advisers may also help reduce a client’s behavioral biases. Shapira and Venezia (2001) showed that professional financial advisers can reduce the tendency to hold losing investments while selling winners (the disposition effect). A comprehensive financial planner may also help clients focus on long-run goals by reducing short-term anxiety from market volatility (Engelmann, Capra, Noussair, and Berns 2009).

Two shortfalls of the existing empirical literature include the inability to distinguish between types of financial advisers and the use of investment alpha to quantify the value of advice. Professional financial planners improve retirement savings behavior by increasing a worker’s awareness of the consequences of low savings, by reducing search and psychic costs of making complex choices, and by improving investment performance and tax efficiency of household portfolios. Some advisers may provide comprehensive financial planning services that include a detailed retirement plan. Others may hold themselves out as advisers or planners, but provide advising services that are more limited in scope. This paper provides insights into differences between these two types of advisers.

Methods

Data. This study used data from the 2004 and 2008 administration of the National Longitudinal Survey of Youth (NLSY79). The survey, which began in 1979, consists of a random sample of 12,686 people and is representative of U.S. men and women who were born between 1957 and 1965. During the 2008 survey, respondents were between 45 and 52 years old. Annual interviews were conducted by phone or in-person and continued every second year from 1994 onward.

Sample. A special module on retirement appeared in the 2008 administration of the NLSY79. To obtain the final sample, the data was censored only to households that were asked whether they consulted a financial planner for retirement planning. This condition on the data reduced the sample size to 7,616 respondents. In a special module on retirement in the 2008 administration of the NLSY79, respondents were asked if they consulted a financial planner for retirement and if they had calculated their retirement wealth. These questions were used to create four different household groups based on retirement planning strategy. The first household group included respondents who answered “yes” to consulting a financial planner and “yes” to calculating retirement income need (comprehensive planner). The second group consisted of those households that only consulted a financial planner (planner only). The third group included households that only calculated a retirement need (self-directed), while the fourth group included households that answered no to both questions (no plan). Most respondents (5,296) had no retirement plan; 1,006 were self-directed; 478 used a planner but had no retirement plan; and 836 indicated that they consulted a planner and had a financial plan.

Empirical model: Accumulated retirement. Quantile regression (QR) was used to model accumulated retirement wealth and the change in accumulated retirement wealth between 2004 and 2008. QR allows users to estimate the ability of the model to predict retirement wealth within retirement wealth quantiles. This method is particularly appropriate for wealth values that are highly skewed and for which the relative impact of predictor variables may be inconsistent as wealth rises.

One potential criticism of the use of accumulated retirement wealth as an outcome variable is the possibility that financial planners target higher wealth clients after they have already become wealthy. This was potentiality addressed first by focusing on savings in sheltered retirement accounts, which are less likely to be affected by sudden exogenous increases in wealth, such as an inheritance. We also estimated the change in retirement wealth between 2004 and 2008 in order to measure active saving during this period.

Results

Descriptive statistics. Figure 1 illustrates the proportion of households following each retirement strategy within the sample. Table 1 compares mean retirement wealth of all households. The mean retirement wealth for all households was $103,978. Those who used a financial planner and had calculated retirement needs had more retirement savings than all other household groups.

The average retirement wealth of those who used a financial planner and had estimated retirement needs was $246,797, while those who used a planner but had not calculated retirement needs saved less than half that amount, or $112,668. Households who had estimated retirement needs but had not used a financial planner saved $163,659. Households with no retirement plan saved only $62,087.

Similar patterns were observed in the change (∆) in retirement wealth between 2004 and 2008. Households that used a planner and had calculated retirement needs saved $83,500 between 2004 and 2008, while those who used a planner but did not calculate retirement needs saved $14,851. This amount was 50 percent less than the households who had no retirement plan and did not use a financial planner ($28,448).

Table 1 also provides results for median retirement wealth and median change in retirement wealth. Median retirement wealth for all households was a mere $1,400 in 2008, with a median change of $0. Households who used a planner and calculated retirement needs had higher median retirement wealth changes compared to planner-only households ($77,568 to $30,000 respectively). At the median, planner households realized higher retirement wealth than self-directed households ($30,000 to $20,000, respectively). Only comprehensive planning households reported retirement wealth changes at the median ($12,000), while all other households report zero change at the median.

When average retirement wealth was examined by survey year (1994–2008), households with a comprehensive strategy to retirement planning consistently recorded higher mean values of accumulated retirement wealth. During the period 1994 through 2004, households using the planner strategy were a modest second; however, between 2004 and 2008 self-directed households showed a mean change of $77,597 in accumulated retirement wealth (see Figure 2).

A more complete list of frequency data is outlined in Table 2.

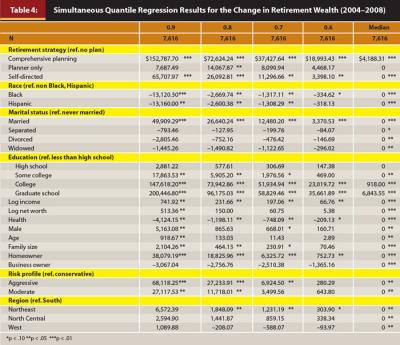

Multivariate analysis: Quantile regression models. Tables 3 and 4 provide quantile regression results showing estimates of the impact retirement planning strategies have on retirement wealth while controlling for differences in household characteristics such as income, education, and home ownership. Results can be interpreted as the impact of the predictor variable on retirement saving within each retirement wealth decile above the median.

Even after controlling for socioeconomic status, households that used a financial planner and calculated retirement needs had significantly higher retirement wealth accumulation across all quantiles relative to households with no plan. The marginal effect was higher than all other strategies. For example, within the 90th percentile of accumulated retirement wealth, households that had calculated retirement needs and used a planner saved $233,617 more in retirement wealth than households that did not have a plan. At the median, developing a strategy and having a planner resulted in $20,777 more retirement wealth relative to not having a plan. Those who estimated retirement savings needs without the help of a planner saved more than those with no plan, but less than if they had used a planner. Among self-directed households at the 80th percentile, accumulated retirement wealth was $41,449 more than households with no plan. In general, those who used a financial planner but had not calculated retirement needs saved less than those who did estimate retirement needs but did not use a planner.

Table 4 estimates changes in retirement wealth between 2004 and 2008. At the 90th percentile, households with a planner that estimated retirement needs accumulated $152,787 more than households with no plan. Compared to overall retirement saving, the use of a planner and estimating retirement needs had an even more dramatic impact on the change in retirement wealth between 2004 and 2008. At all levels of retirement wealth, the relative impact of using a comprehensive planner was much stronger than self-directed households. Similar to the results for total retirement savings, using a planner without estimating retirement needs had little impact on accumulation compared to having no retirement strategy at all.

Conclusions

Few academic studies estimate the value provided by a comprehensive financial planner. Using a special retirement module from a nationally representative longitudinal data set, we were able to differentiate between households who used a financial planner and did not estimate retirement needs from those who were more likely to have received a comprehensive plan that included a retirement needs calculation. We were also able to estimate the potential benefits of using a financial planner compared to a self-directed retirement planning strategy.

Results indicate consistent evidence that a retirement planning strategy and the use of a financial planner can have a sizeable impact on retirement savings. Those who had calculated retirement needs and used a financial planner (which likely captures those who used a comprehensive planner who follows a more thorough planning process that includes retirement needs assessment) generated more than 50 percent greater savings than those who estimated retirement needs on their own without the help of a planner. Those who relied on a planner whose advice was not comprehensive enough to include the estimation of retirement needs had half as much saved for retirement. In the multivariate analysis that controlled for the higher education and income of those who used a comprehensive planner, we still found a strong and consistent relation between a comprehensive planning strategy and higher retirement savings and change in retirement savings between 2004 and 2008. We also noted that those who used a non-comprehensive planner consistently saved less than those who estimated retirement savings needs on their own.

Prior research shows that the lack of sufficient retirement savings can negatively affect spending in retirement (Bernheim et al. 2001; Hamermesh 1985; Skinner 2007). The transition to defined contribution plans has transferred the financial responsibility of retirement funding and investment management to households. However, not all households possess the financial sophistication needed to efficiently plan for retirement. Financially unsophisticated households and households with other behavioral biases can benefit from the use of a financial intermediary such as a financial planner. Although there was little evidence in the prior literature that financial planners provide value, most prior studies focused on investment performance within accounts of clients who used broker services; we focused on retirement wealth accumulation.

Results from this study demonstrate the importance of differentiating between financial planners whose primary objective is to sell financial products versus financial planners who create a retirement plan by first quantifying retirement goals and objectives.

References

Bergstresser, Daniel, John Chalmers, and Peter Tufano. 2009. “Assessing the Costs and Benefits of Brokers in the Mutual Fund Industry.” Review of Financial Studies 22 (10): 4129–4156.

Bernheim, B. Douglas. 1993. The Merrill Lynch Baby Boom Retirement Index: Is the Baby Boom Generation Preparing Adequately for Retirement? Summary Report. New York: Merrill Lynch.

Bernheim, B. Douglas, Lorenzo Forni, Jagadeesh Gokhale, and Laurence J. Kotlikoff. 2000. “How Much Should Americans Be Saving for Retirement?” The American Economic Review 90 (2): 288–292.

Bernheim, B. Douglas, Jonathan Skinner, and Steven Weinberg. 2001. “What Accounts for the Variation in Retirement Wealth among U.S. Households?” The American Economic Review 91 (4): 832–857.

Bodie, Zvi, and Dwight B. Crane. 1997. “Personal Investing: Advice, Theory, and Evidence.” Financial Analysts Journal 53 (6): 13–23.

Campbell, John Y. 2006. “Household Finance.” The Journal of Finance 61 (4): 1553–1604.

Choi, James, David Laibson, and Brigitte Madrian. 2006. “Reducing the Complexity Costs of 401(k) Participation through Quick Enrollment.” National Bureau of Economic Research Working Paper No. w11979.

Dahlquist, Magnus, Jose Martinez, and Paul Söderlind. 2011. “Individual Investor Activity and Performance.” SSRN Paper 2018816.

Engelmann, Jan B., C. Monica Capra, Charles Noussair, and Gregory S. Berns. 2009. “Expert Financial Advice Neurobiologically ‘Offloads’ Financial Decision-Making under Risk.” PLOS One 4 (3): e4957.

Finke, Michael S., Sandra J. Huston, and Danielle D. Winchester. 2011. “Financial Advice: Who Pays.” Journal of Financial Counseling and Planning 22 (1): 18–26.

Hackethal, Andreas, Michael Haliassos, and Tullio Jappelli. 2012. “Financial Advisers: A Case of Babysitters?” Journal of Banking and Finance 36 (2): 509–524.

Hamermesh, Daniel S. 1985. “Expectations, Life Expectancy, and Economic Behavior.” The Quarterly Journal of Economics 100 (2): 389–408.

Helman, Ruth, Craig Copeland, and Jack VanDerhei. 2012. “The 2012 Retirement Confidence Survey: Job Insecurity, Debt Weigh on Retirement Confidence, Savings.” EBRI Issue Brief 369.

Hung, Angela, and Joanne Yoong. 2010. “Asking for Help: Survey and Experimental Evidence on Financial Advice and Behavior Change.” RAND Working Paper.

Jacobs-Lawson, Joy M., and Douglas A. Hershey. 2005. “Influence of Future Time Perspective, Financial Knowledge, and Financial Risk Tolerance on Retirement Saving Behaviors.” Financial Services Review 14 (4): 331–344.

Kramer, Marc M. 2012. “Financial Advice and Individual Investor Portfolio Performance.” Financial Management 41 (2): 395–428.

Lusardi, Annamaria, and Olivia S. Mitchell. 2009. “How Ordinary Consumers Make Complex Economic Decisions: Financial Literacy and Retirement Readiness.” National Bureau of Economic Research Working Paper No. w15350.

Mayer, Robert N., Cathleen D. Zick, and Mitchell Marsden. 2011. “Does Calculating Retirement Needs Boost Retirement Savings?” Journal of Consumer Affairs 45 (2): 175–200.

Milevsky, Moshe A., Peng Chen, and Kevin X. Zhu. 2007. Lifetime Financial Advice: Human Capital, Asset Allocation, and Insurance. Charlottesville, VA: Research Foundation of CFA Institute.

Mitchell, Olivia S., and James F. Moore. 1998. “Can Americans Afford to Retire? New Evidence on Retirement Saving Adequacy.” Journal of Risk and Insurance 65 (3): 371–400.

Poterba, James, Joshua Rauh, Steven Venti, and David Wise. 2007. “Defined Contribution Plans, Defined Benefit Plans, and the Accumulation of Retirement Wealth.” Journal of Public Economics 91 (10): 2062–2086.

Shapira, Zur, and Itzhak Venezia. 2001. “Patterns of Behavior of Professionally Managed and Independent Investors.” Journal of Banking and Finance 25 (8): 1573–1587.

Simon, Herbert A. 1955. “A Behavioral Model of Rational Choice.” The Quarterly Journal of Economics 69 (1): 99–118.

Skinner, Jonathan. 2007. “Are You Sure You’re Saving Enough for Retirement?” National Bureau of Economic Research Working Paper No. w12981.

Yuh, Yoonkyung, Catherine Phillips Montalto, and Sherman D. Hanna. 1998. “Are Americans Prepared for Retirement?” Financial Counseling and Planning 9 (1): 1–12.

Warschauer, Tom. 2008. “The Economic Benefits of Personal Financial Planning.” Financial Services Review 21 (3): 195–208.

Citation

Martin, Terrance, and Michael Finke. 2014. “A Comparison of Retirement Strategies and Financial Planner Value.” Journal of Financial Planning 27: (11) 46–53.