Journal of Financial Planning: October 2016

Randy Gardner Vincent, J.D., LL.M., CPA, AEP, CFP®, is a practicing estate planning attorney with more than 30 years of experience.

Leslie Daff, J.D., is a state bar certified specialist in estate planning, trust, and probate law; and the founder of Estate Plan Inc.

The first week of august was a busy one for the U.S. Treasury Department. On August 4, the Treasury released proposed regulations for code section 2704, limiting estate planning valuation discounts. And on August 8, the IRS released Revenue Procedure 2016-41 expanding the availability of charitable remainder annuity trusts (CRATs).

Clients wishing to claim minority discounts on transfers of family businesses may want to evaluate whether to act before the proposed regulations become effective, possibly as early as January 1, 2017. Clients looking for the substantial deductions and the income stream available from a CRAT may be able to create one before the end of the year.

Section 2704 Valuation Discounts

Clients with taxable estates that include closely held businesses and/or real estate often engage in discounting strategies to reduce the impact of the gift and estate tax. Over the years, an established body of IRS rulings and case law has developed supporting reducing the value of business interests sold or given to business owners who lack control by as much as 60 percent. The proposed regulations administratively overturn the benefits of some of these holdings.

Section 2704 prevents value from avoiding the transfer tax system because of lapsing rights and restrictions contained in the entity’s operating agreement. Here are a few of the provisions discussed in the proposed regulations:

The elimination of deathbed transfers with the addition of a three-year look-back rule with regard to the relinquishment of certain rights, including the right to liquidate a business.

Expansion of the definition of business entity to include, in addition to corporations and partnerships, limited liability companies and any other entity or arrangement where the transferor owns a 50 percent (not a controlling 50.1 percent or more) interest in capital and/or profits.

Disregarding of nonfamily interests of less than 10 percent where the nonfamily member does not have a right to demand distributions of cash and property equal to their percentage ownership.

Removal of the exception that applies to limitations that are more restrictive than under state law.

Other discounting opportunities, such as fractional property interests and time value of money-based strategies (GRATs and QPRTs), are not affected by these proposed regulations, but the release of the proposed regulations 26 years after Congress enacted section 2704 may just be the start of an effort by the IRS to close perceived loopholes.

Charitable Remainder Annuity Trusts

The use of charitable remainder trusts in recent years has been limited because of the low section 7520 rates and the government’s requirements to qualify as a charitable remainder annuity trust (CRAT). In Rev. Proc. 2016-41, the government relaxed the CRAT requirements by permitting the use of contingency language in the initial trust document. This change is effective for CRATs created after August 8, 2016.

A CRAT generally must satisfy all of the following requirements:

- a sum certain of at least 5 percent and not more than 50 percent of the initial fair market value (FMV) of all property placed in the CRAT is to be paid at least annually to one or more persons for a term of less than 20 years or for the life or lives of the individuals;

- no amount, other than such payments, may be paid to or for the use of any person other than a charitable organization;

- following the termination of such payments, the remainder interest in the trust is to be transferred to or for the use of a charitable organization; and

- the value of the remainder interest, determined based on the applicable federal rate, must be at least 10 percent of the initial FMV of all trust property.

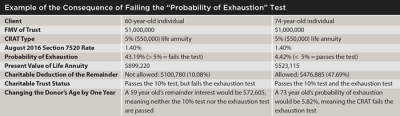

Rev. Ruls. 70-452 and 77-374 added what is referred to as the “probability of exhaustion” test. This test provides that if there is a greater than 5 percent probability that payment of the annuity with asset appreciation at the section 7520 rate over the donor’s life expectancy will defeat the charity’s interest by exhausting the trust assets before the end of the trust term, then the possibility that the charitable transfer will not become effective is not so remote as to be negligible, and the trust fails to satisfy the CRAT requirements. As shown in the example in the table, one consequence of failing the “probability of exhaustion” test is the disallowance of the charitable deduction.

With the current low section 7520 rate, it is difficult to design a CRAT paying a life annuity for an individual under age 74 that passes the exhaustion test at the outset. This consequence occurs even if the asset contributed to the trust produces a stream of income greater than the section 7520 rate and even the payout rate. Advisers in this situation will often resort to an annuity for a term of years or a charitable remainder unitrust (CRUT) to salvage the client’s goals of obtaining a stream of income with an immediate charitable deduction.

However, in Rev. Proc. 2016-41, the IRS allows an additional alternative—language in the trust that creates a qualified contingency requiring the trust to immediately terminate in the year before the trust fails the “probability of exhaustion” test. Here is the language the IRS recommends in the Revenue Procedure for a one-life inter vivos trust:

“The first day of the annuity period shall be the date the property is transferred to the trust and the last day of the annuity period shall be the date of the Recipient’s death or, if earlier, the date of the contingent termination. The date of the contingent termination is the date immediately preceding the payment date of any annuity payment if, after making that payment, the value of the trust corpus, when multiplied by the specified discount factor, would be less than 10 percent of the value of the initial trust corpus. The specified discount factor is equal to [1 / (1 + i)] t, where t is the time from inception of the trust to the date of the annuity payment, expressed in years and fractions of a year, and i is the interest rate determined by the Internal Revenue Service for purposes of section 7520 of the Internal Revenue Code of 1986, as amended (section 7250 rate), that was used to determine the value of the charitable remainder at the inception of the trust. The section 7520 rate used to determine the value of the charitable remainder at the inception of the trust is the section 7520 rate in effect for [insert the month and year], which is [insert the applicable section 7520 rate].”

The Revenue Procedure also includes modifications for a testamentary trust and a trust with more than one measuring life.

Example of Trust Termination

Consider this, based on the example from the Revenue Procedure:

On January 1, year one, donor, age 60 (from the example shown in the table), transfers property valued at $1 million to an inter vivos trust providing for an annuity payment of $50,000 (5 percent of the value of the initial trust corpus) on December 31 of each year to the donor for the donor’s life, followed by the distribution of trust assets to charity. The trust includes the precise language of the above sample provision and specifies the section 7520 rate in effect for January 1, year one, which is 1.40 percent. Consequently, the trust qualifies as a CRAT even though it does not pass the “probability of exhaustion” test on January 1, year one. The donor is allowed a charitable deduction of $100,780.

Each year, prior to payment of the annuity to the donor, the trustee performs the calculations required to determine if the trust will terminate early in accordance with the terms of the qualified contingency. In each year from year one through year 17, the trustee determines that the value of the trust corpus, minus the $50,000 annual payment and then multiplied by the specified discount factor, is greater than 10 percent of the initial trust corpus. The value of the trust corpus as of December 30 in year 18 is $175,000. Only in year 18 does the value of the trust corpus as of December 30, when reduced by the annuity payment and multiplied by the specified discount factor, fall below $100,000 (10 percent of the value of the initial trust corpus).

The calculations required to determine if the trust will terminate early in year 18 are:

x = ($175,000 – 50,000) x

[1 / (1 + .014)]18

x = $125,000 x 0.9861918

x = $125,000 x 0.77860 = $97,325

Because the value of the trust corpus ($175,000), when reduced by the annuity payment ($50,000) and then multiplied by the specified discount factor (0.77860), is less than 10 percent of the value of the initial trust corpus ($100,000), the trust terminates on December 30, year 18, and the principal and income remaining in the trust (including the annuity payment for year 18 that otherwise would have been payable to the donor) then must be distributed to charity.

The donor received a charitable deduction at the outset, but only received the $50,000 annuity payments for 17 years, not for life. If the donor values the deduction more than the stream of payments, then this approach may be appealing. Numerous other factors, such as the property’s appreciation and cash flow potential, and the donor’s actual life expectancy, may also influence the donor’s decision to establish the CRAT.

In the current low section 7520 rate environment, these examples show that individuals under age 60 will still be thwarted by the 10 percent test, but the Revenue Procedure does provide relief to individuals in the 60- to 73-year-old age range who wish to take advantage of CRATs.