Journal of Financial Planning: October 2019

David M. Cordell, Ph.D., CFA, CFP®, CLU®, is director of finance programs at the University of Texas at Dallas.

Jared Pickens, EdD., CFP®, AFC®, is an assistant professor of finance and the director of personal financial planning at Texas A&M University—Commerce.

Do you take education seriously? There is a high probability that, as a reader of the Journal, you are a CFP® professional, which requires a college degree and specialized training in financial planning. So, we’ll check that box. And you are reading this column, which means you are seeking knowledge. We’ll check that box, too. As a CFP® professional, you also complete a minimum of 30 hours of continuing education every two years, so we’ll check that box, too. Or maybe not.

The Emphasis Should Be on Education

Full disclosure: as two professors with doctorates and multiple certifications, we readily acknowledge we have a bias toward formal education. Both of us left the “real world” for academic careers where it’s all education, all the time, whether teaching, learning, or performing research.

The emphasis on education, and especially continuing education, in the financial planning profession isn’t limited to professors, though. FPA, the largest organization of financial planning practitioners with over 22,000 members, publishes this Journal, which includes scholarly articles each month in addition to columns like this one. The Journal includes articles that CFP® practitioners can utilize to satisfy CE requirements for CFP Board. The Journal also sponsors the Montgomery-Warschauer Award to honor the paper that provided the most outstanding contribution to the betterment of the profession in the preceding year.

Not coincidentally, leading practitioners in the financial planning community emphasize the importance of education as critical to professionalism. Earlier this year, the Journal (which is celebrating its 40th anniversary in 2019) published an article by editor Carly Schulaka titled “To Think, Feel, and Learn Like a CFP,” which included comments on several articles published between 1990 and 2011. This collection of articles is inspiring in many ways, and each article is worthy of the attention of anyone who wants to be worthy of the CFP® designation. Each article reinforces the concept of financial planning as a true profession rather than an after-thought job.

“To Think … Like a CFP,” written by the late Dick Wagner in 1990 is a classic. It is one of the most important guideposts in the relatively early development of financial planning into a true profession. According to Wagner, “We are entrusted with the responsibility to think…like a CFP. We must accept the challenge or lose the charter.”

Elissa Buie and Dave Yeske later argued in “Evidence-based Financial Planning: To Learn … Like a CFP” that, to become a truly learned profession, the financial planning community must mandate that CFP® practitioners dedicate a considerable amount of time to staying abreast of current developments. They suggested that it would be a challenge to accomplish this goal if completing merely 30 hours of continuing education every two years were considered sufficient.

CFP® professionals require a substantial investment in education, a rigorous examination, ethical requirements, and experience to obtain the certification. The barrier to entry is high, and rightfully so, given the responsibility to clients of all types. Given these standards and with regard to continuing education and being a learned profession, is the equivalent of a 15-hour-per-year requirement sufficient?

Continuing Education: Some Sample Requirements

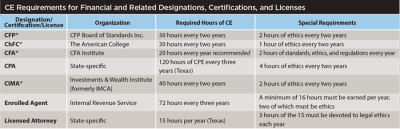

After a review of other professional designations and licenses related to financial services, we believe that the CE requirements for many financial designations, including the CFP® designation, are insufficient.

Perhaps surprising to some, CFA (Chartered Financial Analyst) Institute has no requirement for CE, although it recommends 20 hours per year and two hours of credit in “standards, ethics, and regulations.” Requirements for other financial and related designations and licenses are listed in the chart above. In addition to the number of hours required for continuing education, there are restrictions on the rules regarding obtaining CE credits, especially concerning ethics.

Should Continuing Education Be Required?

Should continuing education be a requirement for financial professionals? We will hedge a bit on the answer. Yes, CE should be a requirement, but no, it shouldn’t have to be a requirement.

Regardless of whatever the minimum required number of hours is, that number becomes the maximum for many practitioners. Too often, the requirement becomes a hurdle to be cleared, and once cleared, the value of ongoing CE is forgotten. Check it off the list. A graph of the frequency distribution of CE hours reported by CFP® practitioners would show that hardly any report fewer than 30 hours, because that is the requirement. After the spike at 30 hours, the number of hours reported trails off significantly.

While continuing education may often feel more like a tedious mandate rather than an opportunity for self-improvement, it is vital to any profession and the clients it serves. Because CFP Board considers the CFP® designation to be the gold standard, it should also consider increasing the CE requirement. Thirty hours every two years is barely over one hour per month. (Don’t forget that 50 minutes equals an hour in CE world.) Planners don’t need to wait for action from CFP Board to increase “requirements.” They can set an aspirational goal that separates them from the minimum standard maintained by the “minimally competent” CFP® practitioner.

One of the authors of this column works with Guy Cumbie, CFP®, CIMA®, on the Certified Investment Management Analyst Certification Commission, of which Guy is the current chairman. Guy is a long-time leader in the profession, including serving a term as president of FPA. Recently, in a discussion about the cost of continuing education, Guy showed his CE record. He had hit the 100-hour mark with two months remaining in the reporting period. Guy is an example of someone who views continuing education as an expectation of a professional who seeks constantly to maintain and improve knowledge and skills, not one who begrudgingly satisfies a minimal hurdle mandated by a regulatory, membership, or certification organization. We know there are thousands of CFP® professionals who share Guy’s commitment, but we wish there were more.

Consider the Words: Continuing ... Education

As academicians, we try to ensure that our students are trained properly in investment planning, insurance planning, education planning, retirement planning, tax planning, estate planning, and so on. We develop the learning objectives in financial planning programs primarily through practitioners. The common body of knowledge that we use as a basis of course material is developed in part through input of practitioners in CFP Board’s Job Task Analysis. We then teach our students through various mediums and with various approaches, often including guest speakers, like you.

An unfortunate fact in higher education, however, is that students don’t retain everything. Indeed, a reasonably good “B” student is correct only 80 to 90 percent of the time. Yet many such students earn the CFP® designation. Yes, they certainly learn something between college and the CFP® examination while completing the experience requirement. However, sometimes that knowledge is very specialized. A sad fact is that a newly minted CFP® practitioner may perform very poorly on the investments questions, for example, and still pass the exam.

We are reminded of an old physician joke, but with a slight twist: What do they call the person who earns the lowest passing score on the CFP® examination? A CFP® professional.

Even for those at the high end of the grading scale, knowledge must be used and reinforced to be retained, and continuing education provides a very efficient avenue.

If You Don’t Know Where You’re Going, You Might Not Get There

You’re a financial planner, right? Well, how about performing some continuing education planning for yourself. Instead of waiting until the eleventh hour of the reporting period, why not start the reporting period by researching your most appropriate CE alternatives and developing a plan for the two years? First, disregard the 30-hour minimum unless you are satisfied with being a minimally competent practitioner.

Second, just as with a financial plan, create your education plan with clear, measurable, and actionable goals. The plan should be made a year in advance as this gives you time to research the different ways to obtain the CE. Such a plan should specify weaknesses that you want to improve and specializations that you want to develop. What are your learning objectives? They will likely be oriented toward your current clients’ respective situations, but perhaps you want to develop your skills in an area that is relevant for a new group of clients, or even a new sub-field within financial planning. You may also want your continuing education to cover areas across the spectrum. Remember, the CFP® examination covers more than 72 topics.

Third, search for conferences, seminars, and online CE providers. When you attend a conference or seminar, pay attention! Think of the session as an opportunity to learn, not as an inescapable requirement. Then, come back and teach the material to your colleagues.

Perhaps most valuable, make use of the CE quizzes provided in every issue of the Journal. An especially attractive aspect of the Journal quizzes is that almost all of your colleagues receive the Journal. By comparison, everyone’s formal education and non-Journal CE is different. You can discuss some of the articles over lunch, or form a study group so you can help each other.

A Final Thought

Our hope is that readers will aspire to be more than minimally competent and will seek knowledge beyond the minimum requirements. And here’s one last observation: if your laptop, tablet, or smartphone is running full blast as you send and answer emails during a seminar, conference session, or other learning opportunity, then you are not serious about your own education.