Journal of Financial Planning: October 2015

Although significant amounts of research and public policy have been directed toward financial literacy in recent years, not nearly as much attention has been placed on the type of information needed by the nearly 10,000 baby boomers reaching age 65 each day until 2030. As this group faces important decisions as they move into retirement, it would be wise to not lose focus on another important literacy measurement: retirement income planning knowledge.

The reality is that retirement income planning is challenging—it requires knowledge across a broad array of legal, financial, and social topics. Although studies have surveyed different groups of people on specific financial topics, such as Social Security knowledge or health care expenditure knowledge, little existing research surveys baby boomers on their overall retirement income knowledge. This task was undertaken by The American College RICP® Retirement Income Literacy Survey. The goal was to gather information about the retirement planning knowledge of those individuals in retirement and nearing retirement. This article discusses the overall results of the research and sets forth the top distinguisher questions that can be used by financial advisers to gauge the retirement income knowledge of their clients.

The Link between Financial Literacy and Decision-Making

Understanding financial literacy is important, as research has shown a link between literacy and decision- making skills. The 2007 article “Baby Boomer Retirement Security: the Roles of Planning, Financial Literacy, and Housing Wealth,” by Annamaria Lusardi and Olivia S. Mitchell (published in the Journal of Monetary Economics) set out to evaluate how well people plan for retirement and the impact that financial literacy has on retirement planning. Their study, which used the University of Michigan’s robust Health and Retirement Study (HRS) dataset, indicated that higher levels of financial literacy improved the likelihood of planning for retirement, which in turn improved their overall wealth.

In 2011, Lusardi and Mitchell examined the HRS data again to review the impact of financial literacy on different demographic groups and their likelihood to plan for retirement (“Financial Literacy and Retirement Planning in the United States,” published in the Journal of Pension Economics and Finance). The researchers found that Hispanics and African Americans scored the worst on financial literacy but also that women and less-educated people demonstrated low financial literacy. One surprising finding was that all groups rated themselves as well-informed about financial matters, regardless of their financial literacy performance.

The 2012 article by Lusardi, “Numeracy, Financial Literacy, and Financial Decision-Making,” published in the journal Numeracy reviewed existing financial literacy and financial decision-making research as it related to different age-banded demographic groups. The article concluded that basic financial literacy, as tracked by numeracy, is very low in the adult U.S. population, especially the elderly. Additionally, links were found between this low level of financial literacy and financial decision-making.

In 2013, David Blanchett and Paul Kaplan published their research paper “Alpha, Beta, and Now . . . Gamma” in The Journal of Retirement on the topic of the value of making intelligent financial planning decisions. The research showed that a retiree could be expected to generate nearly 22.6 percent more income by making more informed decisions than in the base scenario of a 4 percent withdrawal rate and a 20 percent equity allocation portfolio. This research highlights the need for financially literate retirees, as good decision-making can substantially improve one’s retirement.

Research Methodology

The American College RICP® Retirement Income Literacy Survey’s primary goal was to determine the level of retirement income planning literacy of Americans near or in early retirement. In order to ascertain their knowledge levels, a questionnaire was developed to include 38 knowledge questions regarding the most pertinent retirement planning issues. These questions were developed with the input of retirement income planning researchers and practitioners, and topic areas from the Retirement Income Certified Professional® (RICP®) education program were consulted to ensure the proper retirement income topics were covered in the survey instrument. Those topics included general retirement planning, the ability to maintain one’s lifestyle, retirement income generation, annuities, Social Security, life expectancy, death of a spouse, taxes, inflation, housing decisions, medical insurance, and long-term care planning.

In addition to the knowledge questions, respondents were asked behavioral and attitudinal questions on retirement income planning topics. Some of these questions were used to gauge the confidence of the respondents in relation to their knowledge levels. The questionnaire also included a series of demographic questions.

The survey was conducted through 15-minute online interviews between July 17 and July 25, 2014. To qualify for the study, respondents needed to be between ages 60 and 75 and have at least $100,000 in household assets, excluding primary residence. A total of 1,019 Americans were interviewed.

Survey Results

The RICP® Literacy Survey found that only roughly 20 percent of respondents could score 61 percent or better, with 60 percent and below being a failing grade. No one scored in the 91 to 100 percent range, and very few people scored in the 81 to 90 percent range (1 percent of respondents). The survey looked at 13 specific areas of knowledge: (1) ability to maintain lifestyle; (2) life expectancy; (3) income generation; (4) early death of a spouse; (5) annuity product knowledge; (6) taxes; (7) inflation; (8) housing; (9) medical insurance planning; (10) long-term care; (11) basic financial and investment questions; (12) Social Security; and (13) company retirement plans. The mean respondent score was 17.12 for an average of 45 percent correct. Among the 13 issues surveyed, only three areas of knowledge averaged a passing literacy score above 60 percent correct (inflation, housing, and medical insurance planning).

Ability to maintain lifestyle. Respondents did not show exceedingly high knowledge on any of the four “ability to maintain lifestyle” questions. Only 32 percent knew that $4,000 is the most they can afford to safely withdraw per year from a $100,000 retirement account (based on Bill Bengen’s 1994 Journal of Financial Planning “4 percent rule” research). In addition, 35 percent of respondents knew that maintaining a portfolio of 50 to 60 percent in equities is likely to yield a higher sustainable withdrawal rate than a much higher equity allocation of 90 to 100 percent, or a much lower allocation of 20 to 30 percent.

Life expectancy. Another barrier for proper planning is poor performance on life expectancy questions, as planning requires a reasonable estimate of the length of retirement. More than half (60 percent) underestimated the life expectancy of a 65-year-old man, suggesting that they may not realize how long their assets have to last. Similarly, only 30 percent understood that it is more effective to work two years longer, or defer Social Security for two years, than to increase contributions by 3 percent for five years just prior to retirement.

Early death of a spouse. When asked about issues dealing with the early death of a spouse and life insurance, respondents scored an average of 26 percent. The failure to understand the risks associated with an early death of a spouse on retirement income planning can put the surviving spouse and the entire family unit at risk.

Annuity product knowledge. Respondents knew very little about using annuities as a retirement income strategy. Overall, respondent knowledge on annuity products was the lowest-performing knowledge area among all 13 categories, with an average score of 18 percent on the three annuity questions asked. As annuities play an increasingly larger role in retirement income plans, it is imperative that Americans understand the products they are purchasing and relying upon to generate their retirement income.

Taxes. Most respondents (68 percent) knew that you must begin required minimum distributions for the year you turn age 70½. Nearly 43 percent knew that all distributions from a Roth IRA could come out tax-free if certain holding period and trigger events were satisfied. However, most respondents (64 percent) did not know when would be a good time to convert a portion of a traditional IRA to a Roth IRA.

Inflation. Inflation was one of the few topic areas in which respondents demonstrated a passing grade, answering an average of 1.5 correct out of 2 inflation questions.

Housing. Most respondents (72 percent) understood when a reverse mortgage would become due, but fewer people (63 percent) understood some basic features of continuing care retirement communities. Nonetheless, both questions received above-passing response rates on average.

Medical insurance planning and long-term care. One-quarter of respondents knew that 70 percent of the population is going to need assistance in the activities of daily living at some point, and 35 percent realized that family members end up paying most of long-term care costs.

Company-sponsored retirement plans. Overall, respondents demonstrated little understanding about what they should consider when taking a distribution from a retirement plan. Just 27 percent of respondents knew that 401(k) assets were protected from the claims of outside creditors, and nearly 17 percent believed they could lose their 401(k) assets to company creditors. This fear of losing money could inhibit increased savings into a 401(k) plan and keep people from saving enough money for retirement because they are not aware of the liability protection their 401(k) has from company creditors.

Attitudes about Retirement Readiness

Respondents were asked about their attitudes toward their preparation for retirement. Respondents showed a high level of confidence that they were financially prepared for retirement, about half indicating they were highly confident about having enough money to live comfortably in retirement, while the other half was somewhat confident. When asked about what retirement issues concerned them the most, the cost of health care headed the list followed by cuts to Social Security and Medicare. Consistent with the level of confidence about their finances, running out of money was the lowest- ranked concern.

Given the results of the survey, what is more concerning is that four in 10 described themselves as “highly knowledgeable” when asked about how much they knew about retirement planning. Almost all of the rest identified themselves as moderately knowledgeable. Only 3 percent admitted to not being knowledgeable. Here the self-reporting did not match the test results, indicating a great deal of overconfidence.

Planning Activity

Nearly two in three Americans surveyed have an ongoing relationship with a professional financial adviser. Typically, they talk with their adviser at least twice a year, and nearly half of those with an adviser rely heavily on that adviser to manage their finances and investments. It is interesting, however, that just one in four have a formal, written retirement plan.

The survey results also showed differences between retirees and pre-retirees. Retirees were more likely to have an adviser (65 percent for retirees and 59 percent for pre-retirees), and were more likely to talk to their adviser two or more times a year (81 percent for retirees and 69 percent for pre-retirees). Retirees were also somewhat more inclined to have a written plan than pre-retirees (30 percent for retirees and 20 percent for pre-retirees).

Those with a financial adviser who did not have a formal written financial plan performed the worst, with an average score of 43 percent and a pass rate of 14 percent. The existence of a formal written financial plan appears to impact the knowledge level of respondents, with a formal written plan having a positive impact for both respondents with and without a financial planner.

Impact of Demographics

The RICP® Literacy Survey gathered data on the respondents’ age, gender, wealth, and education. Gender appears to have a large impact on retirement income planning knowledge; nearly 29 percent of male respondents posted a passing score, compared to 11 percent of female respondents.

Wealth also had a strong correlation to the respondents’ knowledge. Scores increased from each asset level range, with individuals in the highest asset range ($1.5 million or more) scoring an average of 52 percent, while those in the lowest asset range ($100,000 to $199,999) scoring only 41 percent on the knowledge quiz.

Distinguisher Questions: How to Better Understand Clients

It should be beneficial for financial advisers to understand the retirement planning knowledge level of their clients. The 38-question RICP® Literacy Survey would help in that regard, but it likely takes longer to complete than most clients and advisers would prefer. As such, in order to determine the best questions for gauging an individual’s retirement knowledge, a point-biserial correlation coefficient was calculated to determine the relationship between a test question and the total final test score, or knowledge level.1

In an attempt to narrow the questions down for use by an adviser to gauge the knowledge of his or her clients, the top 10 questions are provided in the sidebar on page 28 as a way to measure knowledge levels with a shorter quiz.

Implications for Advisers

The survey results show that consumers seem to think they know more than they actually do about retirement income planning. This lack of understanding can make it difficult for clients to make good decisions, and make it difficult for the adviser to understand the clients’ rationales for the decisions they are making. Here are some suggestions to remedy this situation:

Quiz clients to see what they understand, asking them to say back to the adviser in their words what was just discussed. Having clients summarize conclusions may help to ensure that everyone is on the same page.

Increase efforts to educate clients. The American College has made the full retirement income planning literacy quiz available online, and to date, more than 5,600 people have taken it. Advisers may wish to use the shortened version that appears in the sidebar. Survey results indicate that individuals who went through a comprehensive planning process did better on the quiz, suggesting that the process of building a plan may be educational in itself.

An educated consumer may be more willing to seek advice. An educated client is likely to be a much better partner as he or she is:

- more likely to make informed decisions and take more ownership in the plan;

- more likely able to appreciate the value the adviser is providing in the relationship; and

- more likely to be a better referral source for a competent adviser.

The knowledge needed for retirement income planning is quite specialized, and general financial literacy may not be a good indicator of retirement income knowledge. For financial advisers, this means that even when working with fairly sophisticated clients, be aware that there may still be a need for additional education.

Improving Financial Literacy

The results of the RICP® Literacy Survey help to establish a baseline for retirement income knowledge. Given the survey performance results, most would agree that retirement income literacy needs drastic improvement. The survey identified three opportunities to increase retirement income literacy and, therefore, the financial security of retired Americans:

- A written retirement plan has been found to be effective in leading to better planning and financial decisions; it is also an effective vehicle for education. However, only one in four have a written retirement plan. Increasing this number can be highly effective in increasing retirement income literacy and security.

- Although two-thirds of people ages 60 to 75 with investable assets of at least $100,000 have a financial adviser, the lack of knowledge here suggests that advisers have not done a good job educating their clients. Support for and further training of advisers on how best to educate pre-retired and retired clients can be an effective strategy for increasing retirement income literacy.

- A significant minority of respondents has never tried to figure out how much they need to accumulate to retire securely, and yet one of the keys to financial security in retirement is accumulating enough money to at least fund basic needs.

Financial advisers are best equipped to educate their clients thanks to the one-on-one interaction and trust most clients have with their advisers, however many clients prefer to delegate decisions to an adviser and not really learn about financial products and strategies. Nevertheless, findings here suggest it is important for all to have some level of knowledge. Efforts to teach financial advisers the most effective methods for educating their clients on key aspects of financial security are likely to produce important results.

Jamie Hopkins, J.D., , LL.M., CLU®, RICP®, is the Larry R. Pike chair in insurance and investments, associate director of the New York Life Center for Retirement Income, and associate professor of taxation at The American College.

David A. Littell, J.D., ChFC®, is the director of the New York Life Center for Retirement Income, the Joseph E. Boettner chair in research, and professor of taxation in The American College’s Retirement Income Certified Professional® (RICP®) program.

Endnote

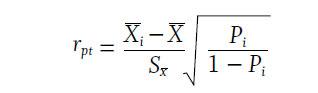

1. Although the point-biserial correlation coefficient was used for the RICP® Literacy Survey, there are other ways to determine the distinguisher quality of a question. The formula used for this statistic is as follows:

Where:

Xi: The mean test score of those who answered question i correctly.

X: The mean test score of everyone who

took the test.

Sx: The standard deviation for everyone who

took the test.

Pi: The percent of students who answered

question i correctly (i.e., item difficulty).

(1 – Pi): The percent of students who answered question i incorrectly (sometimes called Qi)

Sidebar: Top 10 Distinguisher Questions

1. Sarah is single, age 65, and takes a reverse mortgage with a lump sum payment. When does the loan have to be repaid?

A. When she permanently leaves the home [CORRECT]

B. When she takes on any other loan

C. Whenever the mortgage company wants it back

D. When she attains age 75

E. Don’t know

2. True or false? Buying a single company’s stock usually provides a safer return than a stock mutual fund.

A. True

B. False [CORRECT]

C. Don’t know

3. Please choose the response below that best completes this statement:

If you had a well-diversified portfolio of 50 percent stocks and 50 percent bonds that was worth $100,000 at retirement, based on historical returns in the U.S. the most you can afford to withdraw is ____ plus inflation each year to have a 95 percent chance that your assets will last for 30 years.

A. $2,000

B. $4,000 [CORRECT]

C. $6,000

D. $8,000

E. Don’t know

4. Most experts agree that the best way to protect against inflation is to have a:

A. Diversified portfolio of stocks [CORRECT]

B. Diversified portfolio of bonds

C. Diversified portfolio of CDs (certificates of deposit)

D. Don’t know

5. True or false? Exchange-traded funds generally have higher expenses than actively managed mutual funds.

A. True

B. False [CORRECT]

C. Don’t know

6. A PE ratio means:

A. Price to earnings [CORRECT]

B. Profits to expense

C. Price to expense

D. Par value to earnings

E. Don’t know

7. Converting a portion of a traditional IRA into a Roth IRA is a good idea this year if:

A. You have a big tax deduction this year and your marginal tax rate is lower than normal [CORRECT]

B. You have more taxable income than usual and your marginal tax rate is higher than normal

C. The value of the assets in your IRA have remained the same for 10 years

D. Don’t know

8. Which one of the following statements concerning the federal income tax treatment of distributions to a 65-year-old retiree is true?

A. All distributions from a Roth IRA that have been maintained for more than five years will be tax-free [CORRECT]

B. Distributions from a traditional IRA prior to age 701/2 will be subject to an additional 10 percent penalty tax

C. All distributions from a traditional IRA created with tax-deductible contributions will be taxed as long-term capital gains

D. Don’t know

9. Which of the following types of long-term bonds typically has the highest yield?

A. AAA-rated corporate bonds

B. B-rated corporate bonds

[CORRECT]

C. Treasury bonds

D. Don’t know

10. If 100 percent of a mutual fund’s assets are invested in long-term bonds and the investment climate changes so that interest rates rise significantly, then the value of the mutual fund shares:

A. Decrease significantly

[CORRECT]

B. May rise or fall depending upon the type of bond

C. Increase significantly

D. Will not change at all

E. Don’t know