Journal of Financial Planning: September 2016

Matt Hougan is president of ETF.com, where he oversees the company’s editorial, data and analytics efforts, and conferences.

A lot of people have written off actively managed ETFs, and for good reason. Compared to the traditional world of mutual funds, actively managed ETFs are pathetic. While 78 percent of mutual fund assets are actively managed, that number is just over 1 percent for ETFs. One percent! Hardly worth mentioning.

And yet, something interesting is happening in the actively managed ETF world. Although they haven’t enjoyed widespread success, active ETFs are gaining traction on the edges. There are now almost 150 actively managed ETFs on the market, including 61 with more than $50 million in assets under management. That number is significant, because it’s broadly considered the level above which the long-term survival of an ETF is virtually guaranteed.

Studying where actively managed ETFs have succeeded is the best possible way to understand what active will look like in the future. ETFs operate in the market of the future—one where products are bought based on their merits and not based on aggressive sales efforts alone. ETFs are bought largely by advisers operating with a fiduciary duty, something more and more advisers and brokers will enjoy in the future.

As such, ETFs are a canary in the coal mine for the active fund industry. And that canary has a lot to say. Here are four insights to be gained from studying the growth of actively managed ETFs.

Active Is Best Received in Illiquid Markets

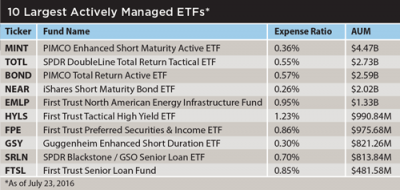

The first thing you learn about “the new active” is that most of the funds that are succeeding operate in illiquid markets. Consider the 10 largest actively managed ETFs on the market as of July 23, 2016 (see the table below).

The list is straight out of a trader’s nightmare. From high-yield bonds to senior loans and preferred securities, these ETFs operate in markets marked by large spreads, over-the-counter trading, and regulation-driven market distortions.

This makes sense. While we like to think that the chief way active managers make money is by selecting the best securities, one sure-fire way to create opportunities is simply to have access to securities and circumstances that other people don’t. PIMCO and DoubleLine, for instance, are so big and important in the fixed-income world that they often get first bite when large institutions or companies are looking to sell bonds. They can leverage that size to negotiate good deals.

If active management is supposed to work best in the least efficient markets, looking at illiquid corners of the securities world makes sense. It seems to be what’s resonating with investors.

Active Works Best in Specialist Areas

The data showing that the vast majority of active equity managers underperform the market is incontrovertible. Based on a 2015 study from S&P, more than 80 percent of large-cap equity managers trailed the market over the past 10 years; small-cap, mid-cap, and international equity managers did no better.

All of this helps explain why active managers have been hemorrhaging money from their core equity strategies. It’s extremely hard to generate alpha in those markets. Increasingly, people know that.

What the top 10 active ETF list shows is that the core is the wrong place for active managers to hunt. While actively managed core equity ETFs have languished, funds pecking around the edges have done well. MLPs, preferred, senior loans, convertibles—these are the hunting grounds for today’s active managers, and investors look keen to reward them for it.

Will satellite strategies replace the trillions of dollars active managers are losing from the core? Of course not. But active managers looking for a foothold in this new era should think about satellite exposures first.

Celebrity and Style Still Matter in Active

The SPDR DoubleLine Total Return Tactical ETF (TOTL) is perhaps the least surprising ETF on the top 10 list. Managed by the acclaimed bond guru Jeffrey Gundlach, TOTL brought the hottest manager in the world into the ETF space and—surprise, surprise—people bought it. The PIMCO Total Return Active ETF (BOND) has a similar heritage, having been originally managed by bond legend Bill Gross. Celebrity, brand, and excitement have always mattered in active funds; the success of these funds show they still matter in this new world.

The Future of Active Is in Asset Allocation

What’s not included on this list is the rest of the $2 trillion that is invested in ETFs. While most of that is invested in index funds, it would be a mistake to assume that all that money is John Bogle pure. An increasing share of that money is invested in smart beta strategies, active in passive closing. And more importantly, for better or worse, the lion’s share of the money invested by advisers in ETFs is invested in either strategic or tactical portfolios; in other words, it’s actively managed.

This is the real story behind actively managed ETFs. While managers used to hang their hats on picking securities, the people who are succeeding most in the ETF space are picking asset classes. This includes so-called “ETF strategists”—a $75 billion market made up of uber-advisers who create portfolios that other advisers can follow. It includes model creators at leading wirehouses, like Bank of America; Merrill Lynch’s Jon Maier, who has well more than $20 billion in assets tied to his strategies; and thousands of advisers from around the world who are managing their own portfolios with an active tilt.

Conclusion

It’s easy to ring the death knell for actively managed funds. From 2007 to 2015, index-based equity strategies pulled in $1.2 trillion in net new money while active funds saw $835 billion head for the doors. Without commission-driven sales to drive them, and with an increasing focus on fees, active strategies face a headwind.

But what active ETFs, and the active use of ETFs, show is that active management isn’t dead, it’s just different.

“Active management isn’t dead, it’s just different.”