Journal of Financial Planning: November 2013

Executive Summary

- This paper seeks to examine the risk exposure taken by women who elect not to invest in their own human capital and how that decision impacts their overall risk exposure in the household portfolio.

- A randomly selected and nationally representative sample of more than 600 divorced women was used for the analyses.

- The paper seeks to quantify the effect of investments in human capital on the income of divorced women using data from the National Longitudinal Survey of Youth 79 (NLSY79).

- Results indicate that both years of education and prior work experience are significant positive predictors of income for divorced women.

- Results suggest that women who decline to invest in their own human capital face significant downside exposure to financial shocks such as divorce, death, disability, market downturns, or unemployment of their spouse.

Kimberly Bridges, Ph.D., CFP®, CPWA®, CDFA™, is a vice president and senior financial planner at BMO Private Bank. Her research explores financial issues affecting women. She has developed and delivered training for advisers on women’s financial issues through BMO Private Bank and the Women’s Interactive Network at Schwab. She is a former president of FPA of the greater Phoenix area. Email HERE.

De’Arno De’Armond, Ph.D., is the Edwards Professor of Financial Planning, director of undergraduate programs, and an assistant professor of finance at West Texas A&M University. His primary research interests explore the interrelation of business practice models and financial planning. Email HERE.

Lukas R. Dean, Ph.D., is an associate professor and the financial planning program director in the Cotsakos College of Business at William Paterson University. His primary research interests are materialism and the conflicts of interest associated with various forms of compensation in the financial services industry. Email HERE.

According to modern portfolio theory (Markowitz 1952), an optimal portfolio is created by combining risky and risk-free assets in a diversified portfolio to receive the highest level of return for a given level of risk. Creating an optimal portfolio for an individual investor involves consideration of the risk and return characteristics of portfolio assets, as well as consideration of the investor’s level of risk tolerance.

Portfolio risk exposure comes in many forms, including inflation risk, market risk, and interest rate risk. Although these types of risk have been widely studied in the finance literature, one area has been neglected; namely, risks associated with human capital.

From a holistic planning perspective, a household’s portfolio includes assets on and off the balance sheet, including not only physical and financial capital, but also social and human capital. Physical capital refers to the tangible assets acquired by the household, including the home, automobiles, personal property, and investments such as art and collectibles. Physical assets are reported on the balance sheet, but often are held for personal use rather than for investment purposes.

Financial capital also is recorded on the balance sheet and includes myriad intangible assets such as stocks, bonds, CDs, mutual funds, and derivative securities. Financial capital is what is commonly denoted by the term “portfolio.”

Social capital is difficult to measure and does not show up on a balance sheet. It refers to the social networks and resources on which an individual may draw and can include networks of family, friends, co-workers, or spiritual advisers. Social networks often are instrumental catalysts in helping families and individuals survive distress, whether caused by physical, emotional, or financial shocks.

Human capital refers to knowledge, skills, and abilities acquired by an individual, traditionally through education and work experience. It is uniquely possessed by each individual and can be enhanced by continued education and job-related training (Becker 1964). Human capital is both an input into production and a component of wealth. As a production input, it is exchanged in the labor market for wages. (Human capital specific to home production is not traded in the labor market, but is an important factor in home production.) As a component of wealth, human capital is measured as the present value of future earnings and represents remaining lifetime earning potential. This paper focuses on human capital as a component of the wealth portfolio.

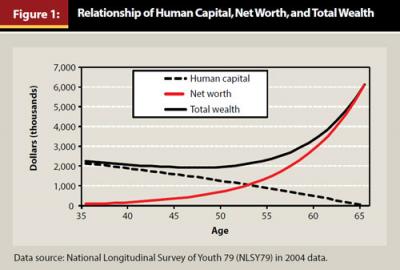

Workers in the early stages of their careers typically have higher levels of human capital than financial capital. During the accumulation stage of the life cycle, they trade their human capital for earnings that can then be used for consumption and savings. By the time they reach retirement they have “spent” their human capital and (hopefully) have replaced it with a store of financial capital. Although total wealth is projected to increase over the life cycle, the proportion attributed to human capital will decline while the quantity attributed to financial capital will increase (see Figure 1).

Theoretically, when an individual reaches retirement, the present value of his or her future earnings will be $0, leaving no remaining human capital. Net worth may continue to rise or be depleted depending on whether the growth rate exceeds the rate of withdrawal.

Several studies have established the importance of including human capital in the household wealth portfolio (Friend and Blume 1975; Graham and Webb 1979; Lee and Hanna 1995; Gutter 2000; Ibbotson, Milevsky, Chen, and Zhu 2007).

Lee and Hanna found that when human capital was included in the measure of total wealth, financial assets represented only a small portion of total wealth for the median household. These findings were supported by Gutter (2000).

According to Ibbotson et al. (2007), characteristics of human capital, such as its magnitude, its volatility, its correlation with financial assets, and the flexibility of the household’s labor supply, should be taken into consideration when assessing overall portfolio risk. Additionally, financial assets should be invested in a way that will diversify and balance the household’s human capital.

With financial assets comprising a small portion of the total portfolio in relation to human capital, researchers have concluded that most households can afford to take on higher risk in their financial portfolios (Lee and Hanna 1995; Gutter 2000; Ibbotson et al. 2007).

Human Capital as a Financial Safeguard

Human capital acts as a safeguard in the event of a financial shock. An individual with a high level of human capital has the ability to rebuild assets lost in a financial shock by exchanging human capital for financial capital. As long as there is earning capacity, financial assets can be rebuilt (although they may never reach their pre-shock levels). Although human capital is subject to risk, to the extent that earning potential exists, human capital can serve as a hedge against adverse financial events.

Consider, for example, an individual approaching retirement during a bear market. Retiring at the bottom of the market could create a situation where the retiree is forced to begin withdrawing from the portfolio when values are depressed, which can have a devastating effect on the long-term success of the portfolio. However, by choosing to delay retirement, the individual could live off of his or her human capital longer, and thus delay taking withdrawals from the financial portfolio until the portfolio has a chance to recover from the market downturn.

This study underscores the importance of maintaining marketable job skills. Human capital depreciates rapidly during absences from the workforce. Individuals who exit the workforce and who are unsure as to whether they will want to reenter should make an extra effort to keep their education, professional networks, and job skills current to facilitate re-entry.

Human capital can act as a financial safeguard, but it is subject to risk, as are other components of the wealth portfolio. The degree of risk to which it is exposed affects overall portfolio risk. To gain an understanding of how risk affects human capital, it is first necessary to review the theories related to the acquisition of human capital and its exchange in the marketplace.

Theoretical Framework

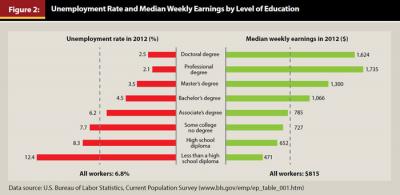

Human capital theory posits that earnings are a function of hours spent in market work (Becker 1962). Human capital is acquired through education and labor market experience (Mincer and Polachek 1974). A positive relationship exists between earnings and both years of schooling and labor market experience. Increases in years of schooling and years of labor market experience lead to increased earnings (Becker; Chiswick 2006; Mincer and Polachek). Increases in education also have been shown to be consistently associated with higher employment rates; whereas low education is associated with high unemployment (see Figure 2).

There are two types of human capital: general and specific. General human capital, commonly measured by education level, is training that will increase a worker’s productivity for multiple employers. In other words, it is transferable. Specific human capital, on the other hand, is firm-specific and is not considered to be transferable to other firms or industries (Becker 1962). While specific human capital makes an employee more valuable to the firm or industry and increases a worker’s wage rates, it also produces higher rates of wage depreciation during periods of nonparticipation in the workforce (Becker; Kriechel and Pfann 2005; Mincer and Polachek 1974).

Although gender differences in human capital acquisition have largely disappeared among younger workforce participants (U.S. Department of Commerce 2011), men and women have historically differed in their acquisition of human capital. These differences can lead to lack of diversification in a family’s human capital portfolio, particularly for older clients who have adopted the traditional family model with a primary homemaker and a primary breadwinner. Differences in human capital acquisition can be partly explained by household production theory.

Household production theory suggests that households seek to maximize utility through the consumption of a combination of market goods, home-produced goods, and leisure. Total household utility can be maximized when one partner specializes in market work while the other specializes in home production (Becker 1985). Such an arrangement increases the marginal productivity of both workers, giving the breadwinner a comparative advantage in market work and the homemaker a comparative advantage in home production. These specialized investments in human capital increase overall household utility and provide economic incentives for the division of labor between husband and wife (Becker).

As long as the couple does not experience a loss of human capital, the family benefits from specialization. However, in the event of a peril, such as disability, death, divorce, or unemployment, in which the breadwinner’s earning power is reduced or lost, specialization can contribute to serious declines in standard of living. These effects can be long-lasting and widespread, leading not only to a loss of earnings, but also to a decline in the client’s overall portfolio. The effects can be especially devastating when the peril is uninsurable.

Evidence overwhelmingly suggests that divorce has greater economic consequences for women than for men (Bianchi, Subaiya, and Kahn 1999; Burkhauser, Duncan, Hauser, and Bernsten 1991; Corcoran, Duncan, and Hill 1984; Daniels, Rettig, and delMas 2006; Dew 2009; Duncan and Hoffman 1985; Hoffman and Duncan 1988; McKeever and Wolfinger 2001; McManus and DiPrete 2001; Morgan, Kitson, and Kitson 1992; Peterson 1996; Smock 1994; Smock, Manning, and Gupta 1999; Weitzman 1985).

Another body of research suggests that financial problems put pressure on marital relationships and may increase the probability of marital dissolution (Dew, Britt, and Huston 2012; Gudmunson, Beutler, Israelsen, McCoy, and Hill 2007; Zagorsky 2003).

Risks to Human Capital

A household’s human capital is exposed to risk, but the types of risk differ from those to which the financial portfolio is exposed. Losses in the family’s human capital portfolio are manifest in lost or reduced earnings and can be the result of depreciating job skills (as occurs during periods of absence from the workforce), obsolescence of skills, disability, and loss of human capital from the household (as when a couple divorces or a working spouse dies).

The level and type of human capital, as well as the allocation of it within the household, determine the level and type of risks to which a family is exposed. For example, workers with low levels of human capital are at greater risk of loss of employment when low skilled jobs are replaced by technology or moved overseas. Similarly, any decline in demand for labor within an industry can put those with specialized human capital within that industry at risk. An individual with very specific job training may find it difficult to transfer that type of human capital into other employment and may experience functional unemployment. Such is commonly the case with former servicemen and women who are trained in very specific military functions and are unable to transfer their skills to the civilian sector. On the other hand, individuals with more general training, such as human resources management, have greater employment flexibility.

Risks can be magnified if there is lack of human capital diversification within a household. Partners who both work as software technicians at the same technology company are exposed to more human capital risk than a couple employed as a professor and a nurse. The second arrangement offers risk reduction via diversification. Exposure to risk also increases when one member is endowed with nearly all of the household’s marketable human capital, as might be the case in traditional breadwinner/homemaker households.

Households with little flexibility in their human capital supply are exposed to greater risk than those with more flexibility. In this context, flexibility refers to the ability of the household to increase participation in the paid labor force. A single parent working full time with young children has little ability to increase participation in the labor force. The same holds true for an 80-year-old widow. But a couple working a total of 60 hours between them has the ability to exchange more human capital for wages in the labor force (Hill et al. 2006).

The benefit of this exchange will be greater for those with higher levels of human capital. For example, if the couple decides that they have 10 more hours available to devote to the labor market, they will receive a higher marginal return if the partner with a higher wage rate increases participation. In effect, this human capital reserve acts as savings that can be tapped into if needed. The greater the amount of human capital available for exchange, the greater the reserve and the greater flexibility.

For families in the asset accumulation stage of life, the greatest threats to the portfolio are those perils that could potentially affect the family’s ability to earn money. Human capital losses are likely to reduce the family’s total portfolio throughout the remaining life cycle. Examples include disability, death, divorce, and prolonged unemployment. Each of these perils has a potentially catastrophic impact on a family’s ability to provide for its current and future needs, because today’s earnings determine not only present consumption, but the amount of resources available to save for future consumption.

Although insurance is available to hedge against some of these risks, in some instances it may be unavailable, unaffordable, or inadequate to protect against a loss of present and future living standard. And in the event of divorce, no insurance is available to replace the lost earning power of the ex-spouse. When individuals have substantial risk exposure to their human capital, they may be less tolerant of taking risk in their financial portfolio.

Methodology

An empirical examination of the National Longitudinal Survey of Youth 79 (NLSY79) data can help predict the effects of education and work experience on income for divorced women. The NLSY79 is a longitudinal panel study that follows 12,686 randomly selected individuals born in the years 1957 to 1964 who were between the ages of 14 and 22 during the first interview in 1979. It oversamples blacks, Hispanics, economically disadvantaged whites, and youth in the military. The oversampling of economically disadvantaged whites and of military was discontinued in 1984 and 1990, respectively.

Participants were interviewed annually from 1979 to 1993, and biennially from 1994 to 2004. The total sample size for 1996 included 4,483 females. The sample was further narrowed to 624 females who reported their marital status as divorced in 1996. For 2004, the sample included 3,983 females with 775 divorced females.

Measures

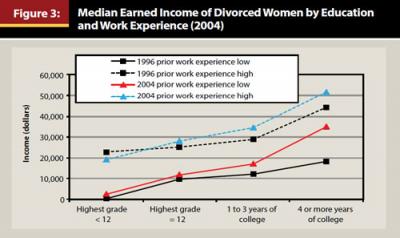

Earned income. Respondents’ earned income is reflected in their annual income. For the multivariate analyses, actual earned income was used (see Tables 1 and 2). For Figure 3, median annual earned income was used.

Total net family income. The NLSY79 asks respondents to report income they received in the prior year from a variety of sources, including wages, salaries, interest, dividends, alimony, business earnings, government transfer programs, and income from other household members. Based on responses to each of these questions, the NLSY79 creates a total net family income variable.

Data analysis method. To capture the effects of human capital on income of divorced women at different stages of the life cycle, this study analyzed data at two points in time: 1996 and 2004. Regression methods were used to analyze the data. Figures from 1996 were chosen due to the age of the participants and the availability of variables of interest. During 1996, participants in the NLSY79 were between the ages of 31 and 39, a significant time in the life cycle for marriage and child rearing, and a time when many women choose to leave the workforce to care for children. Sorensen and McLanahan (1987) found that women are more dependent on their husbands in this age group than any other. During 2004, the comparison year, respondents were between the ages of 39 and 47.

Results

As expected, investments in human capital (both education and work experience) were found to be associated with higher incomes. For both samples (1996 and 2004), any increase in the level of education had a positive monotonic association with increased income. The increased income levels were quite dramatic. For example, a woman with low prior work experience and a high school diploma would earn an annual median income of slightly more than $10,000. However, a woman with low prior work experience and a college degree would earn on average almost $35,000 annually.

The difference was similar, but not quite as dramatic, for women with high levels of prior work experience. A woman with high prior work experience and a high school diploma would earn on average around $25,000 annually. A woman with high prior work experience and a college degree would earn on average more than $40,000 annually.

Although the value of a college education, as it relates to increased income, has been known for some time, the results from these analyses demonstrate that prior work experience has a separate impact that doesn’t get recognized as much as a formal education. This supports Becker’s (1964) human capital theory, which posits that investments in human capital (whether via education or on-the-job training and experience) increase expected future lifetime earnings. Figure 3 demonstrates that for almost all levels of education, high levels of prior work experience boost a woman’s earned income levels by approximately $20,000 per year.

Overall, women who had not completed high school and had low prior work experience fared the worst, by far, with virtually no income. Those women with high levels of education and high levels of prior work experience fared the best with more than $43,000 (1996) and more than $50,000 (2004) in average annual income.

As expected, the average annual income for all groups increased from 1996 to 2004, with the exception of women who had not earned a high school diploma. Regardless of the reasons for this phenomena, it suggests that women with less investment in human capital (whether it be education or work experience) may be at greater risk to financial shocks in the household.

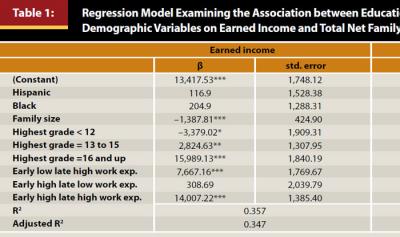

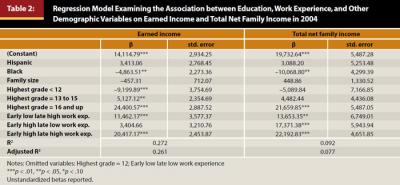

Tables 1 and 2 show the results from the regression models. Both education and work experience have a significant positive impact on income. This relationship is most pronounced when measuring earned income. In both 1996 and 2004, all of the variables measuring education, and two of the variables measuring work experience, were significant and positively related to earned income. Other significant variables include family size when measured in 1996, and black when measured in 2004.

Having less than a 12th grade education had a negative impact on earned income. In 1996, divorced women in their 30s with less than a high school education could expect to make $3,379 less per year (measured in 1996 dollars) than divorced women who had completed a 12th grade education (p = .10). In 2004, the significance level was slightly higher. Divorced women with less than a high school education could be expected to make $9,200 less (measured in 2004 dollars) than women with a 12th grade education (p < .01). In 1996, divorced women with college experience could expect to make more in earned income than divorced women with a 12th-grade education: $2,825 more for women with one to three years of college (p = .05), and $15,989 more for women with four or more years of college (p < .01). The same pattern appears in 2004, when women with one to three years of college could expect to make $5,127 more than women with a high school education (p = .05), and women with four or more years of college could expect to make $24,401 more (p < .01).

The positive relationship between education and earnings can be predicted and explained through human capital theory, however, the profound and dramatic boost to having four or more years of college cannot be explained solely by applying the theory. In both years, the increase in earnings of those women with four or more years of college was almost five times that of women with one to three years of college. In fact, when measuring earned income in both 1996 and 2004, having four or more years of college was a stronger predictor than any of the other variables used in the model, with high work experience being the second strongest predictor of earned income.

In answer to the question of whether general (measured by education) or specific (measured by work experience) human capital is more valuable for divorced women, it appears that general human capital is more valuable, at least when measured as having four or more years of college. But specific (work experience) is a close second.

Levels of prior work experience were also significantly and positively related to earned income. Women with consistently high prior work experience could expect to make $14,007 more in 1996 ($20,417 more in 2004) than women with consistently low prior work experience (p < .01).

What is perhaps a little more surprising is the importance of work experience timing for women with changing levels of work experience. In both years, women with low early work experience, but high late work experience, made significantly more than women with continuously low prior work experience; but the reverse is not true.

Women with high early work experience followed by low recent work experience did not make significantly more than women with continuously low work experience. This relationship is most salient when comparing work experience for women in 2004, when there were 20 years of cumulative prior work experience, divided into 14 years of early work experience and six years of late work experience. Women with 14 years of high work experience followed by six years of low work experience did not make significantly more earned income than women with continuously low work experience, while women with 14 years of low work experience followed by six years of high work experience made $11,462 more (p < .01).

Recency of work experience appears to have a very important connection to earned income. Six years of recent work experience are worth more in terms of earned income than are 14 years of less recent work experience.

Differences between Divorced Women in their 30s and 40s

The model successfully predicts a large amount of the variance in earned income for divorced women in their 30s (34.7 percent of the variance in 1996) and in their 40s (26.1 percent of the variance in 2004). However, the model does not predict nearly as much of the variance in total net family income (TNFI). For women in their 30s, only 1.7 percent of the variation in their TNFI was predicted by this model. Whereas for women in their 40s, 7.7 percent of the variance in TNFI was explained by the independent variables (human capital and demographics).

When examining 1996 TNFI, only one variable made a significant difference: completing four or more years of college. In 2004, completing four or more years of college remained significant, but was joined by all three of the work experience predictors. In fact, for women in their 40s, having high prior work experience was the strongest predictor of TNFI, even stronger than completing four or more years of college.

This outcome shows that although human capital translates directly into higher earnings for divorced women at both stages of life, it has a less direct impact on TNFI for women in their 30s than in their 40s. Furthermore, all of the work experience variables are significant at the p < .05 or p < .01 levels when measuring TNFI for women in the older group, while none were significant for the younger group. It is apparent that longer work histories have a more significant impact for women in the 40-something age group.

One possible explanation for why human capital has little significance in TNFI for women in their 30s is that family members, divorce courts, and government transfer programs favor younger women who are likely to have younger children in the home. This provides a greater portion of total net family income through transfers (alimony, child support, and social welfare) particularly to those women with lower levels of human capital.

Differences among Races

Another interesting finding in 2004 was that although black women did not have significantly lower earned income, they did have a significantly lower level of TNFI. This suggests that black divorced women are at an even greater risk, and are likely receiving less support than their counterparts. The difference was not significant for Hispanic divorced women, although Hispanic women did receive more TNFI than their counterparts. Although the difference was not statistically significant, this warrants further research to determine if Hispanic women have stronger support networks.

Conclusion and Implications

Households face a large number of perils across the lifecycle. In addition to market performance, there also are risks for financial shocks including death, disability, unemployment, and divorce. Insurance is a commonly used tool for transferring risk, including certain risks pertaining to the loss of human capital, such as disability and death. For risks that are not insurable (divorce and unemployment), other techniques such as risk reduction and risk retention are used.

Although diversification has been widely applied to the management of financial portfolios, it has not been readily applied to human capital portfolios. In fact, economic theory argues that greater returns can be obtained through specialization and exchange than through diversification of human capital. While a financial planner is typically unble to manipulate a client’s human capital portfolio, it is important to understand a client’s human capital risk exposure since it affects the overall portfolio. The individual with the greater human capital in the relationship can afford to take more risk. The individual who has less human capital cannot afford to take as much risk, as their human capital, potentially, is at risk. High levels of risk in the human capital portfolio may necessitate an adjustment elsewhere.

A financial planner who attempts to do comprehensive or holistic financial planning would need to address risk exposures the family faces in all aspects of their household portfolio, not just as it pertains to the financial assets listed on their balance sheet. Results from this study suggest that financial planners need to recognize human capital factors in the lives of their clients and that human capital has an associated risk. Because human capital is a part of the overall portfolio, risk characteristics need to be identified and understood.

Because women who specialize in home production take on the greater risk in a relationship, policy makers and legislators may wish to consider allocating more resources to women in the event of marital dissolution.

Findings from this study also suggest that employers who offer flexible work options should have an advantage in recruiting and retaining employees due to the fact that their flexible work options act as a buffer to reduce the risk exposure of employees who experience a sudden change in their marital or parental relationships.

Four noteworthy conclusions emerged from the analyses. First, human capital plays a significant role in determining earned income for divorced women at both stages in the life cycle. Second, while human capital does not appear to play a significant role in total net family income for divorced women in their 30s, it does become more important later in life. Third, general human capital has a more pronounced effect on earned income of divorced women than specific human capital, although both contribute significantly and positively to earned income. Lastly, recent work experience is an important determinant of earned income.

References

Becker, Gary S. 1962. “Investment in Human Capital: A Theoretical Analysis.” Journal of Political Economy 70 (5): 9–49.

Becker, Gary S. 1964. Human Capital: A Theoretical and Empirical Analysis, with Special Reference to Education. New York: National Bureau of Economic Research, Columbia University Press.

Becker, Gary S. 1985. “Human Capital, Effort, and the Sexual Division of Labor.” Journal of Labor Economics 3 (1): 33–58.

Bianchi, Suzanne M., Lekha Subaiya, and Joan R. Kahn. 1999. “The Gender Gap in the Economic Well-Being of Nonresident Fathers and Custodial Mothers.” Demography 36 (2): 195–203.

Burkhauser, Richard V., Greg J. Duncan, Richard Hauser, and Roland Berntsen. 1991. “Wife or Frau, Women Do Worse: A Comparison of Men and Women in the United States and Germany After Marital Dissolution.” Demography 28 (3): 353–360.

Chiswick, Barry R. 2006. “Jacob Mincer, Experience and the Distribution of Earnings.” In Jacob Mincer: A Pioneer of Modern Labor Economics, edited by Shoshana Grossbard, 109–126. New York, New York: Springer.

Corcoran, Mary, Greg J. Duncan, and Martha S. Hill. 1984. “The Economic Fortunes of Women and Children: Lessons from the Panel Study of Income Dynamics.” Signs 10 (2): 232–248.

Daniels, Kathrine C., Kathryn D. Rettig, and Robert delMas. 2006. “Alternative Formulas for Distributing Parental Incomes at Divorce.” Journal of Family and Economic Issues 27 (1): 4–26.

Dew, Jeffrey, Sonya Britt, and Sandra Huston. 2012. “Examining the Relationship between Financial Issues and Divorce.” Family Relations 61 (4): 615–628.

Dew, Jeffrey. 2009. “The Gendered Meanings of Assets for Divorce.” Journal of Family and Economic Issues 30 (1): 20–31.

Duncan, Greg J., and Saul D. Hoffman. 1985. “A Reconsideration of the Economic Consequences of Marital Dissolution.” Demography 22 (4): 485–497.

Friend, Irwin, and Marshall E. Blume. 1975. “The Demand for Risky Assets.” American Economic Review 65 (5): 900–922.

Graham, John W., and Roy H. Webb. 1979. “Stocks and Depreciation of Human Capital: New Evidence from a Present-Value Perspective.” Review of Income and Wealth 25 (2): 209–224.

Gudmunson, Clinton G., Ivan F. Beutler, Craig L. Israelsen, J. Kelly McCoy, and E. Jeffrey Hill. 2007. “Linking Financial Strain to Marital Instability: Examining the Roles of Emotional Distress and Marital Interaction.” Journal of Family and Economic Issues 28 (3): 357–376.

Gutter, Michael S. 2000. “Human Wealth and Financial Asset Ownership.” Financial Counseling and Planning 11 (2): 9–19.

Hill, E. Jeffrey, Nicole T. Mead, Lukas R. Dean, Dawn M. Hafen, Robyn Gadd, Alexis A. Palmer, and Maria S. Ferris. 2006. “Researching the 60-hour Dual-Earner Workweek: An Alternative to the ‘Opt-Out Revolution.’” American Behavioral Scientist 49 (9): 1184–1203.

Hoffman, Saul D., and Greg J. Duncan. 1988. “What Are the Economic Consequences of Divorce?” Demography 25 (4): 641–645.

Ibbotson, Roger G., Moshe A. Milevsky, Peng Chen, and Kevin X. Zhu. 2007. Lifetime Financial Advice: Human Capital, Asset Allocation, and Insurance. Charlottesville, Virginia: Research Foundation of CFA Institute.

Kriechel, Ben and Gerard A. Pfann. 2005. “The Role of Specific and General Human Capital after Displacement.” Education Economics 13 (2): 223–236.

Lee, Hye K., and Sherman Hanna. 1995. “Investment Portfolios and Human Wealth.” Financial Counseling and Planning 6 (1): 147–152.

Markowitz, Harry. 1952. “Portfolio Selection.” Journal of Finance 7 (1): 77–91.

McKeever, Matthew and Nicholas H. Wolfinger. 2001. “Reexamining the Economic Costs of Marital Disruption for Women.” Social Science Quarterly 82 (1): 202–217.

McManus, Patricia A., and Thomas A. DiPrete. 2001. “Losers and Winners: The Financial Consequences of Separation and Divorce for Men.” American Sociological Review 66 (2): 246–268.

Mincer, Jacob, and Solomon Polachek. 1974. “Family Investments in Human Capital: Earnings of Women.” In Marriage, Family, Human Capital, and Fertility, edited by Theodore W. Schultz, 76–108. Washington, D.C.: National Bureau of Economic Research.

Morgan, Leslie A., Gay C. Kitson, and James T. Kitson. 1992. “The Economic Fallout from Divorce: Issues for the 1990s.” Journal of Family and Economic Issues 13 (4): 435–443.

Peterson, Richard R. 1996. “A Re-evaluation of the Economic Consequences of Divorce.” American Sociological Review 61 (3): 528–536.

Smock, Pamela J. 1994. “Gender and the Short-Run Economic Consequences of Marital Disruption.” Social Forces 73 (1): 243–262.

Smock, Pamela J., Wendy D. Manning, and Sanjiv Gupta. 1999. “The Effect of Marriage and Divorce on Women’s Economic Well-Being.” American Sociological Review 64 (6): 794–812.

Sorensen, Annemette, and Sara McLanahan. 1987. “Married Women’s Economic Dependency, 1940–1980.” American Journal of Sociology 93 (3): 659–687.

U.S. Executive Office of the President, Office of Management and Budget, and U.S. Department of Commerce, Economics and Statistics Administration. 2011. “Women in America: Indicators of Social and Economic Well-Being.”

Weitzman, Lenore J. 1985. The Divorce Revolution: The Unexpected Social and Economic Consequences for Women and Children in America. New York: Free Press.

Zagorsky, Jay L. 2003. “Marriage and Divorce’s Impact on Wealth.” Journal of Sociology 41 (4): 406–424.

Citation

Bridges, Kimberly, De’Arno De’Armond, and Lukas R. Dean. “Importance of Human Capital in Recovery from Divorce for Women.” Journal of Financial Planning 26 (11): 40–47.